How Is the Electrification of Automobiles Progressing in Europe?

![]() 10/09 2025

10/09 2025

![]() 492

492

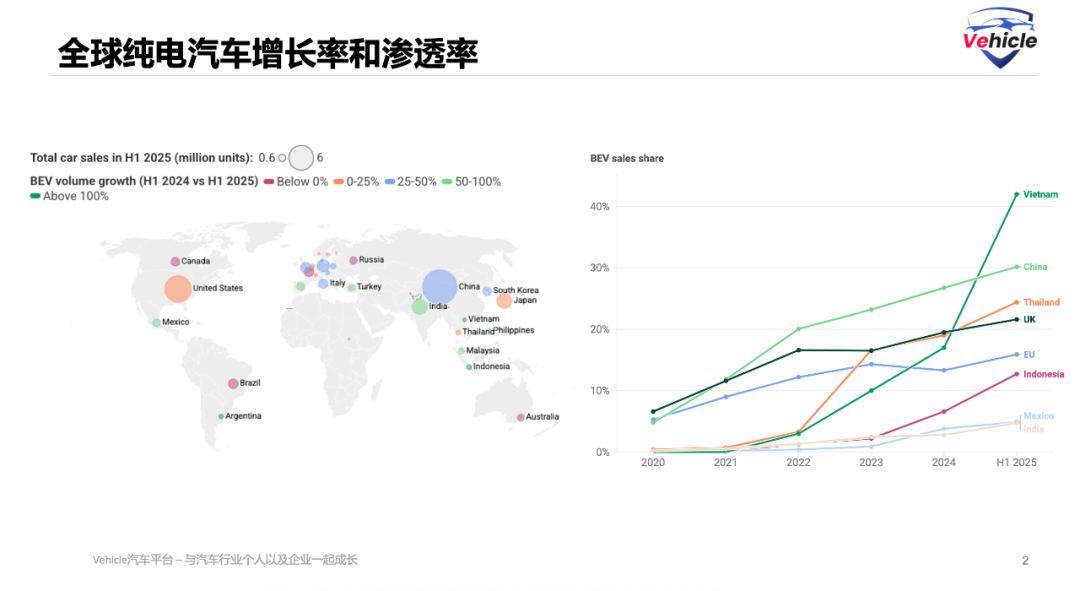

As is widely known, Europe, the cradle of the automobile industry, has lagged behind in the previous wave of electrification. Taking global data from the first half of this year as an example, the global automotive market is undergoing rapid electrification, particularly in Southeast Asia and South America.

Firstly, China, a pioneer in automotive electrification, witnessed a 44% year-on-year surge in pure electric vehicle (BEV) sales in the first half of 2025, with the overall BEV penetration rate reaching 30%.

In Southeast Asia, Indonesia's BEV market is emerging rapidly, with a staggering 158% year-on-year increase in BEV sales in the first half of 2025, and the overall BEV penetration rate reaching 13%. Vietnam also saw BEV sales grow by over 100%, with the BEV share reaching 42%. Thailand's BEV sales increased by 25%, with the overall BEV penetration rate reaching 34%.

In South America, both Mexico and Argentina experienced nearly 100% year-on-year growth in BEV sales in the first half of 2025.

In contrast, the 27 EU countries saw a 22% growth in BEV sales, with the BEV sales share barely reaching 16%.

So, is Europe missing out on the robust automotive electrification trend?

This article will delve into the progress of electrification in Europe, drawing on relevant data from T&E (Transport & Environment). It will cover Europe's electrification policies, the state of the European electric vehicle supply chain, and the product strategies of major European automotive OEMs.

Electrification Policies in Europe

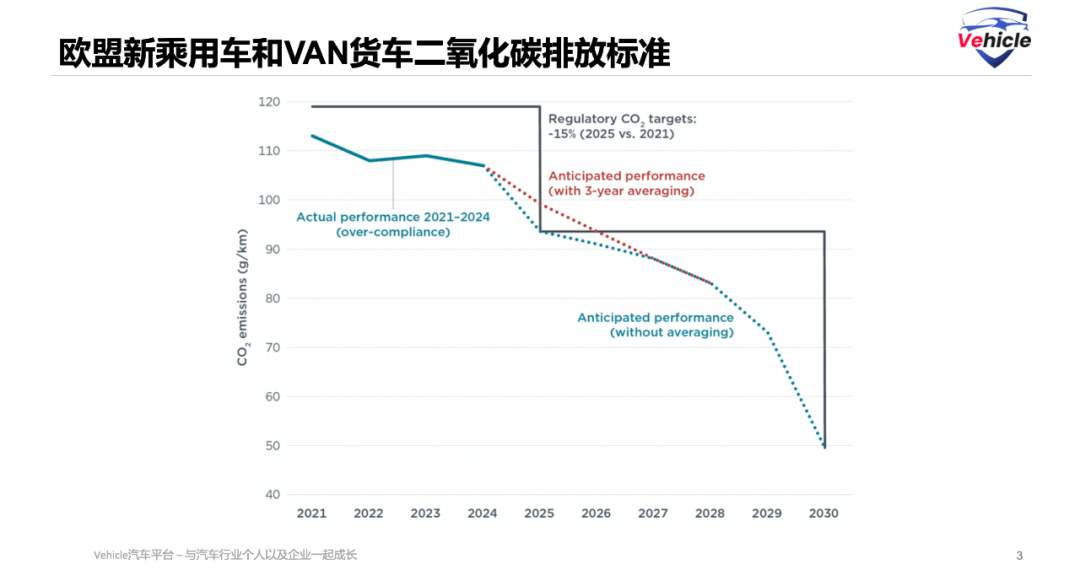

EU regulations mandate automakers to reduce carbon dioxide (CO2) emissions from new passenger cars and vans by 15% by 2025, 55% by 2030 (50% for vans), and achieve 100% reduction by 2035. This is the widely discussed EU regulation banning the sale of fuel-powered vehicles by 2035.

Calculations suggest that to comply with these regulations, European automakers should have BEV sales accounting for at least 20% of their total new vehicle sales; otherwise, they will face substantial fines.

However, in May of this year, the EU finally approved the postponement of the 2025 CO2 emission targets, providing automakers with some breathing room.

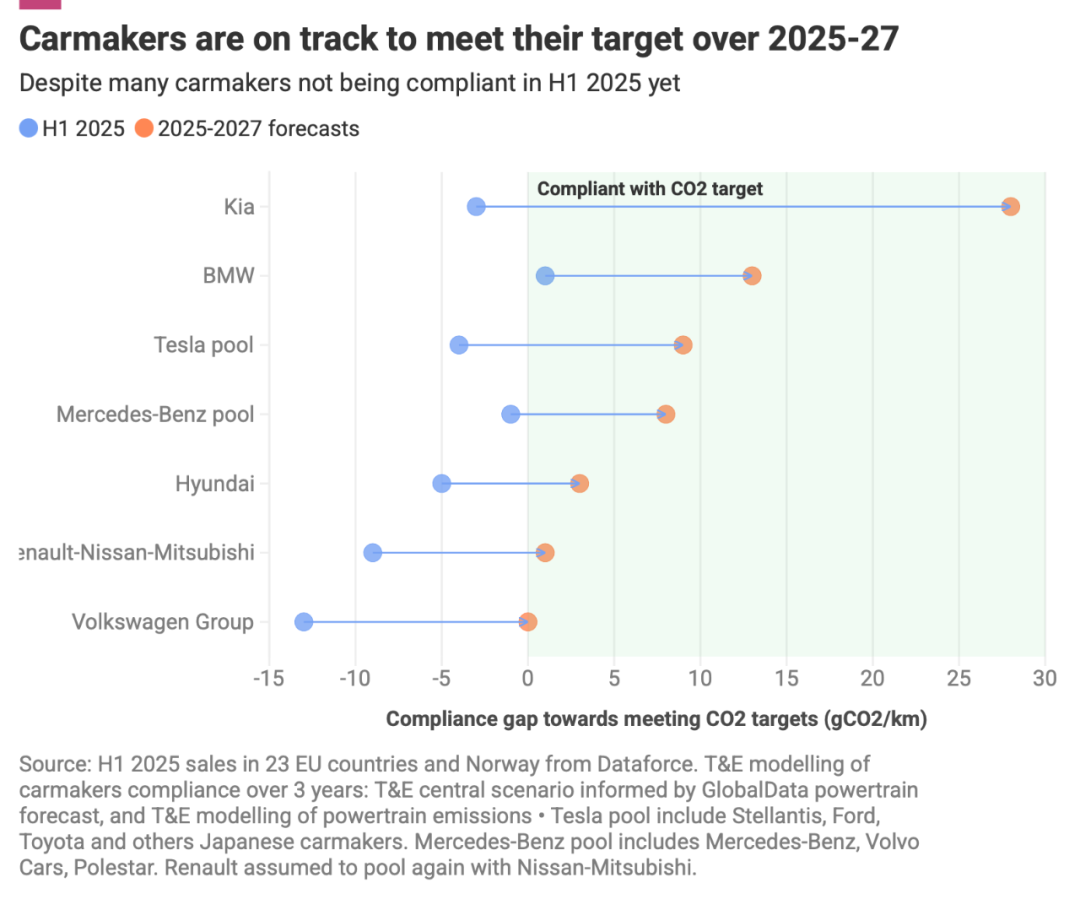

According to the amended average carbon emission regulations, compliance will no longer be based on automakers' CO2 emission performance in 2025 but rather on the average emission levels over the three-year period from 2025 to 2027, effectively relaxing the time constraints.

Overall, while the EU's long-term goals for carbon emission regulations remain unchanged, they have been postponed because, based on data from various automakers in 2025, few have met the original requirements.

Battery and Charging Facilities

The primary concern for electric vehicle users is range anxiety, which is influenced by two main factors: battery range and charging infrastructure. Addressing these concerns is crucial for the widespread adoption of BEVs.

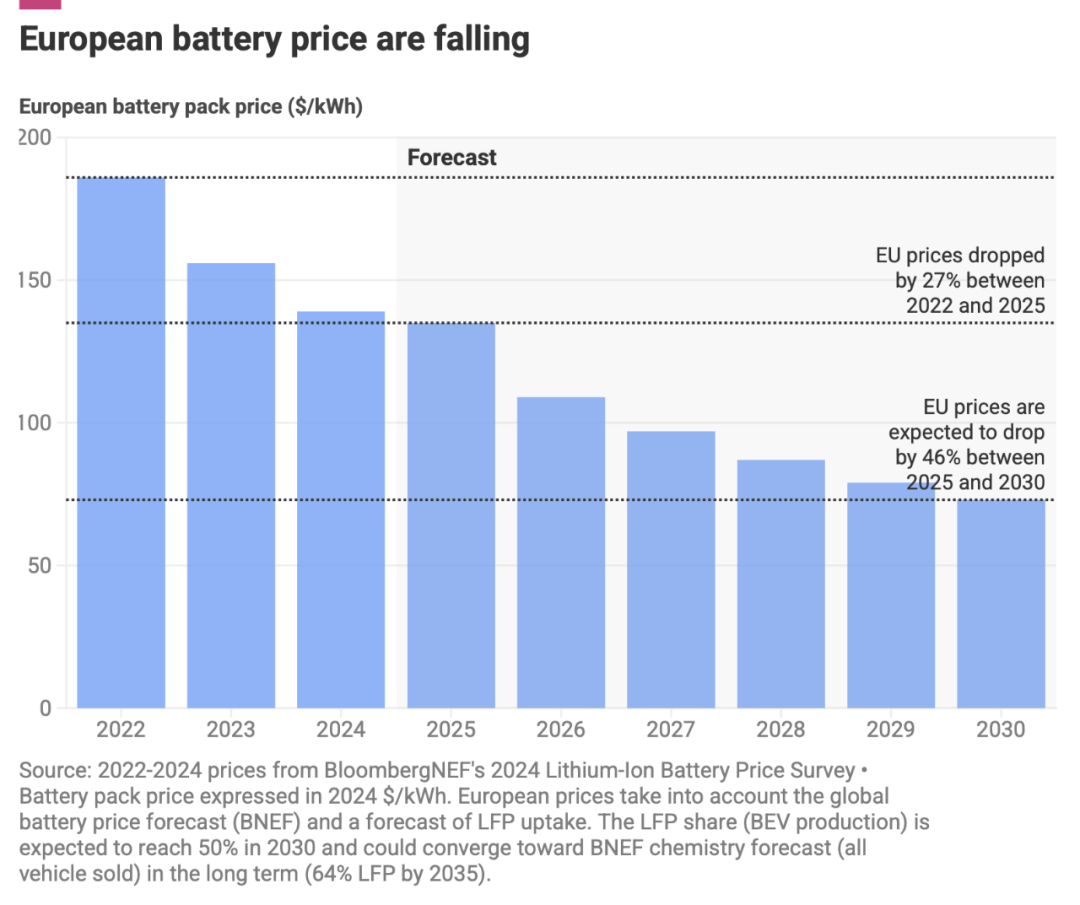

According to T&E's forecast, EV battery prices are expected to decline more significantly by 2027 than they have in the past three years. European battery prices are projected to fall by 28% between 2025 and 2027, surpassing the decline of the past three years and further enabling BEV price reductions.

It is anticipated that battery prices will drop by 46% between 2025 and 2030. The main driver is the increasing share of LFP batteries in Europe (expected to reach 50% by 2030), which supports the price decline. For reference, China has already achieved a 67% LFP share by 2025.

Consequently, the prices of power batteries for pure electric vehicles in the EU are rapidly declining.

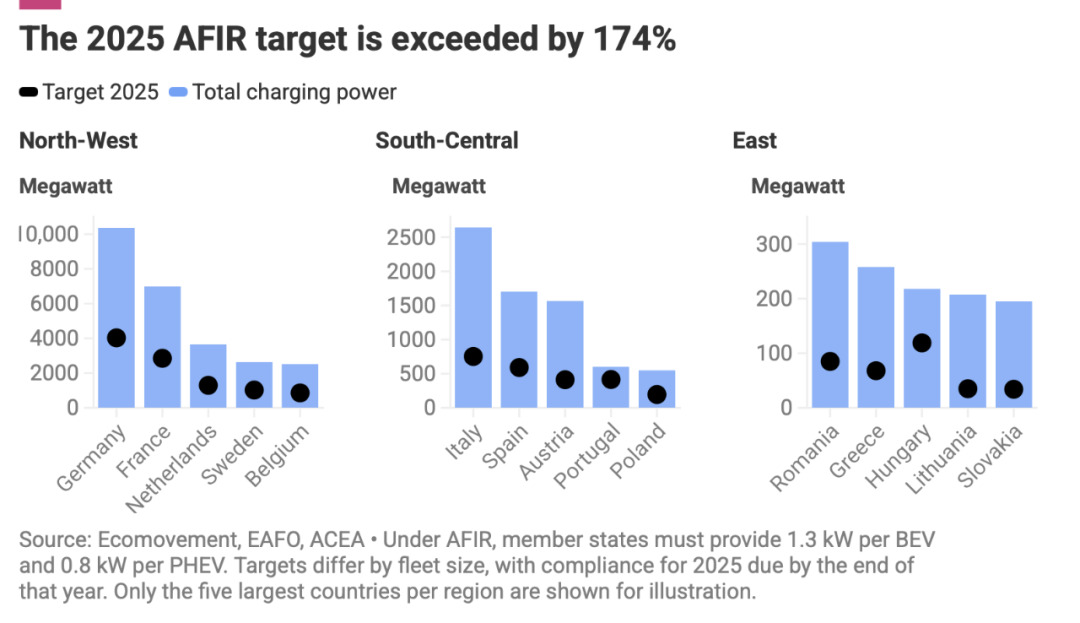

To ensure the development of new energy in Europe, the EU has established the AFIR (Alternative Fuels Infrastructure Regulation) regulations.

Regarding public charging infrastructure for light-duty road vehicles (cars and vans), the regulations set mandatory national charging station targets: a minimum power output of 1.3 kW per pure electric vehicle and at least 0.8 kW of total output power per plug-in hybrid vehicle.

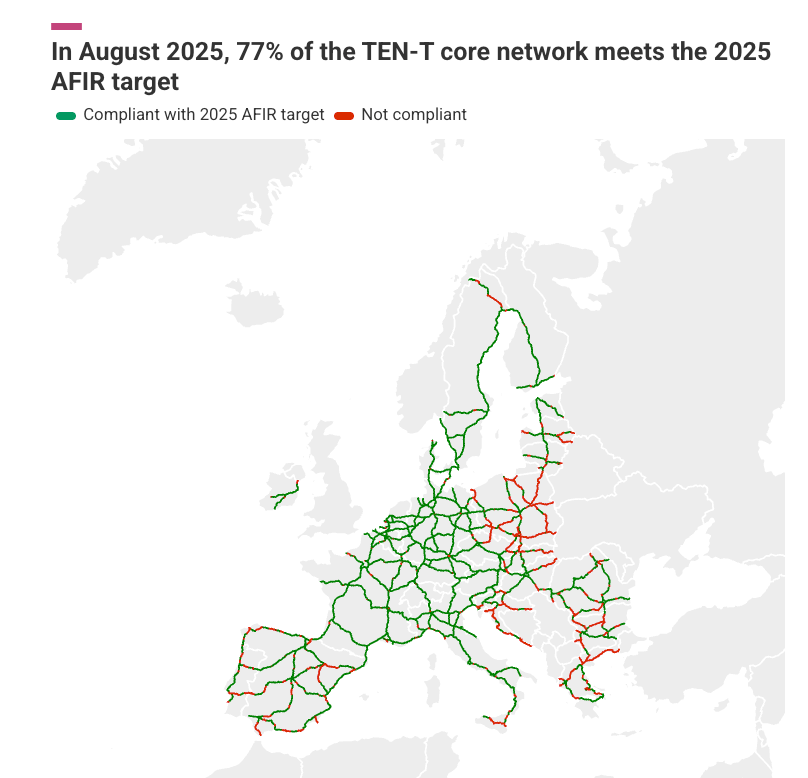

Additionally, the regulations specify distance targets for light-duty and heavy-duty road vehicles traveling on the TEN-T core network and comprehensive network. They also require EU member states to ensure the installation of a certain number of charging stations for heavy-duty vehicles in urban hubs and safe, reliable parking areas.

Currently, all EU countries have exceeded their established targets for the total number of charging stations by 2025. Overall, the EU has surpassed its AFIR targets by 174%.

T&E predicts that the number of public charging stations in the EU will reach 1.1 million by 2025, five times the number in 2020. 77% of the core highway network (TEN-T) is already covered by ultra-fast charging, meeting the 2025 network coverage AFIR targets.

Charging Network Development: Charging Coverage Surges Alongside BEV Adoption

As battery prices decline, so will the prices of electric vehicles (refer to our previous article "A Visual Guide to the Cost Structures of Fuel-Powered, Pure Electric, and Extended-Range Electric Vehicles" for a detailed breakdown of new energy vehicle cost structures), making them more accessible to a broader audience. The widespread availability of charging facilities alleviates range anxiety.

Therefore, Europe's electric vehicle adoption is no longer hindered by battery and charging shortcomings.

Developments Among European Automakers

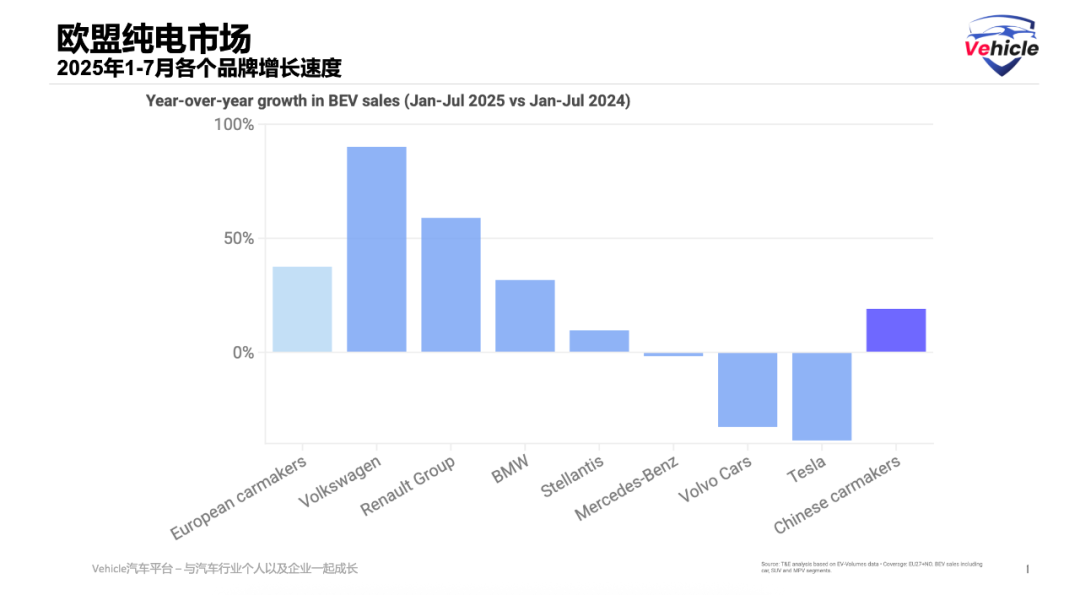

According to data from Transport & Environment, pure electric vehicle sales among mainstream European automakers grew by 38% from January to July, with Volkswagen and Renault experiencing growth rates of 90% and 60%, respectively, in major markets. Chinese brand automakers, despite facing imposed tariffs, also saw sales growth of nearly 20%.

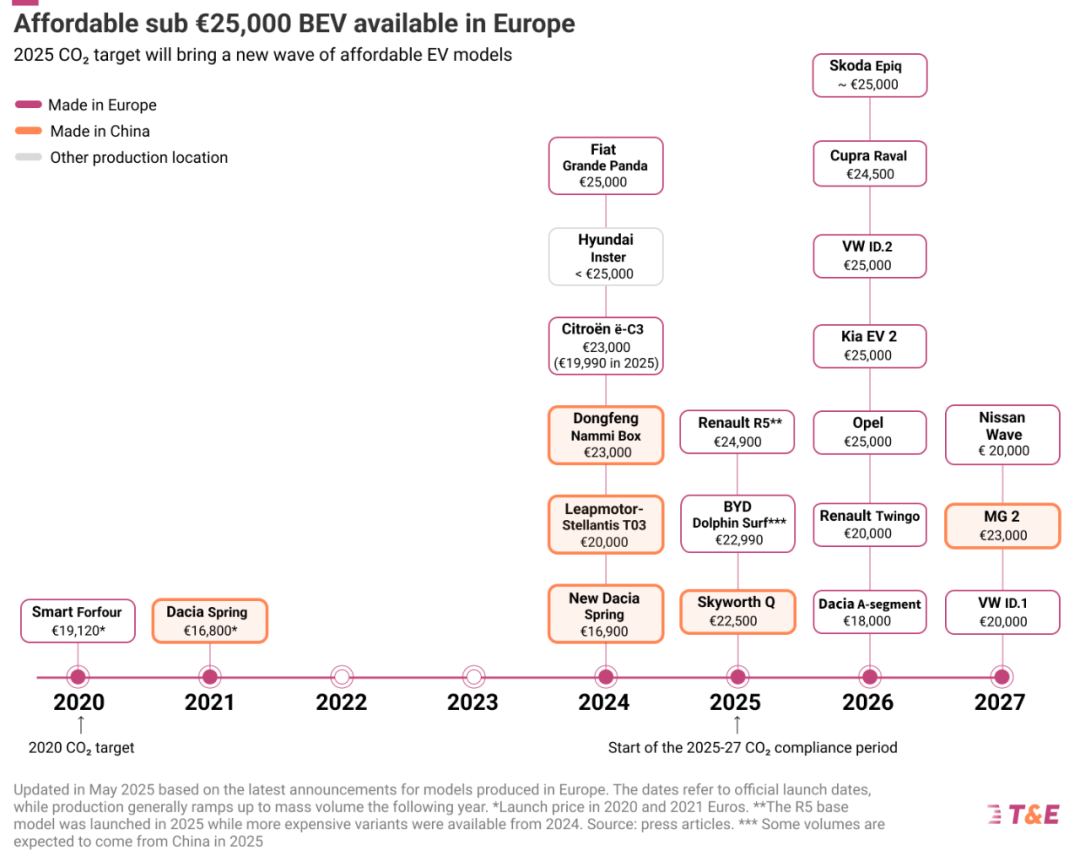

Benefiting from the decline in European battery prices, European automakers have begun introducing new affordable models with starting prices below €25,000 since 2024. In 2025, sales of affordable models are expected to double compared to 2024.

It is anticipated that nine affordable models will be available by the end of 2025, with at least 19 expected by the end of 2027. Increasingly, these affordable models will be manufactured in Europe; previously, the vast majority were produced in China, such as the Dongfeng Nanomi, Leapmotor T03, Dacia Spring, Skyworth Q, and models produced in South Korea like the Instar. Subsequently, Volkswagen and Renault will introduce seven to eight affordable models manufactured in Europe, and BYD's Dolphin will also be produced locally in Europe this year.

These models will significantly drive the electrification process in Europe.

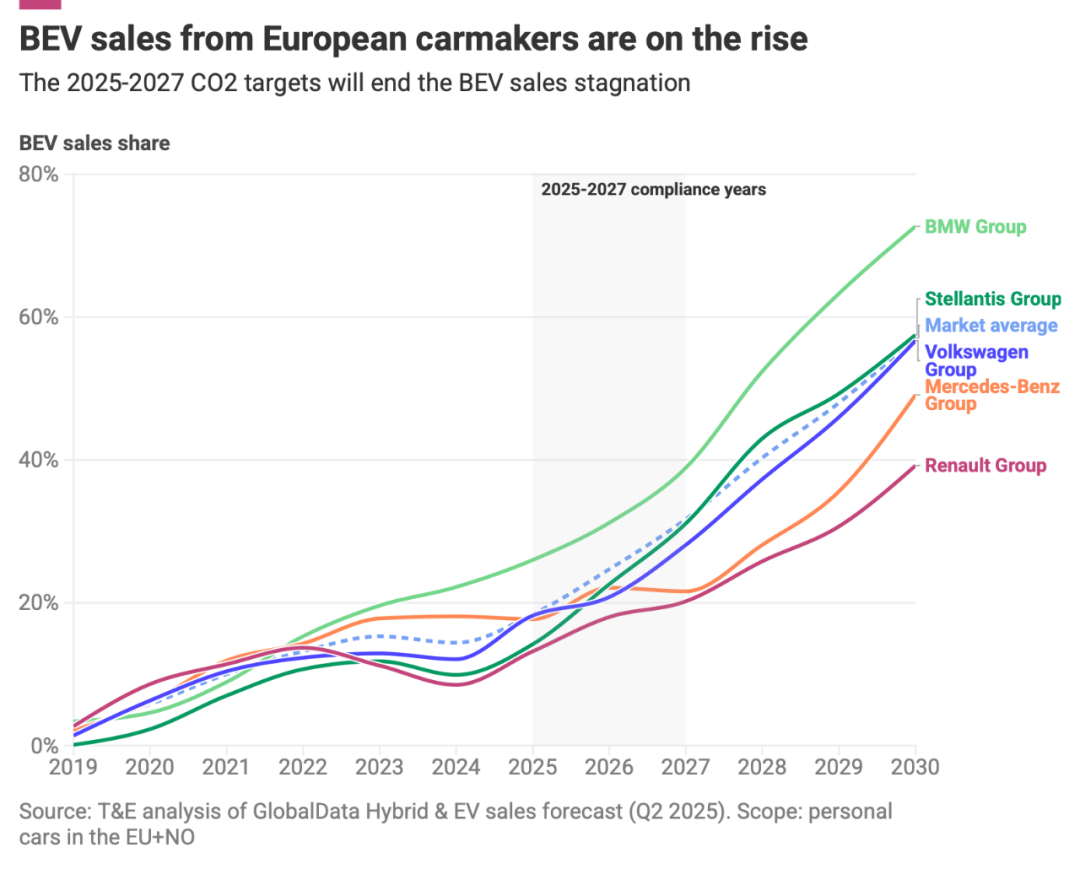

Based on data from T&E, 2025 will be a pivotal year for the electrification of European automakers, with electrification accelerating from this point onward.

In 2025, the proportion of pure electric vehicle sales among European automakers should be around 18%. From 2025 to 2027, pure electric vehicle sales should reach around 25%, ultimately reaching approximately 55% by 2030.

Conclusion

The electrification of automobiles in Europe is transitioning beyond the early adoption phase, with more and more automakers introducing affordable electric vehicle models.

2025 can be considered the inaugural year for the widespread adoption of electric vehicles in Europe, with affordable models set to rapidly increase in volume. As more people try electric vehicles, it will drive the rapid development of electric vehicles in Europe.

Reference Articles and Images

European Electric Vehicle (EV) Progress Report - T&E

*Unauthorized reproduction and excerpting are strictly prohibited.