Profits Soar! A Look at the Interim Results of China's Automotive Race from Great Wall Motor

![]() 07/18 2024

07/18 2024

![]() 620

620

It's said that the domestic automotive race in 2024 should not be too intense.

Since the first day of the Lunar New Year when BYD initiated the "price war," the entire industry and beyond have seemed to anticipate that vehicle manufacturers will strive to achieve "winning through volume" and "trading price for market share." After half a year, the results of these efforts by vehicle manufacturers can already be glimpsed.

And coincidentally, the share prices of A-share automotive sector have recently performed relatively strongly. On July 16, A-share automotive stocks led the gains with a 3.24% increase, with Kinglong Motor and Ankai Automobile leading the way with limit-up gains, and Great Wall Motor, Changan Automobile, and other enterprises following suit. Thus, it seems that domestic automakers' business strategies in the first half of the year should have achieved good results.

So, what's the specific situation?

According to statistics, among the 90 automotive listed companies that have announced their 2024H1 performance forecasts, nearly 70% have reported positive results. Among them, Great Wall Motor leads the industry in both profit scale and growth rate, so we can try to glimpse some of the industry's operating status and trends from Great Wall Motor.

Profits Soar, Great Wall Motor's "Going Global Ecosystem" Starts to Harvest?

Unlike many domestic new energy vehicle brands that have actively or passively raised the "price" banner in 2024, Great Wall Motor can be considered a "breath of fresh air" in the industry.

Judging from the propositions behind its products released in the first half of the year, such as the personalized market-focused Great Wall Cannon, the intelligent-focused WEY, the more powerful 330 V6 Tank 300, the Tank 300 PHEV version priced at 269,800 yuan, and the new Haval H6 that continues the pricing of the fuel version, price strategy is not Great Wall Motor's choice at the moment.

In fact, as early as 2023, when some signs of price competition emerged in the domestic automotive market, Great Wall Motor chose to respond to this market competition by reshaping its product line and upgrading its brand image, rather than falling into the "price trap."

And the results, at least from 2023, were impressive. Financial report data shows that Great Wall's sales increased by 15.29% year-on-year to 1.23 million units in 2023, with corresponding total revenue growth of 26.12%, slightly faster than sales growth, indicating an increase in average revenue per vehicle and significant brand upgrading results. Among them, domestic market revenue increased by about 9%, while overseas market growth reached 101.5%, contributing the main increment.

Fast forward to 2024, with the same choices, Great Wall Motor's overall sales remained stable, with cumulative sales of 559,700 units in 2024H1, up 7.79% year-on-year. Although it fell out of the top five independent automakers in terms of rankings, it is worth noting that its operating results have greatly improved.

From the financial report, Great Wall Motor's net profit returned to growth in 24Q1 and set a new high for the same period in previous years, continuing this trend in the second quarter. The forecast shows that its net profit for 2024H1 is expected to be 6.50 billion to 7.30 billion yuan, a surge of 3.77 to 4.36 times year-on-year and 16% to 30% higher than the same period in 2022, which was the most profitable year in the past, and it is even likely to surpass the full-year net profit in 2023.

Correspondingly, its gross margin also returned to above 20%, rising from 18.38% in 2022H1 and 16.85% in 2023H1 to 20.04% in 2024Q1. Although the second quarter figure is not yet known, it is likely to remain around 20% based on its net profit.

And the reason is also due to the "volume and price increase" driven by overseas market sales when its brand moves upwards.

On the one hand, based on the strong purchasing power of foreign currencies, consumer demand in overseas markets has always been robust, especially in large oil-consuming markets such as Russia and the Middle East. According to data from the General Administration of Customs, China's total import and export value in the first half of 2024 increased by 6.1% year-on-year, with automotive exports growing by 22.2%. China's automotive exports continue to surge.

Great Wall Motor is one of the most significant players in this "going global ecosystem." Since laying out its overseas market in 1997, it has formed a global layout of full power, full range, and full grades through continuous research, production, supply, sales, and service actions.

Data shows that in 2024H1, it exported 201,500 vehicles, with year-on-year and quarter-on-quarter growth rates of +62.59%, respectively, and overseas sales accounted for 36.0% of total sales, up 12.2 percentage points year-on-year.

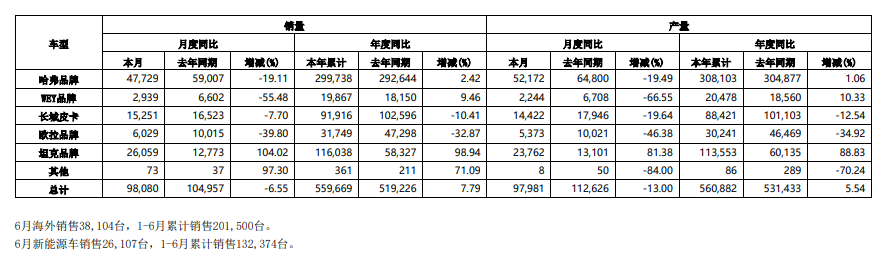

Figure: Great Wall Motor's Production and Sales Bulletin for June 2024

On the other hand, in terms of unit price, based on Great Wall Motor's overseas sales and revenue in 2023, its average overseas unit price was about 168,000 yuan, higher than its overall average revenue per vehicle of 141,400 yuan. Several popular high-end brands, including Tank and WEY, have prices in overseas markets comparable to luxury brands such as BBA. According to the announcement, its high-end MPV product WEY Mountain's starting price in Europe is 47,990 euros (approximately 370,000 yuan).

The past 26 years of "going global ecosystem" work have enabled Great Wall Motor to find the best way out amid the wave of going global and domestic competition. But at this time, are other domestic independent automakers equally fortunate to find the best way out?

Polarization is Apparent, Automakers Have Entered a Phase of Survival of the Fittest

In fact, although competition in the domestic automotive race in 2024 still seems intense, and everything seems unsettled, from the "halfway results," it can be seen that this race has reached a critical point.

Overall, according to statistics, among the 90 automotive listed companies that have announced their 2024 first-half performance forecasts, more than 70% are expected to achieve profitability. However, in the passenger vehicle sector, among the seven automakers that have announced their results so far, several companies still maintain years of losses.

Specifically, Great Wall Motor, Changan Automobile, Thalys, and JAC Motor are expected to report profits, with the lower limit of net profit in the forecasts being 6.5 billion yuan, 2.5 billion yuan, 1.39 billion yuan, and 290 million yuan, respectively. Thalys has maintained its profit turnaround since the first quarter.

But on the contrary, BJEV's losses have increased again, and Zotye Auto and Haima Automobile are still deeply mired in losses. This is the fourth to sixth consecutive year of losses for these major passenger vehicle brands.

It can be seen that although they are all domestic independent automakers, there is a significant polarization in terms of profits at present. And this polarization is also reflected among different enterprises under the same growth logic, which also means that the survival of the fittest in the industry may be right around the corner.

Taking the export increment logic as an example, as analyzed above, the overseas market explosion driven by the "going global ecosystem" is the underlying pillar for Great Wall Motor to achieve a surge in profits at a critical juncture.

But Haima Automobile, which has been focusing on the overseas market based on its export advantages in Hainan, has not reaped this dividend. Data shows that the company sold a total of 4,589 vehicles in 2024H1, a year-on-year decline of 73.27%; among them, SUV sales decreased by 70.34%, and MPV sales decreased by 86.50%. It is expected that its net profit loss during this period will be 140 million to 180 million yuan.

Image source: Haima Automobile official account

Regarding this, it stated that in the first half of this year, it mainly adjusted its overseas business strategy to control risks based on changes in the external market environment, resulting in a phased reduction in product exports, a significant decline in sales, and an increase in losses.

However, considering the excellent trend of domestic automotive exports in recent years, combined with the fact that it developed multiple models targeting overseas markets last year and achieved significant order growth in advantageous regions such as the Middle East, as well as initial expansion into new markets in Southeast Asia, Haima Automobile's current performance is obviously below expectations and forms a sharp contrast with Great Wall Motor's overseas business.

In this regard, we can perhaps consider it from two aspects. On the one hand, from an export regional perspective, it is undeniable that South America, the Middle East, Southeast Asia, Russia, etc., have always been key markets for Chinese automakers to go global over the years, especially in the Middle East market, where Chinese automotive brands have established a foothold in the Saudi market.

But precisely because of this, when the domestic market falls into a red ocean competition, domestic automakers' going global strategies naturally prioritize these regions. At this time, major brands such as Chery and Great Wall, which have been deeply investing overseas markets for many years and have advantages such as brand effect and scale effect, will naturally "harvest" more market share and profits, which also squeezes the sales capabilities of other brands, especially small-scale brands like Haima Automobile.

On the other hand, there is the inherent growth logic of the enterprise itself. Although Haima Automobile has been telling the "going global story" for many years, it is clear that "going out" does not mean "going in." Starting from 2020, the sharp decline in Haima Automobile's sales has actually revealed signs of insufficient product innovation and lagging behind market demand. However, four years have passed, and although its sales have recovered overall, the "story" of the product and brand itself has not yet been well-told, which is the main reason for its failure to reap the benefits of going global this time.

In contrast, Chery and Great Wall's "going global stories" have evolved from localized production capacity to localized operations, cross-cultural branding, and secure supply chains. It can be seen that in this race segment, Haima Automobile's loss is actually an inevitable result of its internal factors.

This also reveals that although both stand on promising growth logics, in the brutal market competition, the enterprise's core competitiveness is the key to its ability to compete in the next race segment; otherwise, it will only become a fleeting memory in history.

Competition Among Highly Crowded Top Automakers Will Intensify in the Second Half

However, it should be noted that although the outbreak of the going global dividend has brought profitability surges to some automakers like Great Wall Motor in the domestic automotive race, this does not mean that they can sustain it in the long run, nor does it mean that the going global dividend can mask the decline in revenue growth caused by the decline in domestic market sales growth.

First, from the perspective of export trends, although China's automotive exports are still dominated by traditional fuel vehicles based on overseas acceptance and awareness of powered mobility, the overseas export growth index of BYD, a representative domestic new energy vehicle enterprise, is the highest among many automakers. Data shows that in the first half of 2024, BYD's exports increased by 160% year-on-year, Great Wall Motor by 62.6%, and Changan Automobile by 60.4%.

Combined with the support for new energy vehicles in countries such as Europe and the United States and the limited incremental demand for fuel vehicles in countries such as Russia and the Middle East, from a longer-term perspective, the going global dividend for automakers will gradually shift towards the electric vehicle sector. For export enterprises like Chery and Great Wall, which currently focus on fuel vehicles, this means they need to continue to deliver excellent electric vehicle products to compete in the next stage.

Second, based on the known sales and performance forecasts on the market, although domestic automakers frequently delivered record sales results in the first half of 2024, none of them have completed 50% of their annual sales targets. Therefore, it is expected that many new strategies will emerge among automakers in the second half, and competition will remain fierce.

In this process, it is difficult to say whether Great Wall Motor can continue to adhere to its non-price war strategy. At least based on its completion rate in the first half, calculated according to its annual sales target of 1.9 million units, only 29% was achieved in the first half, so it must show sufficient "sincerity" in the second half to seize more domestic market demand and complete its sales targets. But this "sincerity" is clearly not achievable through product line innovation and industrial scale effects.

In a protracted tug-of-war, it is undoubtedly the easiest to decide the outcome of the tail elimination, but for the top players with increasingly high congestion in the early to mid-stage, it is difficult to make relatively accurate predictions at this time, and this is also when major manufacturers need to vigorously throw out their real "trump cards." Just like the current domestic top automakers, it remains to be seen which will ultimately work.

Source: Pinecone Finance