2025: The Grueling Battle for Survival in the New Energy Vehicle Industry

![]() 01/13 2025

01/13 2025

![]() 479

479

Surviving the Prelude to the Grand Finale.

Recently, the China Passenger Car Association (CPCA) released the latest statistics, revealing that nationwide passenger vehicle retail sales totaled 22.894 million in December 2024, marking a 5.5% year-on-year increase.

Cui Dongshu, CPCA's secretary-general, commented, "The national auto market exhibited a U-shaped growth trend in 2024, bolstered by robust trade-in and scrapping subsidy policies in the second half of the year, driving the auto market to a 5.5% year-on-year growth in 2024."

Source: CPCA

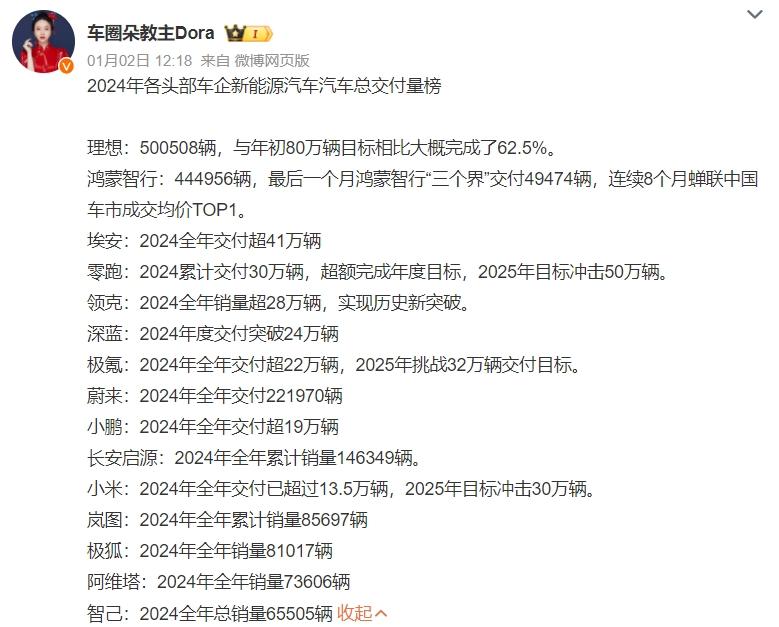

2024 was a landmark year for China's new energy vehicle market.

Data indicates that 10.899 million new energy vehicles were sold in 2024, up 40.7% year-on-year, with a penetration rate of 47.6%, a 12% year-on-year increase. Notably, the penetration rate surpassed 50% for five consecutive months in the second half of 2024.

In July 2024, domestic new energy passenger vehicle retail sales surpassed those of fuel vehicles for the first time. By November, China's new energy vehicle production surpassed 10 million, making it the first country globally to achieve this milestone.

Source: Weibo Screenshot

Amidst the booming sales of new energy vehicles, market competition among automakers has intensified. As financial crises emerged for brands like Nezha and Jiyue, automakers have embarked on a fierce 'survival of the fittest' competition.

Indeed, many brands have already exited the electric vehicle arena in recent years. Globally, dozens of automakers have been eliminated in the past two years, resulting in nearly 100,000 layoffs.

He Xiaopeng's prediction that 'only seven auto brands will survive the next decade' continues to be validated by time.

Breaking the mold, bankruptcies, and price wars were the three defining keywords of the electric vehicle industry in 2024. Competition in the electric vehicle sector in 2024 can be described as 'chaotic yet orderly', further intensifying the fierce 'survival of the fittest' dynamic.

01. Navigating the 'Bloody Battle'

'Swimming in a sea of blood until the water turns blue' was a phrase used in XPeng's Q3 2024 earnings report. This sentence aptly describes the situation faced by all electric vehicle brands in 2024.

At the beginning of 2024, Tesla and BYD led the charge. Tesla's Model 3 and Model Y saw price reductions, followed by BYD's slogan 'electricity is cheaper than oil', pushing model prices into the tens of thousands range.

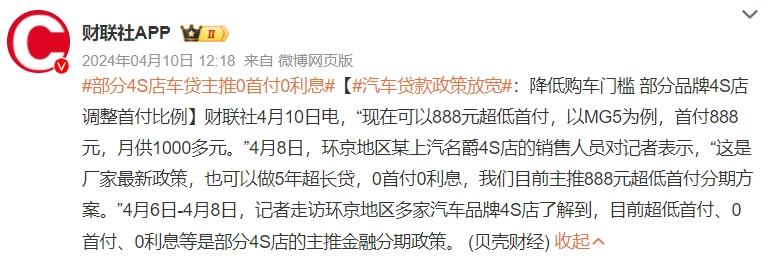

According to 'Qu Xie Shang Ye' observations, electric vehicle brands typically employ several strategies for price reductions: the most direct approach is an 'open' price cut, stating the new, lower price; a more 'abstract' method is to increase configurations, such as offering a top-spec model at the price of a previously low-spec model; even more 'subtle' tactics include financing gimmicks like '0 down payment, 0 interest' loan policies, which, while not a direct price reduction, give consumers the impression of a great deal.

A Beijing netizen named Becky (pseudonym) remarked, 'Buying a car now feels like it's 'free', driving it home without a down payment. This advanced sense of satisfaction is very tempting.'

Source: Weibo Screenshot

Whether active or passive participants, those involved in this price war can be described as experiencing mixed emotions.

BYD appears to be the biggest winner. While SAIC Group's cumulative wholesale sales in 2024 were 4.013 million, BYD announced sales of 4.272 million in 2024. Thus, BYD ended SAIC Group's 18-year streak as the annual sales champion, becoming the new domestic automaker group champion in 2024. Furthermore, in the third quarter of 2024, BYD achieved revenue of 201.1 billion yuan, surpassing Tesla's quarterly revenue of 25.182 billion USD (approximately 180 billion yuan) for the first time. Thanks to economies of scale, BYD quickly offset the weakened profitability caused by price reductions; in the second quarter of 2024, BYD's gross profit margin briefly dropped from 22% to 19%, but rebounded to 22% in the third quarter.

Source: Weibo Screenshot

The 'new force trio' of NIO, XPeng, and Li Auto were all affected to varying degrees. In the third quarter of 2024, the gross profit margins of NIO, XPeng, and Li Auto's businesses were 13.1%, 8.6%, and 20.9%, respectively. Based on the automotive industry's benchmark of a healthy gross profit margin of 20%, only Li Auto barely met this standard, and that was under the condition that most of Li Auto's models are extended-range electric vehicles.

In the price war, the average vehicle sales price also took a hit. According to 'Dolphin Investment Research' statistics, the average transaction price of NIO, XPeng, and Li Auto in the third quarter declined to varying degrees and were below market expectations. This was primarily influenced by two factors: the increasing sales proportion of relatively low-priced models within the brand and promotional activities by the brand.

This was particularly challenging for brands with higher price positioning, affecting their profit margins; for brands with lower initial prices, they found themselves even more trapped in a dilemma of 'having nowhere to cut prices further'.

For example, GAC Aion's cumulative sales in 2024 were 374,884 units, a 21.9% year-on-year decline compared to 2023. The timing of GAC Aion's sales decline coincided with BYD's price reductions to the tens of thousands range. Unlike BYD's gross profit margin of 20%, GAC Group's overall gross profit margin was only 7% in the third quarter of this year, making trading volume for price a less favorable proposition for them.

Source: CanTouTuKu

In 2025, the price war shows no signs of abating.

According to 'Qu Xie Shang Ye', BYD and Tesla successively announced relevant preferential measures at the end of December 2024. By January 7, according to a reporter from 'Beijing Business Daily', more than 30 automakers had successively launched promotional policies such as limited-time direct price reductions, and more than 10 brands had introduced 'guaranteed subsidy' schemes.

Cui Dongshu, CPCA's secretary-general, stated that the scale of new energy vehicles has shown explosive growth, with a significant increase in batch production per vehicle and a noticeable decline in the cost per vehicle. The head-to-head competition pattern remains unstable; therefore, in such a high-growth market, the 'price war' will continue in 2025 and will be extremely fierce.

Lin Shi, secretary-general of the China-EU Association for Intelligent and Connected Vehicles, believes that BYD and Tesla's continuous 'preferential price reductions' will once again bring a catfish effect to the domestic auto market, forcing the degree of competition within China's auto market to deepen in 2025.

'If we can't become one of the top five globally, we won't be able to survive.' Lei Jun's goal for Xiaomi's foray into the automotive industry was once ridiculed as 'presumptuous', but now, with the elimination of a wave of electric vehicle enterprises, people increasingly recognize that the electric vehicle industry will gradually become a 'winner-takes-all' scenario.

Source: CCTV Screenshot

'The shift in the competitive landscape of electric vehicles is inseparable from the maturity of electric vehicle technology,' analyzed Colin (pseudonym), a senior automotive practitioner. 'The price war is a result of the gradual maturity of electric vehicle technology, making cost control more efficient for automakers and diluting the exclusivity of electric vehicles for consumers. Therefore, whether driven by market forces or corporate initiatives, price wars will become a trend; moreover, I believe that the electric vehicle price war will persist next year.'

Regarding the 'winner-takes-all' scenario, Colin also concurs, 'When we replace the engine with a battery, the differentiation compared to the previous internal combustion engine is greatly reduced. In the past, fuel engines affected the final driving experience from materials, technology to exhaust. Current battery technology primarily focuses on one aspect: how to make the battery more durable. So, the premium nature of electric vehicles isn't about electrification efforts but rather intelligentization efforts; and intelligentization is more about software development, which is easier to grasp compared to time-consuming and labor-intensive hardware development. Hence, we now find that a new energy automaker can encompass various positioned new energy sub-brands and models from low to high.'

02. Collective 'Breaking the Mold'

As 'winner-takes-all' became a consensus in electric vehicle competition, electric vehicle enterprises began to collectively step out of their comfort zones this year, making 'breaking the mold' another keyword for new energy vehicles in 2024: breaking the price mold, technology mold, and model mold.

Players breaking the price mold: BYD, XPeng, NIO, etc.

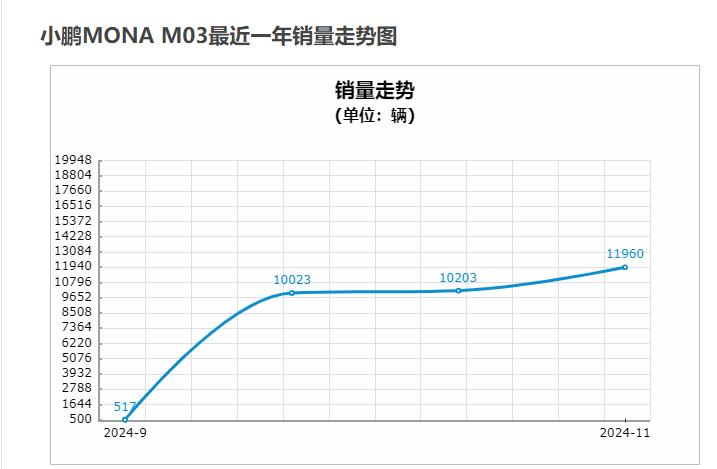

After BYD initiated the price war, the 'new forces' also ventured into price ranges that did not originally belong to them; the most representative examples are XPeng's MONA M03 and NIO's LeDao L60, which suddenly entered the tens of thousands range for electric vehicles.

Source: Car Owner Guide

'Actually, launching low-priced models is a variation of a price war,' Colin commented, 'Rather than continuously reducing prices on existing models, it's better to directly launch low-priced models.'

The original intention behind breaking the price mold is straightforward: seize the market.

For example, after BYD entered the under-100,000-yuan range, GAC Aion, which was originally in this comfort zone, became uncomfortable. Another example is XPeng, where consumers of its original P7+ model typically compared it with Tesla's Model Y or ZEEKR 007X, with some also comparing it with Xiaomi's SU7, but consumers of the MONA M03 most commonly compared it with BYD's Seal 06.

The most successful feedback for a product is when consumers who originally did not pay attention to the brand start to notice it. Attracting the attention of consumers from another segment through one product is akin to drawing from a completely different traffic pool.

Source: CanTouTuKu

Besides breaking the price mold, electric vehicles are also breaking the model and technology molds, with Zero Run and XPeng as notable players.

Zero Run, which had previously languished at the bottom in sales, accelerated its sales growth starting in June 2024. In June, Zero Run sold 20,116 units, surpassing 20,000 units for the first time; in August, sales reached 30,305 units, surpassing 30,000 units for the first time; in November, sales reached 40,169 units, surpassing 40,000 units for the first time and achieving the annual sales target ahead of schedule. In 2024, Zero Run delivered nearly 300,000 vehicles, exceeding its annual target; in 2025, Zero Run will aim for a new target of 500,000 vehicles.

Looking back, Zero Run's two biggest 'heroes' were the C10 and C16 launched in 2024. These two models, known as 'small ideals', resemble the Ideal L7 and L8 in appearance, but their starting prices of 128,800 yuan and 158,800 yuan are considerably lower, equivalent to a 'steep discount' compared to Ideal. Similar appearance, extended-range options, and ultra-low prices directly propelled Zero Run's sales.

Source: CanTouTuKu

At XPeng's AI Technology Day held on November 6, 2024, He Xiaopeng announced that the company would launch a new electric technology platform called the 'Kunpeng Super Electric System'. This imposing name can be broken down into two parts: 'Kun' represents the super extended-range system, adopting the next-generation extended-range technology, while 'Peng' represents XPeng's pure electric system.

When discussing the deployment of extended-range technology, He Xiaopeng stated, 'If an enterprise wants to enter the global market, it needs a new energy replenishment method, including extended-range hybrids; moreover, to achieve a driving range of over 1,000 kilometers for a vehicle, it requires a power form other than pure electricity.' 'My perspective has significantly changed over the past year; previously, I considered scale first, but now the logic is to survive the elimination tournament and be the first in scale under the condition of being a versatile fighter.'

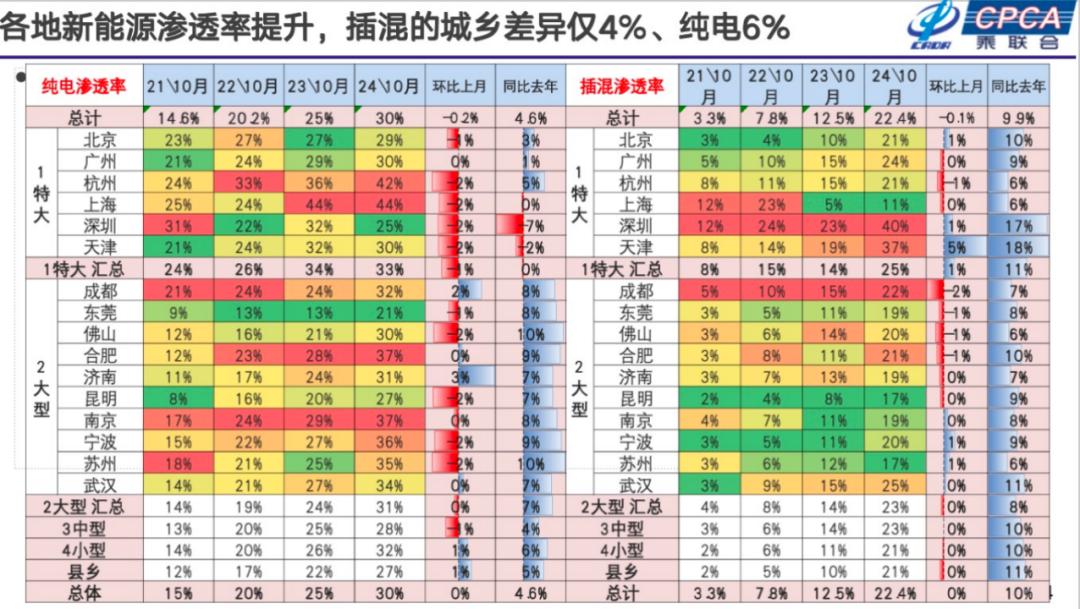

He Xiaopeng's realization can be described as quite 'pragmatic'. According to CPCA data, the combined retail sales of hybrids and extended-range vehicles in October 2024 were 522,000, almost equal to the 673,000 pure electric sales. Moreover, the year-on-year growth rate of hybrid vehicle sales was 107.7%, and that of extended-range vehicles was 55.2%, both exceeding the year-on-year growth rate of pure electric vehicle sales.

Source: CPCA

When the Ideal ONE was introduced, the electric vehicle industry was steadfast in its belief that 'pure electricity is the future, with extended range serving merely as a temporary bridge.' However, market trends reveal a different story. In 2024, both domestic plug-in hybrids and pure electric vehicles experienced remarkable growth, particularly plug-in hybrids which sold briskly in rural and emerging markets. According to CPCA data, plug-in hybrids achieved a 22.4% penetration rate in the overall domestic market, closely mirroring the 21% seen in counties and townships. This suggests that more pure electric vehicle brands will inevitably venture into the realm of hybrids and extended-range vehicles in the future.

Source: CPCA

Ideal serves as a prime example of a company that has defied both technological and model conventions. Despite MEGA's underwhelming sales, Ideal's transition from extended range to pure electric continues unabated. Not only will it introduce pure electric models in 2025 but will also amplify its investment in the energy replenishment network by establishing more supercharging stations.

Screenshot source: Weibo

Following the Xiaomi SU7, Xiaomi unveiled the Xiaomi SU7 Ultra with a presale price of 814,900 yuan, marking a strategic move across industries. Colin commented, "The Xiaomi SU7 Ultra is not just a cross-industry model; it's also a branding maneuver that transcends sectors." The SU7 Ultra's intriguing positioning as a racing car, coupled with marketing through driving school courses, has allowed Xiaomi, an internet-based automaker, to shed the "outsider" label to a certain extent. Colin further elaborated, "The SU7 Ultra doesn't need to sell in large volumes; its primary objective is to reshape Xiaomi Automobile's brand image. In the short term, Xiaomi Automobile isn't interested in introducing models that directly compete with the SU7. In the future, Xiaomi could introduce a car priced between 200,000 and 300,000 yuan, claiming that it leverages technology from the SU7 Ultra. This cross-industry move is ingenious, paving the way for future model and brand transformations."

Regarding new-energy vehicle companies venturing into the electric supercar market, Lin Shi, secretary-general of the Sino-European Association of Intelligent and Connected Vehicles, believes that "the affordable power brought by electrification has presented many brands with an opportunity to enter the market. However, ultra-high-end electric models are not yet mainstream, though they do represent a chance for reshuffling. There is undoubtedly market space, but from the perspective of automaker profits and R&D output ratios, ultra-high-end electric models like electric supercars are more of a technological emblem. For the market, the differentiating advantage of electric supercars should lie in exploring niche markets and offering freshness through intelligence and driving experience."

03.2025, "Survive"

As we enter 2025, while the industry anticipates continued growth in car sales, there's a consensus within the sector that a more intense "elimination round" is imminent.

Past tactics of cleverly justifying insufficient sales are now ineffective in this all-out competitive elimination round. All brands are now grappling with the same question: "How to survive?"

For automakers to survive in the current landscape, they must focus on three key areas: popular models, gross profit margin, and cash flow.

For instance, one can look at the "reverse case" of Geely Auto's Geometry: Geometry's models failed to gain popularity, ultimately collapsing due to a broken capital chain, illustrating a progression from unsold cars to unprofitable operations.

Conversely, BYD, which surpassed Tesla in sales in 2024, boasts a gross profit margin of 22% in the third quarter and operating cash flow of 213 billion yuan, with monetary cash of 66.32 billion yuan, exemplifying a case of "being able to sell cars and make money."

Screenshot source: Weibo

However, there are also those caught in the middle, who "can sell cars but can't make money." For example, Wuling, once hailed as a "miracle car," sold 1.54 million vehicles in 2024, including 800,000 new energy vehicles, marking a 63% year-on-year increase. Yet, SAIC-GM-Wuling's financial data reveals that in the first half of 2024, its total operating revenue was 32.963 billion yuan, with a net profit attributable to shareholders of only 97 million yuan. This disparity arises due to a low gross profit margin; previously, relevant research reports from CFT Securities estimated that the gross profit margin of the Wuling Hongguang MINI EV might be as low as 2%-3%. Selling at low profit margins but in high volumes is a strategy, but "high volumes" cannot sustain "low profits" indefinitely. Moreover, as the incremental market space narrows, the challenge of low profitability will become even more pronounced.

Image source: Canned image library

Unlike Wuling, which is trapped by the concept of "cost-effectiveness," NIO's losses are exacerbated by its multiple business lines. Car manufacturing, self-researching chips, mobile phone production, and battery swapping business are all significant money-burning ventures. Taking the battery swapping business as an example, according to "Qujiexieshang," the cost of a single station for NIO's first-generation battery swapping station exceeds 3 million yuan, while the cost of the second and third generations ranges between 1 and 2 million yuan. The cost of the fourth-generation, launched in June 2024, has risen to between 2 and 3 million yuan per station. Based on NIO's current estimate of over 2,800 battery swapping stations, the construction cost alone would exceed 5 billion yuan, not to mention long-term operating costs and battery reserve fees.

These long-term high-cost investments have placed significant pressure on NIO to bear losses since its listing. From 2016 to 2023, NIO accumulated losses of 80.483 billion yuan, coupled with losses of 15.53 billion yuan in the first three quarters of 2024, bringing the total loss to 96.013 billion yuan.

The transition from burning money to making money for automakers hinges on their cash strength; in layman's terms, it's about who can afford to endure the losses the longest.

NIO remains relatively strong in this regard, with cash and equivalents of 42.2 billion yuan in the third quarter of 2024. Another company with an advantage in this area is Xiaomi Automobile, backed by Xiaomi Group. Despite reporting a net loss of 1.5 billion yuan in the third quarter of 2024 for its automotive business, Xiaomi Group has a cash reserve of 151.6 billion yuan, solidifying its status as a worthy "cash king." Moreover, Xiaomi's automotive business has achieved a gross profit margin of 17%, a relatively optimistic milestone.

Image source: Canned image library

However, the electric vehicle industry's past has taught us that this sector can shift dramatically. A misstep in model launch or branding transformation can take several quarters to rectify, and in a highly competitive environment where survival is at stake, several quarters can be too long.

The Passenger Car Association recently released its analysis and forecast for the national passenger car market, predicting that China's domestic car retail sales will reach 23.4 million units in 2025, marking a 2% year-on-year increase. New energy passenger car retail sales are expected to be 13.3 million units, up 20% year-on-year, with a domestic retail penetration rate of 57%. Cui Dongshu, secretary-general of the Passenger Car Association, noted that the current forecast for domestic passenger car sales in 2025 indicates a trend of a slow first half and a robust second half. "In the first quarter, we estimate a negative growth rate of 3%, with January experiencing a negative growth rate of over 10% due to the Spring Festival. However, due to scrapping and replacement policies, trade-in policies, and the phasing out of the new energy vehicle purchase tax reduction policy in the fourth quarter of 2025, the growth momentum in the fourth quarter of 2025 is expected to be strong."

In 2025, new energy automakers will continue to delve deeper into various "cross-industry" strategies. Let's wait and see which ones will generate substantial profits with the support of new popular products.