September Sales Teaser: Who's Sacrificing Profits for Hype, and Who's the True 'Champion'?

![]() 10/09 2025

10/09 2025

![]() 527

527

Fueled by the traditional peak sales period known as "Golden September, Silver October" and regional policy subsidies, the automotive market in September came alive with long-awaited vigor. Data from the China Passenger Car Association (CPCA) reveals that from September 1st to 27th, nationwide retail sales of passenger cars hit 1.776 million units. This marked a 0% year-on-year increase compared to the same period last September, and a significant 12% month-on-month surge. Many brands eagerly unveiled their sales figures during the National Day holiday. Today, let's delve into the performance of domestic brands.

1. Transformation in the New Forces Arena

Leapmotor delivered a staggering 66,657 vehicles in September, marking a 97% year-on-year spike. Not only did it break through the 60,000-unit barrier for the first time, but it also set a new monthly sales record for China's emerging automotive forces. This feat secured Leapmotor's seventh consecutive monthly sales crown among new forces brands, nearing the monthly sales volume of GAC Toyota.

The "40,000-Unit Monthly Sales Club," comprising XPeng and Xiaomi, emerged as another September market highlight. XPeng delivered 41,581 units in September, marking a 95% year-on-year increase and setting a new brand record. It boasts best-selling models across all segments, including the MONA M03 with over 10,000 deliveries, the P7+ with cumulative deliveries of 77,000 units, and the X9, which excels in the pure electric MPV segment.

Xiaomi Automobile, a dark horse in the industry, once again surpassed 40,000 deliveries in September, maintaining its strong performance since launch. Currently, production capacity, rather than order volume, remains the primary constraint on Xiaomi Automobile's deliveries.

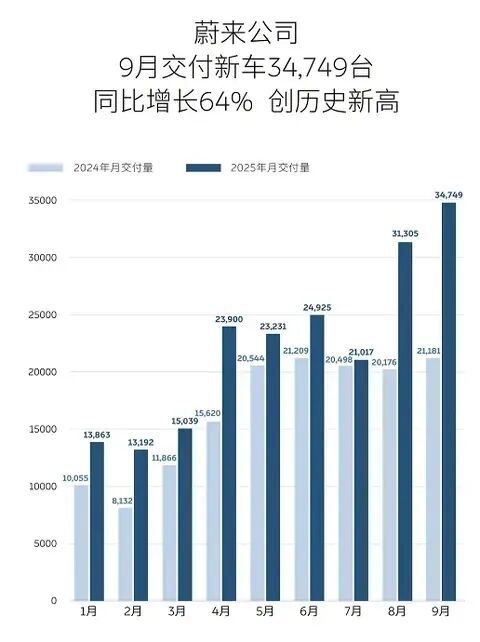

Within the "30,000-Unit Club," NIO and Li Auto exhibited contrasting development trajectories. NIO delivered 34,749 new vehicles in September, marking a 64% year-on-year increase and setting a new historical high. Among them, the NIO brand delivered 13,728 units, and the Onvo brand delivered 15,246 units. The most surprising September delivery was not the L90 (with 21,626 units delivered in two months since launch) but the Firefly, which sold 5,775 units.

Li Auto, on the other hand, continued to face pressure, with September sales reaching 33,951 units, marking a 36.8% year-on-year decrease. This marks the fifth consecutive month of year-on-year decline since May. Li Auto has successively launched two new models in the i series, the i8 and i6. Whether it can regain momentum with pure electric vehicles in the future remains a notable question.

2. Significant Disparities Among Traditional Automakers

Among traditional automakers, BYD's global sales in September reached 396,270 units, exhibiting a trend of "domestic pressure and overseas growth." Specifically, BYD's domestic sales in September were approximately 325,400 units. In overseas markets, BYD's exports hit 71,256 units in September, with passenger vehicle and pickup truck overseas sales reaching 70,851 units, becoming a key pillar of BYD's September sales.

Geely Automobile impressed with September sales reaching 273,125 units, marking a 35% year-on-year increase. Among them, the Geely Galaxy brand performed exceptionally well, with September sales reaching 120,868 units, marking a staggering 131% year-on-year increase.

Changan Automobile also achieved September sales of 266,000 units, marking a 25% year-on-year increase, with new energy vehicles accounting for 103,000 units, marking an 87% year-on-year increase.

The continuous rise in new energy penetration rates is another significant trend faced by traditional automakers. According to CPCA data, from September 1st to 27th, retail sales of new energy vehicles in the national passenger car market reached 1.039 million units, marking a 9% year-on-year increase compared to the same period last September, with a new energy retail penetration rate as high as 58.5%.

3. Overseas Markets: A Vital Growth Engine

Amidst increasingly fierce competition in the domestic market, overseas markets are emerging as a crucial growth driver for many automakers. According to CPCA data, from January to August, China's automobile exports reached 4.94 million units, marking a 21% year-on-year increase.

China's new energy vehicle exports exceeded expectations, primarily due to plug-in hybrid and hybrid vehicles replacing pure electric vehicles as new growth points in exports. Notably, the export of plug-in hybrid pickups performed strongly, becoming a highlight in the export of new energy commercial vehicles.

In Conclusion

As the September sales battle concludes, the "Silver October" competition has already commenced. Small-scale auto shows are being held across regions, and multiple automakers have rolled out promotional policies. AITO, ZEEKR, and Li Auto have introduced purchase tax subsidies, while NIO has launched power replenishment subsidies.

The "Golden September" battle is over, and the "Silver October" competition has begun. Who can seize the initiative during the National Day holiday not only concerns the achievement of annual sales targets but will also shape the future market landscape. 2025 may prove to be a watershed year. What will the domestic automotive market look like this year? Let's wait and see! Welcome to follow "Auto Domain Boundless" and share your opinions in the comments section.