In Less Than 20 Days, Automakers Intensify Capital Influx: Is It a Breakthrough or a Warning of Industry Reshuffle?

![]() 09/11 2025

09/11 2025

![]() 602

602

On September 7, Chery Automobile passed the listing hearing of the Hong Kong Stock Exchange, marking a key milestone in its IPO; on the 6th, FAW Pentium completed a capital increase of over RMB 8.5 billion; on the 5th, Geely Automobile's privatization plan for Zeekr was approved by shareholders.

Looking further back, on August 28, a collaboration among government, enterprises, and foreign parties was announced to plan a new company for the Jetta brand; on the 22nd, Dongfeng officially announced that VOYAH Automobile would list independently on the Hong Kong Stock Exchange through an introduction, with Dongfeng Group Co., Ltd. simultaneously completing privatization and delisting...

In less than 20 days, China's automotive industry has sparked a new wave of capital operations, raising questions: What is happening in the industry? Are these positive signals or harbingers of an impending storm?

In fact, there are no permanent champions in the market, only a continuous chain of evolution. The recent market performance of several popular models vividly reflects this rule.

The Xiaomi YU7 entered the market with a starting price of RMB 253,500, securing 289,000 reservations within one hour of its launch; the new SERES M7 opened for pre-orders at a pre-sale price of RMB 288,000, receiving over 150,000 orders within 24 hours; the SHANGJIE H5 exceeded 80,000 small reservations; even the Zeekr 9X, priced at nearly RMB 400,000, garnered 42,667 orders within one hour...

It is evident that Xiaomi and Huawei-affiliated products have easily captured sales championships.

These figures have dealt a significant psychological blow to traditional automakers, prompting them to reflect on the underlying consumer trends and market shifts: Why are consumers flocking to these vehicles? How can they survive in this landscape?

This anxiety is no secret. “In five years, China may only have five mainstream automakers left,” predicted He Xiaopeng, Chairman of XPENG Motors. Li Xiang, founder of Li Auto, showed emotional vulnerability during an interview with Luo Yonghao. Li Bin, Chairman of NIO, went to great lengths, even continuing live broadcasts despite physical exhaustion requiring oxygen support.

From last year to the present, particularly in the first half of this year, industry competition has intensified—price wars have erupted, with companies not only vying for technological innovation but also engaging in pricing strategies, while corporate leaders personally promote their products. This all-encompassing competition and internal friction have left most automakers drained.

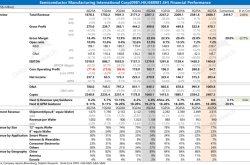

According to Bangning Studio's statistics, BYD was the most profitable automaker in the first half of 2025, with a net profit of RMB 15.511 billion, up 13.79% year-on-year, and the only automaker earning over RMB 10 billion. Geely and Great Wall Motors followed, with net profits of RMB 9.290 billion and RMB 6.337 billion, respectively, but both saw a decrease of over 10% compared to the previous year.

On the other end of the spectrum, JAC Motors, XPENG Motors, BAIC BluePark, and NIO continue to struggle with losses, facing immense profitability pressures.

Even state-owned and central enterprises are facing difficulties. Leading state-owned automakers such as Dongfeng, Changan, and SAIC have not met market expectations in their profitability, with their earnings capabilities under sustained pressure. Among them, Dongfeng's net profit plummeted by 92% year-on-year, while GAC Motor shifted from profit to loss.

Furthermore, with recent bankruptcies like Jiyue and Neta, automaker failures are no longer surprising.

Under such circumstances, whether through IPOs or strategic capital introductions, these automakers are essentially pursuing one goal: survival.

VOYAH Automobile listed independently on the Hong Kong Stock Exchange through an introduction; Chery Automobile's Hong Kong IPO is entering its final countdown, while Geely Automobile's privatization plan for Zeekr was approved by shareholders.

Behind VOYAH's independent listing on the Hong Kong Stock Exchange through an introduction is the central automotive enterprise, Dongfeng Motor Corporation; Chery Automobile's Hong Kong IPO, entering its final countdown, is backed by the dynamically growing local mixed-ownership reform state-owned enterprise, Chery Group; Geely Automobile's privatization plan for Zeekr, approved by shareholders, is supported by the private automotive giant, Geely Group.

Their strategies are clear and consistent—securing funds for expansion.

For instance, due to prolonged low valuations and loss of financing capabilities, Dongfeng Group Co., Ltd.'s independent listing of VOYAH not only broadens its financing channels and aligns with international governance and operations but also helps Dongfeng break free from valuation constraints.

Chery's IPO aims to open new financing avenues, injecting funds into NEV R&D, intelligent connected vehicle upgrades, and overseas expansion to expand market share and solidify its industry position.

Geely's privatization and full integration of Zeekr will enable internal consolidation of R&D and supply chain resources, reducing internal friction, while externally achieving coverage across multiple powertrain forms and full price bands, enhancing overall competitiveness.

“From an insider's perspective, the greatest advantage of the merger (between Zeekr and Lynk & Co) is the ability to integrate the strengths of their early development,” said Lin Jie, Senior Vice President of Geely Automobile Group, Vice President of Zeekr Technology, and General Manager of Lynk & Co Sales Company, highlighting the core value of Geely's merger with Zeekr.

He explained that during its years of independent development, Zeekr has made substantial investments in technology, particularly in the three electric domains (batteries, electric motors, and electronic control), achieving technological leadership. Despite both being under the Geely Group, Zeekr and Lynk & Co had limited insight into each other's technological reserves, a situation that the merger has reversed.

“Take the global debut of the NVIDIA Thor chip in the Lynk & Co 900 model as an example. Initially planned for a Zeekr model, after the merger, technological synergy not only made resource utilization more efficient but also clarified the development directions of both brands,” Lin said.

Securing funds is crucial, but technology is equally indispensable. FAW Pentium's recent RMB 8.5 billion capital increase will primarily be used for three purposes: NEV technology research, smart manufacturing upgrades, and channel ecosystem construction.

Jiangsu Yueda Automobile Group invested RMB 1.71 billion, Agricultural Bank of China's investment platform, ABC Financial Asset Investment Co., invested RMB 1 billion, China Telecom invested RMB 500 million, and Nanjing Horizon Information Technology Co., invested RMB 100 million... Local state-owned assets, leading central enterprises, and technological pioneers are collaborating. By integrating resources and aligning goals, they are assisting FAW Pentium's transition to NEVs.

“As the NEV industry enters a crucial phase in its second half, the group will fully support Pentium in implementing institutional and mechanistic reforms, transforming it into a new automotive force backed by central enterprises, supported by diverse capital, and with higher openness, striving for a place in the top tier of independent brands and creating a new model for central enterprise reforms,” said a representative from FAW Group.

In less than 20 days, automakers have made a series of major capital moves. While onlookers see it as entertainment, automakers read it as anxiety or ambition.

This is neither a signal of overall improvement, considering even state-owned teams face profit declines, nor an omen of an impending storm; rather, it reflects automakers' determination not to be left behind in the industry reshuffle.

After all, in the NEV sector, technology requires funding, R&D burns money, and market competition demands financial resources. Without proactive financing, they may not survive.

Thus, the recent industry-wide capital operations seem more like collective survival efforts by automakers. Whether pursuing IPOs or introducing strategic capital, the goal is to endure in an uncertain market. As for whether the future will be sunny or stormy, it depends on whether today's strategies can translate into tomorrow's victories.