90% of dealers are not making money, the used car market is facing a major shake-up

![]() 07/19 2024

07/19 2024

![]() 557

557

"I didn't sleep all last night," "I feel like the sky of the used car industry has collapsed," "I really don't want to do used cars anymore."

These are the sentiments expressed by several used car dealers with over 100,000 or even 1 million followers on Douyin, as this year's used car business has been especially challenging, with some dealers struggling to even cover their rent.

"Those who operate on Douyin and have more ways to acquire customers might be slightly better off, while traditional used car dealers are mostly gone."

From a macro perspective, the used car market is not in dire straits. In the first five months of this year, the cumulative transaction volume of the national used car market reached 7.8639 million units, an increase of 8.69% year-on-year.

On one hand, there is a survival crisis, and on the other, the market has not shrunk. Why is there a discrepancy between macro and micro-level performances? What are the difficulties faced by used car dealers? How were these difficulties caused? And what are the possible solutions for dealers? This article will discuss these issues.

I. 90% of dealers are losing money

On the evening of April 28th, a used Maybach was auctioned off at Beijing Wangjing 360 Headquarters Building, attracting used car dealers and traders from all over the country.

Although there is only a one-character difference between "trader" and "dealer," they represent different business philosophies.

The term "trader" often carries a pejorative connotation. In the early stages of industry development, traders would often sell cars with major accidents as high-quality vehicles at inflated prices to earn higher profits. They focused on one-time transactions rather than referrals, and there was even a saying, "To get rich, sell big accidents."

Dealers, on the other hand, are relatively more standardized. They typically do not sell problematic cars as good ones, operate with integrity, and offer additional value-added services. Overall, their profits are not as exorbitant.

Zhou Hongyi's Maybach was eventually auctioned off to someone who claimed to be "Chairman Chu." Chairman Chu entered the used car industry in 1995, self-proclaimed as the first dealer to open a shop in Huaxiang (Beijing's largest used car trading market). Seven years later, he built his own auto repair shop and began offering after-sales services.

This self-operated model requires setting up after-sales and sales teams, as well as using self-funded capital to purchase cars, making it highly capital-intensive. Any market fluctuations could pose significant risks.

For instance, in the current automotive market, dealers with heavier operating models are more vulnerable.

After the economic recovery last year, there was a wave of retaliatory automobile consumption, and many used car dealers made profits. However, when they hoped for a sustained market and bought cars at high prices, new car price wars erupted, from new energy vehicles to fuel vehicles and even luxury brands like BBA. From last year to this year, new car price wars have been relentless, making the used car business increasingly difficult.

In 2022, the average inventory days for used car dealers were approximately 37 days, while in May of this year, it was 55 days.

Media reports have stated that new car prices are adjusted every 15 days on average, meaning that inventory vehicles continue to lose value during the sales process. When new cars drop in price by ten to twenty thousand yuan, used car dealers may have to sell recently acquired cars at a loss or risk further depreciation. As a result, used car dealers are incurring heavy losses.

Since most used car dealers operate self-managed models, they are the ones most affected by changes in car prices, especially smaller dealers with simple business models and husband-and-wife operations, who are the ones constantly lamenting, "The used car market is tough."

According to research data from the China Automobile Dealers Association, 92% of used car dealers have experienced losses in recent years, posing severe challenges to their survival and development.

In terms of the number of registered used car enterprises, the pace of new dealership openings has slowed down this year.

Over the past decade, the number of registered used car brokerage-related enterprises in China has grown steadily each year. In 2022, the number of registrations exceeded 150,000 for the first time, with a year-on-year increase of 25.1% to 187,900 in 2023. However, in the first half of 2024, the number of related enterprise registrations decreased by 17.7% year-on-year to 80,000.

Both the used car and new car industries are highly competitive, and both view traffic as a lifeline.

Chairman Chu's purchase of Zhou Hongyi's used car also had an intention of "seeking attention." When speaking with Zhou Hongyi, he said, "Our used car industry is tough right now, and I'm actually speaking up for used cars." The entire process, from confirming the purchase to rumors of "not being able to pay the 9.9 million auction price and running away" to finally completing the payment, took two months, during which Chairman Chu gained hundreds of thousands of followers.

Some used car dealers have the ability to transform into live streaming platform dealers, accumulating a large number of followers and adopting a strategy of small profits but quick turnover, willing to sell a car for even 1,000 yuan in profit, leaving even fewer customers for smaller used car dealers.

For those dealers who are not doing well, the upcoming slow seasons in July and August will only make things harder. Still, some dealers are expanding against the trend. Aokangda, which focuses on high-end used cars, opened its Chengdu store in March this year, and its new Tianjin store will officially open in August. Additionally, home appliance giant Haier has also entered the used car market, opening its 001 superstore in Zhengzhou last month.

The used car industry has entered a period of reshuffling.

II. How to survive during the reshuffling period?

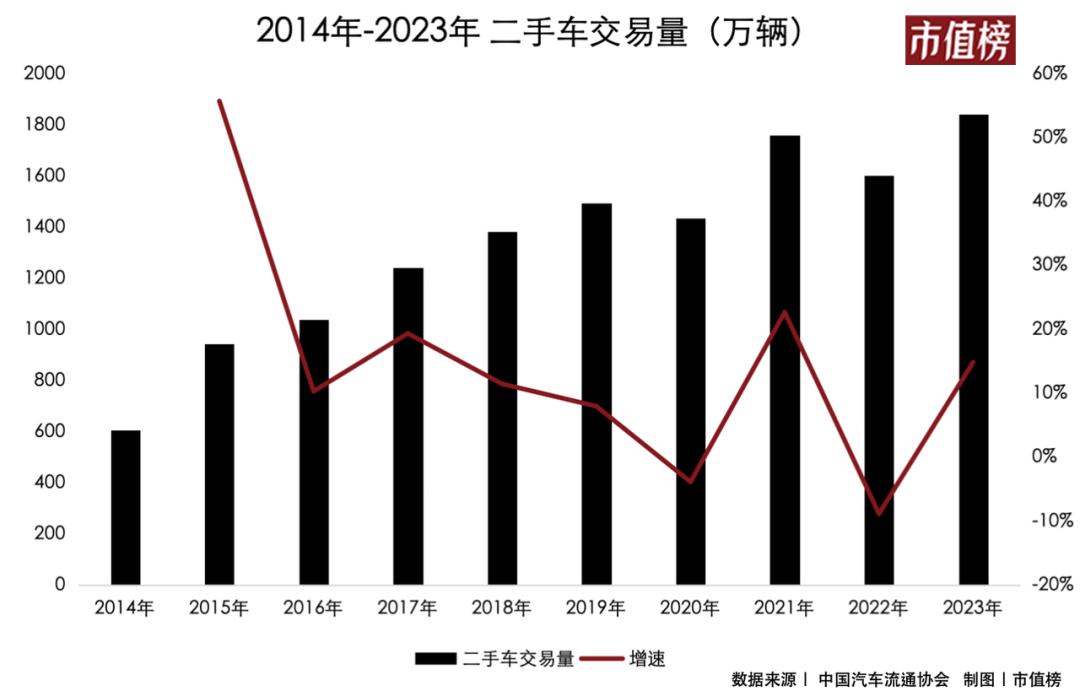

Looking at used car transaction volumes, only 2020 and 2022 saw declines due to special circumstances, while other years have experienced growth rates of around 10% or more. In 2023, 18.41 million used cars were transacted, an increase of 15% year-on-year. During the same period, 30.094 million new cars were sold, with the sales gap between the two rapidly narrowing.

As car ownership enters a stage of single-digit growth, used car sales begin to catch up and surpass new car sales, marking the golden age of the used car industry.

Based on the experiences of other countries, the used car industry is a sector with growth potential and a sufficiently large market size.

Only by surviving the current reshuffling period can one have the opportunity to enter a stage of "long-term improvement."

Survival requires a shift in mindset to enhance risk resistance capabilities.

The used car market is a "secondary market" characterized by information asymmetry between buyers and sellers. Sellers often have more information advantages and are more inclined to conceal flaws in vehicles to earn higher profits.

In the past, the used car industry focused more on profits, with normal operating profit margins reaching 10% or even higher, especially for luxury cars. Irregular operations, as mentioned earlier, involved exorbitant profits.

Nowadays, as information becomes increasingly transparent, price information can be obtained through price comparisons on different platforms. At the same time, information such as vehicle accident history, maintenance records, and service conditions can be accessed through various channels, making used car prices more transparent.

In the future, as the price system of new energy vehicles becomes more stable, resale values increase, and the industry becomes more standardized, industry profit margins may recover, preventing large-scale losses. However, market transparency is a deterministic long-term trend. Under this trend, focusing on turnover rate is a more prudent choice.

Aokangda, which has been expanding as mentioned earlier, shifted its business strategy in 2020, publicly committing to a gross profit margin of no more than 5%, placing greater emphasis on turnover rate assessments and requiring an average vehicle turnover period of 20 days.

For small used car dealers, maintaining cash flow is crucial for survival.

As a result, some self-operated used car dealers will inevitably shift to consignment models, which require lower capital investment.

The consignment model is akin to the dealer acting as an intermediary, without the need to spend money to purchase cars. Instead, they match genuine sellers with buyers and earn commissions from the transactions. This model is less affected by new car prices and can serve as a short-term survival strategy.

However, in the long run, this is not an optimal choice.

Because dealers have no responsibility for consignment cars, car buyers cannot be guaranteed, and they can only take a gamble that the genuine seller is honest, which increases the risk for buyers and deters many potential customers.

Of course, while offering a consignment model, used car dealers can also provide services such as vehicle inspections, evaluations, and financial loans. On the one hand, this enhances credibility, and on the other, it provides value-added services, similar to what used car e-commerce platforms like Guazi and Renrenche offer.

However, this is obviously not a low-barrier transformation method and requires used car dealers to have a certain scale to achieve.

Large used car dealers will also be affected by the decline in new car prices, but they have stronger risk resistance capabilities and a higher probability of smoothly navigating the reshuffling period.

For example, Haier is still increasing its investments in the used car industry. Its used car brand, Kataichi, has allied with 18 used car dealers across various regions, operating 28 offline stores in cities such as Beijing, Shanghai, Zhengzhou, and Wuhan. Haier has chosen to become the controlling shareholder of large dealers in various regions without participating in their actual operations.

The used car market places a higher demand on trust, making branding and chain development almost inevitable trends. More mature markets like the United States follow the same pattern. The US used car market is dominated by auto dealers, supplemented by used car chains. Almost all auto dealers offer both new and used car services. In terms of market share, auto dealers and used car chains account for 60% and 25%, respectively, with the remaining 15% coming from private transactions.

Therefore, China's future used car market will inevitably see larger players swallowing up smaller ones, with increasing market concentration and better services. During this round of used car industry reshuffling, more dealers are bound to exit the market. The current reshuffling is just the beginning.

Those who can better withstand risks will survive longer.