Geely and Volkswagen Have Found a Way Out for Gasoline Vehicles

![]() 09/11 2025

09/11 2025

![]() 627

627

Gasoline vehicles have not performed as poorly as expected.

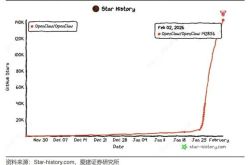

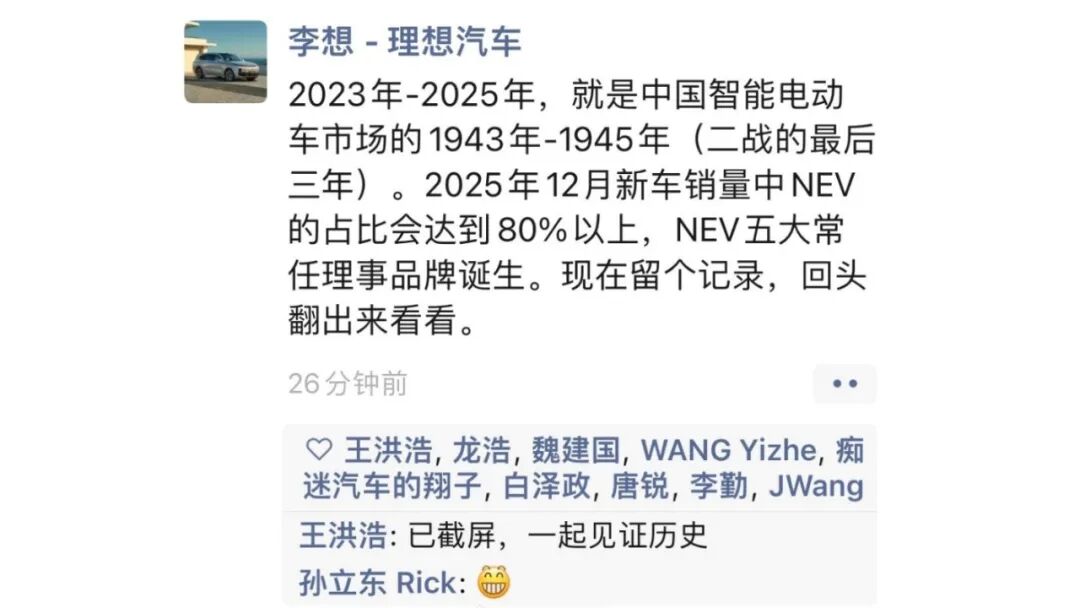

The Porsche priced at over RMB 2 million, the Audi with in-depth cooperation with Huawei on intelligent driving assistance, the new Sagitar L and Lamando with updated engines, and Geely's Dongfangyao. A series of newly launched cars recently all prove the same point: the aggressive predictions made a few years ago were wrong. And it was not just people like Li Xiang, who are bold speakers, who were wrong; the entire industry was wrong. For example, many multinational automakers are adjusting their plans to phase out gasoline vehicles.

The reason why the internet mindset is so prevalent today is precisely because it is radical enough. As long as 80% of what is said can be achieved, it can significantly change many people's perceptions. In the automotive circle, public opinion was led by new forces a few years ago and by Huawei and Xiaomi in recent years. Technological breakthroughs are one aspect, such as active assisted driving with navigation and voice control in the cabin. On the other hand, they have brought about conceptual innovations, such as building cars according to user needs and co-creating cars.

So, as long as sales can increase and the stated goals can be achieved, perceptions can be changed. The recent setbacks for Li Auto in terms of sales and new car launches are essentially due to this. Continuous winning can create a myth, but once there are fluctuations and setbacks, the deconstruction of the myth in the internet age is also swift.

In any case, amidst the rapid changes of the times, gasoline vehicles have begun to find new vitality.

Porsche's Strategy: Defeating Magic with Technology

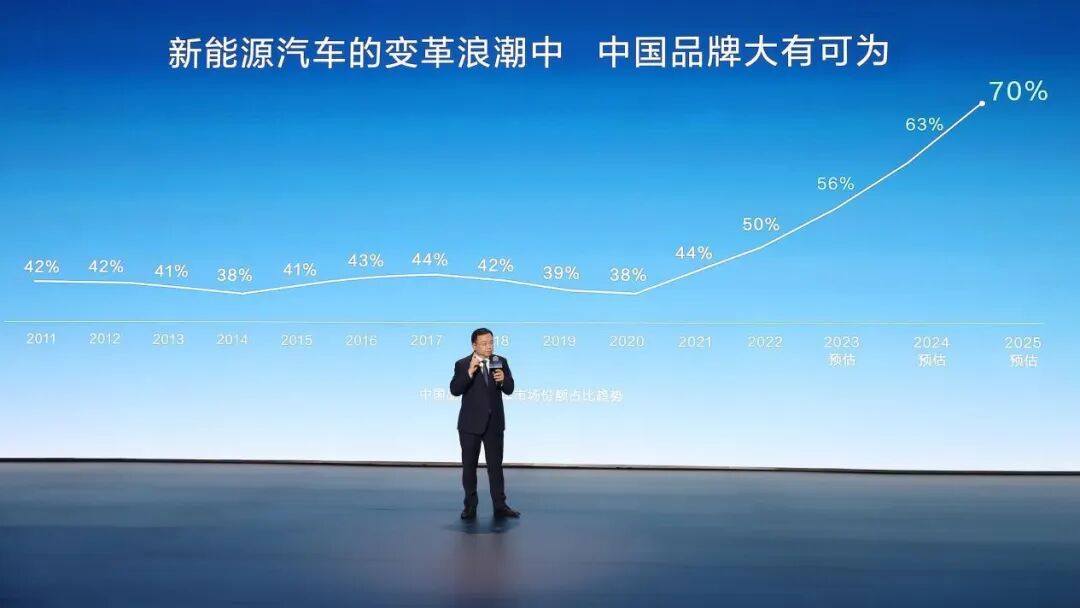

Li Xiang boldly predicted in 2023 that by the end of 2025, the monthly penetration rate of new energy vehicles would exceed 80%. In comparison, Wang Chuanfu's prediction in 2023 now seems more reliable. He forecasted that the penetration rate of new energy vehicles would reach 60% by 2025. In the passenger car market, the latest figure for August is 55.3%, a new monthly high and the sixth consecutive month above 50%.

Looking at the data, in January this year, the market share of gasoline vehicles suddenly surged from 49.4% in December 2024 to 58.5%, while the market share of new energy vehicles dropped to 41.5%. From January to July this year, gasoline vehicle sales only fell by 1.8% year-on-year, a significant narrowing compared to the 17.3% drop in 2024. All this indicates that the market landscape is stabilizing again.

Of course, the initial stabilization of the market landscape does not mean that gasoline vehicles can still win easily as they did a few years ago. New strategies must be employed to have a chance. The latest response from German automakers is to use groundbreaking new technologies to create significant differentiation, as exemplified by Porsche.

Porsche has been facing continuous difficulties recently. Its stock price has fallen by more than 24% this year, leading to its removal from the German DAX index and transfer to the MDAX index. In short, the capital market believes it is no longer as competitive and more in line with the characteristics of medium-sized enterprises. Porsche's counterattack is the launch of the 911 Turbo S.

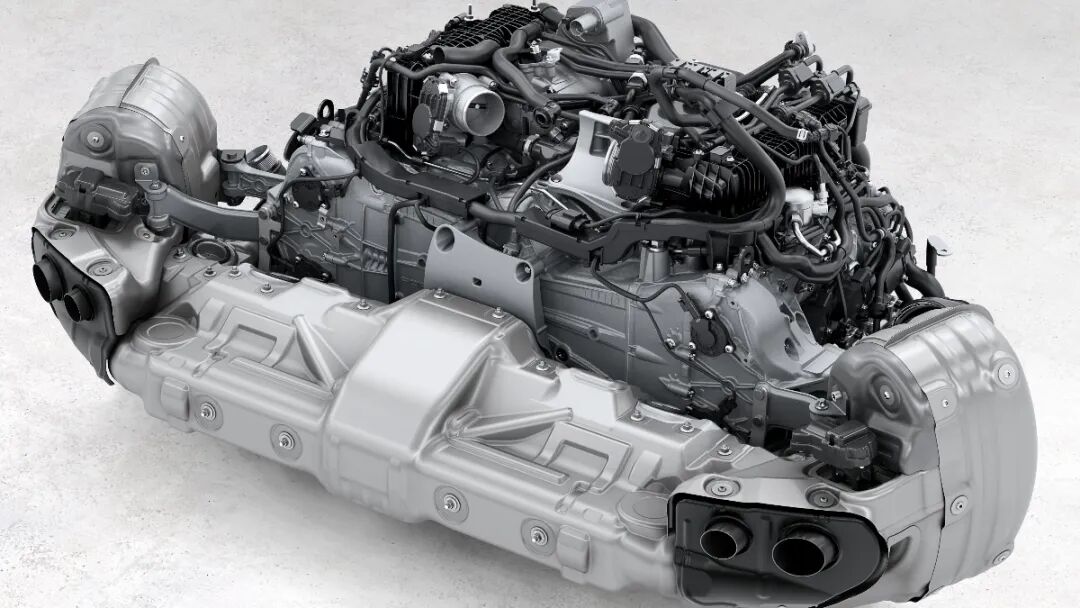

This car boasts numerous technological features. The most notable is the unique electrification of the gasoline engine. The 3.6L horizontally opposed engine is equipped with two electric turbos. Despite a 0.1L reduction in displacement compared to the 2024 model, the maximum power has increased by 61 horsepower. As a result, the new Nürburgring lap record stands at 7 minutes and 3.92 seconds, an improvement of over 14 seconds compared to the previous model. It comes standard with an electric hydraulic Porsche Dynamic Chassis Control system and incorporates intelligent active aerodynamics technology, ultimately reducing wind resistance by 10% compared to the previous generation.

To some extent, you can understand this as Porsche abandoning its incremental upgrade approach under immense sales and capital pressure and instead delivering significant improvements. Of course, its price has also risen accordingly. The Turbo S version starts at RMB 2.728 million, up from RMB 2.363 million for the 2023 model. However, for buyers in this segment, the price difference seems insignificant.

From a technological perspective, the newly added electric turbos represent an advantage that new energy vehicles are unlikely to match in the short term. This eTurbo system has already been applied in the GTS model. You can think of it as a top-tier plug-in hybrid without a large battery, or even an extreme civilian version of a racing plug-in hybrid.

A motor has been added between the compressor and exhaust turbo, allowing for rapid pressure buildup using only the motor even when the engine is idling. This ensures an adequate air-fuel mixture from the start, resulting in quicker peak power delivery and some degree of fuel efficiency improvement.

In simple terms, this system is the closest to racing specifications among civilian models. In addition to increasing power and torque, the motor can also generate electricity through rotation, with a maximum power generation capacity of 11kW in the GTS model. In the Turbo S, with two electric turbos, the response speed is even faster, approaching that of an electric vehicle.

Undoubtedly, once the most significant shortcoming of gasoline vehicles—power output—is addressed, the appeal of electric motors diminishes. Additionally, an objective fact is that while the global market for cars priced over RMB 1 million is shrinking rapidly, with Porsche's global sales down 6% in the first half of the year, China down 28%, Lamborghini down 25%, and even Rolls-Royce down over 20%, new energy vehicles have yet to make significant inroads in the supercar and ultra-luxury car segments.

Furthermore, for Porsche, the introduction of new technologies is more about showcasing strength and boosting confidence. The high price of the 911 Turbo S limits its sales growth potential. However, the benefit lies in the potential for further deployment of eTurbo technology. Given Porsche's track record, it is unrealistic to expect this technology to be available in the RMB 500,000-800,000 range. Nevertheless, it establishes another technological barrier in the supercar segment.

Geely and Sagitar L's Strategy: Functional Substitution

Porsche's approach essentially continues its traditional path. In the civilian market segment for gasoline vehicles priced under RMB 200,000, more effective strategies have emerged. Looking at the latest three new models, Geely has launched the Dongfangyao versions of the Star Rui and Star more L, while Volkswagen has updated the Sagitar L. Furthermore, considering the two recently launched German models, the Audi A5L and the SAIC Volkswagen Lamando.

Taking the SAIC Audi A5L as an example, feedback from some dealers in second-tier cities indicates that nearly 20 orders have been placed in less than a month since its launch, doubling the sales performance of the previous Audi A7L. The same applies to the Lamando launched by SAIC Volkswagen at the Chengdu Auto Show. The limited-time starting price for the 220-horsepower 2.0T high-power version is only RMB 139,900, leading to certain growth in the terminal market.

Moreover, even without considering the launch of entirely new models, there is the resurgence of the Lexus ES. In the first half of this year, Lexus became the only luxury brand in China to achieve positive year-on-year growth, with total sales exceeding 85,000 units. More importantly, the Lexus ES, its largest sales contributor, saw only a moderate increase in discounts compared to 2024, largely maintaining its price system compared to Mercedes-Benz, BMW, and Audi.

In essence, the reason why gasoline vehicles can still compete with new energy vehicles lies in the same answer: large brands or groups leverage their system capabilities to achieve technological decentralization, ultimately making it difficult for new energy vehicles to replace them.

The pre-sale of the Geely Dongfangyao emphasizes three points. First, nearly 50% of consumers still purchase gasoline vehicles, so Geely will continue to produce them. Given China's annual auto market size of over 20 million units, this still represents a market base of over 10 million units. Second, new energy vehicles priced between RMB 100,000-200,000 often adopt similar designs to enhance market competitiveness. Therefore, drawing on its heritage as the "most beautiful Chinese car," the Dongfangyao introduces more emotional value by incorporating many classic Chinese colors into its paint options, such as Crescent Green, Mogao Blue, and Danqing, making them less likely to clash on the road. Third, there are significant technological upgrades. Whatever new energy vehicles offer now, gasoline vehicles can provide as well, or even better.

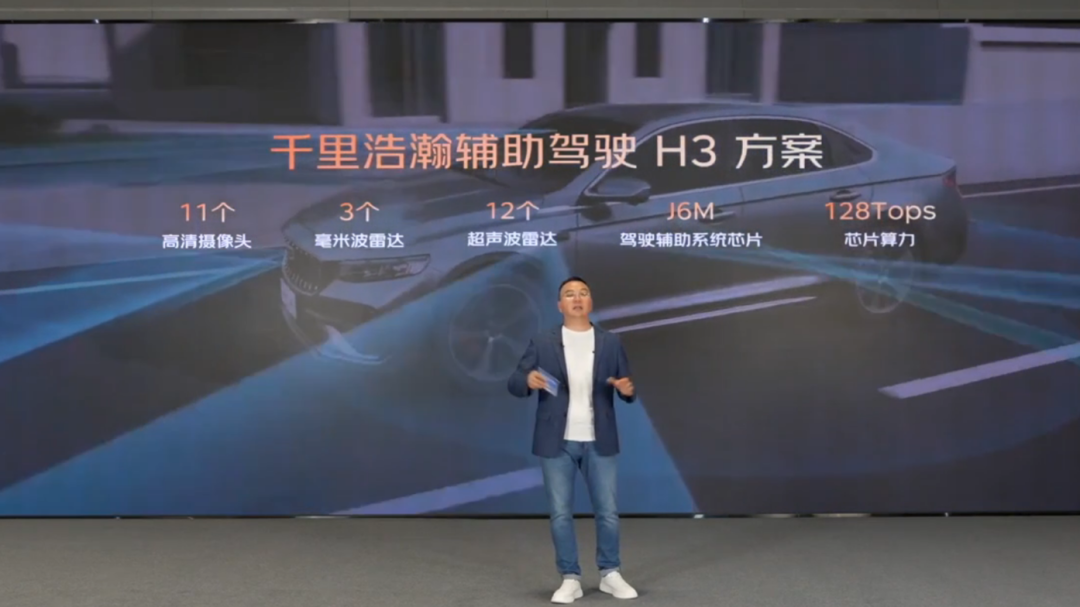

There are many areas involved, including intelligence, vehicle performance, and the currently popular aspects of comfort and safety. Intelligence is achieved through the adoption of a new electronic and electrical architecture similar to that of new energy vehicles, enabling compatibility with the highly acclaimed Flyme Auto cabin system used in the Galaxy E5 and Galaxy A7. It even offers the Thousands of miles and vastness H3 (Qianli Haohan H3) highway assisted navigation. In terms of performance, the entire lineup is equipped with 2.0T engines. The Star Rui can accelerate from 0 to 100 km/h in 6.5 seconds, while the Star more L does it in 7.3 seconds. Comfort features include queen-style front passenger seats and CDC suspension, all provided at once.

The logic behind the Sagitar L is the same, but as a completely new generation model, its overall changes are more significant.

On a superficial level, the core changes are also threefold. First, the design and dimensions are further aligned with the Magotan, as FAW-Volkswagen aims to leverage a sense of premium quality to overcome perceptions of the previous model. For example, features like IQ.Light pixel matrix headlights are now available on a Volkswagen A-class sedan, which was unimaginable a few years ago. In fact, many details indicate that it has learned from currently popular high-selling new energy vehicles. A closer look at the front and rear taillights reveals structures and techniques currently be good at (proficient) in by domestic new energy vehicles.

The second point is the enhancement of intelligence. The size of the central large screen is further increased, similar to that of the Magotan. The functions within the in-vehicle system now include the most popular AI large models, video entertainment, and other features. It even offers compatibility with Huawei smartphones. Additionally, it has enhanced high-speed intelligent driving assistance capabilities and intelligent parking assistance. The third point is to further cater to Chinese car owners. For example, the chassis provides a more comfortable feel, and the seats of German cars are no longer overly stiff, among other improvements. Although many new configurations require optional installation, considering subsequent terminal discounts, the car price will not be particularly high.

When these features enter the niche market, it becomes evident that the pressure from new energy vehicles is not as significant as expected.

For instance, among the top 10 new energy sedans, priced between 100,000 and 150,000 yuan, are the BYD Qin L, Seal 06, and XPENG MONA M03. From a performance perspective, all three of these cars have a 0-100 km/h acceleration time exceeding 7.4 seconds. After upgrades, this has become an advantage for fuel-powered cars. For example, the Xingrui Dongfangyao can accelerate to 100 km/h in under 7 seconds.

After the intelligent configurations are fully complemented, advantages such as interior space, comfort in overhead driving control, absence of motion sickness, and no range anxiety have also become strengths of fuel-powered cars.

Furthermore, even in terms of cost savings, where new energy vehicles excel, fuel-powered cars are not entirely outmatched after a new round of upgrades. For example, if it is a pure electric vehicle without a home charging station or convenient charging conditions, the energy replenishment cost at third-party DC charging stations is not significantly different from the fuel consumption of the Sagitar L, which is under 6 liters per 100 kilometers.

In conclusion

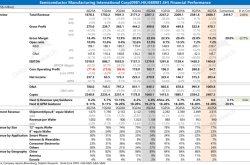

A set of data further highlights the recent contrast in facts. Geely's China Star series sold 615,800 units in the first half of 2025, a year-on-year increase of 7%. It also secured the top position in sales among independent brand fuel-powered cars for 16 consecutive months in relevant niche statistics.

FAW-Volkswagen has also experienced similar growth, with fuel-powered car sales increasing by 1.4% year-on-year in March, 7.9% in April, 15.1% in June, and 4.2% in August. Additionally, its market share in the fuel-powered car segment continues to steadily rise.

All of the above indicates one thing: after being frequently challenged for over four years, fuel-powered cars are now gradually making a comeback. As long as they can achieve slightly better levels than new energy vehicles in terms of configuration, performance, and intelligence, they can still continue to survive.

However, there are several limiting conditions for this scenario. For example, in the market segment above 200,000 yuan, once the budget is sufficiently high, fuel-powered cars may struggle to match the intelligent capabilities of mainstream new energy vehicles. Additionally, if the manufacturer does not possess the large-scale system capabilities and the willingness to continue deep cultivation (deeply cultivate) the fuel-powered car market, like Geely and Volkswagen, the vehicles produced may easily lack competitiveness.