DJI Automotive Steps into the Luxury Arena: FAW Emerges as the Largest Shareholder

![]() 09/26 2025

09/26 2025

![]() 587

587

FAW Speeds Up Its Intelligent Transformation

Author: Wang Lei

Editor: Qin Zhangyong

The deal is sealed: FAW has finally decided to make a substantial investment in Zhuoyu.

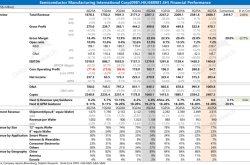

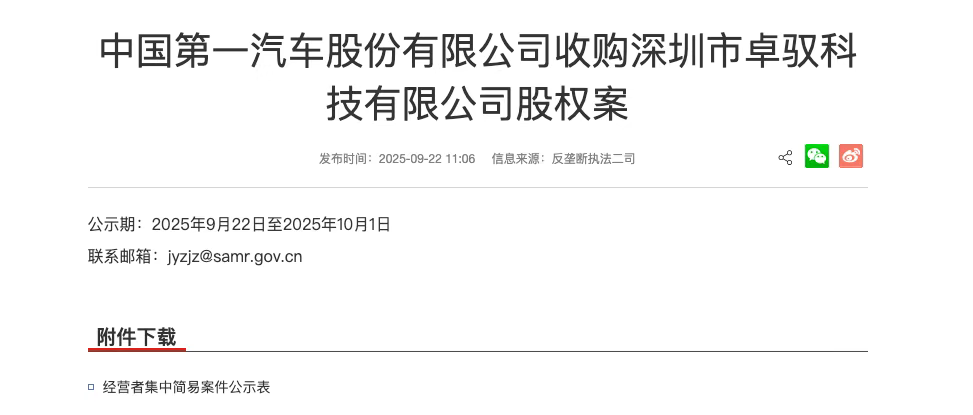

According to the equity acquisition case disclosed by the State Administration for Market Regulation, which details FAW Group Corporation's acquisition of a portion of Shenzhen Zhuoyu Technology's equity, FAW Group Corporation will acquire a 35.8% stake in Zhuoyu Technology through a combination of capital increase and equity acquisition. Consequently, the original controlling shareholder, New Territory, will see its stake reduced to 34.85%. Both entities will now jointly control Zhuoyu Technology.

The announcement did not reveal the specific transaction amount, rendering it impossible to verify the previously speculated 'equity transaction exceeding $800 million' or confirm 'control'. Nonetheless, this move has already established FAW as the largest single shareholder of Zhuoyu Technology.

Notably, FAW Hongqi recently announced a deepened collaboration with Huawei, with new models set to incorporate Huawei's Qiankun intelligent driving and HarmonyOS cockpit systems. Now, with its investment in Zhuoyu, FAW—the 'industry leader'—is finally ramping up its efforts, forming partnerships with Huawei on one side and Zhuoyu on the other.

01 FAW Had Its Sights Set on Zhuoyu Early On

Had the State Administration for Market Regulation not disclosed this equity acquisition, speculation would have persisted regarding which entity would invest in Zhuoyu Technology, as FAW Group was not the sole contender.

Although the announcement is relatively concise, it outlines the transaction and operator structure.

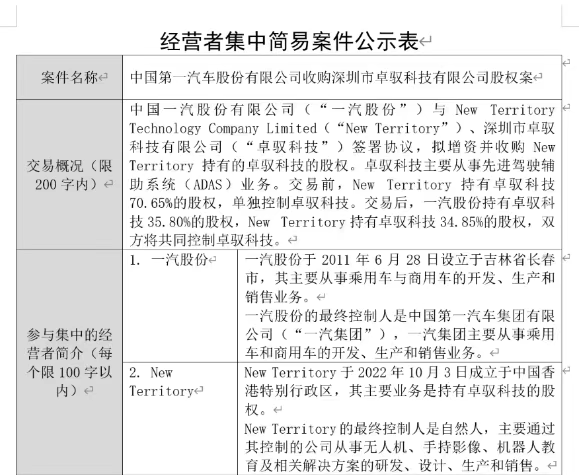

The disclosure reveals that China FAW Group Corporation ('FAW Group') entered into an agreement with New Territory Technology Company Limited ('New Territory') and Shenzhen Zhuoyu Technology Co., Ltd. ('Zhuoyu Technology') to increase capital and acquire equity in Zhuoyu Technology held by New Territory.

The transaction falls under the category of 'operators with upstream-downstream relationships, each holding less than 25% market share in their respective markets'.

It also discloses that in the 2024 Chinese advanced driver-assistance system (ADAS) market, New Territory (through Zhuoyu Technology) held a market share ranging from 0-5%, while in the downstream 2024 Chinese passenger vehicle market, FAW Group held a share between 10-15%.

Prior to the transaction, New Territory held a 70.65% stake in Zhuoyu Technology, exercising sole control. Post-transaction, FAW Group will hold a 35.80% stake, and New Territory will hold a 34.85% stake, with both entities jointly controlling Zhuoyu Technology.

Zhuoyu Technology, formerly DJI's automotive division, was established in 2016 and became an independent entity in 2023. It officially adopted 'Zhuoyu' as its brand name in June 2024 and introduced external capital. The company has secured investments from automakers and institutions such as BYD, SAIC, China State-owned Venture Capital Investment Co., Ltd., Cornerstone Capital, and Guangyuan Capital, with cumulative financing surpassing 2.5 billion yuan.

Notably, Zhuoyu Technology's former largest shareholder, New Territory, held a 70.65% stake. This company, established in Hong Kong in 2022, may not be widely recognized by the public.

However, based on the operator's introduction in the announcement, New Territory's ultimate controller is a natural person primarily involved in the R&D, design, production, and sales of drones, handheld imaging, robotics education, and related solutions through controlled companies. It is not challenging to deduce the actual controller of New Territory.

Although the announcement does not specify the exact transaction price for the 35.8% stake, if we calculate based on the previously reported $800 million investment corresponding to a 35.8% stake post-transaction, Zhuoyu Technology's post-transaction valuation can be roughly estimated at approximately 16 billion yuan.

This estimate aligns with media reports mentioning a 'post-transaction valuation exceeding 10 billion yuan'.

In reality, FAW's investment in Zhuoyu Technology is not surprising. After all, Zhuoyu and FAW have been strategic partners, and as early as 2023, when Zhuoyu was still known as DJI Automotive, its Pre-A round financing was led by FAW.

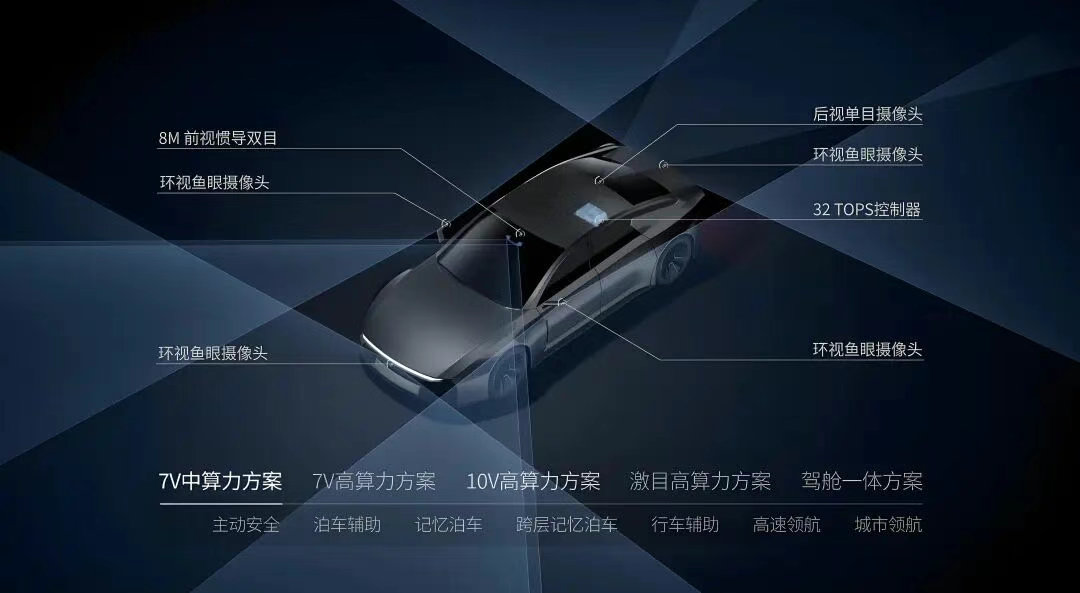

At Zhuoyu's Chengxing Technology Day in March this year, FAW's Hongqi Tiangong 05 showcased Zhuoyu Chengxing Intelligent Driving 3.0+, the world's first 10V vision-based intelligent driving assistance system, the first inertial guidance trinocular solution, and the global launch of the Snapdragon Intelligent Driving Platform SA8650P, achieving the 'industry's only' bionic vision end-to-end full-scenario solution.

Additionally, the newly launched FAW-Volkswagen Sagitar L, featuring the IQ.Pilot enhanced driving assistance system co-developed with Zhuoyu Technology, became the first and only mainstream fuel sedan to achieve map-free end-to-end highway navigation assistance.

02 The Champion of Cost-Effectiveness

Today, autonomous driving technology routes primarily fall into two categories: one is the high-computing-power, multi-sensor fusion approach, which achieves higher-level autonomous driving functions through the integration of high-computing-power chips, LiDAR, high-definition maps, and other sensors, albeit at relatively high costs. Huawei exemplifies this approach.

The other is the low-cost, vision-centric approach, which advocates for reducing reliance on high-cost hardware through algorithmic optimization to achieve high-level intelligent driving functions at low costs. Zhuoyu Technology falls into this latter category and was the earliest supplier to introduce intelligent driving solutions to vehicles priced around 100,000 yuan.

As early as 2024, the Baojun Yep Plus, equipped with Zhuoyu's intelligent driving solution, introduced highway navigation assistance functions to vehicles priced around 100,000 yuan. Subsequently, with the Baojun Yunhai model featuring seven cameras, a binocular vision system, a low-computing-power chip, and a 32TOPS computing solution, it brought map-free end-to-end intelligent driving to models priced below 100,000 yuan.

Zhuoyu Technology's core advantage has always been its low-computing-power requirements facilitated by its pure vision system, enabling low-cost deployment. A Chengxing platform solution with a 7V+32TOPS domain controller computing power can have its lowest vehicle installation price reduced to below 7,000 yuan.

The extreme product cost-effectiveness under the 'people's route' was once Zhuoyu Technology's unbeatable 'secret weapon'. However, with the trend of intelligent driving democratization sweeping through this year, a substantial number of competitors have entered the 100,000-200,000 yuan market segment, exerting significant pressure on Zhuoyu Intelligent Driving.

This has led to increasing voices suggesting that Zhuoyu is lagging behind in the first tier of intelligent driving, alongside DJI, Huawei, and Momenta, especially this year when orders from Baojun were intercepted by 'Huawei ADS'.

Therefore, expanding its partner network and achieving large-scale deployment have become top priorities for Zhuoyu Technology. Currently, the industry's perception of Zhuoyu's cooperative models is mostly limited to Wuling Baojun and Hongqi Tiangong.

At the Shanghai Auto Show in early May this year, Zhuoyu publicly announced nine major cooperative clients for the first time, including Volkswagen, SAIC-GM-Wuling, BYD, Chery Automobile, Great Wall Motor, China FAW Group, Dongfeng Motor, Audi, and BAIC Group. Zhuoyu Technology also stated that over 20 models have already entered mass production, with more than 30 additional models set to follow soon.

This year, Volkswagen Group's first batch of fuel vehicles in China equipped with highway navigation assistance officially launched. While the solution for Audi models comes from Huawei, all solutions for Volkswagen brand models are from Zhuoyu.

Moreover, Zhuoyu is already preparing for future intelligent driving overseas deployments. Zhuoyu's test fleet has been spotted on the streets of Munich, Stuttgart, and Ingolstadt, Germany, officially commencing local testing in Europe.

During the recently concluded Munich Auto Show, Zhuoyu officially launched its European strategy, announcing the establishment of its headquarters in Braunschweig, Germany. Its business will primarily consist of two parts: engaging with European OEMs and assisting Chinese automakers in going global.

It is anticipated that within the next year, Zhuoyu's test vehicles and test scenarios in Europe will cover the entire country of Germany, with future plans to continuously increase investment in computing power and infrastructure construction in Europe. In the near future, at least six Volkswagen Group models equipped with Zhuoyu's assisted driving systems are set to debut.

It is evident that Zhuoyu Technology is intentionally accelerating its mass production deployment towards large-scale operations. With FAW completing its strategic investment in Zhuoyu Technology, bearing the title of 'China's First', Zhuoyu Technology's confidence will undoubtedly strengthen.