30 New Cars Unveiled in a Week: Auto Media Struggles to Keep Up

![]() 09/24 2025

09/24 2025

![]() 608

608

Lead

Introduction

This represents an industry-wide rush.

"Either at events or on the way to them."

Recently, when discussing work travel with peers, the overwhelming consensus is that September's intense new car launch schedule has left everyone physically and mentally drained. As an automotive media professional, I also feel the industry's fervor during this year's "Golden September and Silver October."

According to incomplete statistics, nearly 20 new car models were launched in the first 15 days of September. These models span a wide price range, from 100,000 to 500,000 yuan, and include both new energy and fuel-powered vehicles, such as sedans, SUVs, and station wagons. The concentrated release of multiple plug-in hybrid models further highlights the strong market demand for this technology.

As September progressed, the surge in new car launches not only continued but intensified. Media-compiled launch schedules indicate that in the final week of September, over 30 new models are set for pre-sale or launch. Major brands seem to have reached an implicit agreement, flooding the market with long-awaited new products.

Amid this automaker frenzy, media professionals covering the events have become "frequent flyers." Some media outlets report attending a launch in Shanghai one day and flying to Guangzhou the same night for a test drive the next morning, only to rush to the airport again for a new car launch in Chengdu. Colleagues joke, "I've been to Chengdu five times in the first three weeks of September alone." The relentless stream of launches resembles Chengdu's endless hotpot gatherings—there's no end in sight. While hotpot can upset the stomach, these events exhaust the mind and body.

This is no exaggeration. Encounters at airports often involve hurried greetings before boarding the same flight, where we realize, "Oh, you're here too." Some peers even wryly smile about nearly attending the wrong launch after being picked up by two brands simultaneously.

However, this frenetic pace isn't exclusive to the media.

01 Industry Anxiety Behind the New Car Surge

"Too many new car launches—not enough automotive media to cover them."

During a Monday meeting on September 22, when a schedule of upcoming new car launches was presented, revealing over 30 models set to debut, attendees were stunned. This joke, though humorous, underscores the escalating competition in China's auto market.

We all know that the auto industry's intense competition didn't emerge overnight. Especially with the evolution of the new energy vehicle (NEV) market, a new era of automotive industry transformation has begun. As more brands, particularly NEV makers, enter the market, the number of automotive products and their replacement cycles have exploded, keeping the industry on edge.

In the traditional fuel vehicle era, the industry developed steadily due to fewer automakers and a relatively stable market structure. From manufacturers to supply chains and sales, each sector operated methodically. New car generations typically saw minor updates annually and major overhauls every 5-7 years. Thus, the industry's pace remained measured.

Today, with the rapid rise of NEVs, the market landscape is reshaping, intensifying nerves across the board. From a product standpoint, major overhauls happening annually have become the norm. This rapid product update cycle forces all participants to keep pace. After all, falling behind means being beaten or even eliminated.

Of course, at a deeper level, the surge in new car launches reflects automakers' inevitable strategy to capture market share in a saturated market.

China's auto market has shifted from growth to saturation, with consumers making more rational purchasing decisions. New car sales now primarily come from replacement and additional purchases. This means every vehicle sold by one automaker likely means one less sold by another. It's a zero-sum game where competition becomes a life-or-death struggle for market share, making intense competition unavoidable.

Under these circumstances, automakers must continuously launch new products to stimulate consumption and maintain market heat. Especially during the traditional peak sales seasons like "Golden September and Silver October," automakers hope to seize market share through new offerings.

However, more product launches don't guarantee better sales. The "New Four Modernizations" of automotive technology have created new segments but also intensified competition.

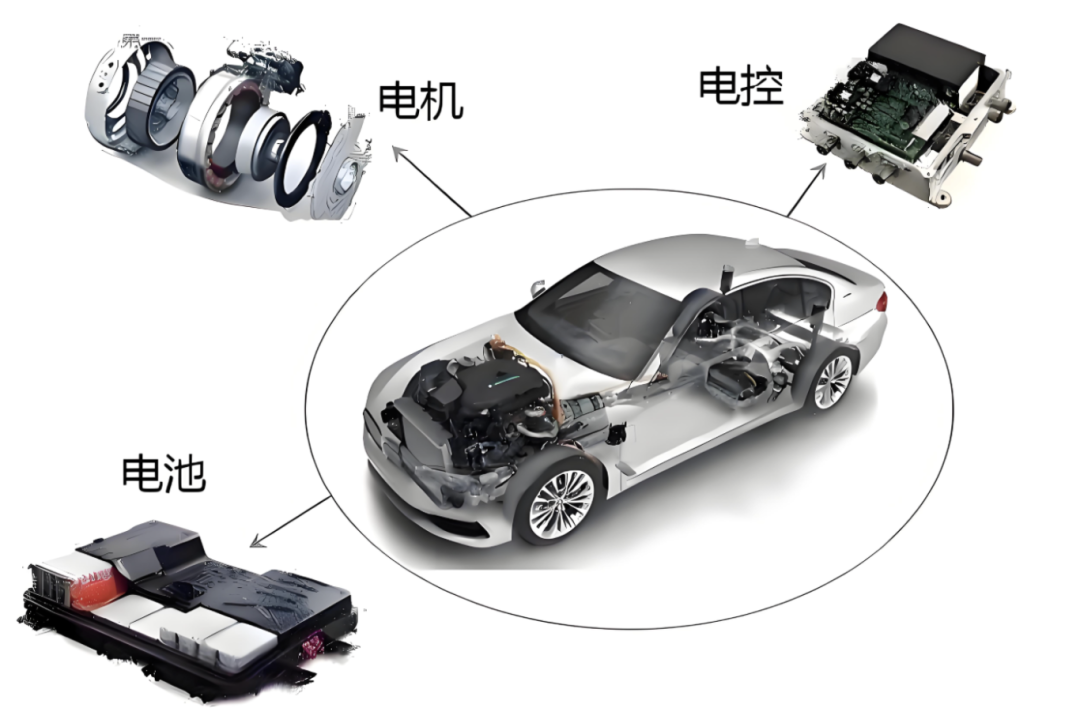

The breakdown of technological barriers has led to greater product homogenization. In the fuel vehicle era, engines and transmissions posed high barriers, giving leading automakers strong competitive advantages. In the EV era, the core technologies of the "three electric systems" (battery, motor, controller), especially batteries, are largely controlled by third-party suppliers like CATL and BYD.

When everyone can access similar batteries, chips, and intelligent cockpit solutions, vehicle performance and technical parameters tend to converge. If you offer 600 km of range, I'll aim for 650 km; if you have a large screen, I'll add more. To stand out, automakers resort to stacking configurations and engaging in a specifications arms race, driving up costs and intensifying competition.

As a result, differences in configuration, performance, and design among brands are narrowing. When products lack distinct advantages, automakers adopt a "quantity over quality" strategy, hoping to overwhelm competitors numerically. This leads to increasingly niche market segmentation, with multiple products competing in every price range and vehicle style, resulting in a growing number of new car launches.

02 Where Does the Industry Go After Intense Competition?

As anxiety spreads, every stakeholder in the automotive industry faces unprecedented challenges.

Take the surge in new car launches: it directly increases workloads for automakers, agencies, sales teams, media, and even parts suppliers. Sustaining this high-intensity pace for months inevitably exhausts everyone physically and mentally.

From a media perspective, when events are so frequent that we must "rush from one to another," deep engagement with each new car becomes impossible. Test drive durations shrink from 2-3 days to half a day or less, turning in-depth reviews into superficial formalities. Content produced under such conditions often lacks substance, failing to provide consumers with meaningful insights.

Meanwhile, when all media attend the same events, hear identical product briefings, and test drive the same models, content becomes repetitive. Often, it lacks unique perspectives or in-depth analysis, failing to help consumers make informed decisions and even undermining media credibility and value.

Of course, brands face their own struggles. Many are trapped in an "arms race" out of necessity. Especially for automakers below the mid-tier, with weak brand recognition and product competitiveness, they follow trends by launching so-called new products to gain visibility, often at the expense of time, money, and even their original development pace—a losing proposition.

Yet, we must ask: Is this intense competition healthy for the automotive industry?

From a market development perspective, some competition is beneficial, driving survival of the fittest and technological progress. However, when competition devolves into a mere numbers game and marketing contest, it warrants caution and reflection.

Automakers must consider whether frequent new car launches are sustainable. On one hand, new car development requires massive R&D investment; frequent overhauls increase costs, which are ultimately passed on to consumers. On the other hand, overly rapid product updates reduce resale value for existing owners, eroding brand loyalty.

Meanwhile, media must preserve professionalism and independence in this environment. Perhaps we need to adjust work methods or rethink content production models. Ultimately, prioritizing truly valuable products and pursuing in-depth, unique reporting should remain our focus.

For consumers, are they beneficiaries of this intense competition? On the surface, yes—they have more choices. But in reality, faced with a sea of similar products, they may feel even more lost.

As we stand in the "Golden September and Silver October" of 2025, China's auto market has reached unprecedented levels of intense competition. The flurry of new car launches and overwhelmed media reflect not just surface-level phenomena but deeper issues. This internal rivalry stems from market saturation, technological disruption, new entrants, consumption upgrades, and supply chain pressures—an inevitable result of multiple overlapping factors.

This is essentially a knockout round. In a saturated market, there's room for only so many automotive brands. Intense competition accelerates industry consolidation, ultimately favoring leading companies with comprehensive strengths in technology, products, costs, user engagement, and capital.

Thus, while the process is painful for automakers and the entire industry, it serves as a core driver for technological upgrades and business model innovations across the automotive sector in the long run.

As industry participants, we all hope to weather the storm and see the rainbow.

Editor-in-Charge: Li Sijia Editor: He Zengrong