China's Auto Market Mid-Year Review: New Forces Accelerate Reshuffling, "NIO, Xpeng, Li Auto" Become History

![]() 07/19 2024

07/19 2024

![]() 670

670

Core competitiveness is the guarantee of sales.

With 4.944 million vehicles delivered and a market share of 35.2%, the domestic new energy vehicle industry set a new record from January to June this year, thanks to the joint efforts of automakers, while the overall Chinese auto industry maintained steady progress. Meanwhile, as of June, the cumulative deliveries of domestic new energy vehicles surpassed 30 million.

However, despite the promising development of the new energy vehicle industry, some automakers are rejoicing while others are lamenting. Some automakers' sales surged by more than 500% year-on-year, while others experienced a "contrarian" decline. At the critical juncture where new energy vehicles are gradually replacing traditional fuel vehicles, failing to follow industry trends and achieve sales growth has become a major concern for automakers.

In fact, except for BYD, which had a sales base of 1.248 million in the first half of last year, and automakers such as Tesla, AITO, Li Auto, NIO, which sell high-end models, other automakers' new energy vehicle sales growth rates are below 35%, requiring them to look inward at their products, marketing strategies, and other aspects.

Only by comparing can we highlight the gaps. Combining the sales figures of major automakers allows us to gain a clearer understanding of domestic new energy automakers and explore the reasons behind their sales changes.

The Battle of the Five Kings: BYD Leads the Way, the "One Superpower and Multiple Strong Players" Structure Remains Unchanged

Compared to new forces in the auto industry, established automakers such as BYD, Geely, Changan, Chery, and Great Wall not only have stronger brand influence but also possess sufficient automotive design and production experience and capacity.

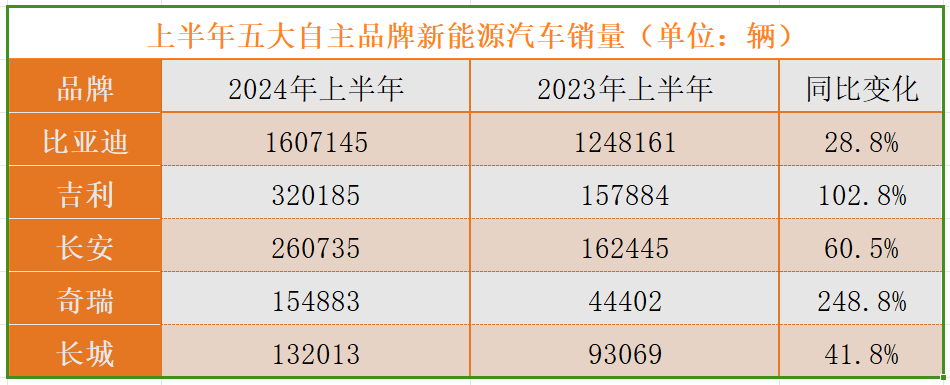

Facing the new energy vehicle industry, choice and layout may be more important than technology. Due to different attitudes and layouts, the new energy vehicle market has formed a "one superpower and multiple strong players" situation. BYD is the industry's unique leader, with 1,607,145 new energy vehicle sales in the first half of this year, an increase of 28.8% year-on-year.

Data shows (note: due to different statistical methods, there may be differences between the data) that there are obvious gaps among the top five established Chinese automakers. BYD stands alone, followed by Changan and Geely in one tier, and Great Wall and Chery in another. The reasons for these gaps lie in their attitudes towards new energy vehicles and the competitiveness of their products.

BYD: The Only Competitor is Itself

Compared to other traditional automakers, BYD's biggest difference is its unwavering commitment to new energy vehicles since entering the market.

While the domestic market share of fuel vehicles still exceeds 60%, the majority of traditional automakers have not halted fuel vehicle production. BYD, however, officially ceased fuel vehicle production in March 2022 to fully focus on new energy vehicle R&D and production.

In 2023, BYD's R&D investment reached 39.9 billion yuan, ranking first among domestic automakers and even surpassing Tesla by more than 10 billion yuan. Beyond financial investment, BYD is actively building R&D teams and recruiting various automotive industry talents to focus on achieving significant achievements.

With these human and material resources, we have witnessed the more fuel-efficient fifth-generation DM technology, the more intelligent body control system Cloud Suspension A/C/P, the DM-o system focusing on off-road performance, the CTB battery-body integration technology that enhances body strength and reduces costs, and engines with a thermal efficiency of up to 46.06%.

In addition to technology, BYD's continuous sales growth has a "public secret": price advantage. At the recent China Auto Forum in Chongqing, Li Yunfei, General Manager of BYD Brand and Public Relations, proposed that the value competition in the automotive industry should start from three aspects: technology, products, and prices.

Although executives from multiple automakers such as GAC, Huawei, and Geely oppose price competition, BYD has made it part of its value competition strategy. The Qin PLUS has seen its price continue to decline from the Champion Edition to the Glory Edition, enhancing product competitiveness (or cost-effectiveness) and ensuring sales.

On the other hand, with the emergence of heavyweight models like the Qin L DM-i and Seal 05 DM-i, we can see that BYD has been leading the market competition trend: In the past, hybrid models competed on cost and fuel efficiency, and BYD set the benchmark; now, the competition trend has shifted to single-charge range, and BYD has once again emerged as the benchmark.

BYD's ability to firmly grasp the initiative in the industry largely stems from its technological advantages, which are not only related to experience but also imply a series of subtexts such as "cost control" and "raising thresholds." From "3.8" to "998" to "2000," BYD's sales secrets are hidden in these numbers and are not unknown. It is just that BYD indeed has cost advantages brought about by connecting upstream and downstream industrial chains and understands user needs better, which explains why other automakers can only imitate.

Of course, BYD's battleground is not limited to the domestic market. The recent roll-out of its 8 millionth vehicle in Thailand is a clear signal that overseas markets have always been BYD's primary focus, and future investments will only increase. Perhaps within this year, we will see news of BYD's 10 millionth new energy vehicle roll-out. At this stage, it is almost an "impossible mission" for any automaker to surpass BYD in the new energy field. They need to consider how to capture a share of BYD's market in individual segments.

Changan and Geely: Opportunities in Niche Segments

When China initially introduced policies to encourage joint ventures between overseas and domestic automakers, the goal was for domestic automakers to learn from overseas automakers' technology and advanced management experience. Changan Automobile is undoubtedly a "model student" among joint venture automakers, focusing on both learning and independent R&D of technology. In terms of sales of independent brand products alone, Changan can barely compare with BYD.

Although Changan is not as aggressive as BYD in new energy vehicles, it is accelerating its layout, with sub-brands such as Deep Blue, Qiyuan, and AVATR demonstrating strong competitiveness.

The same is true for Geely, which boasts a new energy architecture, the Leishen Hybrid 8848, the Shield Battery Safety System, ADAS assistance systems, and more, providing support for its sub-brands such as Zeekr, Galaxy, and Geometry. In particular, the Zeekr brand has carved out a niche in the market above the 200,000 yuan price range.

These two automakers have paid close attention to the layout of the new energy vehicle industry and launched multiple sub-brands targeting different price segments. The constraint of fuel vehicles prevents Changan and Geely from abandoning fuel vehicles as early as BYD, but both automakers have demonstrated their commitment to new energy vehicles.

Objectively speaking, after re-planning product lines and reforming sales channels, especially by actively following the price war, Changan and Geely's models are not without competitiveness in terms of absolute product strength. Their current sales are far behind BYD, mainly due to the loss of first-mover advantage.

As I mentioned earlier, it is almost impossible for other automakers to compete with BYD based on its current momentum. However, automakers such as Changan and Geely can capture a share of the market in niche segments where BYD is relatively weak. Indeed, Changan's Qiyuan and AVATR sub-brands have seen incremental growth, while Geely has achieved certain results in the pure electric vehicle field with the Zeekr brand.

Especially Zeekr, after the introduction of two important new models, the Zeekr 007 and the new Zeekr 001, its monthly sales have surpassed 20,000 units, ranking at the top of the new force sales list. For these second-tier automakers, preserving the current basic market and exploring niche segments have become almost the only way out. Catching up with BYD cannot be achieved overnight, and they can only maintain patience for now.

Chery and Great Wall: Attitude Determines Success or Failure

Relatively speaking, Chery and Great Wall's new energy vehicle sales are somewhat unimpressive, even falling behind Li Auto. Of course, this does not mean that Chery and Great Wall lack technological strength. On the contrary, Chery has always been regarded as the "geek" among domestic automakers,consistently focusing on researching and developing technology.

I believe that the reason for Chery's meager 154,883 new energy vehicle sales in the first half of this year lies in its attitude towards the new energy vehicle market. Unlike other independent brands, Chery exported 532,200 vehicles in the first six months of the year, accounting for nearly half of its total sales. With China accounting for more than 60% of the global new energy vehicle market share and the slower growth of overseas new energy vehicles, Chery can easily become a giant in domestic cars by relying on the overseas fuel vehicle market.

Therefore, Chery does not seem to attach much importance to new energy vehicles. Unlike other independent brands that have launched sub-brands for early layout, Chery has been relatively slow, and its marketing efforts for Star Era and Fengyun have not garnered much attention. Chery's collaboration with Huawei on the Zhide Auto, an intelligent selection model, initially received many orders but suffered reputational damage due to delays in delivery caused by production capacity issues.

From Chery's relaunch of the Fengyun series, we can see that Chery intends to change the current situation and increase its investment in new energy vehicles. Although the sales volume of 154,883 units is not outstanding, the year-on-year increase of 248.8% proves Chery's potential. I believe that after adjustments, Chery's new energy vehicle sales will experience explosive growth.

Unlike Chery, Great Wall is extremely active in new energy vehicles. Whether it's the early WEY, or later Ora, or new energy versions of other fuel vehicles, Great Wall has garnered significant online attention. However, Great Wall's sales have not met expectations.

Similarly, Great Wall's problem does not lie in technology. In addition to the well-known Hi4 hybrid technology, Great Wall's Hive Energy is also a leading domestic power battery enterprise. Based on computing power, algorithms, and large models, Great Wall has built a full-link AI technology system, connecting the entire development process of power, chassis, styling, and bodywork.

Before the rise of the new energy vehicle industry, Great Wall was the leader among independent automakers for several consecutive years, with its popular model Haval H6 winning the domestic SUV sales championship for nine consecutive years. I have no doubt about Great Wall's technological strength, but why has this outstanding automaker failed to meet sales expectations?

Many Zhihu users believe that the reason lies in Great Wall's overly feminine product line. From the naming of some models under the Ora, WEY Coffee, and Haval brands and series, we can see a glimpse of this. Great Wall's image during the fuel vehicle era was durable, spacious, and rugged, catering to male consumers' needs. Now, by abandoning its strengths to tap into the female consumer market, the difficulty is naturally high.

Yu Chengdong, Chairman of Huawei's Intelligent Automotive Solution BU, once said that if products are customized for female users and disliked by male users, the market will be narrow. He hopes that product functions and configurations can gain recognition from female consumers.

Products can be designed with configurations and functions that better meet the needs of female consumers, but it is not necessary to design products exclusively for them. After all, buying a car is a family matter that needs to satisfy everyone's requirements. Moreover, the WEY VV5/7 once had a good reputation, but suddenly they became "coffee" models like Blue Mountain and Alpine, confusing many people.

For Great Wall, perhaps the most important thing now is to refocus and find the right positioning. Considering Great Wall's significant investment in intelligence in 2024, there is still hope for good results in the second half of the year.

Summary: Choice is More Important Than Effort

In the first half of the battle, traditional automakers vividly illustrated that choice is more important than technological strength. Accurately grasping consumer needs and target consumer groups is the key to breaking through sales. The so-called "choice" also refers to automakers' understanding of product definition and customer positioning. BYD's ability to consistently create "blockbuster" models is not accidental.

From an overall perspective, traditional automakers delivered satisfactory performance in the first half of 2024, with sales significantly improved compared to the same period in 2023. This indicates that China's auto industry's new energy transformation has approached or surpassed the critical period, and the new energy vehicle category has indeed brought positive benefits to participants in the industry.

Macroscopically speaking, this is also a typical example of "choice being more important than effort." In Li Shufu's keynote speech at the 2024 China Auto Forum, he repeatedly mentioned the transformation and upgrading of the entire automotive industry. I believe that industry progress cannot be driven by just one or two automakers, and the automakers we mentioned earlier and below have all contributed their share of strength.

New Forces Accelerate Reshuffling: AITO and Li Auto Become Dual Powers, "NIO, Xpeng, Li Auto" Become a Thing of the Past

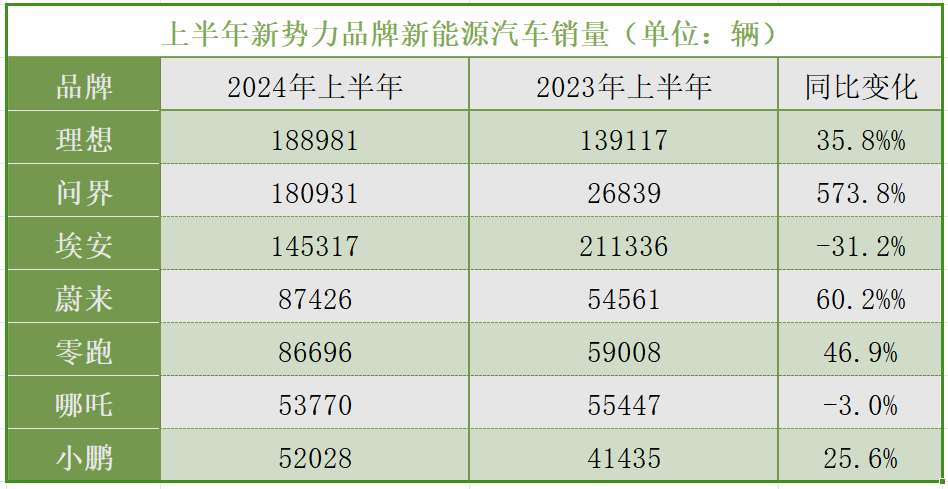

Compared to two or three years ago, the landscape of new forces in the auto industry has undergone significant changes. NIO, which once relied on price to enter the top sales ranks, and Aion, which challenged Tesla in the B-end market, have both seen sales declines.

The two brands of AITO and Li Auto have maintained impressive growth rates, especially AITO, with a year-on-year increase of up to 573.8%. Of course, I believe this is the result that AITO deserves, given Huawei's influence, intelligent driving capabilities, and the quality of AITO vehicles.

Similar to traditional automakers, new forces in the auto industry that rank high in sales have also grasped their core competitiveness.

AITO and Li Auto: Addressing Family Users' Pain Points

AITO and Li Auto are undoubtedly the two kings among new force brands. Their positioning is not exactly the same but basically similar, both relying on extended-range SUVs to capture the market. AITO experienced internal disagreements last year that affected product design and production, but the adjusted AITO has shown formidable strength.

AITO's core competitive advantage is undoubtedly Huawei's comprehensive suite of intelligent enhancements, including autonomous driving, smart cabins, intelligent vehicle control, and more. Especially notable is their autonomous driving feature, which is the first in the country to be usable nationwide. Additionally, Huawei has achieved self-development in autonomous driving chips, LiDAR, and algorithms, and their MDC autonomous driving hardware platform is even being used in collaboration with Toyota for some Toyota vehicles.

To many consumers, Li Auto’s success seems to rely on features like refrigerators, TVs, and large sofas. But is this really the case? First of all, we need to be clear that it's not shameful to consider any function or configuration that enhances the travel experience of consumers as a core competitive advantage, whether it’s a refrigerator, TV, or large sofa.

Secondly, Li Auto's core competitiveness comes from its deep understanding of the needs of family users, who often experience range anxiety and require large spaces and comfortable seating. Li Auto's self-developed "Magic Carpet" suspension can rival those of luxury cars worth millions, and its MindGPT large language model enhances the intelligence and humanization of its voice assistant. Additionally, Li Auto’s autonomous driving features are also outstanding. Unlike other car manufacturers, Li Auto guarantees that ADMax 3.0 will be free for life.

Rather than saying AITO and Li Auto rely on range-extended powertrains and features like refrigerators, TVs, and large sofas, it’s more accurate to say that they have tapped into the travel needs of middle-class families. Choosing the right path is the fundamental reason for the high sales of these two car manufacturers.

However, AITO and Li Auto also face some issues, such as relatively average competitiveness in pure electric vehicles. Especially for Li Auto, after the failure of the MEGA project, they abandoned their original "4+4" product line plan, delaying the remaining three pure electric models until next year.

In October last year, Li Auto's monthly sales exceeded 40,000 units for the first time, but sales have since fluctuated noticeably. In the first half of this year, only June saw monthly sales break 40,000 units, and they have yet to surpass the 50,000-unit monthly sales barrier. Given the aggressive competition from HarmonyOS Smart Cockpit, Li Auto is likely facing considerable sales pressure.

If Li Auto wishes to reach new heights, they must focus on pure electric vehicles, and may even need to consider entering the sedan market. However, the current situation is quite challenging for Li Auto. AITO is catching up quickly among the new forces, while traditional car manufacturers like Geely and BYD are also making strides in the high-end market. With the delay in the launch of their originally planned three pure electric vehicles, some of their strategies are difficult to implement. Li Auto may need more time to refine their pure electric products.

NIO, Leapmotor, and XPeng: One Step Away from Breaking Even

Although these three automakers don't match the sales volumes of Li Auto and AITO, they have at least managed to maintain an upward sales trend. In fact, they have all reached a critical point where they are on the brink of breaking even.

The sales growth of NIO, Leapmotor, and XPeng is not just in line with industry trends but also tied to their own strengths. NIO's high-end image and NIO Power energy replenishment ecosystem, Leapmotor's full-stack self-development and cost-effectiveness, and XPeng's autonomous driving technology are all top-notch in the new energy vehicle sector.

However, each of these three automakers has its own set of issues. NIO has historically faced severe losses, and the number of battery swap stations is insufficient to meet user demand, requiring further resource investment in the future. Since the end of last year, NIO has reached battery swap model cooperation agreements with seven other automakers, indicating an intention to co-build and share battery swap stations to reduce its own expenditure.

Leapmotor might be the most optimistic among the three, not only achieving continuous sales breakthroughs but also partnering with Stellantis, one of the global top five automotive giants, to jointly explore overseas markets.

Leapmotor's issue lies in its lack of brand recognition; relying solely on cost-effectiveness is unlikely to turn losses into profits. In the first quarter of this year, Leapmotor reported a loss of 1.013 billion yuan, which is only a slight reduction compared to the 1.133 billion yuan loss in the same period last year. In fact, Leapmotor's losses are not severe, and after collaborating with Stellantis, there is a good chance of breaking even next year. However, to achieve significant profitability, Leapmotor needs more blockbuster products and must build its brand image to prepare for the launch of the D series and entry into the high-end market.

XPeng, once one of the top three new forces in car manufacturing, has noticeably fallen behind. For a long time, XPeng's core competitiveness has been in the field of autonomous driving. However, as more automakers are now focusing on autonomous driving, industry competition has become increasingly fierce, leaving XPeng increasingly strapped.

XPeng's product planning is sound, covering the full range of mid-to-high-end sedans and SUVs. However, the intense industry competition has made it difficult for XPeng to keep pace with Li Auto and AITO, despite maintaining a growth trend. In response to future competition, XPeng has launched the MONA brand, aiming to achieve a sales breakthrough by targeting lower-tier markets.

MONA is expected to be positioned in the 100,000-200,000 yuan range and will support advanced autonomous driving. Judging from the parameters revealed for the first model in this series, the XPeng MONA M03, this car shows considerable competitiveness in the sub-200,000 yuan market. However, whether the M03 will become a hot seller remains to be seen until the actual vehicle hits the market.

Aion and Neta: Finding Their Paths to Survival

There is some debate within the industry about whether Aion Automotive should be classified as a new energy vehicle manufacturer. Generally, Aion's sales are counted separately, so we will include it in the category of new energy vehicle manufacturers.

In the first half of this year, Aion's sales declined by 31.2% year-on-year, putting the company in a very challenging position. Those familiar with the automotive industry are likely aware of the reason behind Aion's declining sales: its over-reliance on the B2B market.

As a brand under the GAC Group, Aion has made significant strides in areas such as batteries and motors, demonstrating notable technical capabilities. The fact that it has been widely chosen by ride-hailing and taxi drivers attests to the durability of Aion vehicles. However, the initial success of attracting ride-hailing drivers with the low operating costs of new energy vehicles has led Aion to become overly dependent on the B2B market.

Now, the ride-hailing market is becoming increasingly saturated, especially in Aion's home base of Guangzhou, where the daily income of ride-hailing drivers has dropped to 311.63 yuan, making it difficult to earn even 10,000 yuan in a full month. The collapse of the B2B market is a key factor behind Aion's declining sales.

Based on the exterior, interior, and features of the second-generation Aion V Tyrannosaurus, which rolled off the production line last month, it is clear that Aion Automotive is determined to shed its ride-hailing image and fully commit to expanding into the consumer market.

In fact, as early as 2021, Aion had been taking various measures to penetrate the consumer market, but the results were not significant. The second-generation Aion V has undergone comprehensive changes from interior design to features, indicating a do-or-die approach. Whether Aion can make a breakthrough in the consumer market and regain its former glory remains highly challenging. The new energy vehicle industry is becoming increasingly entrenched, making it progressively harder to achieve sales breakthroughs.

Neta Automotive is another company experiencing a decline in sales. Like Leapmotor, Neta is trying to move upmarket but primarily relies on mid-to-low-end models for volume.

Competing on cost-effectiveness is the simplest route but also the hardest to break through, especially for new energy vehicle startups. Leapmotor claims to be fully self-developed, with more than 60% of the vehicle's components being self-developed and manufactured, giving it the confidence to engage in price wars. While Neta offers highly cost-effective products, it still struggles against fierce competition from numerous other car manufacturers.

In the face of intense competition, the core competitiveness of both XPeng and Neta is becoming increasingly indistinct. They need to quickly launch blockbuster models to seize the last golden opportunity in the new energy vehicle sector. Once the penetration rate of new energy vehicles surpasses 50%, sales growth will slow down significantly, making future sales breakthroughs even more difficult.

Finally, although Tesla is not a domestic company, it's worth mentioning that Tesla's domestic sales in the first half of this year were 426,623 units, a year-on-year decline of 10.5%, indicating a similarly dire situation. The reasons for Tesla's sales decline are similar to those affecting domestic new energy vehicle startups. Besides finding it hard to maintain unique selling points, even though Tesla has advantages in energy efficiency and driving control, it cannot completely make up for the overall configuration gap. It's worth noting that the interior of the Model 3/Y has been criticized as being like a "bare shell" for many years.

The upcoming introduction of FSD (Full Self-Driving) in China might be an opportunity for Tesla to reverse its sales decline. However, the impact on sales will depend on whether FSD can outperform the smart driving technologies of domestic competitors like XPeng and Huawei.

Summary: The Gap Widens, Elimination Looms

Compared to traditional car manufacturers, new energy vehicle startups are evidently in a more difficult position. Traditional car manufacturers, with a bit of effort, can surpass most startups in sales and have the advantage of revenue from their fuel-powered vehicles to support them financially, alleviating short-term funding concerns.

The gap between new energy startups is gradually widening, with companies like AITO (Wenjie) and Li Auto forming a distinct lead. Over the past decade, many new energy vehicle startups have been eliminated, including some that were once highly regarded by numerous investors. However, this elimination race is not yet over; the remaining startups still face the risk of being phased out.

In fact, the actions of major car manufacturers reveal that companies with relatively high-end positioning, such as NIO, XPeng, Li Auto, and AITO, have a certain technological lead, particularly in smart driving technologies. Although NIO and XPeng may have larger deficits, they have attracted a considerable number of investors due to their technological prowess, ensuring a secure cash reserve and the potential to return to the top in the future. Aion, backed by the GAC Group, also has a chance to reclaim its peak position.

The ones who should be most concerned are lower-end startups that lack sufficient investor confidence. Both their brand and products are not competitive enough, and if they fail to find a breakthrough point in time, they are likely to be eliminated in the upcoming competition.

Traditional Car Manufacturers Adopting New Energy Vehicle Traits, New Energy Startups Becoming Traditional

With the gradual increase in the penetration rate of new energy vehicles, the domestic new energy vehicle industry is becoming increasingly dominated by a few key players.

On the side of traditional car manufacturers, brands like Geely and Changan are leveraging their brand, resource, and technological advantages to rapidly increase their new energy vehicle sales. While they may not yet rival BYD, they have already surpassed many new energy vehicle startups.

The investments made by traditional car manufacturers in the past year or two are now beginning to show results. In the upcoming competition, their advantages will become increasingly evident. After all, besides expanding into the new energy vehicle market, consumers who originally trusted their fuel-powered vehicles might also become buyers of their new energy vehicles.

In terms of new energy vehicle startups, the industry has been divided into three tiers based on a threshold of 20,000 units. The first tier includes AITO (Wenjie) and Li Auto, both of which have monthly sales exceeding 40,000 units and have achieved phased profitability. They also have the chance to achieve full-year profitability this year, essentially securing their ticket to becoming industry giants.

NIO, Aion, and Leapmotor, with monthly sales around 20,000 units, belong to the second tier. While not as dynamic as AITO and Li Auto in terms of market activity, their monthly sales are stable, providing them with opportunities to break even and advance further.

XPeng, Neta, and most other new energy vehicle startups fall into the third tier and may face elimination in upcoming competition. However, XPeng still has technical strength, brand influence, and cash reserves, making it more likely than other third-tier companies to rise to the top.

There is also a unique entrant among the new energy vehicle startups—Xiaomi. At the end of March this year, Xiaomi launched its first product, the SU7. It delivered 7,058 units in April, 8,630 units in May, and over 10,000 units in June (though specific numbers are not available). Riding on the Xiaomi brand and the influence of Lei Jun, the Xiaomi SU7 secured 88,898 orders within 24 hours of its launch, and its June orders exceeded 10,000 units. This indicates that Xiaomi Auto has a promising momentum and potential for sustained growth.

The arrival of Xiaomi Auto adds a different flavor and vitality to the domestic new energy vehicle market. However, whether Xiaomi Auto can grow into an automotive giant remains uncertain for now.

What is evident is that almost all brands are accelerating their market positioning. Mid- to low-end brands are moving upmarket, such as Leapmotor's planned D series; high-end brands are also trying to tap into lower market segments, like NIO's sub-brand Alpine and XPeng's sub-brand MONA.

These brands and new products could become disruptors, but the industry is becoming more solidified. The time left for second- and third-tier companies is running out, and it will be difficult for these firms to create a "Xiaomi miracle." If they do not seize the opportunity to advance in the second half of this year, the domestic market may see a reduction in the number of new energy vehicle startups next year.