"Budget-Friendly" Tesla: Who Is It Attracting?

![]() 10/09 2025

10/09 2025

![]() 441

441

Lead-in

Introduction

Tesla: Once again, let's demonstrate the power of branding.

"Who is buying Teslas in China?" For years, Chinese automakers have been striving to find an answer to this question, employing various strategies.

Yet, the reality is that, regardless of external factors, Tesla's unique approach has cultivated a loyal fan base. From the Model 3 to the Model Y, and now the Model YL, no matter how similar Tesla's new models may appear or how seemingly basic each innovation is, there is always a significant number of Chinese users willing to pay a premium for them.

As of 2025, many still argue that while Tesla's individual technologies may not be the most advanced, its overall product strength in terms of safety, intelligence, and performance, combined with its strong brand image, makes it highly appealing to Chinese consumers.

Facing fierce competition from Chinese brands—which are leveraging ecosystem strategies, focusing on energy replenishment, piling on features, competing on price, and even engaging in public opinion battles—Tesla remains unperturbed, acting as an "industry benchmark" with sales volumes largely unaffected by external pressures.

Of course, from a corporate perspective, Tesla has its unique attributes. Founder Elon Musk and his ventures, such as SpaceX, have created a formidable brand moat. However, when we calmly assess Tesla's product offerings in recent years, are some of the reasons for its popularity a bit exaggerated?

For instance, when Chinese startups introduce detail-oriented innovations, many criticize them as flashy but impractical. Yet, when it comes to Tesla, from hidden door handles that require a reverse grip to open to later screen-based gear shifting and push-button turn signals, these become selling points for product updates. The speed at which users adapt to these changes is astonishing.

Now, with a budget-friendly Model 3/Y making headlines and potentially coming to China, it's unclear how potential users will perceive Tesla's latest move. However, judging by the current trend, perhaps Tesla remains the same Tesla.

01 When a "Budget-Friendly" Tesla Arrives in China

This year, unlike previous years, one might have expected Tesla to face greater sales pressure in the global market due to the strong overseas presence of Chinese new energy vehicles and slowing demand for pure electric vehicles in various regions.

However, when Tesla released its global production and delivery report for the third quarter of 2025, the data revealed that Tesla produced approximately 447,000 pure electric vehicles worldwide this quarter and delivered 497,000 units, marking a year-on-year increase of 7.4% and setting a new quarterly delivery record. Among them, Model 3/Y deliveries reached 481,000 units, a year-on-year increase of 9.4%.

In the Chinese market, possibly spurred by generous national subsidies, Tesla not only achieved sales of 169,200 units in the third quarter, a 31% increase from the previous quarter and setting a new annual high, but also delivered over 90,000 units from its Shanghai Gigafactory in September alone, with the Model Y once again leading the market in pure electric SUVs.

Since late September, car purchase subsidy policies in various regions have either tightened or been suspended, casting a shadow over the entire new energy vehicle market. However, for Tesla, the strong demand from Chinese users seems largely unaffected by policy changes. After all, Tesla announced on October 1st that it would continue to offer preferential car purchase policies.

Against this backdrop, let's revisit Tesla's decision to introduce a budget-friendly model.

In Tesla's calculation, this move reflects its ambition to capture the mass market. For the Chinese market, given the strong support from Chinese users, the introduction of a budget-friendly model, akin to when BBA (BMW, Benz, Audi) introduced entry-level sedans, aims to target those who are drawn to the brand.

So, will Chinese users be willing to pay for it?

Most likely. As we've mentioned, Tesla holds a unique position in the purchasing decisions of Chinese users. If a six-seater model like the Model YL, with cramped third-row space, can attract a large number of Chinese users to place orders, it only proves one point: Tesla's potential customers will not be deterred by changes in the external environment.

Simply put, consumers who want to buy a Tesla only hesitate over which Tesla model to choose, rather than considering other brands.

Everyone is asking, what is Tesla's magic? Is it that prices never betray users? Is it the unparalleled driving experience? Is it the intelligent configurations, especially the driving assistance features, that far exceed expectations?

I can only say, because it's Tesla. Around me, I don't know how many people have cited reasons for choosing Tesla such as "it drives well" or "it's intelligently designed." In reality, some of them are either complete beginners who have just started driving or theoretical enthusiasts who have never opted for FSD driving assistance. What does this mean? I'll leave it at that.

Now, setting aside the discussion of whether the Chinese market will continue to view Tesla through rose-tinted glasses, the addition of a budget-friendly model, as the market pushes Tesla from a "technology leader" to a "scale monopolist," and before the global market penetration rate of pure electric vehicles reaches a critical point, expanding the user base through budget-friendly models, whether to accumulate users for subsequent FSD software services or to build a competitive advantage ahead of rivals, seems like a clear strategy for Tesla.

02 When Will Tesla "Lose Its Charm"?

At this moment, many industry practitioners believe that Tesla's introduction of a budget-friendly Model Y is driven by both Elon Musk's long-standing vision of "making electric vehicles affordable" and the harsh realities of the current market. This strategic move not only concerns short-term sales growth but also impacts Tesla's long-term development in the global electric vehicle market.

Moreover, in the United States, with the withdrawal of subsidies creating significant pressure, to make up for the loss of up to $7,500 in individual car purchase subsidies, introducing budget-friendly models holds significant importance for Tesla.

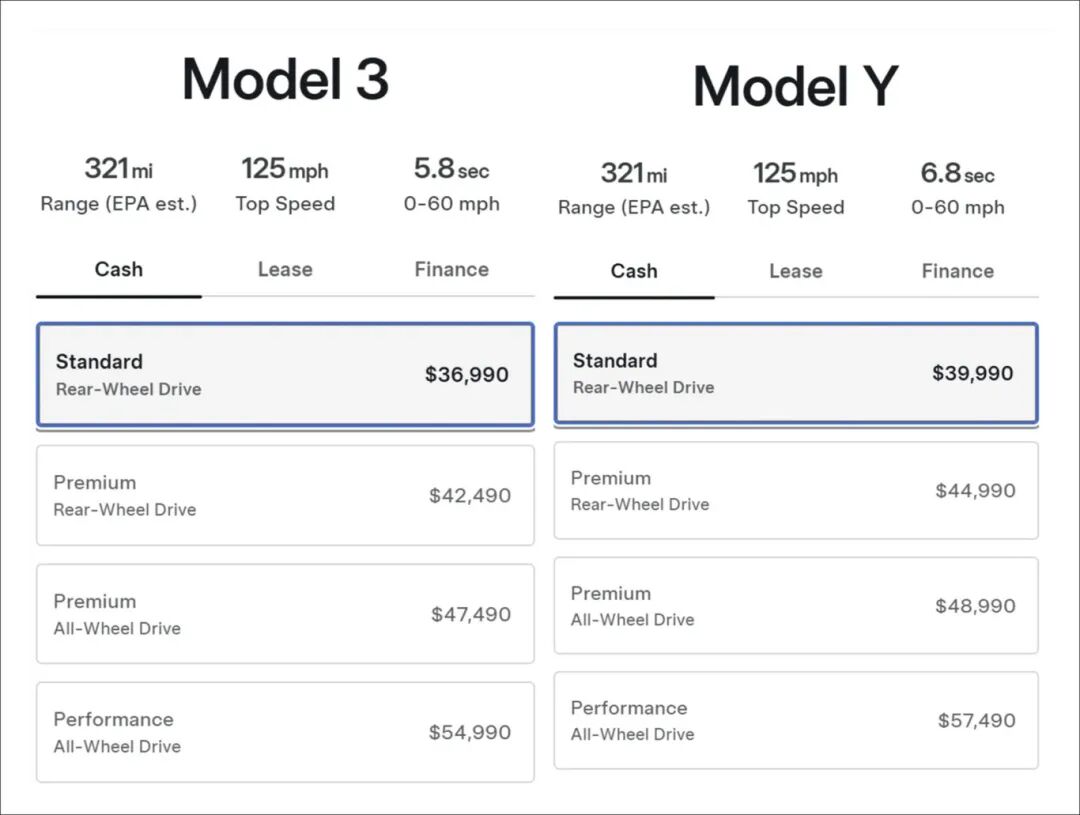

As a budget-friendly model, the Model Y Standard was launched in the United States on October 7th, priced at $39,990 (approximately RMB 284,700), with deliveries planned for November-December. The starting price of the Model 3 Standard has also been reduced to $36,990, obviously just the first step.

Based on Tesla's own plans, we have no intention of questioning its purpose in introducing new models. However, this time, the significant configuration reductions made solely for price cuts seem unconventional in 2025.

On October 8th, Beijing Time, at the close of the US stock market, Tesla's stock fell by 4.46%, with its market value evaporating by $65 billion, approximately RMB 463 billion, the largest drop among major tech stocks, which actually speaks volumes.

As a model that is not exactly new, can you imagine that the Model Y Standard can have all the configurations you can think of reduced to the bare minimum?

Externally, the front penetrating lamp group and rear diffuse reflection lights have been removed. Internally, features like ambient lighting, panoramic sunroof, electric steering wheel adjustment, physical buttons for electric seat adjustment, rear screen, and seat ventilation have been eliminated. The audio system has been reduced to 7 speakers. Even the seat material has been downgraded from a fabric + perforated leather advanced fabric to pure faux leather, with the interior roof changed to fabric and the movable cover for the center console cup holder removed...

Meanwhile, the suspension has been changed to passive shock absorbers, the battery capacity has been reduced, and the range has dropped to 517 kilometers (WLTC standard).

Yes, yes, even with all these reductions, there are still people on the internet who insist that as long as Tesla's mechanical quality remains and its energy consumption level is good, such a budget-friendly model is still worth buying.

But in China, I would like to ask: if these budget-friendly models enter the Chinese market and Tesla can still attract a large number of people to pay for such extremely optimized products, can Chinese automakers, who advocate for comprehensive product configurations and continuously lower prices, really stand by and watch?

The game theory between brand premium and configuration trade-offs will determine market acceptance. Tesla's strategy of "reducing configurations to preserve core strengths," packaging its brand value and three-electric technology advantages into low-priced products, seems like a wise move. However, such significant configuration reductions, almost presenting the car at a taxi's configuration level, are too damaging in terms of value perception.

To be honest, even today, domestic brands dominate public opinion. However, have you noticed that the path of offering products with high cost-effectiveness has never been abandoned? Whenever consumers now cheer for the idea that "joint venture brands cannot harvest Chinese users with low-spec, high-price strategies," they fail to realize that Tesla is still playing the role of past joint venture brands. I really don't know what to say about this.

Editor-in-Chief: Cao Jiadong Editor: Chen Xinnan