BYD Abandons Low-Price Competition: Will Audi Feel the Heat?

![]() 01/20 2025

01/20 2025

![]() 662

662

After achieving the milestone of 4 million vehicles sold, BYD's next ambition is to conquer the market segment priced at RMB 300,000 and above.

The design of BYD's new office next to Shenzhen Pingshan High-speed Railway Station ensures that the walking time between any two executive offices does not exceed 2 minutes. This detail underscores Wang Chuanfu's commitment to fostering efficient internal communication, a crucial aspect as the company prepares for the next wave of transformation.

Contrary to external speculation, BYD plans to shift gears in 2025, moving away from the low-price competition strategy of 2023-2024. Instead, it aims to focus on higher-end markets, recognizing that the industry requires profit margins, breathing space, and the creation of more job opportunities.

However, unlike some industry reports, BYD's ambition extends beyond merely competing in high-level intelligent driving. Its true goal is to capture a significant share of the market priced at RMB 250,000 and above, particularly the RMB 300,000 bracket. This is akin to dividing the world into three parts.

Executives are now focusing on the high-end market, with multiple BYD brands—Dynasty, Ocean, FANGCHENGBAO, DENZA, and YANGWANG—working in unison. While the mass deployment of high-level intelligent driving and its penetration into the RMB 100,000 price bracket are still under consideration, BYD has recently completed the formation of an early adopter test group comprising heads of various brands and series.

BYD's ambition is clearly aimed at the RMB 300,000-plus market.

The 2-minute walking time requirement underscores BYD's need for efficient internal communication. The dynamics of the high-end market are too complex to be captured solely by the "affordable prices" strategy that has worked in the household segment.

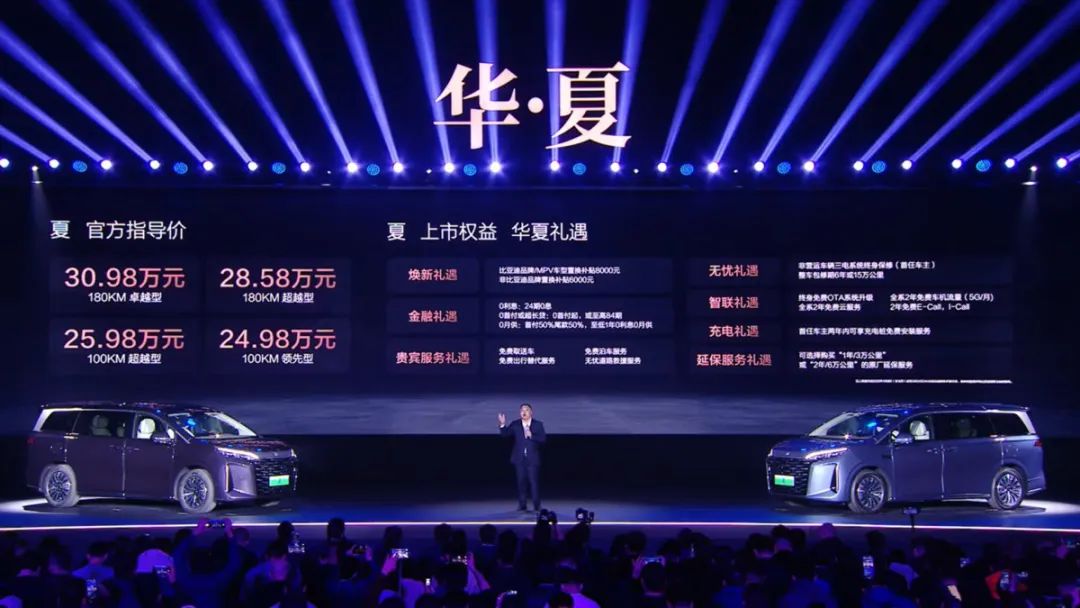

Each BYD brand has its own strategy. For instance, BYD Dynasty is considering two strategies for 2025: the launch of the MPV Xia, which, despite Denza D9's precedence, will have a stronger household focus, and the reinvigoration of BYD Han L and Tang L, which have seen significant market success since the beginning of the year.

BYD Han L and Tang L's first surprise came with the revelation of a new powertrain exceeding 1000 horsepower, a top-tier motor that ranks among the best alongside Xiaomi V8S and Porsche's 500kW motor. Later, a design conference showcased BYD's updated design language, incorporating dragon whisker lines, phoenix tail feather taillights, and Wu Dian-inspired interior trims, aiming to resonate with high-budget consumers who appreciate Chinese culture.

While BYD Xia, Han L, and Tang L all aim to penetrate the RMB 300,000 market, their underlying strategies differ. BYD Xia, being in a relatively new segment with fewer competitors, can easily stand out with superior performance. In contrast, the RMB 200,000-300,000 range for new energy sedans and SUVs is fiercely competitive, with models like AITO M5, AITO M7, AITO R7, Lixiang's L6 and L7, Xiaomi SU7 and YU7, and Tesla's Model 3 and Model Y.

BYD Han L and Tang L aim to recapture the market share lost around 2018, when Aiger's Dragon Face design and the Tang's 4.5-second 0-100km/h acceleration time were game-changers. Today, these models seek to win back consumers who shifted to newer brands and establish a solid sales base by breaking into new markets.

Beyond Dynasty's ambitions, FANGCHENGBAO partners with Huawei Intelligent Driving for the FANGCHENGBAO Tai 3, DENZA with the DENZA N9, and YANGWANG with the ambitious YANGWANG U7.

BYD's ascent into the high-end market: Will Audi be the biggest casualty?

In summary, BYD's 2025 plan not only involves abandoning low-price competition but also emphasizes intelligent driving. However, intelligent driving remains a complex field with many unresolved paradoxes. Firstly, BYD's intelligent driving strategy is still being finalized, as evidenced by the early adopter test group. Secondly, while intelligent driving is a must-have in the high-end market, it is not yet a decisive factor.

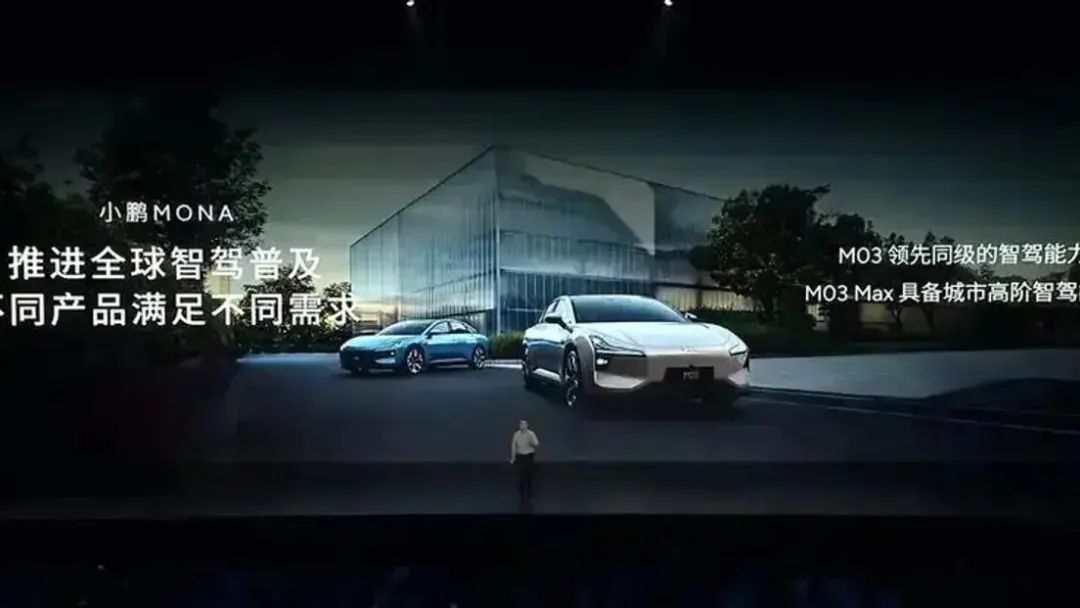

The widespread adoption of intelligent driving also faces commercial challenges. The definition of high-level intelligent driving is often marketing jargon, with many automakers claiming it as standard. However, the presence of urban NOA functionality is crucial. For instance, XPeng offers high-level intelligent driving in models like the P7+ and MONA M03, but the integration of urban NOA in the RMB 100,000 price range is unsupported, leading to alternatives like high-speed NOA + urban memory route navigation.

Similarly, Deep Blue, equipped with Huawei Qiankun Intelligent Driving ADS3.0, supports high-speed NOA and enhanced lane-keeping LCC in urban areas but lacks full navigation-following capabilities. With the rise of end-to-end technologies, automakers have limited choices for intelligent driving suppliers: Huawei, Momenta, or Yuanrong Qixing.

Although the cost of high-level intelligent driving is declining, it still adds around RMB 6,000 to many models for high-speed NOA deployment alone. For urban NOA, the budget needs to be significantly higher. This poses a dilemma for household consumers: whether to spend an extra RMB 10,000 or more on a feature they may not fully trust.

Technically, the future of intelligent driving remains uncertain.

If BYD, a leading enterprise, shifts away from low-price competition and targets the high-end market, who will be most impacted? The answer includes luxury brands with weak consumer recognition and automakers offering inferior packages. Traditional automakers will face a particularly challenging situation.

BYD's new models, Han L and Tang L, offer significant improvements in energy efficiency and suspension, posing a threat to fuel vehicles. Audi A4L, currently priced below RMB 250,000, will be replaced by the A5 supported by Huawei Intelligent Driving. However, given Yu Chengdong's statements about selling models like AITO and AITO R at a loss below RMB 300,000, the new Audi car's price competitiveness remains questionable.

Cadillac and Lexus will also face similar challenges. Tang L, with its 5+2 layout, positions itself as a large 5-seater for daily use with an emergency 7-seater option. This makes it akin to BYD using Audi Q7's product model to compete with the Audi Q5L.

Final Thoughts

BYD is playing a bold game, aiming to occupy the high ground of public opinion before engaging in product competition. Imagine a sales consultant in a 4S store saying, "Look at the taillights, the Wudian style, the bamboo trim." This will undoubtedly attract consumers' attention.

The answer will unfold starting from March this year, with the launch of Tang L and Han L and the intense competition at the Shanghai Auto Show in April. The speed of response and the reasonableness of pricing will determine whether sales soar or plummet in 2025.