Car Dealers: Don't Mourn Me in 2024

![]() 01/14 2025

01/14 2025

![]() 562

562

By Liu Jinnan

Produced by Jieche Technology

"The once thriving car market seems to be fading. I've always been puzzled why the car dealership industry, which still generates considerable revenue, suddenly turned into a money-losing venture."

During the first weekend of 2025, car dealer Zhou Qinghu (pseudonym) secluded himself in the general manager's office, helplessly sighing as he perused the business data tables. Amidst the beautifully decorated office and bleak business data, the investor, with over 15 years of experience in terminal operations and management, felt a stark contrast. "Let's not dwell on the past," he remarked.

It was lunchtime, and Zhou Qinghu, known for his warmth and generosity, maintained the frankness and straightforwardness of a seasoned car salesman. However, he switched his lunch venue from the luxurious hotels of previous years to the company cafeteria. The boss, nearing his retirement age, conveyed a hint of apology in his words: "The harvest (referring to the profit of his 4S shop in 2024) is a bit meager, and I'm sorry to trouble you, brother."

According to data from the Passenger Car Market Information Joint Meeting (hereinafter referred to as the Passenger Car Association) of the China Automobile Dealers Association (hereinafter referred to as the Dealers Association), from January to November 2024, the cumulative retail sales of new cars reached 20.257 million units, marking a year-on-year increase of 4.7%. In November, national passenger car sales amounted to 2.423 million units, a year-on-year increase of 16.5% and a month-on-month increase of 7.1%. The overall performance of the passenger car market was impressive, with its growth rate surpassing the industrial sector average.

Mitsubishi Brand 4S Shop Closed

Conversely, the Dealers Association predicts that the number of car 4S shops exiting the market in 2024 will reach approximately 4,000, with the number of "withdrawing" shops nearing 200% of the previous two years. Among these exiting 4S shops, the number of traditional fuel brand shops significantly outnumbers that of new energy brands. The fundamental reason for their withdrawal is the unbearable continuous losses.

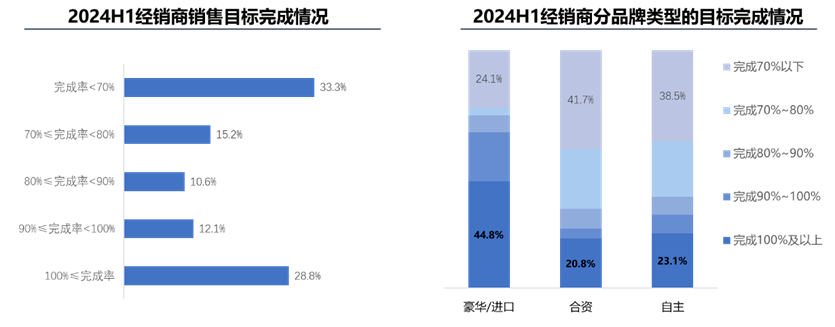

On August 21, 2024, the Dealers Association released the "2024 First Half Year National Auto Dealer Survival Status Survey Report" (hereinafter referred to as the Report), highlighting that market competition was fierce, with frequent price wars. Brand manufacturers and dealers competed for market share through price reductions and promotions to achieve sales targets. The strategy of "trading volume for price" also posed severe challenges to OEMs and dealers, with declining profit levels.

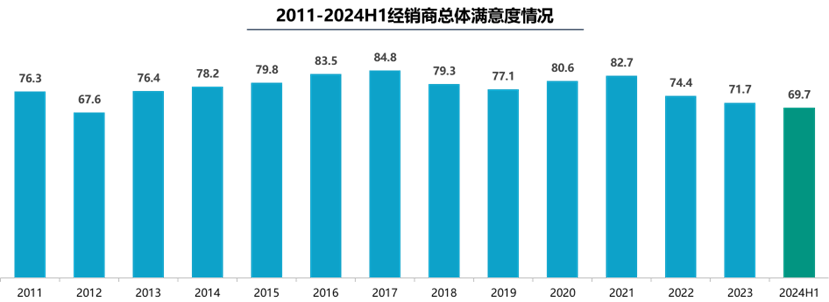

The survey revealed that during this period, dealers' overall satisfaction score was 69.7 points, with a significant decline in dealers' overall satisfaction with manufacturers. New car prices were severely inverted, the market price was chaotic, manufacturers' policies lacked continuity, and tied sales and inventory pressure occurred periodically, increasing dealers' operating pressures. A substantial number of dealers incurred losses or were on the verge of losses.

As shown in the figure above, car dealers' overall satisfaction in the first half of 2024 was the lowest in 12 years, surpassing only 2012 when "inventory pressure (i.e., forcing dealers to purchase and stockpile vehicles) was the harshest."

To swiftly achieve sales targets, the terminal market resorted to radical and efficient growth methods—trading volume for price. With continuous discount expansion and frequent promotional activities, dealers' new car transaction profits during this period plummeted to -26.5%. Despite the continued increase in profits from after-sales services, financial insurance, used cars, and other businesses, they could not compensate for the losses from new car transactions in the short term.

Ultimately, 50.8% of dealers incurred varying degrees of losses during this period, 35.4% achieved profits, and 13.8% maintained a break-even point.

Automotive analysts noted that maintaining an 8:2 profit ratio in the automotive dealership industry signifies a healthy level of development. This indicates that 80% of industry entities maintain profitability or break even, while the remaining 20% of weaker enterprises undergo continuous optimization and iteration with industry development. Such an industrial scale fosters positive and upward development. However, the 2024 situation was somewhat disappointing. Within the automotive dealership industry, only brands with robust "new energy" product development momentum achieved profits. Luxury brands faced intensified competition within the overall industry, while joint venture brands suffered the most significant losses, with only 11.5% of dealers achieving profits.

Infiniti's promise now seems somewhat ironic.

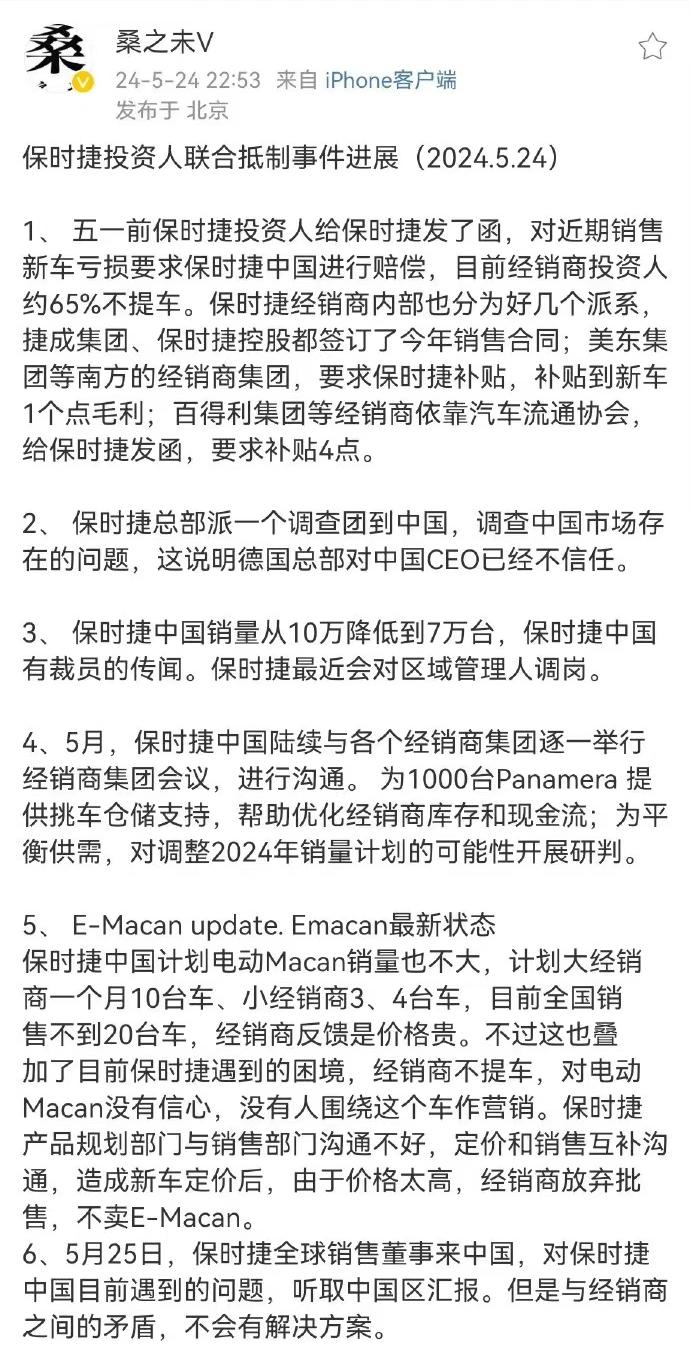

According to public internet information and media reports, at the beginning of 2024, the number of Infiniti dealerships sharply declined to 58. In May, Porsche dealers sent an open letter to the brand, stating that their car trading business was losing money and facing immense financial pressure. In August, Beijing Hyundai dealers confronted a surge in inventory-to-sales ratio and requested the brand to suspend inventory allocation. Subsequently, brands such as Buick, Chevrolet, Nezha, BMW, Mercedes-Benz, and Audi successively reported dealers exiting the market and closing stores.

Image source: Sangzhiwei V

In fact, car dealers' income sources generally encompass five aspects: OEM rebates, new car transaction profits, after-sales service profits, used car business profits, and financial derivatives profits. Even after 2018, when new car transaction profits gradually inverted, dealerships could still maintain normal operations at a slight profit or break-even level. In Zhou Qinghu's view, the direct cause of widespread dealer losses in 2024 was the chain reaction triggered by "price wars."

"The price wars between automakers are intense, with many peers experiencing a purchase and sales price inversion (purchase price lower than sales price) of over 20%. The more cars they sell, the more they lose," said Zhou Qinghu. He added that as price wars among OEMs intensified, terminals had to adjust according to the OEMs' unified pricing strategies. Although dealers have some discretion over vehicle prices, failing to implement the price reduction strategy would inevitably lead to sluggish sales. Most vehicle procurement funds come from bank operating loans. If sales are not realized and funds are not recouped in the short term, the interest and late fees generated would exacerbate dealerships' operating burdens.

For ordinary people, as new cars become increasingly unprofitable, dealerships can balance corporate revenue by reducing purchase volumes and expanding other business operations. However, for automotive dealerships, "it is better to accept short-term losses to obtain rebates from manufacturers," and "rebates" are a crucial source of dealer profits.

The so-called rebate is a "reward mechanism" formulated by OEMs and dealerships based on business policies. OEMs set a series of task indicators for dealers within their channels over a certain period, such as new car sales, after-sales spare parts consumption, and regional marketing activities. A former BMW dealership manager in Shandong told Jieche Technology:

"If the dealership fully completes the business tasks set by the manufacturer, it can obtain rebates amounting to tens of millions of yuan. In some years, the rebate income for the entire group can exceed hundreds of millions of yuan. If the dealership fails to fully complete the business tasks or fails to meet the minimum business indicators required for rebates, the rebates will not be issued or will be issued on a pro-rata basis, directly impacting the dealership's overall income."

Not only were rebates difficult to achieve, but previously stable revenue sources such as after-sales services and financial derivative businesses also experienced widespread declines.

Taking after-sales services as an example, although the profit rate of dealer after-sales services in the first half of 2024 increased from 60.7% in 2023 to 69.7%, the number of in-store repairs declined by 10%-30% varying degrees. Zhou Qinghu noted that a considerable number of fuel car owners have replaced their cars with pure electric models, gradually reducing the customer base. The basic maintenance income of pure electric models is significantly less than that of fuel cars, leading to a decline in the after-sales scale of traditional fuel brand dealers; the after-sales scale of new energy dealers is very small. Even though the profit of this business has increased, the shrinking scale year by year still poses operating pressure on the enterprise.

In terms of financial derivative businesses, multiple dealers revealed that in 2023, insurance business rebates could reach approximately 15%. Since 2024, many insurance companies have only provided dealers with accident vehicle repair orders equivalent to policy fees and canceled their direct economic compensation. Regarding car loan purchases, with the deepening of OEMs' self-operated "0% interest and 0% handling fee" products, the previous commission of "3% of the loan amount" or "25% interest (including handling fees)" has been gradually eliminated. The "one-price" commission model of bank channels for dealerships has decreased as the sales scale of some dealerships has declined.

The intensification of price wars, the "loss-making" of new cars, the shrinking of after-sales scale, and the increased difficulty in obtaining "rebates" have collectively impacted car dealers, causing them to face various operating challenges.

In March 1999, Guangzhou Honda pioneered the introduction of the 4S shop model for car dealers into China and successfully implemented it. Since then, this single-brand authorized car dealership model has generally become the standard for terminal sales and services across various automakers, and the car dealership industry has embarked on a high-speed development trajectory for 19 years.

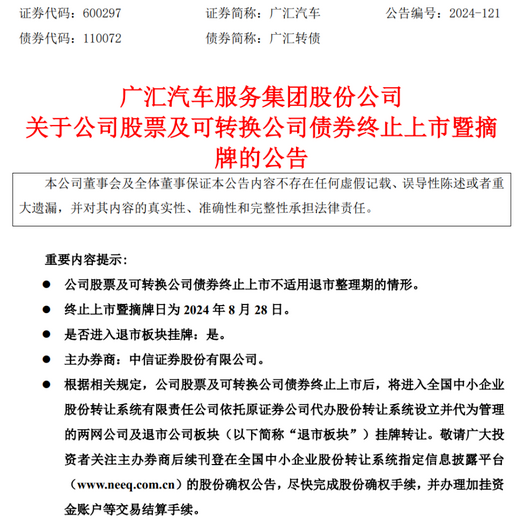

By 2018, with the first decline in car sales, this business, once considered a "sure thing" in the industry, began to gradually show signs of fatigue. In 2019, "the king of 4S shops," Pang Da Group, was deeply mired in operational difficulties and delisted in 2023. In 2024, "the auto trading elder brother," Guanghui Auto, was delisted by the Shanghai Stock Exchange due to its stock price closing below 1 yuan for 20 consecutive trading days. The two stock codes "601258" and "600297" witnessed the rise and fall of Pang Da and Guanghui, respectively. The failure of these two giants in the capital market has raised questions from the outside world: Are car dealers still important?

In fact, car dealers play more than just sales and service roles in the automotive industry. For OEMs, this industry primarily undertakes four functions: logistics and warehousing, marketing promotion, consumer "buffering," and redistribution.

From a marketing promotion perspective, relevant data shows that in 2022, the cost of opening a 4S shop for an independent brand (excluding land leasing) ranged from approximately 6 million to 30 million yuan. Even for OEMs with relatively strong financial strength, it is impossible to quickly cover major cities nationwide with their own funds in the short term. At the same time, the organizational structure of OEMs is relatively scientific and tight, and they cannot directly employ a large number of terminal personnel for terminal support. 4S shops are precisely the solution to these operational pain points.

Moreover, during the implementation stage of OEMs' marketing activities, 4S shops also have advantages over OEMs' direct sales systems. In the direct sales system, store marketing plans need to be highly aligned with the group, making it difficult to adapt to local consumer demand based on local customs and trading habits. Chang Jian, a former car dealership staff member, told Jieche Technology: "A market activity at a joint venture brand I previously worked for mainly promoted white car models, but residents in that area preferred red car bodies and had some aversion to white ones. Although our promotion ideas were contrary to those of the OEM, the final effect was very ideal; for some car models that focused on a 'young' strategy, the regional users were mostly middle-aged people, and their purpose of purchasing cars was not for fashion, but only for transporting goods. Then the dealer has to formulate promotion strategies based on the needs of local users."

The annual auto production plan for Original Equipment Manufacturers (OEMs) is fixed and inherently inflexible, making it challenging to implement significant adjustments or changes. Consequently, if these enterprises fail to successfully sell their vehicles, they end up tying up excessive capital, thereby impeding the progress of other business segments. Conversely, 4S shops assist OEMs in managing inventory based on their sales plans. Additionally, for areas with high consumption of vulnerable parts, whether remote or central, OEMs rely on 4S shops to alleviate logistics pressure, enabling swift delivery of spare parts and complete vehicles within a short timeframe. This ultimately enhances organizational operating efficiency.

"We essentially serve as a buffer between consumers and the brand," remarked Zhou Qinghu. He believes that in scenarios involving customer complaints, public skepticism, and other such issues, 4S shops often take the lead in addressing them. This grants OEMs additional time and a more comprehensive strategy to respond and manage these problems effectively. Without the cushion provided by 4S shops, OEMs would be directly confronted with these challenges, significantly intensifying public pressure. Furthermore, in the relatively underdeveloped used car circulation sector for OEMs, 4S shops often wield regional pricing power, which supports vehicle residual values and indirectly reinforces the brand premium of vehicles.

"We (dealers) have contributed significantly to them (OEMs), yet their support for us remains limited. At times, it feels as though we're not even part of the same team," Chang Jian lamented. "We are all aware of the market's difficulties over the past two years. However, if the car dealership business operates normally, there is still potential for profit. What dealers fear most is that setbacks faced by OEMs will adversely affect us. Even when we haven't made any mistakes, we (dealers) are invariably the first to suffer the consequences."

Note: To protect privacy, certain names in the text have been replaced with pseudonyms.