Leapmotor, Having Clinched Monthly Sales Crown with 70,300 Units Sold, Faces Acquisition Rumors Involving FAW After Nearly Six Years of Cooperation

![]() 11/05 2025

11/05 2025

![]() 569

569

Recently, Leapmotor's monthly sales have surged past the 70,000-unit mark, propelling it to the forefront of new energy vehicle (NEV) brands. Amidst this newfound acclaim, whispers of an acquisition have started to circulate.

On November 4th, market rumors suggested that FAW Group was poised to acquire Leapmotor. Leapmotor's official response to the media was prompt and unequivocal: "That's not true." Earlier reports had hinted at FAW's plan to gradually acquire Leapmotor's shares through a private placement, eventually becoming its largest shareholder. It was also rumored that the deal had received approval and was set to be announced on November 17th.

The rumors of FAW emerging as the major shareholder have gained particular traction this time, yet they are not entirely baseless—after all, Leapmotor and FAW have indeed been drawing closer.

In August of this year, market speculation arose that FAW was set to acquire a 10% stake in Leapmotor.

Should the aforementioned acquisition rumors remain unsubstantiated, the strategic cooperation forged between the two entities in March of this year stands as a tangible testament to their partnership. On March 3rd, FAW and Leapmotor inked a strategic cooperation memorandum in Changchun. The collaboration is primarily structured around two key areas: Firstly, the two companies will join forces in technology research and development, co-developing NEVs and components, leveraging their technological complementarity to bolster product competitiveness. Secondly, they are exploring the potential for deeper capital-level cooperation to integrate more industrial chain resources. Just 20 days after the signing, a new model development project for the Hongqi brand was confirmed to be undertaken by Leapmotor.

In fact, their partnership traces its roots back even further. In 2019, FAW and Leapmotor began exploring the possibility of jointly developing the "three electric systems." By April 2020, the collaboration had deepened, with FAW Pengteng signing an agreement with Leapmotor to collaborate on key components of intelligent electric vehicles and jointly plan and develop new models.

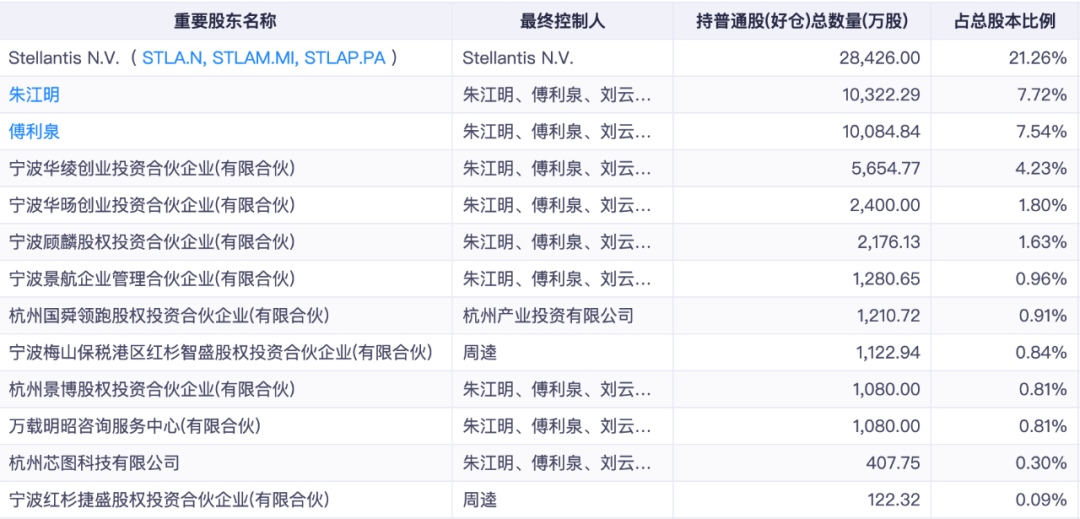

Now, let's delve into Leapmotor's current shareholding structure. Currently, the largest shareholder is the Stellantis Group, holding a 21.26% stake. As a strategic investor, Stellantis primarily aids Leapmotor in expanding its overseas channels and supply chains. However, Stellantis has made it clear that despite its significant stake, it does not exert control over Leapmotor but merely participates in decision-making.

Among the founders, Zhu Jiangming and Fu Liquan, along with their concerted action parties, collectively hold 24.99% of the shares. Specifically, Zhu Jiangming and related parties hold 6.93%, Fu Liquan and his spouse hold 6.82%, and funds like Ningbo Hualing hold 8.62%. Together, they command 24.64% of the voting rights, making Zhu Jiangming the de facto decision-maker with control over Leapmotor.

Additionally, external investors such as Sequoia Capital, Shanghai Electric, and CICC Capital collectively hold 15.28% of the shares; employees hold 5.7%; and public shareholders account for 34.29%.

Should the rumors of FAW acquiring a majority stake in Leapmotor prove to be true, it would spark market speculation as to whether FAW would merely participate in decision-making, akin to the European automotive group Stellantis, or seek to gain control.

Behind the rumors of FAW's acquisition, many in the market may ponder whether it is attempting to capitalize on Leapmotor's success.

In the first half of this year, Leapmotor sold a total of 221,700 vehicles, ranking first among NEV brands. In terms of financial performance, its total revenue reached 24.25 billion yuan, marking a 174% year-on-year increase. Its net profit attributable to the parent company stood at 30 million yuan, marking its first profitable half-year report and making it the second domestic NEV brand to achieve half-year profitability. Its cash flow has also seen a significant improvement, with the net cash flow from operating activities surging from 270 million yuan in the same period last year to 2.86 billion yuan. By the end of June, its free cash flow was 860 million yuan, compared to a negative figure in the same period last year.

Looking at the recent October sales, Leapmotor soared to 70,300 units, setting a new monthly sales record for NEV brands. Its cost-effective strategy precisely caters to market demands, earning it the moniker of the "price killer" among NEV brands. Leapmotor has set itself an ambitious goal: to challenge sales of 1 million vehicles by 2026.

In comparison, FAW Group sold 305,000 vehicles in October, an 8.1% increase, with its own brand of NEVs selling 38,900 units, roughly half of Leapmotor's sales. From this vantage point, FAW's acquisition of Leapmotor's shares would be a significant boost to its NEV business. From January to October this year, it sold a cumulative total of 2.688 million vehicles, a 5.9% increase, although FAW did not disclose specific data on its self-owned NEVs.

From a stock price perspective, Leapmotor's shares have witnessed a substantial increase since 2025, rising from around HK$33 per share to a peak of HK$76.3 per share in August, more than doubling. Subsequently, the company's stock price began to decline, currently trading at HK$56.8 per share with a market capitalization of HK$80.76 billion.