Can't take it anymore! Multiple automakers withdraw from the price war, are car prices about to rise collectively?

![]() 07/22 2024

07/22 2024

![]() 659

659

The auto market price war finally seems to be coming to an end. Following BMW's official announcement of withdrawing from the price war, foreign brands such as Mercedes-Benz, Audi, Volvo, Cadillac, Volkswagen, Honda, Guangfeng, and Buick have already or will soon reduce terminal discounts. The latest news is that NIO will also lower its discounts, and some models are about to increase in price, indicating that the intense price war that has persisted since the beginning of the year is expected to draw to a temporary close.

The auto market's cessation of the price war will initially impact consumers by potentially increasing the cost of purchasing cars. Potential buyers who have been "spoiled" by the price war may resist this change, leading to a wait-and-see attitude. Does the cessation of the price war by automakers truly harm consumers' interests? In fact, it may not. Excessive price wars can lead to the overextension of product quality and services, and allowing market prices to return to rationality is the best safeguard for consumer rights.

01 BMW leads the way, foreign brands withdraw from the price war

Over the past two years, the auto market's price war has never truly subsided. At the start of 2024, BYD's two plug-in hybrid models, the Qin PLUS Glory Edition and the Destroyer 05 Glory Edition, entered the market with a starting price of 79,800 yuan, officially escalating the price war. Not only did new energy vehicles follow suit with price cuts, but traditional gasoline-powered vehicles and even luxury cars were hardly spared, initiating a price plunge mode. For example, some models in the Mercedes-Benz EQ series saw their actual selling prices drop to 50-60% of their original value, and the once "price-hiking king" Highlander offered discounts of up to 80,000 yuan at dealerships.

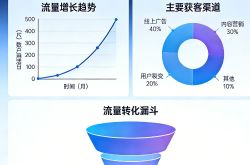

After six months of a frenzied price war, the auto market was left in disarray. In the first half of this year, the market share of foreign brands in China fell below 40% (38.1%), and even former "giants" like BMW and Mercedes-Benz could not escape the fate of declining sales. Having learned from their mistakes, BMW, which had never suffered such a defeat in a price war, took the lead in choosing to withdraw.

It is reported that due to significant losses at dealerships caused by the price war, BMW will stabilize prices by reducing sales starting in July to alleviate the operational pressure on dealerships. This means that BMW is officially ending its nearly year-long strategy of "reducing prices to maintain market share."

BMW's move sparked widespread reactions among foreign brands, with Mercedes-Benz, Audi, Cadillac, Volvo, Volkswagen, Honda, Guangfeng, Buick, and other foreign brands following suit by indirectly raising prices. However, unlike BMW's official announcement, these brands primarily relied on dealer actions, achieving indirect price hikes by canceling or reducing terminal discounts.

Sales personnel at BMW dealerships indicated that prices for all BMW models have increased by 30,000 to 50,000 yuan. Cadillac dealers revealed that they have received verbal notice that headquarters will gradually reduce the extent of terminal price cuts, with some promotional measures ending by the end of July and prices for all models set to rise in August. Guangqi Honda dealers stated that the extent of price reductions will no longer increase starting in July, and car prices will stabilize, although there may be variations depending on the dealership and model.

Dealers for brands such as Volkswagen, Honda, and Volvo also indicated that terminal prices have been adjusted upwards starting in July. Buick will further stabilize car prices starting in August, and promotional activities for July may be canceled.

It is worth mentioning that the "price defense war" has not only erupted among traditional automakers but has also spread to new-energy vehicle startups. Recently, media reports claimed that certain NIO models will increase in price by 3,000 to 5,000 yuan after July 22. In response, NIO dealership staff stated that this was a temporary reduction in benefits, effectively achieving an indirect price hike by reducing discounts on available vehicles, a move that aligns with the actions of the aforementioned foreign brands.

02 Dealers become the backbone of the "price defense war"

In the auto market's price war, dealers, caught between manufacturers and consumers, have always been the most vulnerable group. In this "price defense war," these traditional automakers have unanimously focused on the survival and operational quality of dealers, and the contraction of automotive terminal price discounts has primarily been dealer behavior. It can be said that dealers play a crucial role in this "price defense war."

According to a survey report released by the China Automobile Dealers Association, the proportion of auto dealers experiencing losses in 2023 reached a high of 43.5%, not only lower than in 2022 but also the second-worst result in six years.

Entering 2024, the auto market's price war continued to escalate, further worsening the survival environment for dealers. On February 29, Guangdong Yong'ao Investment Group Co., Ltd. announced that due to poor management and heavy debt, the company would officially close down starting March 1. In addition to Yong'ao, Zhongtong Group, Lifeng Automobile, Ningbo Haishu Automobile, Chongqing Longhua, and other 4S store groups either ran away, went bankrupt, or delisted. Another compelling piece of evidence is that the direct reason for BMW's withdrawal from the price war was significant losses at dealerships.

Based on such a severe survival situation, OEMs have begun to pay attention to the operational status of dealers and provide policy support. For example, BMW expressed support for dealers to take a steady approach, and insiders at SAIC-GM stated that they would focus on sales and service quality in the future to help dealers improve their operational quality.

Many foreign brands have decided to ease the burden on dealers by adjusting supply structures or sales targets. These measures not only alleviate the situation for dealers but also help mitigate the terminal price war. For example, starting in the third quarter, BMW China and Brilliance BMW canceled sales target assessments for dealers in the eastern region, significantly reducing inventory pressure for BMW dealers, who subsequently reduced terminal promotions, leading to an average increase in BMW's per-vehicle selling price of over 10,000 yuan since July.

03 With the price war ending, have consumers really lost out on car purchases?

If the auto market's price war ends, it should be consumers who are the most reluctant to see this outcome. Amid the automakers' relentless price wars, automotive terminal prices have been driven to their limits, with many dealers and manufacturers selling cars at a loss just to boost sales, while consumers reap the benefits. The end of the price war and subsequent rise in car prices mean that consumers will have to spend more money to buy the same model, causing potential buyers who are concerned about increased purchase costs and feel like they've "lost out" to worry and adopt a wait-and-see attitude, waiting for price trends to become clearer before making a purchase decision.

In fact, has the cessation of the auto market's price war really made consumers lose out? Not necessarily.

From a consumer perspective, after 20 years of rapid development, the automotive industry has experienced a widespread phenomenon of "not making money selling cars," with the majority of automotive product profits being compressed to extremely low levels. The classic case is Wuling Hongguang MINI, which only earns 89 yuan per vehicle sold. Some brands have even resorted to selling cars at a loss in exchange for volume.

In the irrational market competition of excessive price competition, some automotive brands achieve price reductions by sacrificing product quality and services, resulting in consumers potentially unable to enjoy normal rights and the car-buying experience, such as using inferior parts and materials, rough product workmanship, and compromised after-sales projects and service quality.

For automakers, only by improving product quality and services can they enhance their market competitiveness. Relying solely on price not only fails to genuinely improve their competitiveness but can even negatively impact brand image, reputation, and product quality in the long run. Therefore, price wars are like a double-edged sword, bringing short-term sales growth while also consuming and overextending the brand itself.

From an industry perspective, this long-term irrational price war is not conducive to the healthy development of the automotive industry. When automotive brands and automakers shift their focus from R&D, technology, and services to price or excessively pursue price advantages, the competition becomes misplaced, leading the entire industry into a vicious cycle.

Furthermore, excessive price wars in the new car market can also significantly impact the used car market, causing ripple effects on used car prices and disruptions to used car transactions.

Therefore, whether from an industry perspective, an enterprise dimension, or a consumer rights perspective, excessive price wars are harmful rather than beneficial. It is worth noting that in this round of the "price defense war," automakers have recognized the importance of returning to quality and service in market competition, starting to shift from competing on price to competing on R&D, technology, quality, and service.