Reaching 100 Billion by 2027: Three Industry Giants Unite to Propel a 'Struggling Automaker' Toward Next Year's Hong Kong Stock Exchange Debut

![]() 09/24 2025

09/24 2025

![]() 591

591

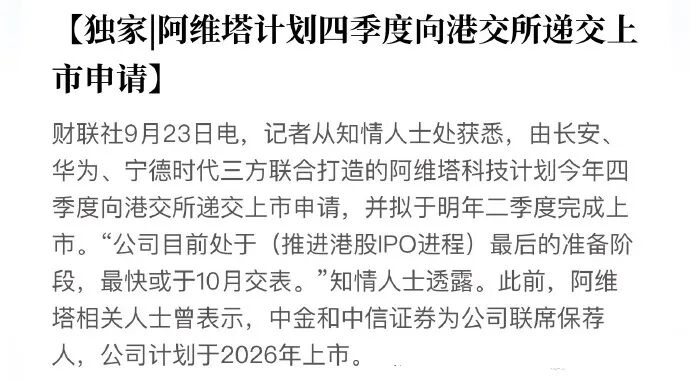

On September 23, Cailian Press reported that Avita Technology, a collaborative venture among Changan, Huawei, and CATL, is set to submit its listing application to the Hong Kong Stock Exchange in the fourth quarter of this year, with an aim to complete the listing in the second quarter of the following year.

An insider divulged, "The company is currently in the final stages of preparation (for the Hong Kong Stock Exchange IPO process) and could submit the application as early as October." CICC and CITIC Securities are serving as the company's joint sponsors, with plans for a public offering in 2026.

Established in 2018, Avita was initially co-founded by Changan Automobile and NIO, with NIO gradually withdrawing its involvement. In 2021, Avita welcomed Huawei and CATL as strategic investors, officially transforming into a global high-end intelligent electric vehicle brand.

The collaboration model among these three industry giants is quite unique. According to the equity structure, Changan Automobile holds a 40.99% stake as the largest shareholder, while CATL holds a 14.1% stake as the second-largest shareholder. Huawei, as a strategic partner, primarily supplies intelligent components such as intelligent driving assistance algorithms and intelligent cockpits.

Given such abundant resources and the backing of powerful entities, why does Avita insist on pursuing a separate listing?

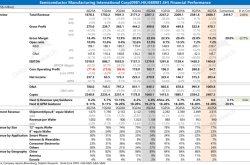

Data from Changan Automobile's financial report reveals that Avita achieved a revenue of 15.35 billion yuan in 2024, marking a year-on-year increase of 171.9%, indicative of rapid growth.

However, this rapid growth is accompanied by significant losses due to substantial investments. In 2024, Avita's net loss widened to 4.018 billion yuan. By the end of 2024, the company's total assets stood at 29.15 billion yuan, with net assets of 8.59 billion yuan and a debt-to-asset ratio of approximately 70.5%.

To bolster business development, in December 2024, Changan Automobile announced that it, along with multiple investors, planned to jointly invest 11.101 billion yuan in Avita. After this capital infusion, Changan Automobile's shareholding ratio remained unchanged at 40.99%.

Therefore, relying solely on internal funding is not a viable long-term strategy, and the urgency for an IPO to support long-term development is self-evident.

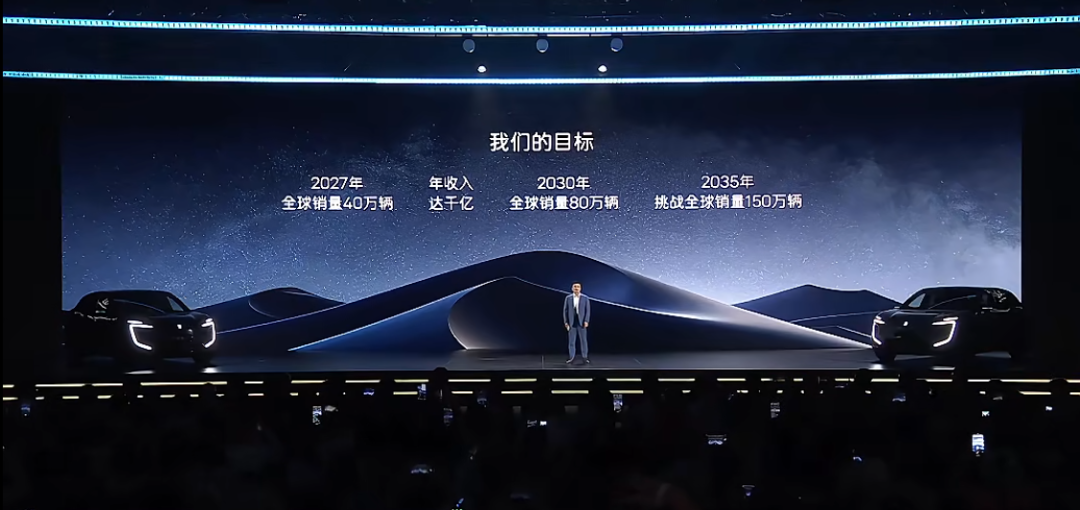

Recently, Avita also unveiled its ambitious development blueprint.

On September 20, the company launched Strategy 2.0, announcing a target of achieving global sales of 400,000 units and an annual revenue of 100 billion yuan by 2027. The plan also includes boosting global sales to 800,000 units by 2030 and setting a long-term goal of challenging 1.5 million units in global sales by 2035.

At the product level, Wang Hui, Chairman of Avita Technology, stated that the company would steadfastly strengthen its strategic cooperation with Huawei and CATL, planning to jointly introduce 5 upgraded models in 2026 and a cumulative total of 17 models by 2030, covering various segments such as sedans, SUVs, MPVs, and sports cars.

With such ambitious plans, securing funding is undoubtedly a top priority. Eager to go public next year, it remains to be seen whether the capital market will embrace this automaker, once derisively dubbed the 'Struggling Automaker' by netizens.

It's worth noting that Avita is not the only Chinese new energy automaker eyeing the Hong Kong Stock Exchange. Recently, multiple Chinese automakers have been intensively preparing for listings on the Hong Kong Stock Exchange.

On September 17, Chery Automobile officially launched its H-share offering, planning to issue 297 million new shares at a price range of HK$27.75 to HK$30.75 per share, with a maximum fundraising amount of HK$9.145 billion. Chery Automobile's shares are scheduled to officially list on the Hong Kong Stock Exchange on September 25.

On August 22, Dongfeng Group announced that its subsidiary, VOYAH, would list on the Hong Kong Stock Exchange through an introduction listing, with Dongfeng Group simultaneously completing privatization and delisting. These series of moves suggest that Chinese new energy automakers are accelerating their capitalization efforts.

Industry analysts believe that "with the deepening of institutional innovations such as the Hong Kong Stock Exchange's technology company special line, this wave of listings not only eases the research and development funding pressure on automakers but also, through the value discovery function of the capital market, subjects China's intelligent manufacturing to a rigorous selection process."