Tesla Counters Chinese Automakers' Rise with a Bold Move

![]() 01/14 2025

01/14 2025

![]() 608

608

Since the release of last year's sales figures, the narrative of "Tesla's fall from grace" has persisted. However, it is crucial not to underestimate Tesla, as it remains the world's preeminent leader in new energy vehicles.

The rapid advancement and aggressive marketing strategies of Chinese new energy automakers have caught Tesla off guard, momentarily pushing it into a corner. Yet, Tesla swiftly responded with a counter-offensive.

1. The Challenge from Chinese Automakers

As the global frontrunner in new energy vehicles, Tesla has enjoyed a decade-long streak of sales growth. However, this trend abruptly halted in 2024.

Earlier this month, Tesla announced its global deliveries for 2024, totaling 1.7892 million vehicles, marking a year-on-year decrease of 1.07% from the previous year's 1.8086 million.

While the decline may seem modest, it signifies that after 14 consecutive years of growth, Tesla has reached an inflection point, experiencing a rare year-on-year sales drop.

The capital market responded with concern, with Tesla's share price plummeting 6.08% overnight, erasing $78.8 billion in market value, equivalent to nearly RMB 600 billion.

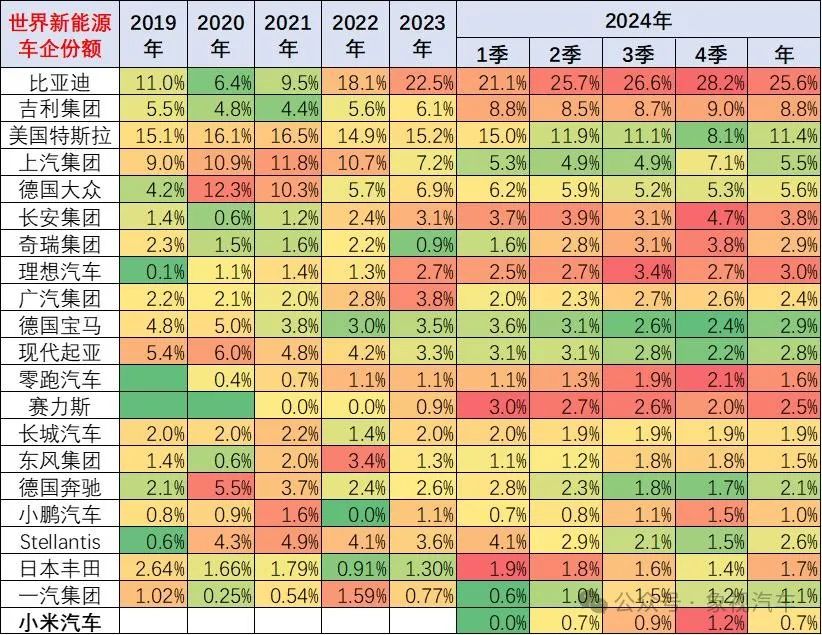

According to statistics from Cui Dongshu, secretary-general of the China Passenger Car Association, Tesla's market share has been declining annually, falling from a high of 16.5% in 2021 to 11.4% in 2024.

In contrast, BYD's market share surged from 9.5% in 2024 to 25.6% in 2024, more than doubling Tesla's share.

Indeed, beyond BYD, other Chinese automakers have also surpassed Tesla in market share.

In the fourth quarter of 2024, Tesla's market share stood at 8.1%, significantly trailing BYD's 28.2% and even Geely's 9.0%, pushing it from the global top spot to third place due to fierce competition from Chinese automakers.

2. Tesla's Counter-Offensive

Several factors contribute to Tesla's sales and market share decline, one being the long-overdue update of its main models, the Model 3 and Model Y, which faced criticism for being outdated and less competitive.

Recently, without a formal press conference, Tesla unexpectedly launched the refreshed Model Y on its official website for pre-sale. This signifies that after five years of inactivity, the Model Y has finally undergone a significant update.

Visually, the mid-section of the new Model Y remains largely unchanged, but the headlights and taillights have undergone notable changes, adopting a sleek through-design reminiscent of Tesla's Cybertruck, an autonomous electric vehicle.

Inside, the traditional gear shift lever has been removed, with shifting operations now integrated into the central control screen. The turn signal lever on the left side has also been replaced by physical buttons on the steering wheel.

Ventilation has been added to the front seats, and the size of the second-row seats has been increased. Energy consumption under CLTC conditions has been reduced to 11.9kWh per 100 kilometers, setting an industry benchmark.

The refreshed model comes in two versions: standard (long-range), with pre-sale prices starting at RMB 263,500 and RMB 303,500, respectively, representing an increase of RMB 13,600 and RMB 12,600 over the current models.

Reports indicate a surge in orders for the new car, proving that even after five years without an update, it remains a top seller. Under pressure, Tesla has struck back against Chinese automakers.

3. Sustaining the Sales Legend

As Tesla's fifth model, the Model Y was released in March 2019 and quickly gained popularity, becoming a cornerstone of Tesla's market value.

Over the years, the Model Y has maintained strong sales, with few competitors in the pure electric SUV segment priced between RMB 250,000 and RMB 350,000.

In 2023, the Model Y sold 1.1 million units, surpassing the Toyota Corolla, which had held the top spot for 37 years, to become the global sales champion. This marked the first time a pure electric vehicle surpassed a fuel vehicle to become the best-selling model.

That same year, the Model Y sold 640,000 units in China, securing the sales crown.

In the recently concluded 2024, despite the fierce competition from Chinese automakers, the Model Y retained its domestic and global sales crown, albeit with significantly reduced sales.

In 2024, the Model Y's sales in China fell to 480,000 units, and global sales are expected to decline 21.28% year-on-year to 865,900 units.

It is evident that the Model Y, which has long relied on its existing strengths, is now in decline. Without an update, its sales crown could be at risk.

In the third quarter of last year, brands such as Zhidian, Zeekr, Ledao, and AITO simultaneously launched new products targeting the Model Y, earning the moniker "six sects surrounding Guangmingding."

Now that the Model Y has finally been refreshed, consumers owe a debt of gratitude to Chinese automakers. Without their competitive pressure, the Model Y might still be resting on its laurels.

Whether the new Model Y can continue its sales legend primarily depends on the product competitiveness of Chinese automakers.

In promoting the refreshed Model Y, Tesla used the phrase "despite the comparison" in its promotional materials, to which Xiaomi, Huawei, Ledao, Zeekr, AITO, and others have responded.

In December last year, Xiaomi's SU7 sold nearly 5,000 more units per month than the Model 3. Will Xiaomi's second new model, the YU7, be able to best the new Model Y? Time will tell.