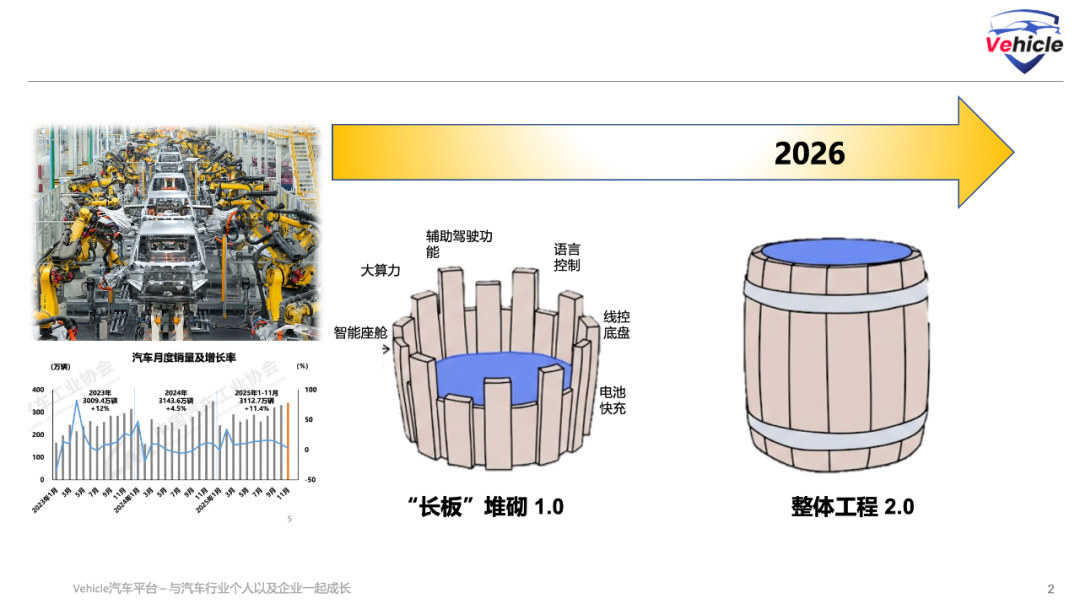

Breaking Free from the 'Long Board Involution': China's Auto Industry Set to Enter the 2.0 Era of 'Integrated Engineering and Design Excellence' by 2026

![]() 12/15 2025

12/15 2025

![]() 537

537

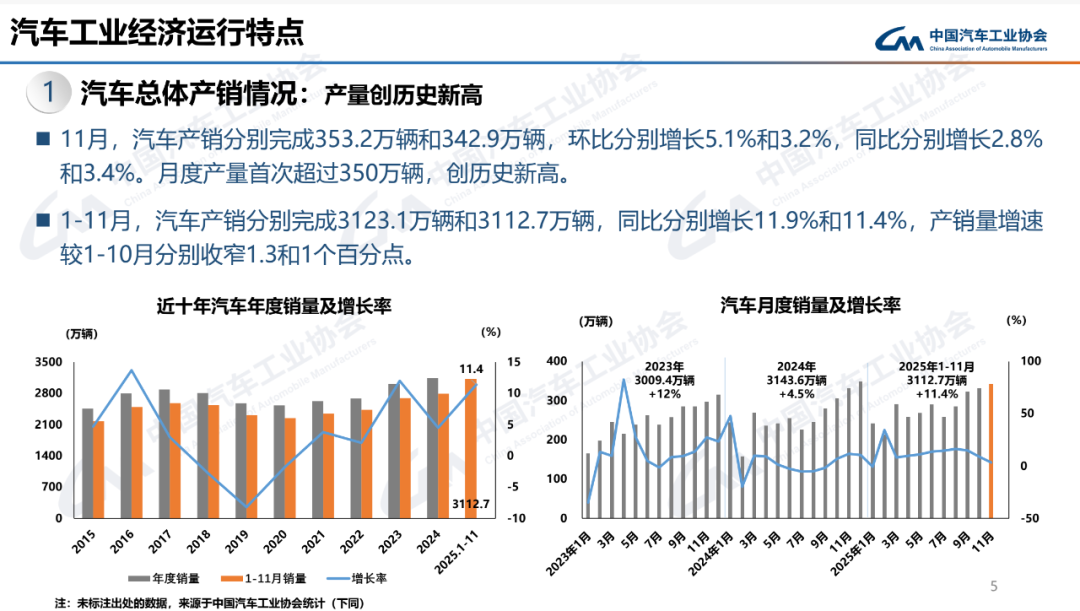

According to the latest data from the China Association of Automobile Manufacturers, from January to November 2025, China's automobile production and sales soared past 31 million units, on par with the 31.43 million units recorded in 2024 and marking an impressive year-on-year increase of over 11%. China's auto sales have repeatedly scaled new heights.

However, from an industry vantage point, the Chinese auto market is currently mired in unprecedented 'involution.' The sector is notorious for its practice of hiring three people to perform five people's tasks while paying salaries equivalent to four, a scenario where overtime and layoffs coexist. Furthermore, industry profit margins have steadily dwindled to below 5%, even plummeting below 3.5% this year. Price wars have become the norm, squeezing the automotive industry's survival space and severely jeopardizing automakers' long-term R&D capabilities.

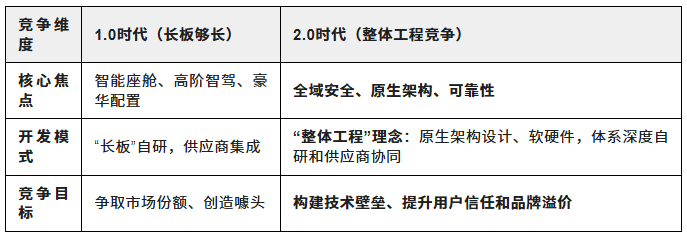

Against this backdrop, the focus of product competition in 2025 and the preceding two to three years has revolved around 'long board' competition: high-level intelligent assisted driving, seamless integration of smart voice GPT, AI Agent incorporation, 5C fast charging, intelligent chassis, and other technological buzzwords.

But here's the catch:

Third-party smart driving solution providers such as Horizon Robotics, Huawei ADS, Momenta, and DeepRoute.ai have emerged as frontrunners due to their efficient and rapid mass production capabilities, enabling many automakers to swiftly equip their vehicles with high-level smart driving functions like urban NOA.

In smart cockpits, high-performance chips like Qualcomm's new 8797, coupled with mobile internet advancements and large models like Deepseek and Qwen, have accelerated the rapid popularization of smart voice and AI Agent technologies.

Not to mention the proliferation of various 5C batteries, all backed by the clout of CATL, the 'Battery King.'

This has further expedited functional homogenization and intensified the 'arms race.'

However, recent developments—from supply chain perspectives, such as our previously published 'Horizon Robotics and Su Qing's HSD: Questioning Tesla FSD, Understanding FSD, Becoming FSD,' to significant layoffs at joint ventures like Nissan, Ford, and General Motors while domestic design centers remain intact, to Geely's recent 'Omni-Domain Safety 2.0' concept, which presents automotive safety as a holistic development, design, and verification product—

are signaling that the 1.0 auto competition model in China, centered on 'long boards,' is nearing its end.

Starting in 2026, the Chinese auto market will usher in a profound 2.0 era of competition centered on 'integrated engineering and design excellence.' The emphasis will shift from highlighting long boards to ensuring there are no short boards.

'Long Board' Accumulation 1.0: The Involution Quagmire

In recent years, competition in China's smart vehicle market has been characterized by:

Functional Long Boardization: Vehicles have been dissected into modules such as cockpits, smart driving, and powertrains, with competition focusing on achieving 'ceilings' in each area. For instance, larger screens, higher chip computing power, and a greater variety of L2-level assisted driving functions.

Supply Chain-Driven Homogenization: Mature smart driving suppliers like Horizon Robotics have significantly lowered the barrier to entry by providing cost-effective, full-stack solutions that encompass 'chips + algorithms + toolchains.' This has enabled numerous new and established automakers to quickly launch seemingly similar high-level smart driving products, erasing functional differences and intensifying price wars.

Profit Margin Crisis: To avoid falling behind on long boards, automakers have been compelled to add features and cut prices, leading to a sustained decline in overall industry profit margins and undermining their ability to invest in core technologies and foundational R&D.

The fundamental flaw in this competitive model is its focus on 'function stacking' rather than 'systemic value.' The cost escalations brought about by function stacking result in longer long boards but inevitably reveal shorter short boards, ultimately compromising product integrity, reliability, and safety.

Integrated Engineering 2.0: A New Dimension of Systemic Competition

Integrated Engineering 2.0 in automotive competition shifts the focus from 'functions' back to 'foundational engineering' and 'systemic value.' It represents a fundamental reconstruction of automotive manufacturing philosophy, not just a single configuration but a holistic approach:

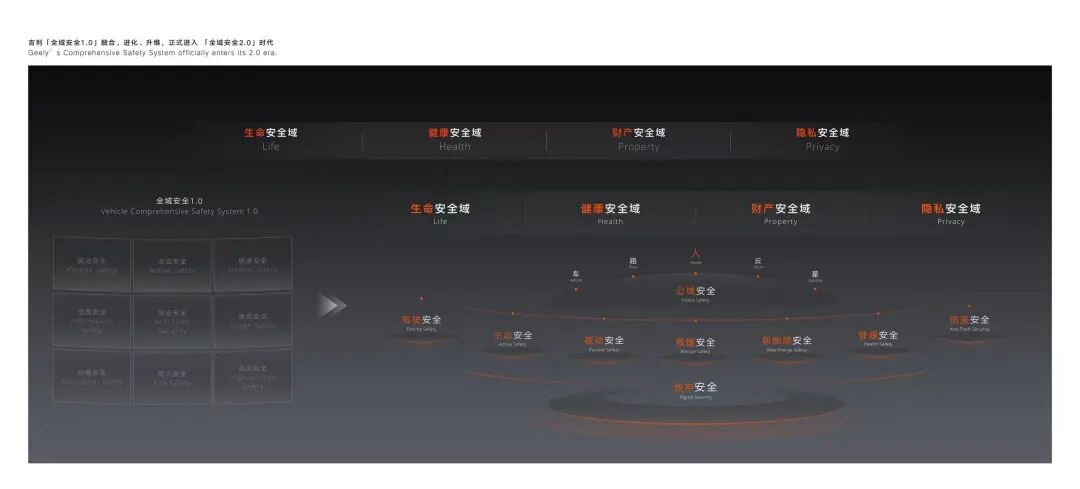

Geely Omni-Domain Safety 2.0

Geely's 'Omni-Domain Safety 2.0' was unveiled alongside the 'White Paper on the Holistic Safety Development of Smart Vehicles,' which clearly defines an omni-domain safety goal centered on 'people,' providing the industry with a strategic and practical action plan. It exemplifies the form of Integrated Engineering 2.0 in automotive competition.

Raising Competitive Barriers: From Integration to Native Design

Integrated Engineering Embodiment: Emphasizes native architecture design (such as the GEA architecture), which deeply integrates safety, smart driving, and powertrains from the initial design phase rather than through post-integration.

Smart driving safety evolves from relying on suppliers' algorithm performance to depending on high-redundancy collaboration among the vehicle's hardware, software, and electronic electrical architecture. This native, foundational collaboration capability is difficult to replicate in the short term, creating high barriers. It breaks free from the functional homogenization caused by smart driving supplier solutions, offering users a holistic experience rather than a jagged one with excessively long long boards and excessively short short boards.

Shifting the Competitive Core: From Functions to Reliability

Integrated Engineering Embodiment: Shifts the competitive core from 'how many functions' to 'how reliable the foundational engineering is.' Guided by the 'Four Zeros Vision' of 'Omni-Domain Safety 2.0,' extreme validation is conducted through five Guinness World Record-holding safety centers.

It guides users to focus on invisible yet more critical values, such as smart driving stability in extreme environments, battery fire resistance in extreme collisions, and in-car air health and safety. This breaks free from the configuration competition of screens, refrigerators, and large sofas.

Expanding the Competitive Scope: From Individual Vehicles to Ecosystems

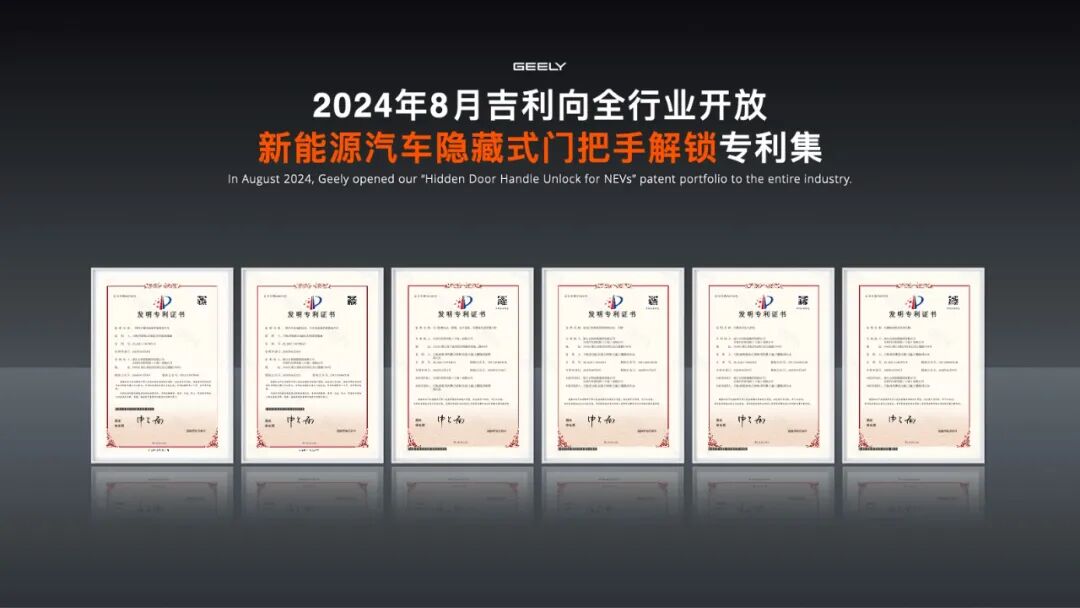

Integrated Engineering Embodiment: Introduces 'public domain safety,' elevating competition from within enterprises to industry standards and ecosystem co-construction through open sharing of safety patents, joint establishment of testing centers, and collaborative release of 'White Papers.'

It takes the lead in defining future safety standards for smart vehicles. Competition is no longer a zero-sum game among enterprises but a collective effort to raise industry thresholds and enhance the global competitiveness of Chinese auto brands. This breaks free from the closed competition among individual enterprises or models.

In short, Geely leverages 'integrated engineering' to shift competition from 'configurations' to 'systems,' from 'functions' to 'reliability,' and from 'individual vehicles' to 'standards,' thereby ending low-level 'long board involution' at a higher dimensional level.

Geely's core logic for breaking free from automotive 'long board involution' through integrated engineering is to elevate competition from incremental 'configuration stacking' to systemic 'system reliability' competition.

Looking Ahead to 2026: Reshaping China's Auto Competition Landscape

With China's auto sales sustaining high levels (around 31 million units+) and the pace of new product launches accelerating, coupled with the looming threat of subsidy withdrawals, the market has entered a stock elimination race.

In the future, the concentration effect among auto OEMs will intensify. Only a few leading enterprises with 'integrated engineering' capabilities will be able to maintain low-cost competition while sustaining high R&D investments to meet 'omni-domain' integrated engineering standards.

The supply chain will undergo differentiation. Smart driving suppliers will face a split, no longer being simple function providers. Those capable of deep, foundational, architecture-level collaborative development with OEMs (such as Huawei, Horizon Robotics, and Momenta) will become partners in the 2.0 era, while those offering only simple solutions will be marginalized or eliminated.

Finally, amid the accelerating wave of globalization, products with 'omni-domain' integrated engineering inherently possess global competitiveness. In mature European automotive societies, only systematized, holistically engineered Chinese products can truly gain the trust of developed markets, facilitating high-quality growth in China's auto exports (expected to strive for 7 million units in 2025).

Conclusion

The automotive competition in China by 2026 will no longer be a simple stacking of functional configurations and price wars centered on 'long board involution.' Instead, it will be a systemic competition based on 'integrated engineering and design excellence.' This represents a transformation from 'visible functions' to 'invisible architectures,' thoroughly screening out China's truly globally competitive automotive leaders.

How do you think the cooperation models between automakers' in-house R&D and third-party suppliers like Huawei, Horizon Robotics, and Momenta in China's domestically grown smart driving sector will adapt to this new era of 'integrated engineering'? Feel free to leave a comment and discuss. Popular comments have a chance to win a book gift from Vehicle and Mechanical Industry Press.

References and Images

CAAM: November 2025 Automotive Industry Production and Sales Report.pdf

*Unauthorized reproduction or excerpting is strictly prohibited.