Is the Domestic Auto Industry, Known for Its High Competitiveness, Truly Profitable?

![]() 10/10 2025

10/10 2025

![]() 503

503

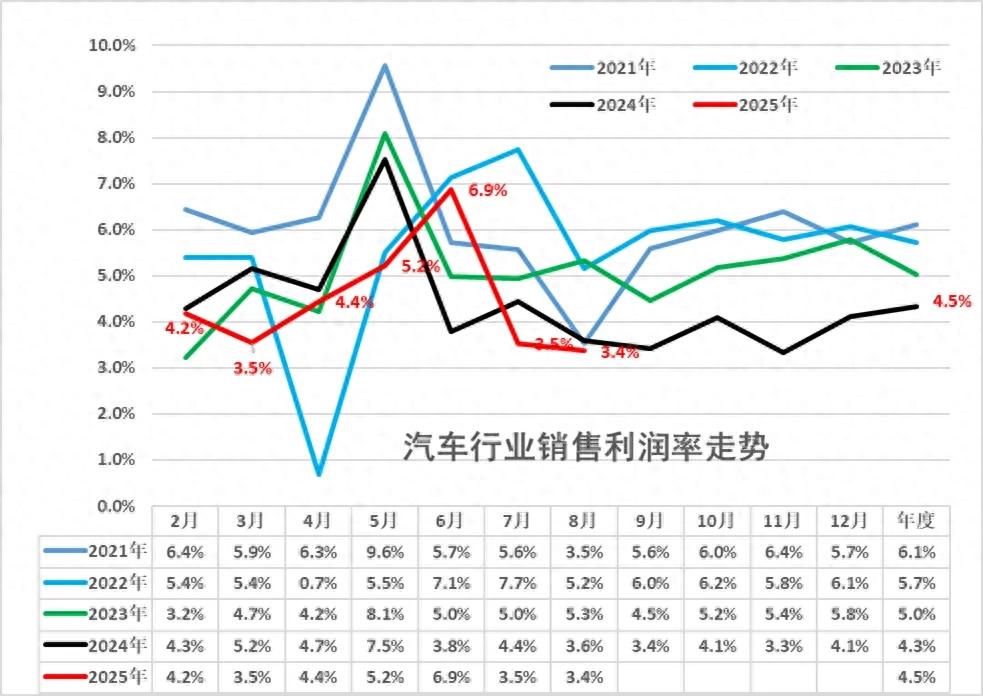

From January to August in 2025, China's auto industry generated revenue amounting to RMB 6,804.9 billion, marking an 8% year-on-year increase. However, the total profits dipped by 0.3% year-on-year, reaching RMB 303.5 billion, with the industry's profit margin standing at a mere 4.5%. This figure not only falls short of the 6% average profit margin seen in downstream industrial enterprises but also represents a historically low level, following a continuous decline from the 6.1% peak in 2021.

In stark contrast to the profitability challenges faced by vehicle manufacturers, the parts sector witnessed a remarkable 15.70% year-on-year surge in net profit during the first half of 2025, showcasing its robust profit resilience.

1. Industry Quagmire: Production Hikes Without Revenue Gains

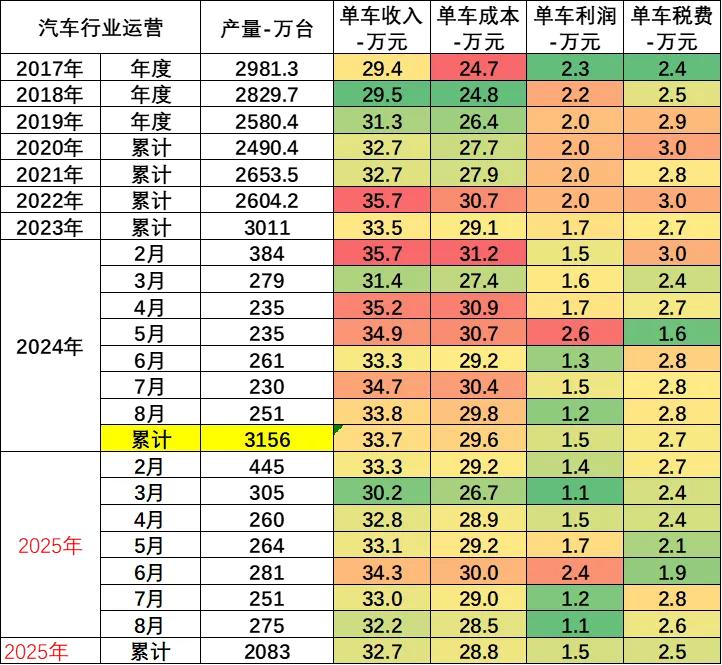

China's auto industry finds itself ensnared in a vicious cycle of 'increased production without commensurate revenue growth.' From January to August 2025, the national auto production soared to 20.83 million units, a 11% year-on-year rise. While the expansion in production and sales fueled an 8% increase in industry revenue, profits took a hit during the same period.

The auto industry's profit margin has been on a downward trajectory, sliding from 6.1% in 2021 to 5.7% in 2022, 5.0% in 2023, and further plummeting to 4.3% in 2024. Although it experienced a slight rebound to 4.5% in the first eight months of 2025, it still remains at a historically low ebb.

What's even more concerning is the monthly performance in August 2025: the industry's profit margin plummeted to 3.4%, a significant drop from July and a further decline from the 3.6% year-on-year figure, marking a historical low for the same period.

From the perspective of per-vehicle profitability, the overall per-vehicle revenue in the auto industry chain stood at RMB 327,000, with a per-vehicle profit of RMB 15,000 from January to August, a level deemed insufficient to sustain the industry's long-term development.

2. Supply Chain Profitability: Parts Sector Defies the Trend with Growth

Against the backdrop of overall profitability pressures in the auto industry, the profitability landscape across supply chain segments has exhibited significant divergence. The parts sector has emerged as a standout performer, becoming a profit beacon in the industry chain.

In the first half of 2025, the parts sector's revenue surged by 15.7% year-on-year and 14.5% sequentially, significantly outpacing the 9.37% growth in the passenger vehicle sector. In terms of profitability, the parts sector's gross margin reached 18.2%, up 0.6 percentage points year-on-year. The net profit margin, excluding non-recurring items, hit 6.1%, showing improvements both year-on-year and sequentially.

Notably, high-quality companies in segments like intelligence and lightweighting have outperformed the industry average in both revenue and profit growth. Enterprises specializing in intelligent driving, automotive electronics, and intelligent cockpits have led the way in net profit growth, excluding non-recurring items.

In contrast, the passenger vehicle sector witnessed a 7.88% year-on-year decline in net profit during the first half of 2025. The decline widened to 25.40% in the second quarter, heavily impacted by price wars.

3. Profit Distribution: Battery Companies Reap Significant Dividends

Amidst the accelerated replacement of new energy vehicles, profit distribution has heavily favored upstream battery companies. In 2024, the combined profit of ten profitable automakers was approximately RMB 95.7 billion, while CATL alone reported a net profit of RMB 50.745 billion. This means that the profit of a single leading battery company exceeded half of the combined profits of ten automakers.

As a core cost component of new energy vehicles, batteries have witnessed a profit distribution pattern that has long favored upstream players. Most automakers lack battery production capabilities, and even with periodic declines in upstream lithium carbonate prices, cost dividends have failed to effectively trickle down to the vehicle manufacturing segment, instead being retained by battery producers.

This profit distribution pattern has left automakers squeezed between 'the difficulty of reducing upstream costs and the challenge of controlling downstream costs.' From January to August 2025, total industry costs rose to RMB 5,988.9 billion, up 8.2% year-on-year, surpassing revenue growth and directly reflecting poor cost pass-through.

4. Vehicle Sector: Internal Profitability Divergence Intensifies

Against the backdrop of an overall industry profit decline, divergence among automakers has become increasingly pronounced. In the second quarter of 2025, gross margins among passenger vehicle companies diverged, with sample automakers at 15.0%, down 0.7 percentage points year-on-year. The extent of scale effect realization and product mix optimization capabilities have emerged as core factors influencing gross margins.

Some automakers have achieved excess returns through a combination of 'technological premium and precise market segmentation.' For instance, Seres, Changan, XPeng, and Leapmotor have seen sequential improvements in gross margins, while Great Wall Motor and Seres have maintained strong profitability in the market through favorable product mixes.

Profit divergence has been particularly pronounced among A-share listed automakers. In the first quarter of this year, BYD, SAIC, Great Wall, and Changan contributed 76.2% of total industry revenue and 94.77% of net profit, further elevating industry concentration.

Meanwhile, former industry giants such as GAC Group and SAIC Motor are grappling with challenges, including declining joint venture brands and pressure from autonomous brand transformations.

5. Dealership Network: Full-Chain Pressure Mounts

Profitability pressure in the auto industry has extended from manufacturing to sales channels. According to circulation sector statistics, over 1,200 4S dealerships faced closure in the first half of this year, with only 27.5% achieving their sales targets.

Data from industry leader Zhongsheng is highly representative. Despite selling 229,000 new vehicles in the first half, gross losses reached RMB 2.388 billion, with per-vehicle losses exceeding RMB 10,000. Parker Holdings saw new vehicle gross profit plummet by 98.2% to just RMB 3 million. The traditional 4S dealership profit model—relying on after-sales maintenance, insurance commissions, and bank rebates—has lost its effectiveness.

6. Underlying Causes: Multiple Factors Squeeze Profit Margins

Intense market price wars have been the primary driver behind the declining profit margins in the auto industry. Since 2023, price wars have spread from the new energy sector to the entire fuel vehicle market, creating a red ocean of competition across all categories and price points. Approximately 710 new models were launched in China over the past year, but only 10% achieved monthly sales exceeding 5,000 units, with just 69 models meeting this threshold.

Additionally, sustained increases in rigid costs such as labor, R&D, and logistics have further compressed profit buffers. In recent years, automakers have invested heavily in new energy and intelligent R&D, but profitability in new energy products remains subpar.

Outlook: Policy Guidance and Structural Optimization

Facing industry challenges, China's 'anti-inner roll' policies are seen as an effective means to improve industry profits. While policy transmission to the terminal market requires time, initial results are becoming visible.

Meanwhile, supply chain optimization and technological innovation have become critical for automakers to break through. Companies with scale effects and high-end positioning advantages in the passenger vehicle sector are poised to sustain profitability in an increasingly differentiated market.

From vehicle manufacturing to core components, from dealership networks to after-sales services, a profound restructuring of profit distribution is underway. What does the future hold for China's auto industry? Follow 'Cheyu Wujiang' and share your views in the comments below.