Seres to Acquire 'Wenjie' Trademark for 2.5 Billion, but It Cannot Do Without Huawei Yet

![]() 07/08 2024

07/08 2024

![]() 715

715

Written by Biancheng

Edited by Chen Feng

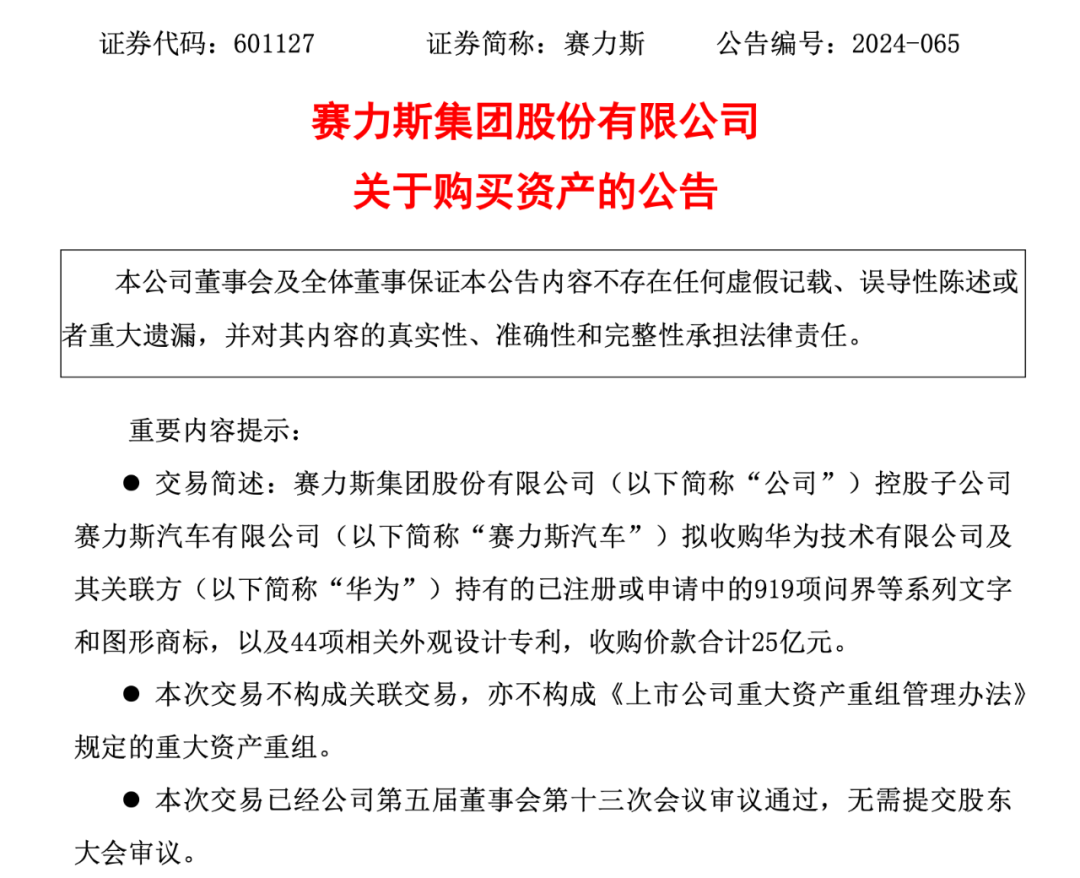

On the evening of July 2, Seres announced that its holding subsidiary plans to acquire the "Wenjie" trademark and some design patents held by Huawei and its affiliates.

This news quickly sparked discussions outside, with many voices speculating whether this meant that Seres was parting ways with Huawei.

Judging from the responses of both Seres and Huawei, this is not the case. Seres stated in the announcement that the transaction will not affect the joint business operations of both parties, and they will further deepen their cooperation; Huawei also pointed out that the transaction will not affect the cooperation, and Huawei will continue to support automakers in manufacturing and selling good cars.

Source: Seres Announcement

Huawei's cooperation with Seres began in April 2021, with a cooperation model called "Intelligent Choice Vehicle." Huawei deeply participated in product definition, design, R&D, quality control, and other aspects, and the vehicles were also sold in Huawei retail stores. In December of that year, the two parties jointly released the "AITO Wenjie" brand, with "AITO" belonging to Seres and "Wenjie" belonging to Huawei.

In the past three years, Wenjie has been the most successful brand under Huawei's "Intelligent Choice Vehicle" model.

2022 was the first full year of sales for Wenjie, with sales exceeding 70,000 vehicles. In 2023, sales approached 100,000 vehicles, and in the first half of this year, Seres' cumulative sales of new energy vehicles have exceeded 200,000.

The success of Wenjie is also significant for Huawei. It helped Huawei recover from the overall downturn caused by the decline in its consumer business and helped Huawei find and successfully validate its business path in the new energy vehicle era.

Now that Huawei is selling the "Wenjie" trademark to Seres, it is a continuation of recent actions.

Previously, Huawei has transferred the ownership of the Zhijie and Xiangjie brands to Chery and BAIC, both of which are partners of Huawei's Intelligent Choice Vehicle model. Now, Huawei no longer owns any complete vehicle brands.

So, why is Huawei retreating further at this time? How will this move affect "Seres-like" companies that have benefited from the Intelligent Choice Vehicle model in the past?

1. What are Huawei and Seres thinking behind the 2.5 billion acquisition?

Huawei transferring all brand trademarks under the "Intelligent Choice Vehicle" model to partner automakers is, in a sense, both a retreat and a long-term consideration:

Simply put, initially fully assisting Wenjie was to prove that Huawei has the ability to help automakers build good cars; after this brand grows and achieves results, transferring the relevant assets is to further demonstrate its position.

After this wave of brand transfers, the boundaries of Huawei's Intelligent Choice Vehicle business are clearer, and more automakers may be willing to enter Huawei's ecosystem. While Huawei took a step back in terms of ownership of the Wenjie trademark, it took a big step closer to becoming another "Bosch."

For example, since the first half of this year, GAC Motor has announced cooperation with Huawei in HarmonyOS and intelligent driving, and some mid-to-high-end product lines from Great Wall, including Tank, are also exploring the possibility of incorporating some of Huawei's intelligent driving solutions. NIO Auto has joined the HarmonyOS ecosystem, and so on.

NIO Auto joining the HarmonyOS ecosystem, source: NIO Auto official WeChat public account

More recently, the day after Seres announced the purchase of the Wenjie trademark from Huawei, Changan Automobile updated the progress of its cooperation with Huawei's car BU to form a new company.

Changan Automobile's announcement revealed that in January this year, Huawei had completed the registration of the target company, named Shenzhen Yinwang Intelligent Technology Co., Ltd., with a business scope mainly including automotive intelligent driving solutions, intelligent cockpits, intelligent automotive digital platforms, intelligent vehicle clouds, AR-HUD, and intelligent headlights.

It is worth noting that news of Changan Automobile's cooperation with Huawei had been circulating since the end of last year, and the industry generally believes that this is an important step forward for Huawei's automotive business, indicating that Huawei's car BU has achieved phased breakthroughs in independent market-oriented operations. At that time, industry insiders told Jiemian News that introducing partner companies as shareholders in an independent company is one of the solutions to essentially address the issue of "automakers losing their soul."

It is not difficult to see that while Huawei is accelerating the weakening of its control over brands, it actually hopes to expand its circle of automaker friends after further clarifying its business boundaries.

On Seres' side, spending 2.5 billion to acquire the Wenjie trademark can not only win face but also substance.

AIOT Wenjie M9, source: Seres official website

First, the brand assets belong to Seres, and the boundaries of the intelligent vehicle selection business are clearer, which is conducive to enhancing Seres' position in the cooperation process with Huawei. The two are increasingly like deeply bound partners, and Seres has, in a sense, taken off the hat of Huawei's OEM, winning face.

Second, according to a report by China Business News, some securities firms believe that "after Seres purchases the Wenjie trademark and styling intellectual property rights, Huawei's commission may be reduced," and Seres will benefit more from future cooperation.

Finally, among the details of this trademark acquisition, it covers the Wenjie trademark in multiple global markets. After separating Wenjie from Huawei, Wenjie's steps to go overseas will be more stable, and Seres will also enjoy more benefits from going overseas. From these two aspects, Seres has won substance.

Moreover, from a purely price perspective, Seres spent only 2.5 billion to acquire the Wenjie trademark worth over 10.2 billion, which can also be described as picking up a big bargain.

Of course, while picking up bargains, Seres should also sound the alarm for itself.

After transferring trademarks and standardizing the intelligent vehicle selection business, Huawei is one step closer to becoming "Bosch." With Huawei's customer base continuously expanding in the future, Seres may find it difficult to enjoy special attention from Huawei. After all, suppliers like Bosch and Continental have never cared about the sales of any automaker; they only care about how many automakers use their products.

Perhaps this is also the reason why Seres' stock price fell somewhat after the news of its acquisition of the Wenjie trademark emerged, as capital always has a keen nose.

2. The cooperation will not be affected for the time being because Seres is still unable to "fly solo"

However, this prediction is from a long-term perspective. In the short term, this round of transactions regarding trademark ownership is unlikely to affect the development of the two parties' intelligent vehicle selection cooperation business.

Previously, Yu Chengdong said that Huawei does not have the resources and manpower to cooperate with other automakers in the intelligent vehicle selection business in the short term. In addition, as Wenjie is currently the most successful sample point for Huawei's car BU business, if Huawei wants to attract more automakers to cooperate with it, it will not rush to cut ties with Seres but will continue the deep cooperation model of intelligent vehicle selection, allowing this carefully crafted sample to continue to play a rallying role.

From Seres' standpoint, it certainly will not easily let go of Huawei's strong support, which can be seen from its intention to invest in Yinwang.

At the beginning of its establishment, the agreement signed between Huawei and Changan Automobile promised to open equity to existing strategic partner automakers such as Seres and investors with strategic value. Once Seres successfully invests in Yinwang, it will become a stakeholder in the same company as Huawei, forming a closely bound interest community, and the bond between the two will undoubtedly become tighter.

So in the short term, one cannot simply equate Huawei's transfer of the Wenjie trademark with Huawei planning to leave. On the contrary, Huawei cannot cut ties with Seres and Wenjie at this moment, and Seres cannot cut ties with Huawei too quickly, as its own wings are not yet fully grown.

Although Seres has seen impressive growth since its cooperation with Huawei, with sales soaring from just over 700 units in 2020 to 200,949 units in the first half of this year, representing an increase of over 2,857% in less than four years.

Source: Seres official WeChat public account

However, it should be noted that among the over 200,000 sales of Seres in the first half of this year, over 180,000 were contributed by Wenjie, accounting for 90.15% of the total sales. Brands like Blue Power, Ruichi, SERES, and DFSK, which belong entirely to Seres without Huawei's empowerment, cannot compare with Wenjie in terms of sales or brand appeal.

Among them, Blue Power, which sells relatively well, has maintained monthly sales of below 1,000 units since its launch in March last year, reaching 1,556 units in November with a month-on-month growth of 68.22% and 3,474 units in December with a month-on-month growth of 123.26%. Its annual sales did not exceed 10,000 units, which is less than the monthly sales of many new forces.

It can be seen that the big sales of Wenjie largely benefit from Huawei's support in channels, marketing, technology, and even branding. Without these, Seres may find itself in a difficult situation.

Financially, Seres also relies on Huawei's support.

In 2020, Seres' revenue plummeted by 4 billion yuan due to its failed electric transformation, with a loss of 1.729 billion yuan. After partnering with Huawei, Seres' revenue began to grow year-on-year from 2022, and in the first quarter of this year, it recorded its first profit, with net profit attributable to shareholders reaching 220 million yuan, a year-on-year increase of 352%, and a gross profit margin per vehicle exceeding 20.6% to reach 21.5%.

And much of this is thanks to Huawei's empowerment of Wenjie, which has enabled Seres to achieve a sales turnaround, and its profits and stock prices have also soared along with sales.

However, brands like Blue Power, which do not have Huawei's support, contribute less significantly to Seres' performance, fully demonstrating that Seres cannot do without Huawei at this moment. And Huawei also needs to rely on its cooperation with Seres to set an example for other automakers, so in the short term, neither can do without the other.

3. Spending a bit too aggressively, how will Seres grab a slice of the cake in 2024?

There is a question that Seres has to consider in the short term.

Huawei did not ask for much for the 2.5 billion acquisition of the Wenjie trademark. But for Seres, due to years of losses, its cash flow is not ample. As of the first quarter of this year, Seres had only 2.7 billion yuan in cash on hand, and purchasing Huawei's Wenjie trademark will immediately require an expenditure of 2.5 billion yuan, so Seres' predicament is imaginable.

Although this payment is not due until the end of the year, giving Seres six months to repair its cash flow, unfortunately, Seres has been spending quite aggressively this year. Before acquiring the Wenjie trademark, Seres also acquired the Liangjiang New Energy Vehicle Super Factory.

This super factory is the production base for the Wenjie M9, and its commissioning has ensured the delivery of the Wenjie M9 in the first half of this year. Originally, the operator of this factory was Longsheng New Energy, and Seres would have to pay rent if it wanted to use it.

However, after this acquisition is completed, the Liangjiang Super Factory will become Seres' own factory, eliminating the need to pay rent and license fees, which may release some profit margin for Seres. But the acquisition of the super factory will also undoubtedly cause a tight cash flow for Seres for a certain period of time, so Seres needs to focus more on sales.

So, in the context of extreme competition in the automotive industry in 2024, how can Seres grab more of the cake in the Chinese auto market?

As mentioned earlier, the current main product under Seres is only the Wenjie series, and the Wenjie series has a strong domestic competitor—the Ideal L series. With the launch of the Ideal L6, Ideal regained the top spot in the new force sales chart in June.

At this point, how should Seres respond to the competition?

Still relying on Huawei? Clearly, this is not reasonable.

The reason it is unreasonable is not only because, unless Huawei builds its own cars, its empowerment of Wenjie has already reached a point where it cannot go any further; it is also because the Zhijie has started delivery, and the Xiangjie and Aojie are about to be released, so Huawei's resources will only become more fragmented, and the dividends Seres receives from Huawei will only decrease, not increase.

This requires Seres to urgently build its own brand to form a joint force with Wenjie. The launch of Blue Power proves that Seres is also seeking a breakthrough on its own.

But fortunately, Seres has partners like Huawei, and it can learn from and accumulate resources through cooperation with Huawei to make up for its shortcomings in marketing, channels, technology, and other aspects, nurturing its own soul in Blue Power.

In addition, overseas markets are also promising areas for Seres.

Seres is one of the earlier automakers to deploy overseas markets. As of the end of 2023, it has entered multiple countries in Europe, the Middle East, the Americas, and Africa, completing the initial layout of overseas markets.

However, in 2023, Seres' overseas auto sales accounted for only 23% of its total sales, with new energy exports accounting for only 16% of its total exports. More than 80% of the remaining exports were contributed by traditional energy vehicles, and Seres' new energy vehicle exports in 2023 did not increase significantly compared to 2022.

It is not difficult to see that Seres' overseas business still has considerable growth potential. Now that it has acquired the Wenjie brand, the next step may be to tap into new increments overseas. This year is also an extremely important year for Seres, as it needs to stabilize its footing both domestically and overseas to compete for more of the cake.

(The cover image of this article is from the Seres official website.)