EU Modifies 'Fuel Ban,' Inadvertently Blocking Its Own Progress

![]() 12/18 2025

12/18 2025

![]() 547

547

Introduction

The cost of this adjustment may result in Europe missing out on the entire new energy vehicle era.

Recently, the EU has encountered severe internal rifts due to potential major modifications to its previously established 2035 target, which aimed for all new cars to achieve zero emissions. According to the latest resolution, automakers will only be required to ensure a 90% reduction in new car emissions, rather than completely banning the sale of fuel-powered vehicles. Additionally, the originally planned total sales ban for 2040 has been canceled.

Behind this policy shift lies a concentrated manifestation of multiple real-world pressures. The most prominent is the alliance formed by traditional automotive powerhouses such as Germany and Italy, along with industry giants like Volkswagen and BMW. They are pushing for this 'policy regression' under the pretext of protecting jobs and addressing competition from China.

As is widely recognized, the automotive industry is a cornerstone sector in Europe, directly linked to substantial investments and hundreds of thousands of jobs. Radical bans could potentially destabilize the economy. However, in recent years, the competitive pressure from Chinese electric vehicle brands has compelled Europe to carefully weigh the speed of its transition against its industrial competitiveness.

Thus, it is undeniable that such a massive and complex revision has ignited intense controversy.

Supporters argue that permitting the sale of engines using synthetic fuels and hybrid vehicles is a pragmatic choice to ensure a smooth industrial transition and address real-world challenges. Opponents, however, criticize it as a betrayal of the climate ambitions outlined in the European Green Deal. They contend that it will not only delay emission reductions in the transportation sector but also weaken Europe's long-term competitiveness in the electric vehicle race due to uncertain policy signals.

01 Short-Term Tactics of Traditional Forces

It is reported that major automotive-producing countries, led by Germany and Italy, along with traditional automotive giants such as Volkswagen, Stellantis, and BMW, form the core force driving the revision of the ban. They attempt to justify the policy rollback with practical reasons, including insufficient market acceptance, the need to keep technology paths open, and potential damage to job positions.

Multiple automakers have pointed out that the current market demand for electric vehicles in Europe is far below the optimistic projections made during the legislation process in 2022. High prices, particularly the disconnect with the small car market, and the uneven development of charging infrastructure, especially in Southern Europe, have deterred many consumers from purchasing pure electric vehicles.

Manfred Weber, chairman of the European People's Party, referred to the original ban as a 'serious industrial policy error' and argued that relaxing restrictions would send a stable signal to the industry. Phinia, an internal combustion engine system supplier, noted that internal combustion engines 'will remain relevant for the rest of this century.' Fully abandoning mature internal combustion engine technology would be tantamount to self-sabotage, ceding market share to competitors.

However, these arguments are, in essence, more about safeguarding vested interests and resisting thorough transformation. The most direct driving force behind the policy shift stems from a conservative effort to maintain the existing industrial structure and job market. The automotive manufacturing industry, as an economic pillar for countries like Germany, is indeed linked to a large number of jobs, which is an objective fact.

Nevertheless, exaggerating this into an unbearable burden and even using it to hijack overall climate goals and future industrial strategies is undoubtedly short-sighted self-limitation. The German Automotive Industry Association's warning of a '270,000 job crisis' one-sidedly emphasizes the potential pain of transition while deliberately ignoring the new job opportunities and long-term value that the electrification supply chain can create.

Meanwhile, the financial difficulties traditional automakers face in the electrification transition are not due to an erroneous electrification path but rather a direct reflection of their lagging transition pace, insufficient technological accumulation, and poor cost control. Relying on cash flow from fuel-powered vehicle businesses to support electrification may seem reasonable in the short term, but relaxing transition pressure will only encourage corporate procrastination, leading to further lagging in the global electrification wave.

The severe internal divisions within the EU are precisely an external manifestation of this contradiction: the 'buffer faction,' represented by Germany, Italy, and some Eastern European countries, strongly demands relaxing the ban under the pretext of protecting industries and jobs.

In contrast, the 'steadfast faction,' represented by France, Spain, and Nordic countries, worries that policy regression will undermine the EU's climate leadership. The CEO of the Swedish electric vehicle brand Polestar warned that if Europe does not lead the transformation, 'the Chinese won't stop; they'll take over everything.'

Ultimately, behind the policy changes lies a game between countries and various interest groups. However, this game based on short-term interests and local considerations will not lead to a better industrial outcome. Instead, it will only delay the necessary historical transition process, causing Europe to lose its edge in the critical arena that will determine future competitiveness.

02 The Gap Between Ideals and Reality

The camp firmly opposing the EU's weakening of the 2035 ban includes environmental organizations, electrification pioneer automakers, and industry experts. They issue a clear warning: any policy shake-up is a premature withdrawal on Europe's future competitiveness. They argue that electrification is not just an environmental imperative but also a strategic choice crucial to the survival of Europe's industry.

For the European automotive industry, the risk of policy regression is particularly fatal. Currently, European automakers are already lagging behind American brands like Tesla and Chinese automakers in the electric vehicle sector. Relaxing transition pressure at this time will further widen the technological and market gaps, leading to Europe's marginalization in the global new energy vehicle market.

Leading electric automakers such as Volvo and Polestar directly question the core issue: 'The technology is mature, the charging infrastructure is complete, and consumers are ready. Europe has no reason to hesitate in the electrification transition.' In fact, a clear ban is essentially the necessary pressure to drive traditional automakers toward comprehensive transformation. Without this rigid constraint, the transformation inertia of traditional giants may drag down the future competitiveness of Europe's automotive industry.

For consumers, policy shake-ups also mean compromised interests. Full lifecycle cost data clearly shows that the driving and maintenance costs of electric vehicles are significantly lower than those of fuel-powered vehicles. Extending the sales period of fuel-powered vehicles will expose European consumers to ongoing risks of oil price fluctuations and high repair costs.

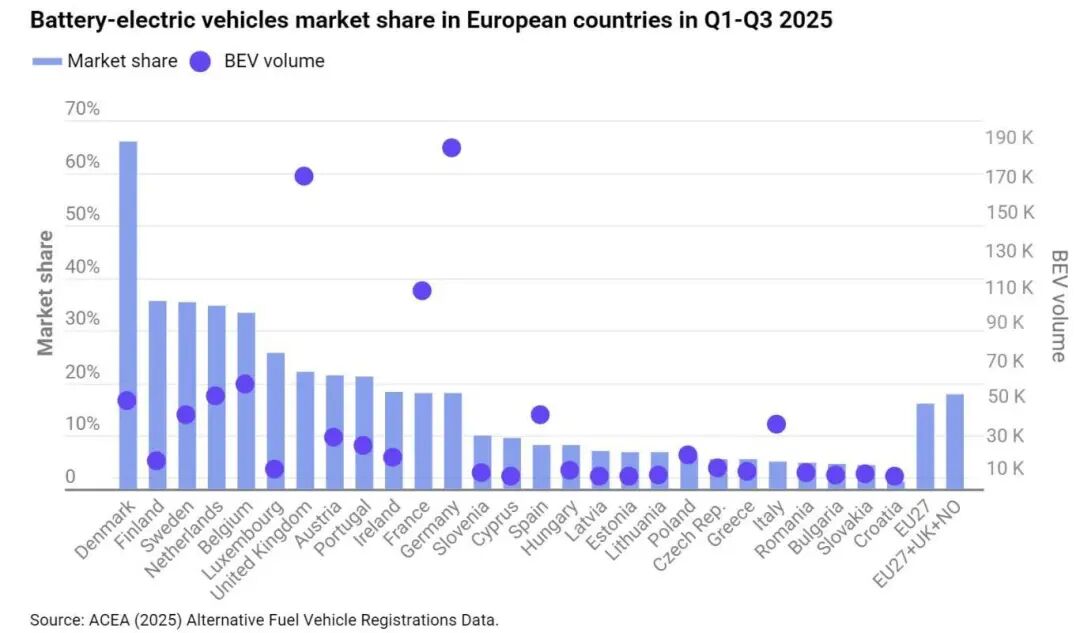

More importantly, successful cases and positive practices provide clear evidence supporting Europe's electrification route. Norway's transformation miracle has long proven that firm and sustained policy support can quickly break down market barriers. Through tax incentives such as value-added tax and toll exemptions, combined with a comprehensive charging infrastructure layout, Norway's electric vehicle penetration rate has surpassed 90%, making it a global model for electrification transition.

The core lesson from this experience is that clear policy guidance and stable incentive mechanisms are the key levers to drive market transformation, rather than compromising under pressure from vested interests.

In fact, the UK's strategic resolve also forms a sharp contrast to the EU's policy shake-up. The UK Prime Minister's Office recently made a clear statement, vowing to firmly implement the established transition roadmap: banning the sale of new fuel-powered vehicles from 2030 and achieving 100% zero emissions for new cars and vans by 2035. Behind this stance lies a combination of regulatory mandates, fiscal incentives, and support for local supply chains:

The 'Zero Emission Vehicle Mandate (ZEV Mandate)' sets rigid targets, requiring electric vehicles to account for 80% of sales by 2030, with heavy penalties for non-compliance, drawing an uncrossable red line for the industry's transition. Among the £1.5 billion in additional investments, £1.3 billion is used to extend consumer purchase subsidies until 2030 and expand coverage, while £200 million is earmarked for expanding public charging networks.

The policy's firmness has translated into market momentum. Data shows that UK electric vehicle sales hit a record high in October, with a penetration rate of 25%. While the overall sales share of 23% this year is slightly below the annual target of 28%, the sustained growth trend confirms the market's potential.

More notably, breakthroughs have been made in the local supply chain. The official launch of Envision AESC's Sunderland Super Battery Factory, with an annual capacity of 15.8 GWh, can supply batteries for over 200,000 electric vehicles. This not only injects core support into the UK's automotive manufacturing industry but also establishes a resilient battery supply chain, providing assurance for Europe's automotive industry to reduce external dependence.

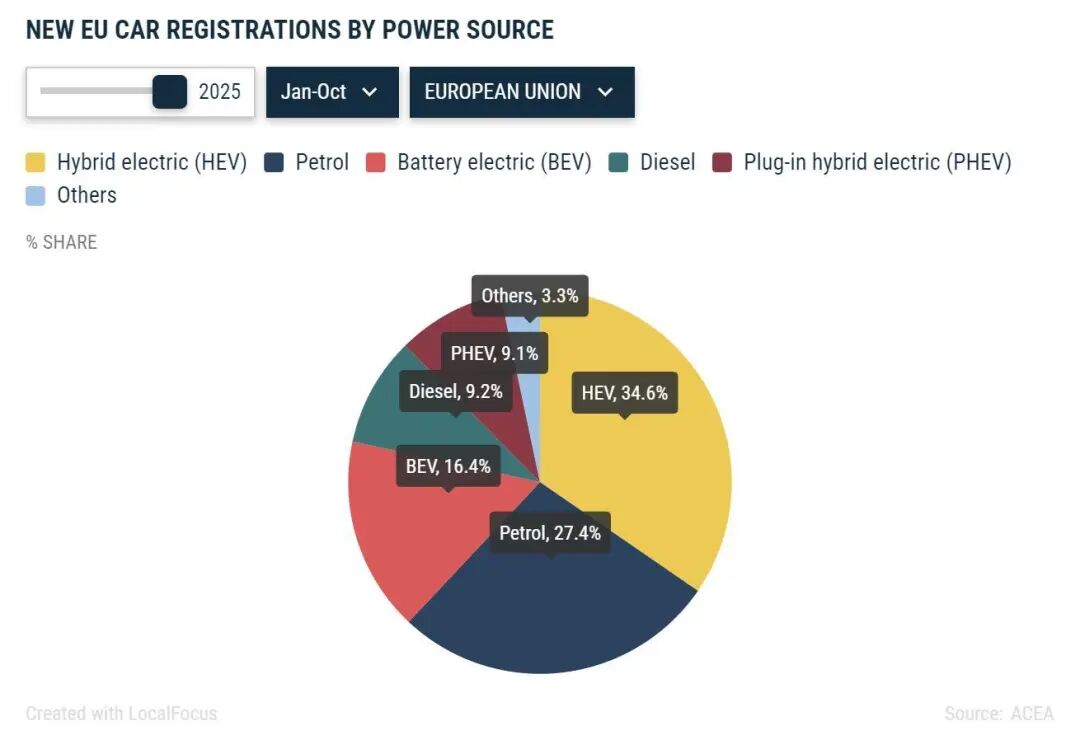

In fact, the data is most persuasive. The overall trend of Europe's electric vehicle market is steadily accelerating. In Q3 2025, the sales share of pure electric vehicles in the EU reached a historic high of 17.4%. From January to October, the EU registered 1,473,447 new pure electric vehicles, accounting for 16.4% of the market share. The EU's four largest markets (collectively accounting for 62% of pure electric vehicle registrations) all achieved growth: Germany (+39.4%), Belgium (+10.6%), the Netherlands (+6.6%), and France (+5.3%).

Battery electric vehicle sales among Europe's six major automotive groups increased by 32% in the first three quarters of 2025 compared to the same period in 2024. Volkswagen Group (+76%) and Renault Group (+63%) saw the strongest growth, mainly driven by strong demand for the R5 model priced under €25,000. In October 2025, European sales reached 370,000 units, a significant year-on-year increase of 37% (cumulative sales of 3.4 million units in 2025, up 33% year-on-year), with pure electric/plug-in hybrid models growing by 35%/41%, respectively.

Combined with the strong growth data in Europe's electric vehicle market, it is clear that electrification is an irreversible industrial trend. The explosion in consumer demand and the concentration of corporate production capacity on pure electric vehicles fully demonstrate that the transition has a solid market foundation. However, just as the industry is accelerating forward, some countries and companies are attempting to loosen policies and avoid transition pains, a tendency that contradicts market momentum and highlights the current core divergence.

This divergence is essentially a game between short-sighted interests and long-term strategic planning. The French Minister of Industry and the CEO of Renault's expectations for policy adjustments, as well as the German Chancellor's call for 'technology openness,' reflect the avoidance mentality of some countries and companies toward transition pains. However, the internal response from the UK automotive industry is more noteworthy, explicitly opposing efforts to emulate the EU in lowering targets, arguing that it would weaken the UK's leading position in the global electrification transition.

Today, competition in the global new energy vehicle market has entered deep waters. The scale advantages of Chinese brands and Tesla's technological edge are forcing Europe to concentrate resources and make breakthroughs, providing the best external driving force for change. Moreover, history has proven that the pains of transition are far less severe than the costs of falling behind. Just as electrification is not a multiple-choice question but a must-answer question for Europe to safeguard climate security, consolidate industrial foundations, and lead future mobility.

Editor-in-Chief: Cui Liwen Editor: Wang Yue

THE END