Braving tariffs to venture overseas, how will NIO find its future?

![]() 07/21 2024

07/21 2024

![]() 685

685

“Buy apricot blossoms, only to bloom after a decade of return.”

A decade is long enough to witness the dramatic changes in every market and brand.

And 2024 marks the 10th anniversary of NIO's establishment. In these ten years, China's new energy vehicle (NEV) penetration rate has increased from 0.32% to 31.6%, and NIO has grown from a startup automaker to one of the leading new forces, delivering over 160,000 vehicles in 2023.

At the start of this new decade, Li Bin aspires to expand NIO's business footprint to 25 countries and regions, including the United States, Japan, and South Korea, aiming to become one of the top five global automakers by 2030. In Li Bin's words, "If NIO can emerge victorious from the red ocean of China's NEV market, it can surely establish itself in other markets. Where can the competition be fiercer than in China?"

After venturing out of the intensely competitive Chinese market, NIO first entered Europe. How has NIO, a "high-end pure electric" brand, fared in the European market? Why have traditional luxury automakers in overseas markets chosen to retrench as Chinese NEV brands make a high-profile foray overseas? While exploring new markets requires substantial investments, NIO also faces the issue of losses. What's next for NIO in this regard?

How can NIO recapture its glory in the European market?

NIO's foray into the European market began in May 2021, when it launched the ES8 model in Norway and simultaneously initiated the construction of battery swap stations. Subsequently, in August 2022, NIO held a press conference in Berlin, the capital of Germany, marking its full entry into the European market.

Three years later, objectively speaking, NIO's performance in the European market has been underwhelming. According to data from consulting firm JATO, NIO sold a total of 2,399 vehicles in the European market from January to December 2023. During the Q1 earnings call, Li Bin also emphasized that NIO's sales in Europe account for a relatively low percentage of its overall sales, and thus have minimal short-term impact on the company's operations.

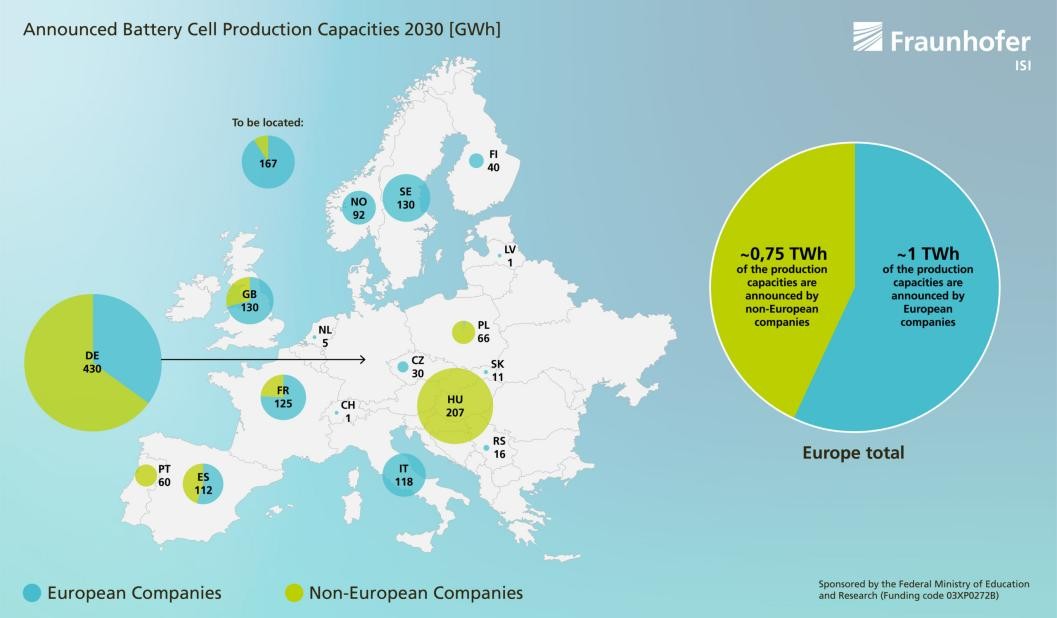

However, this is not NIO's fault but rather related to the "barren" charging infrastructure in the European market. Taking batteries as an example, over 90% of the world's battery supply for electric vehicles in 2023 came from Asia. The EU's previous €3 billion policy subsidy and investment plan also highlights the region's shortcomings in new energy infrastructure.

At this year's Beijing Auto Show, NIO founder Li Bin joked in front of Li Xiang, founder of Lixiang One, "High-end pure electric vehicles aren't easy to sell, are they?" Li Xiang responded with emotion, "Without a robust charging network, they're impossible to sell." This underscores the crucial link between charging infrastructure and pure electric vehicle sales.

For this reason, NIO places great importance on building charging infrastructure in the European market: As of July 18, NIO has deployed 50 battery swap stations and 19 charging stations in five European countries, accessing over 600,000 third-party charging piles.

This business model of "first building extensive charging infrastructure and then leveraging it to promote related services and product sales" aligns with the expansion logic of emerging markets and helps increase user stickiness. JD.com, for instance, continuously invested in its supply chain system and then relied on its self-operated logistics services to support its e-commerce platform, ultimately retaining high-quality merchants and users.

Moreover, NIO has accumulated considerable experience in building charging infrastructure in China, making it the automaker with the most joint brands and the largest number of charging piles deployed. From this perspective, NIO is poised to leverage its successful domestic experience to support its expansion in the European market, replicating its growth story there.

NIO goes left, BMW goes right

While NIO seeks growth in Europe, Europeans have their own stance. On June 12, the EU announced tariffs on Chinese electric vehicles, with NIO facing a weighted average tariff rate of up to 20.8%.

Yet, just five days after the announcement of the anti-subsidy policy, NIO chose to continue launching the EL8 model, with a starting price as high as €94,900. In contrast, the BMW X5 starts at just €53,000 in Germany, making the NIO EL8 about 80% more expensive.

Braving tariffs, NIO remains resolute in its "counter-trend" expansion in the European market. Meanwhile, traditional luxury automakers in the European market have taken a starkly different path: On July 17, BMW announced a price increase, followed by Mercedes-Benz and Audi, as German luxury automakers exited the "price war" first.

In contrast, on one hand, NIO focuses on high-end luxury electric vehicles and actively enters the European market; on the other hand, BBA raises prices and "exits" the Chinese market. What has caused this change in market dynamics? The main reasons can be summarized in three points:

1. Whether to cut prices or not, BBA is under pressure

The intense price war in the Chinese market has forced BBA to follow suit with price cuts. Taking BMW as an example, its gasoline-powered models have generally seen price reductions of over RMB 100,000. Among its NEVs, the price of the 23-model BMW i7 has even dropped by RMB 360,000.

Such price cuts have impacted corporate profits, with BMW's net profit in 2023 declining by over 30% year-on-year, and its EBIT margin for the automotive business standing at 9.8%. More importantly, price cuts have not translated into increased sales. According to AutoLink data, BMW sold 375,900 vehicles in China in the first half of 2024, a year-on-year decline of 4.2%.

Thus, for BBA, the price war has impacted brand reputation, marketing networks, and profits, yet sales have not been preserved. Therefore, choosing to prioritize protecting brand and dealer networks, albeit reluctantly, is a rational decision.

2. China's NEV market pursues cost-effectiveness to the extreme

On the one hand, most consumers prefer lower price ranges. According to iMedia Consulting's survey, Chinese consumers favor vehicles priced between RMB 100,000 and RMB 200,000, followed by those priced between RMB 210,000 and RMB 400,000. On the other hand, consumers seek relatively high-end configurations at low prices: "cross-grade configurations," "best-in-class," and "million-yuan luxury car configurations" are common in vehicle promotional materials.

In reality, configurations once available only in extremely high-priced models, such as electric suction doors, massage and ventilated seats, air suspension, and CDC, are now found in mainstream mass-market vehicles.

3. Redefining "luxury" with intelligence: NEVs overtaking in the bend

Traditional luxury brands often rely on high prices and high configurations, leveraging industrial advantages such as sheet metal styling, quiet comfort, and manufacturing processes to build product appeal. In contrast, intelligent electric vehicles redefine luxury through energy and technological revolutions. They are natural data terminals with iterable technological genes (OTA), evolving at a faster pace.

This is a difference in underlying architecture, a competition of dimensions. It's akin to electrification replacing steam engines and smartphones replacing feature phones. When Nokia abandoned the Symbian system and turned to Microsoft and Google, its decline was inevitable. Similarly, when Mercedes-Benz purchased its first battery from CATL, and when BMW and Audi relied on Joyson Electronics to design their infotainment systems, the industry disruption had already arrived.

Where will NIO find its future?

However, NIO, which relies on intelligence to penetrate the high-end market, also has its own challenges. On July 18, following BBA's exit from the "price war," NIO also decided to adjust the discount range in the end market.

If BBA's price hikes are to protect dealer profits, then for NIO, which adopts a direct sales model, this round of price hikes is more like ensuring its own survival. After all, financial data shows that in Q1 2024, NIO's vehicle revenue was RMB 8.4 billion, a 45.5% decrease from the previous quarter. With a vehicle gross margin of 9.2% and an overall gross margin of just 4.9%, the company also faced a net loss of RMB 5.185 billion.

Under these circumstances, Li Bin stated during the Q1 earnings call, "Optimizing gross margin is our key task for the next stage." With the market and brand in place, how can NIO achieve profitability?

NIO pins its hopes on the charging network. Since November 2023, NIO has continuously expanded its battery swap alliance. On July 17, Huawei HarmonyOS announced its joining of NIO's charging network, further enhancing NIO's brand penetration in the charging infrastructure sector.

However, according to calculations by Shen Fei, NIO's Vice President, the break-even point for NIO's battery swap stations is around 50 to 60 swaps per day, while the current daily average is 35 to 36 swaps, still incurring losses.

Taking Tesla as a reference, Tesla's early energy business also experienced prolonged losses, but long-term investments brought about scale effects and network effects, making it dominant in North America and attracting automakers like GM and Ford to join. Wall Street estimates that when Tesla's global charging pile count reaches 500,000, its charging network's annual revenue will reach $25 billion.

Thus, to accelerate profitability in the charging business, the top priority is to expand the battery swap alliance faster and reduce costs by increasing the utilization rate of charging and swapping stations. "Pooling resources" is more meaningful than "going it alone" and can better address NIO's profitability issues.

For the NEV industry, the existence of charging infrastructure is akin to the shovel sellers during the gold rush era or NVIDIA in the AI era, a rigid demand for the entire industry. From this perspective, as long as NEVs are on the road, charging infrastructure will always have value. NIO's future relies on all Chinese NEVs.

Facing this charging market with immense imagination space, NIO has no reason to back down.

Source: Hong Kong Stocks Research Institute