13,000 Workers at Risk of Unemployment: Bosch Claims It's 'Out of Options'

![]() 09/26 2025

09/26 2025

![]() 595

595

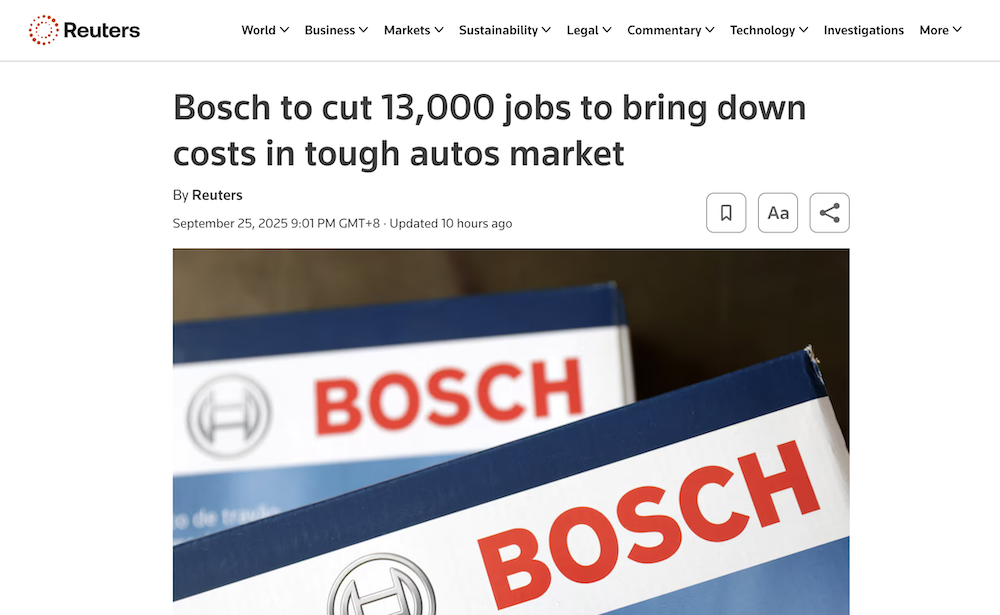

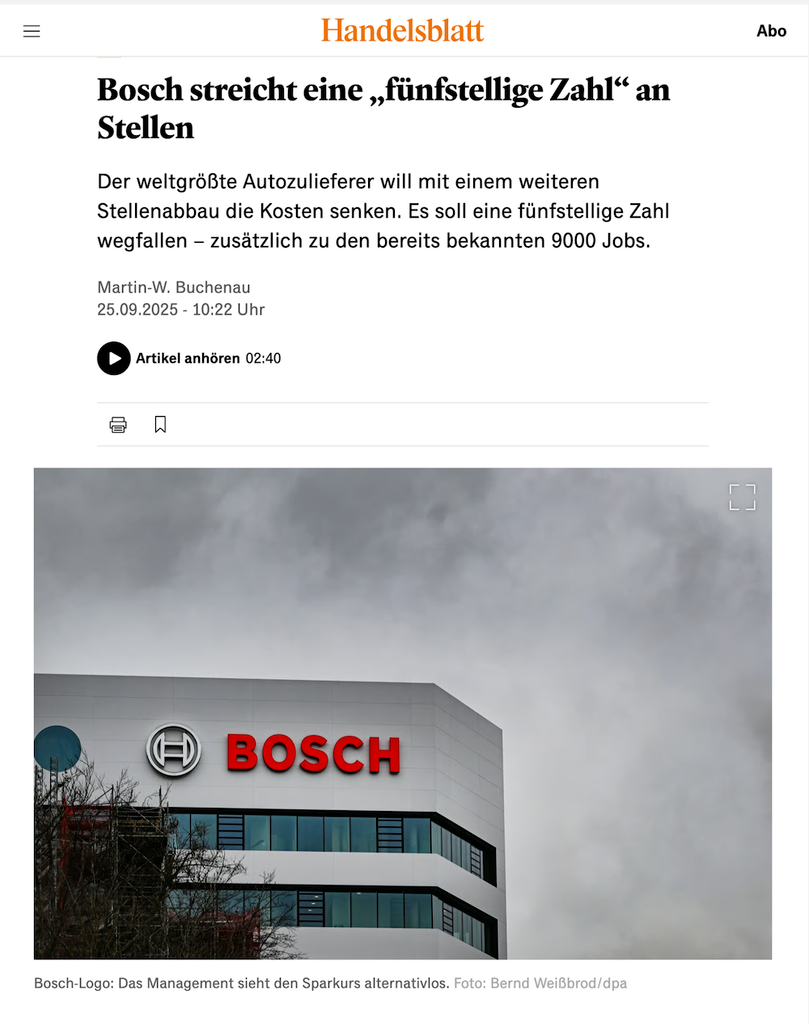

Yes, you've read correctly—tens of thousands of workers are on the brink of losing their jobs. With management stressing the need for cost-saving strategies, the global automotive supply chain behemoth is poised for significant layoffs, framing the move as a necessary evil. On September 26 (local time, Thursday), Reuters reported that Bosch, the world's foremost automotive parts supplier, unveiled plans to lay off 13,000 employees within its mobility division.

The layoff initiative will be carried out exclusively in Germany, impacting roughly 10% of Bosch's workforce in the nation and 3% of its global staff.

These job cuts form a part of the company's broader strategy to achieve annual savings of €2.5 billion, a goal that also encompasses the divestiture of assets and the refinement of logistics and supply chain operations.

The layoff scheme is projected to conclude by the end of 2030, with the most substantial repercussions anticipated at Bosch's production hub in Germany's Stuttgart region.

Last year, Bosch announced the layoff of 9,000 workers in Germany. When combined with this year's 13,000 layoffs, the total number of planned job reductions reaches 22,000. In the previous year, Bosch slashed 11,600 positions in its most crucial automotive sector worldwide. By the end of 2024, Bosch's global workforce stood at approximately 418,000.

What's driving Bosch to take such 'extreme measures'?

Confronted with an annual cost shortfall of €2.5 billion (approximately $2.9 billion), Bosch is enacting cost-cutting measures that extend beyond the 13,000 layoffs. These include trimming expenses in raw material procurement and daily operations, curtailing investments in factory infrastructure, and undertaking a comprehensive optimization of logistics and supply chains.

As Bosch previously articulated, to endure in a fiercely competitive market, the company must 'strive for every cent of profit.'

Indeed, Bosch had already issued 'warnings' in early September. At that juncture, the company disclosed that its core mobility division (which primarily manufactures key products like fuel injectors and driving assistance software) was grappling with a €2.5 billion (roughly $2.95 billion) cost shortfall, rendering 'sweeping cost reductions and layoffs' an unavoidable decision.

What are the root causes of Bosch's profound crisis?

Global trade barriers, dwindling demand, and the exorbitant costs linked to the electrification transformation process.

On Wednesday of this week, the United States announced the formal enactment of the U.S.-EU trade agreement, lowering tariffs on EU automobiles and parts to 15%. The German Association of the Automotive Industry (VDA) remarked that existing trade barriers impose a substantial burden on European automakers. In the first half of this year, U.S. tariffs took a severe toll on the profits of multinational automakers such as Volkswagen, BMW, and Mercedes-Benz.

Consequently, suppliers like Bosch are encountering even greater challenges.

Diminishing demand has also resulted in overstaffing in administrative and sales departments, as well as 'significant overcapacity' in research, development, and production—on one hand, orders are dwindling, while on the other, operating costs remain elevated. Under this dual pressure, layoffs have emerged as 'the only viable path forward.'

Presently, the automotive industry is at a pivotal juncture of electrification and intelligent transformation. Traditional parts companies are grappling with challenges stemming from technological advancements and shifts in orders. Not only has Bosch, the world's largest automotive parts supplier, announced the layoff of 13,000 workers, but Schaeffler also revealed plans last year to lay off approximately 4,700 employees in Europe and shutter two factories, while ZF Friedrichshafen intends to lay off 11,000 to 14,000 workers in Germany. These actions underscore the cost crisis confronting the supply chain industry.

To navigate the industry downturn, supply chain giants have resorted to layoffs as a last-ditch effort. Perhaps layoffs are merely the beginning for them. The paramount challenge for established supply chain companies in the years ahead will be how to preserve technological advantages and market share while slashing costs. I'm curious to see if everyone concurs with the blogger's viewpoint. Feel free to share your thoughts in the comments section for a lively discussion...