【Weekly Auto Talk】Must New Entrants 'Diverge from Core Business' to Achieve Success?

![]() 12/08 2025

12/08 2025

![]() 428

428

Introduction

"Some companies are laser-focused on selling cars, while others are venturing into the realm of embodied AI."

"Cut through the noise, concentrate on meaningful work, excel in your core business, and wholeheartedly commit to selling cars."

"The automotive sector holds immense growth potential. After years of learning and paying our dues, we're determined to go all-in on smart electric vehicles, providing users with truly valuable experiences starting with cars."

"Our current priority is to concentrate our efforts, focus intently, and zero in on our goals."

These three consecutive paragraphs present clear viewpoints. Can you guess which leader in the new-force automotive sector they originate from? Perhaps many would be surprised to learn that it's William Li, the founder, chairman, and CEO of NIO. As a seasoned entrepreneur with three decades of continuous experience, Li was once criticized for 'straying from his core business'.

Indeed, after enduring numerous challenges and trials, he has become more cautious, focused, and determined to succeed than ever before. During communications following the Q3 earnings report, Li reiterated his confidence in achieving profitability in Q4 of this year, with ambitions to reach full-year profitability next year.

As an observer, the underlying message I discern is: "NIO, now 11 years old, simply aims to build exceptional cars moving forward. After all, survival is a prerequisite for discussing dreams and distant horizons."

Faced with this, I can't help but recall past tech events where Li, standing center stage, passionately promoted NIO's Phone—a stark contrast to his current demeanor. The adage rings true: "People often make the right decisions when they're at their lowest."

At a time when nearly every automaker is chasing new trends, endlessly narrating grand stories involving AI, even betting on humanoid robots, entering the Robotaxi market, and exploring flying cars, NIO's dedication to car-making stands out as a refreshing anomaly.

Interestingly, just this week, Li Auto, a 'competitive teammate' in the same sector, once deemed the most efficient and focused, has begun to 'diverge from its core business.' It officially launched its most powerful AI accessory—Li Auto AI Glasses Livis, priced starting at 1,999 RMB nationwide.

Regarding this product, Fan Haoyu, Senior Vice President of Li Auto's Product Department, stated: "Building on our technological accumulations in assisted driving, spatial intelligence, and AI Li Xiang Tongxue (Li Auto's AI assistant), we've been exploring intelligent device forms that can naturally and continuously accompany users. Glasses, with their long daily wear time, proximity to eyes, ears, and mouth, and without requiring users to change habits, represent the most natural interaction gateway. Thus, Li Auto AI Glasses Livis become the optimal carrier for extending smart experiences beyond the car, marking the first 'embodiment' of our long-accumulated AI large model capabilities in external spatial interactions."

Combining official introductions, in product design, Li Auto directly addressed the industry's triangular conflict of balancing weight, battery life, and performance. Starting from users' real-world needs, it minimized frame weight to 36 grams while maintaining battery life and performance, enabling all-day, hassle-free wear.

Li Auto AI Glasses Livis are not just a sincere offering to Li Auto owners but a delightful surprise for all tech and innovation enthusiasts. Upon release, I promptly sought feedback from several friends in the tech circle, who uniformly praised the product, especially considering its subsidized starting price of 1,699 RMB.

This time, Li Auto's 'diversion' has garnered largely positive feedback.

Yet, the recurring question remains: Does this truly benefit its core automotive business? Currently, this new-force automaker is still mired in a significant slump, far from its peak of over 50,000 monthly sales.

Of course, in Li Auto's view, with sustained AI investment and vertical integration refinement, cars are being redefined as perceptive, learning, and evolving spatial robots. Thus, embodied AI represents its next strategic frontier.

To this end, Li Auto has allocated half of this year's R&D budget—6 billion RMB—to AI. Echoing Li Xiang's words during the Q3 earnings call, "For the next decade, Li Auto has chosen embodied AI as its toughest challenge, striving to become a genuine embodied AI company."

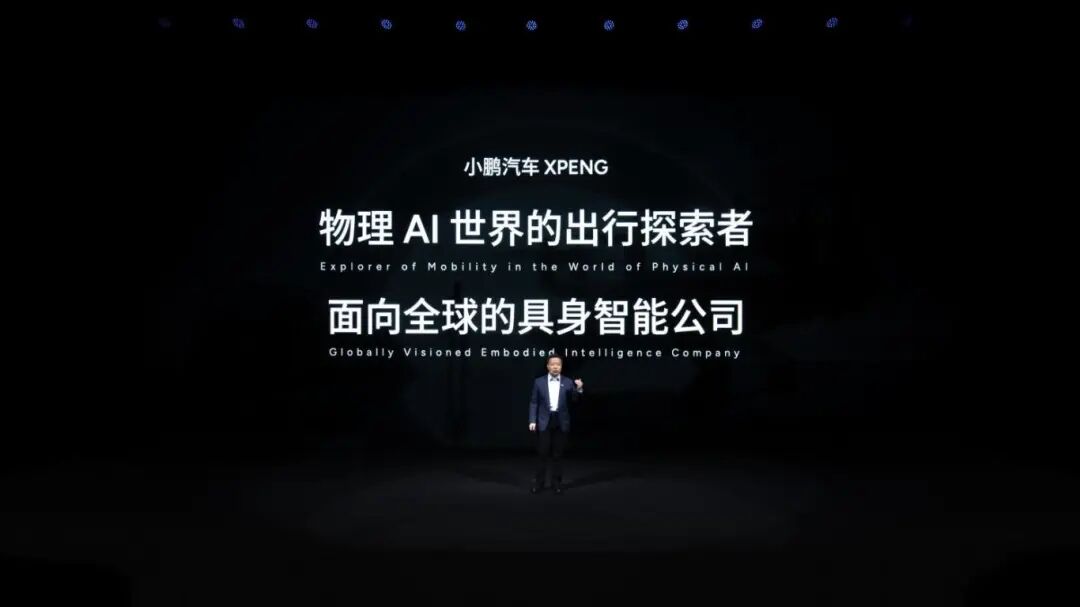

Similarly, at XPENG's recent Tech Day, this new force also unveiled four key applications centered around 'physical AI,' including XPENG's second-generation VLA, XPENG Robotaxi, the next-gen IRON, and two aerial mobility systems from HT Aero, painting a clear picture of future physical AI mobility.

Moreover, these four AI applications have clear mass-production plans, conveying a direct message: 'Physical AI' is not distant but within everyone's reach. To this end, He Xiaopeng officially announced XPENG's upgraded positioning as a 'mobility explorer in the physical AI world and a global embodied AI company.'

Like Li Auto, this new force has boldly laid its ambitions and vision on the table.

Meanwhile, Leapmotor, the standout performer this year having pre-emptively achieved 500,000 annual sales and aiming for 1 million next year, shares a contrasting stance with NIO.

When asked about 'diverging from core business' during the Lafa5 post-launch interview, Zhu Jiangming directly stated: "The automotive industry is vast enough—the world's largest sector by far. The pie is enormous; you can't do everything. Leave opportunities for others too; don't monopolize everything."

He further explained: "My view is that we should first focus on mastering one thing—making cars is already a great feat, requiring depth and expertise. Currently, technologies in smart cars do share significant overlaps with embodied AI. However, these remain in very early stages, extremely costly, and lacking clear application scenarios. I believe we should only enter when there's a strong, essential demand that creates societal value."

In just 200 words, his core message is clear: "Leapmotor will remain focused on its core business for now."

Today’s 【Weekly Auto Talk】highlights four first-generation new-force automakers, showcasing starkly different attitudes toward their corporate positioning and future development.

So, should they 'diverge from their core business' or not? More bluntly, should they focus solely on selling cars or swiftly transition into so-called embodied AI companies?

Editor-in-Chief: Shi Ye Editor: Chen Xinnan

THE END