When Will the Obstacles to New Energy Vehicle Maintenance Be Removed?

![]() 12/19 2025

12/19 2025

![]() 452

452

Introduction | Lead

In recent years, the domestic fleet of new energy vehicles has witnessed exponential growth. As the number of vehicles in use continues to climb, the clash between after-sales maintenance services and insurance premiums for new energy vehicles has become increasingly pronounced. How can we tackle these pressing issues?

Published by | Heyan Yueche Studio

Written by | Zhang Chi

Edited by | He Zi

Full text: 2,447 characters

Reading time: 4 minutes

On one hand, new energy vehicles are surging ahead, while on the other, after-sales challenges have emerged following the industry's restructuring.

According to data from the China Association of Automobile Manufacturers, in October 2025, the proportion of new energy vehicle sales in the domestic auto market surpassed 50% for the first time, achieving a penetration rate of 51.6%. By 2025, the domestic new energy vehicle fleet is projected to reach 48 million units. Some forecasts even suggest that by 2030, the fleet could exceed 100 million units and potentially reach 150 million.

Compared to traditional fuel vehicles, the after-sales system for new energy vehicles is relatively more exclusive. In China, there have been notable cases, such as "two mechanics being sentenced for repairing new energy batteries" and "a popular new energy repair influencer losing a lawsuit," which have made third-party repair platforms hesitant to engage in new energy vehicle maintenance. Data indicates that currently, only 8% of new energy vehicle repairs are handled by third parties. Increasing the proportion of third-party maintenance has emerged as a crucial step in resolving related conflicts.

△ Increasing the proportion of third-party maintenance has become a pivotal step in resolving conflicts related to new energy vehicles.

Insurers Subsidize New Energy Vehicle Segment with Fuel Vehicle Profits

Compared to third-party repair platforms, manufacturer-operated or authorized repair facilities charge higher prices for both parts and labor. This not only compels owners to pay more for repairs but also results in significant losses for insurers in new energy vehicle insurance. Data reveals that in 2024, domestic new energy vehicle insurance premiums exceeded 140 billion yuan, yet the industry incurred losses of 5.7 billion yuan. In contrast, traditional fuel vehicle insurance remains profitable at around 3%. This implies that insurers, much like domestic traditional automakers, are subsidizing new energy vehicle losses with profits from fuel vehicles.

△ Insurers are using profits from fuel vehicles to subsidize losses in new energy vehicles.

To offset these losses, insurers continue to hike new energy vehicle premiums, and some may even refuse coverage for new energy vehicles. Ultimately, these losses are passed on to vehicle owners. As domestic new energy vehicle subsidies decline, consumers will further weigh the pros and cons of fuel and new energy vehicles. If premiums continue to rise, a scenario could emerge where manufacturers, consumers, and insurers all suffer. However, if manufacturers are willing to outsource some non-core maintenance tasks, even marginally, to third-party platforms, repair costs for consumers would drop significantly, and insurers could lower premiums, creating a win-win-win situation.

In fact, the Chinese auto market is vast, with annual new energy vehicle maintenance revenue exceeding 100 billion yuan and set to grow further. For manufacturers, rather than investing heavily in a less profitable new energy vehicle insurance business, collaborating with insurers and ceding some maintenance profits to repair shops and insurers would enable them to focus more on developing new models and technologies.

△ Manufacturers venturing into the auto insurance business may not be a cost-effective move.

Why Do Manufacturers Restrict After-Sales Services?

From a manufacturer's perspective, both publicly and privately, they prefer customers to utilize their 4S stores or direct-sales outlets for repairs.

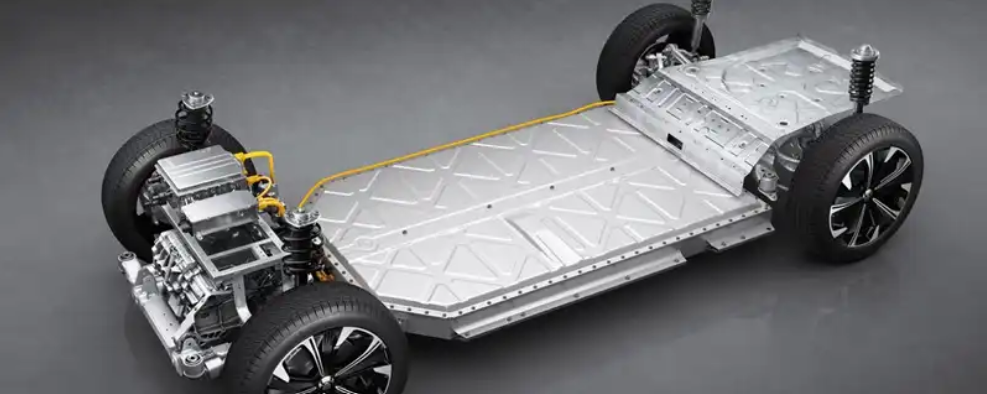

Compared to fuel vehicles, new energy vehicles feature more complex electronic architectures and high-voltage batteries and components. Without proper manufacturer guidance, third-party repairs could endanger the safety of repair personnel and lead to fires during or after repairs, resulting in liability disputes. Such incidents could severely tarnish a manufacturer's reputation, justifying their cautious approach to maintenance policies. While few users or media outlets pay attention to third-party repair platforms, accidents involving domestic automakers are easily remembered.

△ Repairing high-voltage components in new energy vehicles may pose significant challenges for third-party platforms.

Privately, manufacturers also favor repairs at their own or authorized outlets. With intense price competition in the domestic auto market, profit margins on new vehicle sales have dwindled, and many dealers even sell at a loss. Consequently, both dealers and manufacturers rely heavily on after-sales services for profitability. Since new energy vehicles require less maintenance than fuel vehicles, repair services have become a crucial revenue source.

To further retain customers, manufacturers often bundle lifetime warranties for the battery, electric motor, and electronic control systems with new vehicle sales. While this alleviates concerns about high repair costs, it effectively ties customers to 4S stores or direct-sales outlets, discouraging them from using more cost-effective third-party repair services.

△ Manufacturers often bundle lifetime warranties for core components with new vehicle sales.

How Can New Energy Vehicle Maintenance Costs Be Reduced?

The optimal way to resolve this issue is to strike a balance between manufacturer-authorized outlets and third-party repair platforms.

Core components like batteries, high-voltage wiring, intelligent cockpits, and autonomous driving modules should remain under manufacturer-authorized repair. However, most interior and exterior parts, which pose minimal safety risks and are easier to repair, could be handled by third-party platforms. With growing vehicle ownership, supply shortages for many repair parts have eased. Items like bumpers and trim are now readily available at competitive prices, and third-party labor costs are often lower than those at authorized outlets.

△ Manufacturers could handle high-voltage components, while third parties could manage interior and exterior parts.

From a manufacturer's standpoint, ceding after-sales profits could significantly impact the business. However, this could also curb price wars in vehicle pricing. Consumers should recognize that manufacturers often recoup discounted prices through other channels, such as higher maintenance or insurance costs. Therefore, when purchasing a new energy vehicle, buyers should consider not just the price and features but also long-term maintenance and insurance expenses, as these represent substantial ongoing costs.

Commentary

The new energy vehicle industry requires collective effort to thrive. Currently, the domestic market is overly competitive, with many manufacturers selling at a loss and relying on post-sale maintenance for profitability—a short-sighted approach. The real challenge lies in achieving rational pricing and minimizing total ownership costs for users throughout the vehicle's lifespan.

(This article is original to Heyan Yueche and may not be reproduced without authorization.)