Who owes money to car suppliers?

![]() 12/04 2024

12/04 2024

![]() 647

647

Author | Lu Shiming

Editor | Da Feng

Since the beginning of 2024, the automotive industry has been experiencing intense competition and escalating price wars, with no signs of abating. White-hot competition, unprofitability if continued, and no company being able to bear tens of billions of losses are prevalent sentiments in the industry. However, the escalation of competition is unstoppable. Today's rivalry between automakers extends beyond price, technology, and products, encompassing the entire industrial chain. Companies within the supply chain are not spared and face severe challenges as well. Recently, two news stories have once again brought the pain points of China's automotive supply chain to the forefront. One is a Weibo post by Tesla Vice President Tao Lin, revealing changes in payment timelines to suppliers by Chinese new energy vehicle (NEV) companies; the other is BYD's demand for a 10% price reduction on products supplied by its suppliers. Payment terms are getting longer, and prices are being pushed lower. The storm of internal competition within automakers is rapidly engulfing every participant in the entire automotive supply chain.

Fragmented 'Payment Terms'

The chilly Chinese automotive market has left most automakers with relatively short operating funds. How can one secure ample cash flow? Besides external financing methods like the secondary market, tapping internal funding sources is also an option. In recent years, many automakers have leveraged their market advantage to continuously delay payments to upstream and downstream suppliers, enabling them to obtain substantial interest-free floating funds, alleviating cash pressure and the urgency of cash flow.

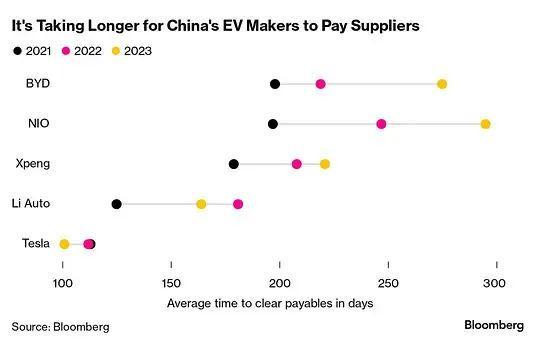

According to Bloomberg data: A Shenzhen-based automaker took 275 days to pay its supply chain suppliers in 2023, up from 219 days in 2022 and 198 days in 2021. A Shanghai-based automaker needed 295 days to clear payables in 2023, higher than 247 days in 2022 and 197 days in 2021. Even more astonishingly, some automakers use acceptance drafts to settle payments with suppliers, meaning some suppliers may not actually receive payment for over a year.

Source: Bloomberg

Delaying payments is not inherently wrong, but overdoing it can easily lead to problems. While it may reduce costs in the short term, it could negatively impact supply chain stability in the long run.

Interestingly, as BYD faced public scrutiny, Tesla also got involved. Late last month, Tao Lin announced that Tesla had further optimized its payment process for supply chain partners in 2024, shortening the cycle to about 90 days, an improvement over last year. Tao Lin said, "Only by working together with suppliers for mutual success and increasing efficiency and reducing costs through technological innovation can enterprises go further, the industry prosper, and consumers consistently receive the best products." She also shared a comparison chart showing the changing trend in payment terms to suppliers by Chinese NEV manufacturers, pointing out that some companies' payment cycles have significantly lengthened instead of shortened year by year. Similar to Tao Lin's data, China Business News also published data on the number of days it takes for automakers to turn over their accounts payable. The specific data is shown in the figure below:

Data Source: Wind

It is evident from the two sets of data that Tesla has the shortest payment cycle. However, there is a difference of over 100 days in the payment cycles reported by Bloomberg and China Business News for BYD and NIO.

Conventional 'Price Pressure'

Misfortunes never come singly. Besides extended payment terms, another worse news is the 'price pressure' from automakers. Recently, a screenshot of an email titled 'BYD Passenger Vehicle Cost Reduction Requirements for 2025' circulated online, signed by He Zhiqi, Executive Vice President of BYD Group and Chief Operating Officer of BYD Passenger Vehicles. The email revealed that on the occasion of BYD's 30th anniversary, the company became the first global automaker to produce its 10 millionth NEV.

While forecasting significant opportunities for NEVs in 2025, BYD also anticipated fiercer market competition, signaling a decisive battle and elimination round. To enhance BYD passenger vehicles' competitiveness, the entire supply chain needed to work together to continuously reduce costs. Therefore, the requirement was put forward - "The products supplied by your company must be reduced by 10% from January 1, 2025." The email also explicitly required relevant suppliers to "effectively explore cost reduction opportunities, actively promote the achievement of requirements, and report the reduced prices to our company (BYD) through the SRM system by December 15th." It is noteworthy that the company to which BYD sent this letter is Sensata Technologies, a wholly US-owned enterprise specializing in sensors, automotive instruments, and other accessories. Formerly part of Texas Instruments' sensor and controller business, Sensata is also a publicly traded US company. Its financial report shows that Sensata's gross profit margin last year was over 38%, much higher than that of BYD and most of its suppliers.

Figure: Sensata's Gross Profit Margin

Sensata's response to BYD's price reduction request was somewhat "strong."

Sensata responded, "As a benchmark enterprise in China's automotive industry, BYD has indeed achieved scale expansion through extreme cost compression strategies in recent years. However, the company's current practices not only violate business ethics but also excessively exploit the diligence and resilience of Chinese workers and the viability of domestic suppliers." In fact, BYD is not the only one exerting price pressure; similar situations also occur with automakers like SAIC MAXUS. SAIC MAXUS told its suppliers, "Through close cooperation, we can jointly develop more cost-effective solutions for a win-win situation. We will further strengthen management, improve quality, enhance services, boost efficiency, reduce costs, and improve survival capabilities under complex pressures, with the goal of a 10% cost reduction." In the automotive industry, annual price negotiations are routine. In this game between automakers and suppliers, automakers hope to reduce costs and enhance market competitiveness by lowering supplier prices, while suppliers aim to maintain profits while securing next year's orders. It is certain that, amid pessimistic expectations, automakers will continuously demand price reductions from suppliers.

Having Your Cake and Eating It Too

Both extended payment cycles and annual price reductions have become controversial actions taken by some automakers. In the current brutal market, these actions ultimately point to the goal of 'survival.' However, transferring pressure down the supply chain makes it difficult to determine if this model is good or bad. On the positive side, it can accelerate industry consolidation, fostering stronger leading enterprises and making the strong even stronger. On the negative side, it may disrupt the diversified market atmosphere, plunging the entire industrial chain into a vicious cycle. Firstly, extended payment cycles coupled with frequent price reduction requests impose a heavy burden on suppliers' capital chains, potentially leading to operational difficulties or even bankruptcy for small and medium-sized suppliers. Additionally, extended payment cycles can trigger a chain reaction: if automakers delay payments, their downstream suppliers, to maintain operations, may transfer the risk to lower-tier suppliers, and this pressure cascades down to third- and fourth-tier suppliers. Ultimately, suppliers at the end of the supply chain may be forced to withdraw if they cannot bear the financial pressure.

Secondly, the intense price competition also affects supply chain stability and sustainability. Faced with tremendous cost pressure, suppliers who cannot achieve technological breakthroughs may resort to improper means to reduce costs. Common practices include: Reducing staffing: Assigning 2-3 times the original workload to individual employees or even cutting quality inspection processes. This is especially prevalent in small companies with inadequate systems, directly compromising product quality. Relaxing quality standards: Shipping defective products that originally required rework or scrapping products after minimal rework. This fosters a culture of lax quality control within the company. Outsourcing unprofitable products: For unprofitable products, suppliers may outsource them to contract manufacturers. This multi-layer subcontracting model, similar to engineering subcontracting, often overlooks initial product standards and requirements after multiple transfers.

As these practices become more frequent, 'cutting corners and exploiting workers' may become widespread throughout the industrial chain. As Wei Jianjun, Chairman of Great Wall Motors, previously stated, "Excessive cost reduction forces some manufacturers to cut corners or even falsify, and once a quality crisis occurs, ultimately, it is the consumers who foot the bill." In Zinc Finance's view, while the goal of cost reduction is commendable, the survival space of suppliers should also be considered. Industry prosperity should not be limited to the success of a single enterprise but should focus on the coordinated development of the entire industrial chain, fostering growth through cooperation and mutual benefit to ensure sustained and healthy industry development. Simply put, if you're eating the 'meat,' don't covet the 'soup' in someone else's bowl.