99% of Electric Vehicle Owners Opt for EVs Again! China's New Energy Vehicle Repurchase Rate Skyrockets!

![]() 11/03 2025

11/03 2025

![]() 510

510

Text by Wang Xin, Illustrations by Yang Lingxiao, Produced by Electric New Species

In 2025, the Chinese new energy vehicle (NEV) market has sent another significant signal.

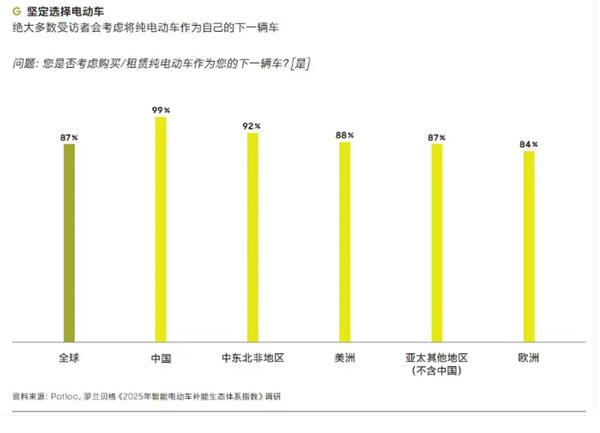

According to Roland Berger's "2025 Smart Electric Vehicle Energy Replenishment Ecosystem Index," a staggering 99% of Chinese pure electric vehicle users have expressed their intention to purchase another pure electric vehicle for their next car.

This data, derived from genuine feedback from 12,000 global respondents, underscores the maturity and confidence of China's NEV industry.

From a mere 1.42% penetration rate in 2018 to a projected historic high of over 60% by October 2025, China's NEV sector has achieved a remarkable leapfrog development in just seven years.

Today, one out of every two newly sold vehicles is an NEV. In September, the penetration rate of new energy passenger vehicles reached 57.8%, with sales volume 1.4 times that of fuel-powered vehicles.

Behind this impressive growth lies sustained policy support, a robust industrial chain, and widespread consumer recognition.

01 High Repurchase Rates Driven by Economic and Ecological Benefits

The core driver behind the 99% repurchase intention is the tangible economic benefits offered by electric vehicles.

Roland Berger's report highlights that in the Asia-Pacific and North American markets, "economic benefits" have overtaken "environmental friendliness" as the primary factor influencing consumers' choice of electric vehicles.

For daily commuters, the cost advantage of electric vehicles is particularly evident. A staggering 80% of electric vehicle users drive over 10,000 kilometers annually, and 74% use their vehicles at least four days a week. Over time, the cost gap between electricity and fuel widens significantly.

The well-developed energy replenishment system has effectively eliminated user concerns. China leads globally in investing in public energy replenishment infrastructure, particularly in promoting high-power charging facilities, bringing charging experiences closer to the efficiency of traditional fueling.

The National Development and Reform Commission has mandated that the number of high-power charging facilities nationwide should exceed 100,000 by the end of 2027. Currently, the top five operators, including Teld and StarCharge, control approximately 70% of public charging stations.

Today, less than 40% of Chinese pure electric vehicle users are dissatisfied with the speed of public charging stations, a proportion significantly lower than the global average.

In shopping malls and highway service areas, charging stations have become a standard amenity, allowing users to recharge while shopping or resting, transforming charging from a "burden" into a "habit."

Upgraded product experiences are crucial for retaining users. From breakthroughs in battery technology to iterative advancements in intelligent driving, China's NEVs have made remarkable progress.

When selecting vehicles, consumers can now witness cutting-edge technologies such as CTB (cell-to-body) battery integration and 800V high-voltage systems, as well as enjoy thoughtful features like heated and ventilated seats and AI fatigue monitoring.

A Beijing user who secured a new energy vehicle quota and purchased a car within just two months experienced firsthand the industry's technological leap. Innovations in range, torque, and AR-HUD have made driving more convenient and enjoyable.

This "technological inclusivity" allows users to truly appreciate the advantages of electric vehicles, making repurchases a natural choice.

02 Domestic Market and Export Boom for China's NEVs

China's NEVs have not only established a strong foothold in the domestic market but also demonstrated strong competitiveness on the global stage.

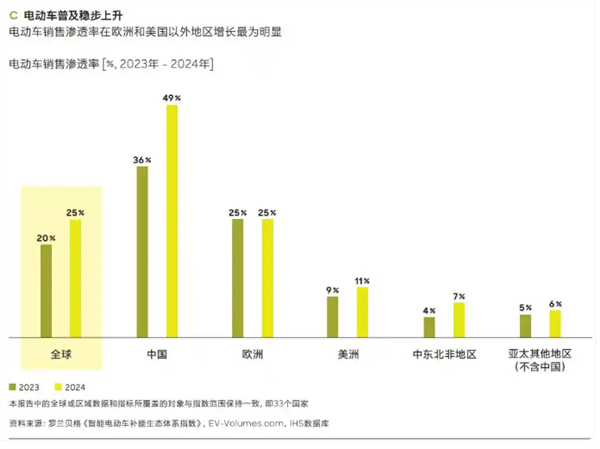

In 2024, China's electric vehicle sales penetration rate reached 49%, far exceeding the global average of 25%. Meanwhile, many mature markets saw little growth in new energy penetration during the same period.

As one of the top three global markets, China has not only solidified its leading position in road transport electrification but also continued to lead in energy replenishment infrastructure, providing a "Chinese model" for global new energy development.

In the domestic market, the divergence between NEVs and fuel-powered vehicles is becoming increasingly pronounced. From January to September 2025, production and sales of NEVs both exceeded 11 million units, with year-on-year growth exceeding 30%, accounting for 46.1% of new vehicle sales.

BYD's sales in the first three quarters surpassed 3.26 million units, retaining its position as the national sales champion. Several models from Seres' AITO brand have become bestsellers, with the M9 delivering over 250,000 units, setting a new delivery record for models priced at 500,000 yuan.

Meanwhile, although fuel-powered vehicles maintain a certain sales volume, with September sales reaching 1 million units and growing year-on-year for four consecutive months, their market share continues to be squeezed. While the "exit theory" for fuel-powered vehicles may be premature, the trend of NEVs dominating the market is irreversible.

The export market further highlights China's global influence in NEVs. From January to September 2025, China exported 5.71 million vehicles, up 21% year-on-year, including 2.32 million NEVs, a staggering 52% increase.

The export structure continues to diversify, shifting from last year's reliance on the Russian market to diversified markets in Central and South America and Europe. Mexico has become China's largest automotive export destination, while Belgium and the UK are the most popular overseas markets for Chinese electric vehicles.

BYD's export volume surged by 107% year-on-year, while automakers like Leapmotor and XPENG have also entered the European market, promoting Chinese technology and products globally.

This trend of "domestic success leading to global impact" has made China the core growth pole of the global NEV industry.

03 Comprehensive Advancements in Technology, Branding, and Ecosystems

The high repurchase rate of China's NEVs stems from the overall maturity of the industrial ecosystem. Policy support has paved the way for industrial development, with measures ranging from energy replenishment infrastructure construction to technology research and development incentives, helping the NEV industry avoid detours.

Market competition has driven continuous innovation among enterprises. BYD's R&D investment in the first three quarters reached 43.748 billion yuan, up 31.3% year-on-year, making it the highest R&D spender among A-share companies. Xiaomi Auto achieved a gross profit margin per vehicle of 26.4%, surpassing many automakers, including Tesla, demonstrating strong cost control and technological transformation capabilities.

A diverse brand matrix caters to various user needs. BYD offers multiple series, including Dynasty, Ocean, Yangwang, and Denza, covering the entire market from economy to luxury.

Geely has launched brands like Galaxy and Zeekr, precisely targeting different consumer groups.

Huawei has collaborated with Seres, BAIC, and Chery to create brands like AITO, Xiangjie, and Zhijie, enhancing product competitiveness through technological empowerment.

This market segmentation strategy allows consumers to find suitable NEV models regardless of their budget or needs, continuously improving brand loyalty.

Balancing technological iteration and safety assurance has increased user confidence. Although the fire intensity of NEVs is higher than that of fuel-powered vehicles, the probability of fires is similar. With advancements in battery technology, safety performance continues to improve.

Meanwhile, automakers have found a balance between intelligence and practicality, offering high-end configurations like lidar and intelligent driving assistance while retaining essential features demanded by users.

For consumers, NEVs are no longer just "tech toys" but safe, reliable, and enjoyable transportation tools. This shift in perception is a key reason for the high repurchase rate.

Conclusion: Repurchase Rates Reflect Industrial Strength, with New Energy Becoming the Mainstream Market Choice

The 99% repurchase intention is the best testament to the development of China's NEV industry. It demonstrates the comprehensive advantages of economic benefits, product strength, and energy replenishment ecosystems, as well as consumer recognition of the new energy trend.

From the domestic market penetration rate nearing 60% to leading global export volumes; from sustained R&D investment to a continuously enriched brand matrix, China's NEV industry has formed an irreplaceable industrial advantage.

Today, the global automotive industry is undergoing a once-in-a-century transformation, with electrification and intelligence becoming irreversible trends. China's automotive industry has seized this historic opportunity, achieving a leap from follower to leader.

Although fuel-powered vehicles still hold a certain market share and issues like rising auto insurance premiums need to be addressed collectively by the industry, the overall direction of NEVs replacing fuel-powered vehicles is clear.

In the future, with continuous technological advancements and ecosystem improvements, China's NEVs may not only continue to lead in the domestic market but also dominate the global market, bringing "Made in China" intelligence to the world.

This 99% repurchase intention is not only an affirmation of the past but also an expectation for the future. The next decade of China's NEVs is worth anticipating.