NIO fights a desperate battle, Li Bin compromises for 'profitability'

![]() 12/04 2024

12/04 2024

![]() 610

610

Unconsciously, XPeng and NIO, among the first generation of new-energy vehicle startups, have successively celebrated their 10th anniversaries.

On the occasion of its 10th anniversary, XPeng Chairman He Xiaopeng announced that XPeng will transform into a global AI automaker over the next 10 years. He Xiaopeng stated that XPeng has survived the first decade of fierce competition and predicted that only seven Chinese automakers will remain dominant in the next decade. Surviving the next decade has become XPeng's new challenge.

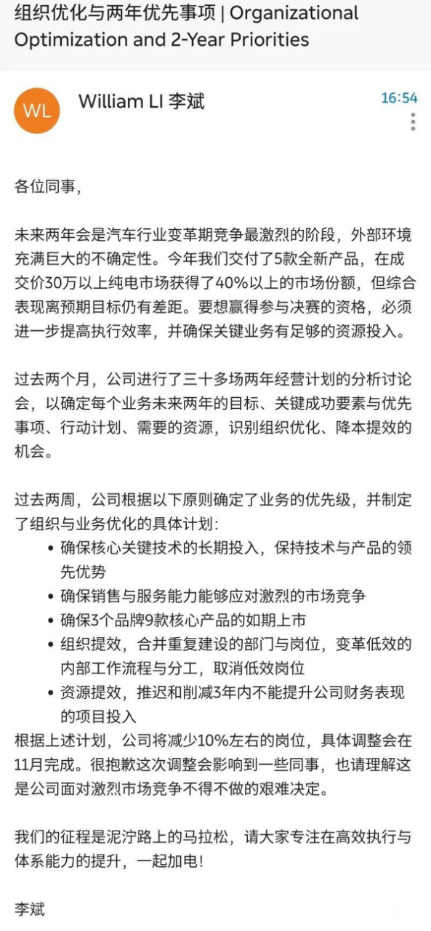

On the same occasion, NIO Chairman Li Bin also released an internal letter, encouraging the team to 'stay true to their original aspirations and focus on action.' Li Bin noted that the most intense and brutal phase of the qualification race in the smart electric vehicle industry has arrived, and only a few outstanding companies will survive in two to three years.

The new-energy vehicle industry has undergone at least two rounds of elimination to date. In 2018, the industry faced subsidy cuts, and some lesser-known automakers reliant on subsidies were the first to be eliminated. Since 2021, industry competition has intensified, and automakers such as WM Motor and HiPhi have gradually been phased out amid rapid changes in the industry.

The elimination race in the new-energy vehicle industry will continue. For NIO, facing the most intense and brutal competition in the industry may start with achieving 'profitability'.

1. 'After a decade of losses, NIO cannot afford to lose anymore'

In his internal letter, Li Bin set clear goals for the team, emphasizing the next two years as crucial. He emphasized the need to continuously launch competitive new products, improve operational efficiency, double sales by 2025, and achieve corporate profitability by 2026.

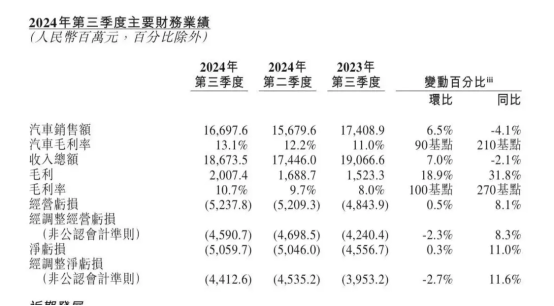

Behind this goal lies NIO's long-unrealized profitability target. Recently, NIO released its third-quarter 2024 financial report, revealing record vehicle deliveries of 61,900 units but disappointing total revenue and net profit figures.

In the third quarter of this year, NIO reported revenue of RMB 18.674 billion, a year-on-year decrease of 2.1%, and a net loss of RMB 5.06 billion, an 11.0% increase from the same period last year. This marked the fourth consecutive quarter with losses exceeding RMB 5 billion. For the first three quarters of this year, NIO's cumulative losses reached RMB 15.44 billion.

Following the release of the third-quarter report, NIO's share price plummeted, falling more than 4% pre-market the next day. Despite record sales, the capital market views the lack of profitability as a 'sin,' especially amid intensifying competition and concerns about funding and market saturation, making investors crave the security of 'extra provisions.'

Looking back at the automakers that have gone bankrupt in recent years, both those backed by professional automotive teams and those seeking transformation from well-funded real estate companies have fallen one after another. The fatal blow in all cases was a broken capital chain.

Therefore, 'profitability' has always been a crucial goal for NIO, but its 'profitability timeline' has changed repeatedly. Initially, Li Bin proposed that NIO would achieve profitability by 2023; in 2022, he pushed this timeline to 2024, and now it is 2026.

Based on the principle of 'three strikes and you're out,' if NIO fails to achieve profitability by 2026, not only may capital lose patience, but NIO may not even qualify for the final stage of the elimination race in the new-energy vehicle industry.

In the third quarter of this year, NIO announced positive free cash flow, with cash and cash equivalents, restricted cash, and other cash reserves totaling RMB 42.2 billion. Considering NIO's history of 'losing billions over a decade,' these cash reserves should support the company for another two to three years.

If NIO can achieve profitability by 2026, its survival crisis should be resolved; however, if its 'profitability target' is delayed again, it may be too late for NIO to adjust its business strategy.

2. 'Long-term vision or profit priority?'

With only one to two years left for Li Bin to turn things around, the first step in 'defying fate' is to reduce losses.

NIO's decade-long losses are not complex. Firstly, there is the burden of fixed assets. For manufacturing, fixed assets involve amortization, depreciation, and operational costs, a significant expense. NIO's heaviest fixed asset burden comes from its battery swapping stations.

In 2023, NIO's fixed assets were RMB 24.847 billion, compared to XPeng's RMB 10.954 billion and Lixiang One's RMB 15.7 billion. Among them, NIO's depreciation and amortization expenses for fixed assets amounted to RMB 4.907 billion, compared to XPeng's RMB 2.107 billion and Lixiang One's RMB 1.805 billion.

While these fixed asset costs can be spread across each vehicle sold, NIO sold 160,038 vehicles last year, better than XPeng's 141,601 but far behind Lixiang One's 376,030. In comparison, Lixiang One has a lighter load, while NIO faces significant cost pressures.

Secondly, there are ongoing marketing and R&D investments. The above only covers depreciation costs from battery swapping stations, not the costs of building new stations, which Li Bin has consistently invested in over the years to maintain the swapping model.

Last year, NIO built 1,035 new battery swapping stations globally, bringing the total to 2,350. According to NIO President Qin Lihong, the cost of a single NIO battery swapping station is approximately RMB 3 million, suggesting that NIO has invested at least RMB 3 billion in these stations.

In marketing, NIO is also generous, investing heavily in membership benefits and activities to enhance user experience.

In R&D, NIO Intelligent Driving seems less vocal but invests heavily, comparable to XPeng. In the first three quarters of this year, NIO's R&D investment was RMB 9.4 billion, compared to XPeng's RMB 4.45 billion and Lixiang One's RMB 8.66 billion. Per vehicle, NIO's R&D expense was the highest at RMB 63,000, compared to XPeng's RMB 45,200.

Faced with high costs, NIO has had to employ various cost-saving measures. Since last year, NIO's membership benefits have been reduced, including the elimination of lifetime free battery swaps and adjustments to the number of free swaps per month. At the end of the year, Li Bin sent a company-wide letter announcing a 10% reduction in positions.

According to Li Bin, NIO also has an internal 'mining' project to drive cost reduction and efficiency improvement. In his internal letter, he also mentioned the need to further enhance the operational efficiency of the company's basic business units.

However, besides cost reduction and efficiency improvement, Li Bin still clings to his 'utopia' of battery swapping and intelligent driving chips. NIO's battery swapping model has faced skepticism, but Li Bin insists it is NIO's 'moat' and a long-term commitment.

Li Bin believes that NIO focuses on user experience, striving to meet user needs. Even when the battery swapping stations were questioned for operating at a loss, Li Bin stated that NIO could 'afford to lose.'

NIO's intelligent driving chips can be described as a 'silent investment.' While XPeng and Lixiang One have showcased their latest end-to-end intelligent driving technologies, NIO has been slower. Considering NIO's consistent high R&D investment, its slightly lagging intelligent driving technology can be attributed to different strategies.

At this year's 'NIO IN 2024 NIO Innovation Day,' NIO announced the successful tape-out of the world's first 5-nanometer intelligent driving chip, the 'NIO Shenji NX9031.' Li Bin claimed that NIO has truly achieved 'a chip with a soul.'

From intelligent driving chips to mobile phones, batteries, and holistic operating systems, NIO's logic behind self-developing intelligent driving and battery swapping models aligns with long-term vision, reflecting Li Bin's idealism.

Ren Shaoqing, Vice President of NIO Intelligent Driving R&D, once stated that NIO's intelligent driving strategy is based on long-term planning, combining chip configuration and user data collection to evolve intelligent driving.

However, with the acceleration of technology and product development in the automotive industry, the market and consumers may not have the patience to wait for NIO's 'long-term layout,' making it a 'long-term gamble.'

3. 'No weaknesses, no quick wins'

In his 10th-anniversary internal letter, Li Bin also mentioned that NIO will face higher-dimensional competition, allowing no weaknesses and no quick wins.

If NIO's 'long-term vision' is a gamble, it could become a weakness before the results are known. The second step towards profitability for NIO is to address these weaknesses as much as possible.

This year, new-energy automakers have been 'complementing each other's strengths.' XPeng has launched two new models, leading to sales growth. The MONA M03 is considered XPeng's comeback vehicle, utilizing a combination of 'intelligent driving + low price + marketing' to successfully break through the highly competitive market.

Zero Run achieved positive gross margin for the full year last year, ending the cycle of losing money on every vehicle sold. Behind this achievement was Zero Run's proactive strategy adjustment, introducing an extended-range model at 'half the price of Lixiang One.' Zero Run Chairman Zhu Jiangming even stated the intention to 'learn from Lixiang One.'

Consequently, NIO has also introduced the sub-brand Ledao and the third brand Firefly, both targeting the mid-to-low price segment. These brands are expected to further expand NIO's production and sales scale, reduce fixed costs, and increase cash flow.

Additionally, media reports suggest that NIO plans to launch its first extended-range hybrid model in 2026, targeting overseas markets and not for sale in China.

NIO, known for its commitment to pure electric vehicles, is also 'wavering,' partly due to sales and overseas expansion compromises. Given the incomplete charging infrastructure in overseas markets, NIO must follow the trend to establish a presence abroad.

Currently, NIO remains optimistic about its fourth-quarter delivery volumes, forecasting between 72,000 and 75,000 units, representing a year-on-year increase of 43.9% to 49.9%.

During the recent Guangzhou Auto Show, Ledao Automobile President Ai Tiecheng revealed that orders for the L60 exceeded expectations, aiming for an average monthly sales target of 20,000 units next year.

In the current new-energy vehicle industry, 'survival' has become the primary goal for automakers. Only by first securing a place in the elimination race can they pursue their ideals and passions.

For NIO, while 'ideals' are valuable, 'profitability' holds higher priority. If Li Bin insists on his ideals of battery swapping, intelligent driving, and user experience, he must compromise to some extent, focusing on more affordable products and scaling up quickly.

The 'elimination race' in the new-energy vehicle industry does not allow for quick wins. NIO must also prepare for a long-term battle. 'Survival' is the first step, and achieving a balance between scale, products, and profits is the premise for NIO to continue building its 'utopia.'