Lei Jun is Terrifying! Is Changan Auto Using 15 Billion Yuan to “Gain Courage”?

![]() 07/19 2024

07/19 2024

![]() 559

559

Author | Meng Xiao

For more financial information | BT Finance Data Hub

The main text consists of 4694 words, with an estimated reading time of 12 minutes

“Lei Jun is terrifying! He inspired me!”

It's hard to imagine these words coming from Zhu Huarong, Chairman of Changan Auto. “Lei Jun is capable, handsome, and modest. He's really terrifying!” Zhu Huarong told reporters at a recent media conference. He said this was a true “asymmetric competition” and “dimensional reduction strike.”

Faced with the uncertainties brought by Lei Jun and Xiaomi Automobile, Zhu Huarong believes that only by firmly investing heavily in research and development, with a daily investment of over 40 million yuan, or approximately 15 billion yuan per year, can Changan provide solid support for its development, achieve a counterattack on the spot, occupy a favorable position in future market competition, and bring a sense of security to Changan Auto.

On March 28th, Xiaomi held the launch event for its SU7 model, where auto industry leaders gathered, including Li Bin, Chairman of NIO; He Xiaopeng, Chairman of Xpeng; Li Xiang, Chairman of Lixiang; Wei Jianjun, Chairman of Great Wall Motors; Zhang Jianyong, Chairman of Beijing Automotive Group; and Dai Kangwei, General Manager of Beijing Electric Vehicle Co., Ltd. There were both new forces in car manufacturing and traditional giants. Zhu Huarong, Chairman of Changan Auto, was unable to attend in person due to unforeseen circumstances, but he watched the Xiaomi Automobile launch event live through a live broadcast.

In Zhu Huarong's view, the Xiaomi Automobile launch event was a success, with the Founder's Edition selling out within 1 minute and 40,000 units booked within 18 minutes, both setting new records in the auto industry. It was likely this launch event that “inspired” Zhu Huarong.

What Zhu Huarong did not expect was that after the launch event, the popular Lei Jun humbly sought his advice: “Mr. Zhu, could you please take a look at tonight's launch event and see if there are any issues or areas for improvement?” Zhu Huarong did not believe this was a showoff of Xiaomi Automobile's achievements but rather saw the reason behind Lei Jun's popularity.

In Zhu Huarong's view, Xiaomi Automobile, combined with internet marketing strategies, is almost a dimensional reduction strike against traditional automakers. Xiaomi's advantages are already very obvious, and Lei Jun is so modest that Xiaomi Automobile may become Changan Auto's “lifelong enemy.”

The day after being inspired by Lei Jun, Zhu Huarong canceled all meetings and began to ponder how to break through in an increasingly competitive market. “Using their own methods against them” was Zhu Huarong's first step, beginning to learn from his competitors. Zhu Huarong, who had previously been somewhat reluctant to engage in live broadcasts, initiated his first live broadcast during the auto show held in Beijing shortly thereafter, personally endorsing Changan Auto. All senior executives of Changan Auto registered relevant accounts and began actively embracing the era of internet traffic.

Zhu Huarong is well aware that he cannot win against Lei Jun in terms of internet marketing thinking, so he began to focus on investing heavily in research and development, setting a research and development expense target of 15 billion yuan per year, which means Changan Auto's daily research and development expenses will reach up to 40 million yuan. It aims to counter Lei Jun's “asymmetric competition” and “dimensional reduction strike” through high research and development investment.

It is evident that Zhu Huarong learned from Lei Jun how to master the “traffic password.” After he made the above remarks in a recent interview, Changan Auto's share price continued to rise, surging from 13.58 yuan at the beginning of the month to 15.70 yuan at the close on July 17th, an increase of 16%, with a total market value of 155.7 billion yuan.

1

Net Profit Plummets by Over 80% in the First Quarter

What worries Zhu Huarong is the decline in Changan Auto's performance.

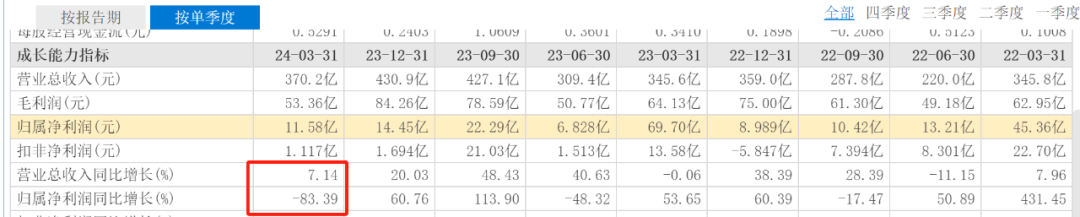

In the first quarter of 2024, Changan Auto's revenue increased without a corresponding increase in profits. The financial report shows that Changan Auto's revenue in the first quarter was 37.02 billion yuan, an increase of 7.14% compared to the same period last year of 34.56 billion yuan. However, net profit attributable to shareholders plunged from 6.97 billion yuan in the same period last year to 1.158 billion yuan, a year-on-year decline of 83.39%. In the same period in 2023, Changan Auto's revenue increased by -0.06%, but net profit attributable to shareholders increased by 53.65%, a typical case of profit growth without revenue growth.

What concerns Zhu Huarong is that Changan Auto's gross margin and net profit margin in the first quarter of this year have both declined significantly. In the first quarter, Changan Auto's gross margin was 14.41%, down 4.15 percentage points from 18.56% in the same period last year, while the net profit margin plummeted from 19.37% in the same period last year to 2.31%, a drop of 17.06 percentage points, setting a record for the largest year-on-year decline. The 2.31% net profit margin is the lowest recorded for the same period since 2019. In 2023, Changan Auto's net profit margin was as high as 6.28%. In fact, Changan Auto's net profit margin began to decline in the fourth quarter of 2023, when the net profit margin was only 1.76%, even lower than that in the first quarter of this year. The net profit margin increased slightly quarter-on-quarter but declined sharply year-on-year.

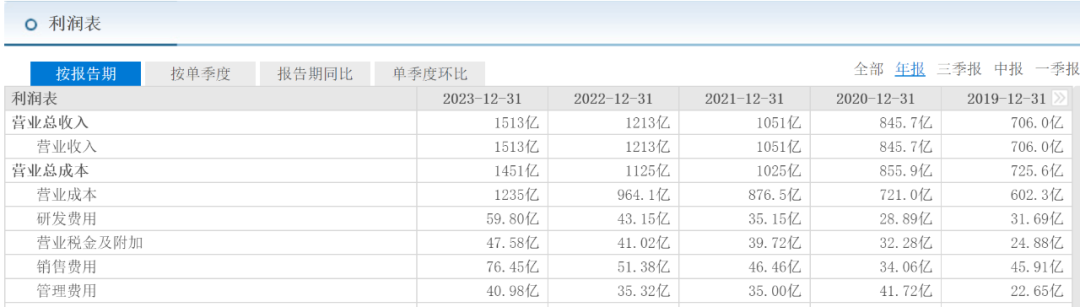

In 2023, despite a weak fourth quarter, Changan Auto performed well overall for the year. Its annual revenue was 151.3 billion yuan, an increase of 24.78% year-on-year, and net profit attributable to shareholders was 11.33 billion yuan, an increase of 45.25% year-on-year. In the previous two years, Changan Auto's revenue increased by 24.33% and 15.32%, respectively, while net profit attributable to shareholders increased by 6.87% and 119.53%, respectively. In the fourth quarter of 2023, Changan Auto's revenue was 43.09 billion yuan, an increase of 20.03% year-on-year, and net profit attributable to shareholders was 1.445 billion yuan, an increase of 60.76% year-on-year. By comparing these data, it can be seen that both Changan Auto's revenue and net profit growth in the first quarter of this year have declined significantly both year-on-year and quarter-on-quarter. Compared to the same period last year, Changan Auto's performance is obviously unsatisfactory to the market.

Changan Auto explained the reason for the sharp drop in net profit in its financial report as the impact of recognizing investment income from the acquisition of Deep Blue Automobile Technology Co., Ltd.

Upon careful analysis of Changan Auto's structure, it is evident that the company still relies primarily on its joint venture brands' gasoline-powered vehicles for profit, using the profits from gasoline-powered vehicles to support losses in the new energy field. After BYD and Lixiang opened the curtain on profitability in the new energy vehicle sector, Changan Auto has yet to achieve profitability in this area. The financial report shows that in 2023, the two brands, Deep Blue and AVATR, suffered a combined net loss of up to 6.6 billion yuan. The continuous losses in the new energy vehicle sector led Zhu Huarong to learn from Lei Jun.

2

R&D Expenses Tripled?

In 2023, Changan Auto's R&D expenses were 5.98 billion yuan. If Zhu Huarong's words are true, and the company invests 15 billion yuan in R&D this year, it will almost triple last year's investment. The financial report shows that from 2019 to 2023, Changan Auto's R&D expenses were 3.169 billion yuan, 2.889 billion yuan, 3.515 billion yuan, 4.315 billion yuan, and 5.98 billion yuan, respectively, with year-on-year increases of -0.49%, -8.84%, 21.67%, 22.77%, and 38.57%, respectively. In other words, Changan Auto has only started to increase its R&D efforts in the last three years, which may be significantly related to its new energy vehicle business segment.

In the previous five years, Changan Auto's R&D investment accounted for 4.5%, 3.4%, 3.3%, 3.6%, and 3.9% of its total revenue, respectively. After 2019, the R&D ratio has been below 4% for four consecutive years.

In the first quarter of 2024, Changan Auto's R&D expenses were 1.544 billion yuan, an increase of 13.32% year-on-year. However, this growth rate is significantly lower than the 41.67% increase in the same period last year. From the second quarter to the fourth quarter of 2023, the year-on-year increases in R&D expenses were 53.42%, 32.99%, and 38.57%, respectively, all higher than the increase in the first quarter of this year. This discrepancy somewhat contradicts Zhu Huarong's statement about increasing R&D efforts. Of course, only half of the year has passed, and the amount of R&D investment in the following quarters will determine whether Zhu Huarong's words are true. In this quarter, Changan Auto's R&D ratio increased to 4.2%.

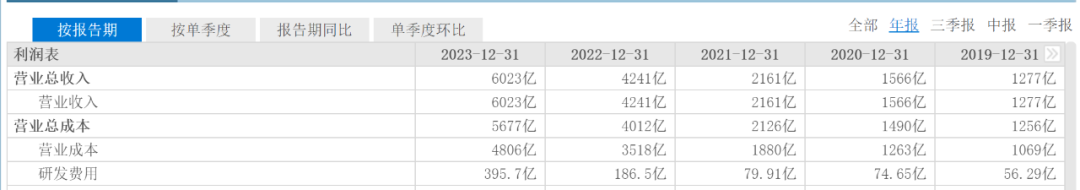

Although Changan Auto's R&D expenses and R&D ratio have increased to some extent, it seems far from enough. Taking BYD and Great Wall Motors as examples, BYD's R&D expenses from 2019 to 2023 were 5.629 billion yuan, 7.465 billion yuan, 7.991 billion yuan, 18.65 billion yuan, and 39.57 billion yuan, with year-on-year increases of 12.83%, 32.61%, 7.05%, 133.44%, and 112.15%, respectively. In the past two years, BYD's R&D expenses have grown rapidly, at 4.3 times and 6.6 times that of Changan Auto during the same period, respectively. During the same period, Great Wall Motors' R&D expenses were 6.445 billion yuan and 8.054 billion yuan, 1.5 times and 1.3 times that of Changan Auto, respectively. In the first quarter of this year, BYD's R&D expenses were 10.61 billion yuan, an increase of 70.1% year-on-year. Changan Auto's R&D expenses were less than one-seventh of BYD's. Great Wall Motors' R&D expenses were 1.96 billion yuan, an increase of 27.73% year-on-year. In terms of R&D investment and growth rate, Changan Auto lags significantly behind BYD and Great Wall Motors.

From 2019 to 2023, BYD's R&D expenses accounted for 4.4%, 4.8%, 3.7%, 4.4%, and 6.6% of its total revenue, respectively. It can be seen that except for 2021, when the R&D ratio was below 4%, BYD's R&D ratio was above 4%, especially in the last two years. Tesla, known for its high R&D ratio, had R&D ratios of 3.8% and 3.7% in the same period, and its R&D investment in 2023 was also lower than BYD's, which is the fundamental reason why BYD has been able to seize the global sales crown for new energy vehicles.

Although Zhu Huarong was inspired by Lei Jun, from Changan Auto's R&D investment in recent years, jumping from 5.98 billion yuan directly to 15 billion yuan will represent a year-on-year increase of 151%, an increase that even the “R&D maniac” BYD has not achieved. Changan Auto's plan to invest 15 billion yuan in R&D this year has also raised market doubts. Excluding the 1.544 billion yuan in R&D expenses in the first quarter, it means that in the following three quarters, Changan Auto will need to invest 13.456 billion yuan, with an average daily R&D expense of nearly 50 million yuan.

Combining Changan Auto's revenue in 2023 and the first quarter of this year, the R&D ratio will reach around 11%. Currently, no domestic or global automaker has achieved such a high R&D ratio. If Zhu Huarong follows through on his words, Changan Auto will become the automaker with the highest R&D ratio globally.

3

Learning from Lei Jun is Not Just About the Surface

Feeling the pressure from Xiaomi Automobile and Lei Jun, Zhu Huarong began to intentionally or unintentionally learn from Lei Jun. Being good at learning is a good thing, but blindly imitating may not yield the desired results. After all, Lei Jun has the genes of an early internet celebrity and possesses strong and advanced internet thinking. Now, many automaker leaders are learning from Lei Jun, hoping to become internet celebrities en masse, but few have achieved good results.

First of all, Lei Jun has 23.933 million and 25.486 million followers on Weibo and Douyin, respectively (as of 11 am on July 17th). During the same period, Zhu Huarong had 632,000 followers on Weibo and 20,000 on Douyin, far fewer than Lei Jun's followers, which also indicates that Zhu Huarong's path to becoming an internet celebrity is almost unfeasible. Even Wang Chuanfu and Li Bin, who are more well-known in the industry and frequently make public appearances, cannot compete with Lei Jun in terms of internet traffic. Zhu Huarong embracing the internet is just an additional marketing method, but if he wants to achieve immediate results like Lei Jun, he may be disappointed.

It's not just Zhu Huarong; the entire auto industry has been “driven crazy” by Lei Jun, and many automaker leaders have begun to learn from him. Wei Jianjun, Chairman of Great Wall Motors, became enthusiastic about live broadcasts and short videos after attending Xiaomi's new car launch event and required his subordinates to actively embrace traffic and strive to become internet celebrities. Seventeen senior executives of Great Wall Motors