Threshold for New Energy Vehicle Purchase Tax Exemption and Reduction Raised, Potentially Sparking a Fourth-Quarter Auto Market Buying Spree

![]() 10/13 2025

10/13 2025

![]() 493

493

A notification issued by three departments, including the Ministry of Industry and Information Technology, has elevated the qualifying threshold for new energy vehicles to enjoy purchase tax exemption next year, thereby injecting vitality into the auto market during the fourth quarter of this year.

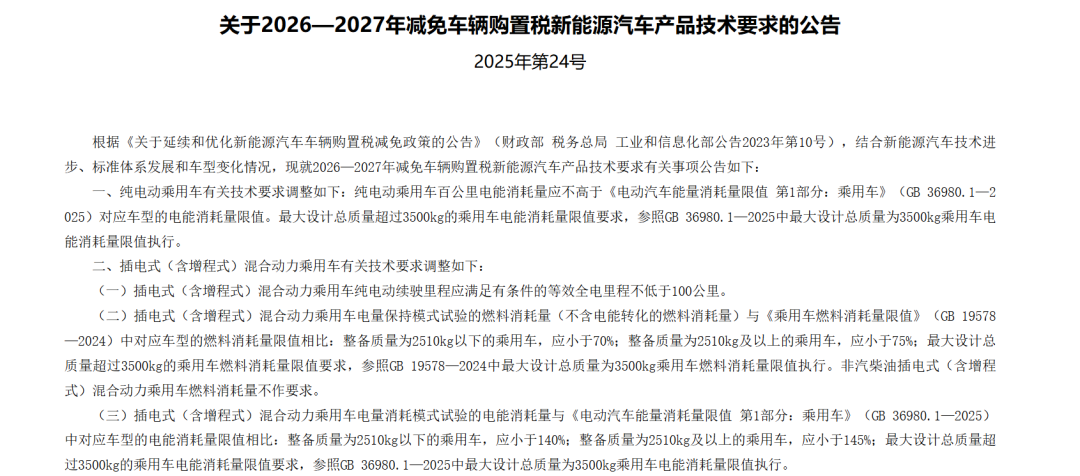

Recently, the Ministry of Industry and Information Technology, the Ministry of Finance, and the State Taxation Administration jointly released the "Notice on Technical Requirements for Purchase Tax Exemption and Reduction for New Energy Vehicles from 2026 to 2027." This notice clarifies the product technical prerequisites for new energy vehicles to qualify for vehicle purchase tax exemption and reduction during the 2026-2027 period.

The new regulations stipulate more stringent technical criteria for pure electric passenger vehicles and plug-in (including extended-range) hybrid passenger vehicles, particularly concerning energy consumption and range. These regulations are set to take effect on January 1, 2026.

Elevating the Technical Bar

The new regulations represent a comprehensive upgrade in technical requirements for pure electric and plug-in hybrid vehicles.

For pure electric passenger vehicles, the energy consumption per 100 kilometers must not surpass the energy consumption limit specified for the corresponding vehicle model in the "Energy Consumption Limits for Electric Vehicles Part 1: Passenger Vehicles" (GB 36980.1—2025). This standard, unveiled in May 2025 and slated for official implementation on January 1, 2026, introduces several modifications to the energy consumption limits for electric vehicles.

The limit format has been transitioned from the original stepped structure to a linear one, with mass inflection points adjusted from the original 750kg and 2510kg to 1090kg and 2710kg. Notably, for vehicle models under 2510kg, the energy consumption limit per 100 kilometers has been further tightened. The requirements for plug-in (including extended-range) hybrid passenger vehicles are even more intricate.

The pure electric driving range must meet a conditional equivalent all-electric range of no less than 100 kilometers. Meanwhile, the fuel consumption in the charge-sustaining mode test (excluding fuel consumption converted from electric energy) compared to the fuel consumption limit for the corresponding vehicle model: passenger vehicles with a curb weight under 2510kg should be less than 70%, and those 2510kg and above should be less than 75%.

The electric energy consumption in the charge-depleting mode test compared to the electric energy consumption limit for the corresponding vehicle model: passenger vehicles with a curb weight under 2510kg should be less than 140%, and those 2510kg and above should be less than 145%.

Adjustment of Purchase Tax Policy

2025 marks the final year of vehicle purchase tax exemption for new energy vehicles in China. Starting next year, taxes will be reinstated, albeit with continued incentives. According to the policy released in 2023, new energy vehicles that meet the new technical requirements and are purchased between January 1, 2026, and December 31, 2027, will be eligible for a 50% reduction in vehicle purchase tax, with a maximum tax reduction of 15,000 yuan per new energy passenger vehicle.

Based on the vehicle's invoice price: a vehicle priced at 100,000 yuan incurs a purchase tax of 4,425 yuan; 200,000 yuan incurs 8,850 yuan; 300,000 yuan incurs 13,275 yuan; and 500,000 yuan incurs 25,707 yuan.

Overall, purchasing a new energy vehicle next year will undoubtedly result in higher taxes. Moreover, there is a possibility that some new energy vehicles may not qualify for any purchase tax exemption due to failing to meet the pure electric driving range or energy consumption standards. Compared to 2025, the cost of purchasing a new energy vehicle for consumers will increase to varying extents, which may prompt some consumers to expedite their purchase plans.

Far-Reaching Industry Impact

In recent years, the purchase tax exemption policy for new energy vehicles has significantly heightened public awareness of the new energy industry and alleviated the economic burden on consumers when purchasing vehicles. The new regulations, by elevating the technical threshold, will further solidify the policy's guiding role and bolster the high-quality development of the new energy vehicle industry.

Relevant industry experts assert that the new regulations have four core objectives: fostering technological progress and industrial upgrading; optimizing the market competition environment; guiding rational consumption and safeguarding consumer rights; and facilitating a smooth policy exit.

Cui Dongshu, Secretary-General of the China Passenger Car Association, emphasized that the new requirements will spur technological upgrades in battery capacity and hybrid systems, enhance the driving experience, and elevate product safety and competitiveness. Stringent standards will compel companies to introduce higher-performance vehicle models, catering to consumer demand for extended range and low energy consumption.

In response to policy changes, several automakers have swiftly implemented measures to provide purchase tax subsidies for users who place orders before the year-end but are scheduled to take delivery in 2026 due to automaker reasons. Meanwhile, some hybrid models destined to fall short of the standards may witness their manufacturers engaging in "fire sales." Consequently, price competition in the auto market is anticipated to intensify again in the final quarter of this year.

Multiple experts concur that policy changes will expedite industry reshuffling, with companies lacking technological reserves facing pressure, while technologically advanced companies will secure greater market advantages. From the perspective of new energy vehicle models, the incorporation of larger batteries in plug-in hybrid and extended-range models is also a prevailing trend.

With the emergence of a buying spree in the fourth quarter, the final three months of 2025 may witness a new round of sales peaks for new energy vehicles.