Carmakers' Price War: BMW Calls It Quits

![]() 07/19 2024

07/19 2024

![]() 675

675

By Qi Gong

In response to the two-year-long price war in the automotive industry, BMW has fired the first shot of "counterattack".

Recently, topics such as BMW withdrawing from the price war and BMW raising prices have soared to the top of trending searches. Even Lei Jun, Chairman of Xiaomi Group, expressed surprise, asking what was happening.

According to media reports, due to significant losses incurred by dealerships as a result of the price war, BMW will reduce production volumes to maintain prices starting in July. BMW stated that in the second half of the year, it will focus on business quality in the Chinese market and support dealers in taking a steady approach.

In fact, following a 15% reduction in annual wholesale sales targets in June, BMW has cut another 15% in July, lowered the threshold for rebates, and abolished financial penetration and secret purchase assessments.

In other words, BMW is giving dealers more relaxed sales KPIs to alleviate their operational pressures.

Behind this decision lies BMW's increasingly severe situation in the Chinese market: even sacrificing brand value has failed to halt the decline in sales.

01 BMW's Sales Challenge in China

BMW probably never expected that its strategy of "trading price for volume" would not even cause a ripple.

Last year, to maintain its market share, BMW proactively lowered its stance, offering a full-year discount rate of 17.66%, far exceeding the industry average of 15.7%. Taking the BMW 5 Series gasoline-powered car as an example, its starting price dropped to approximately 310,000 yuan, equivalent to a 30% discount.

In June of this year, BMW demonstrated even greater courage and sincerity with its "high-diving" approach. The BMW i3, an electric sedan originally priced at over 350,000 yuan, had a minimum bare-car price of 170,000 yuan, and prices were still negotiable upon in-store inquiries.

However, despite these efforts, BMW's sales trend continued to decline.

Public data shows that BMW Group sold 2.555 million vehicles globally in 2023 (including BMW, MINI, and Rolls-Royce), a year-on-year increase of 6.5%, but net profit plummeted by 34.5% compared to the previous year.

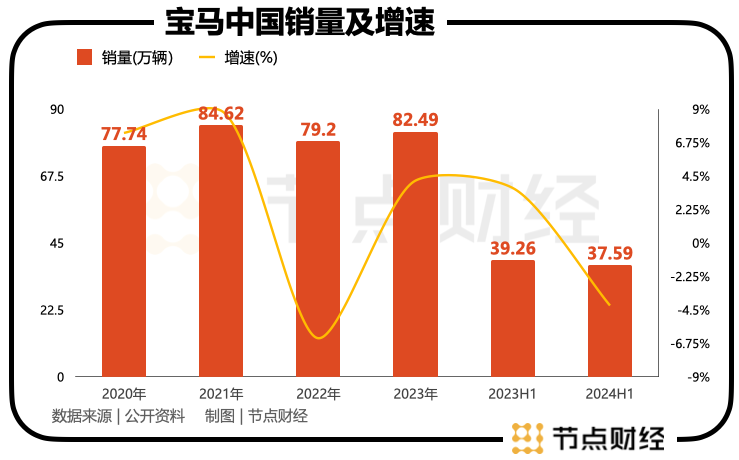

Among them, growth in the Chinese market significantly slowed, with a total of 825,000 vehicles sold, a year-on-year increase of only 4.2%.

Entering 2024, the situation remained unoptimistic. In the first half of the year, BMW Group sold 1.0965 million vehicles globally, a year-on-year increase of 2.3%, while sales in the Chinese market were 375,900 vehicles, a year-on-year decrease of 4.2%.

In other words, despite an overall upward trend, the Chinese market has held BMW back, reflecting the failure of the "discount promotion" strategy: not only has it failed to retain existing market share, but it has also lowered the brand's value.

Such an outcome is definitely not what BMW anticipated and has had a negative impact on its prestigious and elegant BMW connotation.

Finding a way to break free from the curse of declining sales in the Chinese market has become BMW's top priority.

Even "buying a BMW for 170,000 yuan" didn't create much of a splash. BMW has decided to try a different approach—raising prices to reduce inventory.

On July 17, Jie Dian Finance conducted an on-site investigation in Beijing and found that BMW's withdrawal from the price war was already underway, with price increases being implemented for various new models.

A salesperson told Jie Dian Finance, "The previous quotes are invalid, and deposits will be fully refunded to customers. Prices will gradually increase within this week. The i3 has risen by nearly 20,000 yuan, while the X1, X3, and 5 Series have increased by 5,000, 8,000, and 20,000 yuan, respectively."

BMW is not alone in this thinking and action. It is reported that Mercedes-Benz and Audi are also actively following suit.

02 BBA's Collective "Ordeal"

Saying goodbye to glory and collectively enduring an "ordeal" is probably the true portrayal of BBA (BMW, Benz, Audi) over the past two years.

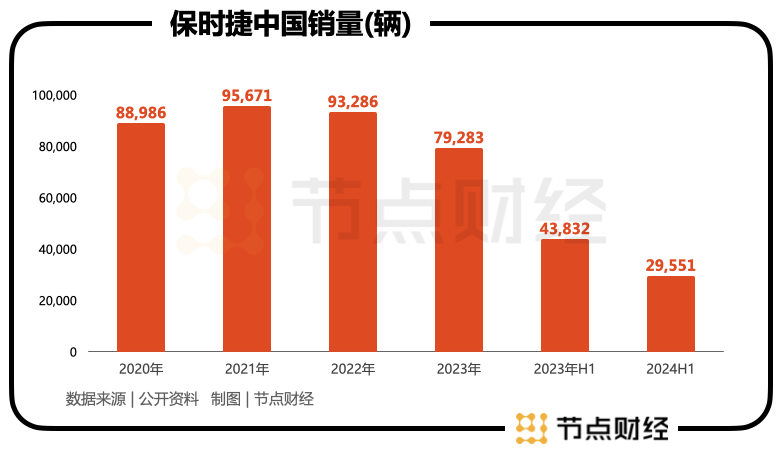

A while ago, a Porsche dealership's "forced confession" to the German headquarters sparked a public outcry. The main "trigger" of the incident centered on Porsche's plummeting sales in China, where Porsche China, in an attempt to meet sales targets, still insisted on pressuring dealers with inventory, leading to intensified contradictions between the two sides.

Public data shows that Porsche sold 95,671, 93,286, and 79,283 vehicles in the Chinese market from 2021 to 2023, respectively, with a total of 16,388 fewer vehicles sold over these three years.

Moreover, this decline is further expanding. In the first half of 2024, Porsche sold a total of 29,551 vehicles in the Chinese market, a year-on-year decline of 33%, making it the only division with a double-digit drop.

Porsche is not the only one facing difficulties. Since 2023, well-known foreign luxury car brands such as Bentley, Lamborghini, and Ferrari have been under immense pressure to "sell cars".

In 2023, Bentley delivered 3,006 vehicles in the Chinese market, a year-on-year decline of 18%; Lamborghini delivered only 845 vehicles, a year-on-year decline of 17%; Ferrari delivered 1,490 vehicles, a year-on-year decline of 4%, and continued to decline by 20% to 317 vehicles in the first quarter of 2024.

From triumph to disappointment, why have foreign luxury car brands suddenly lost their luster? Exploring the root causes, one aspect is directly related to the instability of the international economic situation and the weakening of consumer purchasing power.

On the other hand, the detachment of foreign luxury car brands' strategies from the rapidly evolving Chinese market cannot be ignored.

First, China's automotive technology has advanced rapidly with fast product iterations, but arrogant foreign luxury car brands have not paid sufficient attention to this characteristic and have not responded agilely enough, resulting in their technologies and products failing to match consumer demands in real-time.

Especially in the era of new energy vehicles, whether in power systems, chassis control, smart cockpits, or intelligent driving, foreign luxury car brands have shown delays. When competing with "upstarts" like NIO, XPeng, Li Auto, and Xiaomi, the introduction of their new vehicles no longer brings surprises or leaves a lasting impression, giving people more of a sense of "just so-so" or a "Ancient Tomb Sect" (outdated) vibe.

Second, facing the unprecedentedly fierce price war in the Chinese market, BBA was forced to participate, attacking each other's strengths with their weaknesses. Not only did this have no effect, but it also deviated from their original brand positioning, suppressed their brand premium capabilities, and compressed their profit margins.

Finally, the rapidly rising local brands are forming direct competition with foreign luxury car brands, supported by strong underlying strengths and more comfortable driving experiences.

03 The "Blow" from Local Brands

Jie Dian Finance recently read an article about how "driving a 500,000 yuan electric car" is becoming a phenomenon in a northern county, with car owners choosing local brands such as NIO, ZEEKR, BYD Yangwang U8, and Li Auto.

Wang Yue, who bought a NIO in 2021, has noticeably perceived a change: "BBA is no longer fashionable here." If in the past, BBA was the spiritual totem of the rich, compensating for a lack of culture and the inferiority complex of being called a "nouveau riche," now, high-end electric cars symbolize the taste of middle-aged people in the county.

This is but a glimpse into the two diverging paths and worlds that have emerged around automobiles in the Chinese market.

On one side, foreign luxury car brands tried to turn the tide with "cost-effectiveness" but unfortunately failed; on the other side, a new definition of luxury cars, encompassing factors such as performance, price, and aesthetics, is flourishing across the vast land.

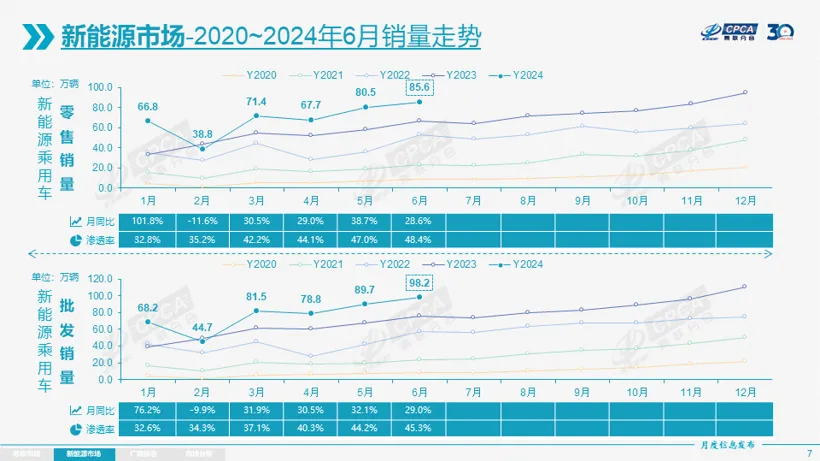

According to the China Passenger Car Association, in the first half of 2024, cumulative sales of new energy vehicles reached 4.111 million, a year-on-year increase of 33.1%, with penetration rates soaring to 41.4%; over the same period, cumulative sales of gasoline-powered vehicles were 5.73 million, a year-on-year decrease of 13%.

This rise and fall reflect the divergent growth potential and development prospects of new energy vehicles and traditional gasoline-powered vehicles, with the latter being the cornerstone of BBA.

Specifically, in June's market share, the retail share of German brands was 18.6%, a year-on-year decrease of 2.6 percentage points; the retail share of Japanese brands was 14.3%, a year-on-year decrease of 3.5 percentage points; and the retail share of American brands was 6.3%, a year-on-year decrease of 2.9 percentage points.

Now, having realized the negative effects of the price war, BBA has finally come to its senses. Since price cuts aren't working, they've decided to raise prices. The question is, will consumers buy it?

After all, today's Chinese consumers, having experienced domestic new energy vehicles brimming with technological advancements, high AI integration, and equipped with TVs, refrigerators, and large sofas, have become very discerning.

As for BBA, besides their logos, everything seems to be the same as before.