16 Auto Groups, 54 Domestic Brands! January 2025 Sales Figures Revealed

![]() 02/05 2025

02/05 2025

![]() 635

635

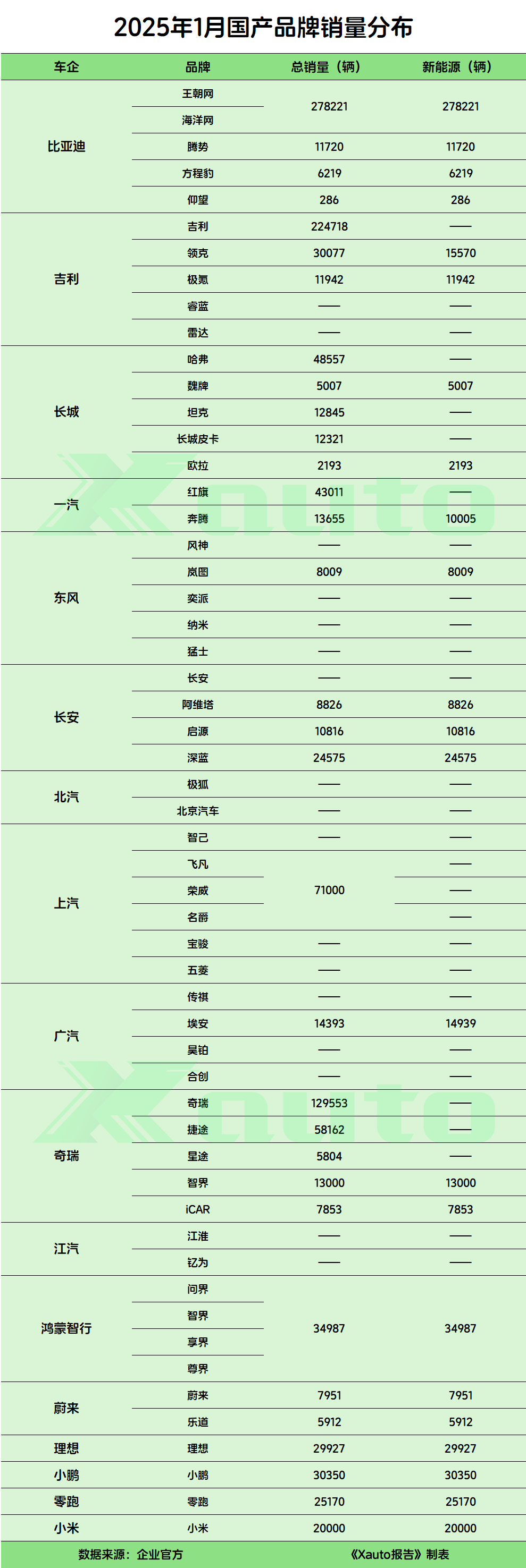

At the onset of February, automotive manufacturers unveiled their sales figures for January 2025.

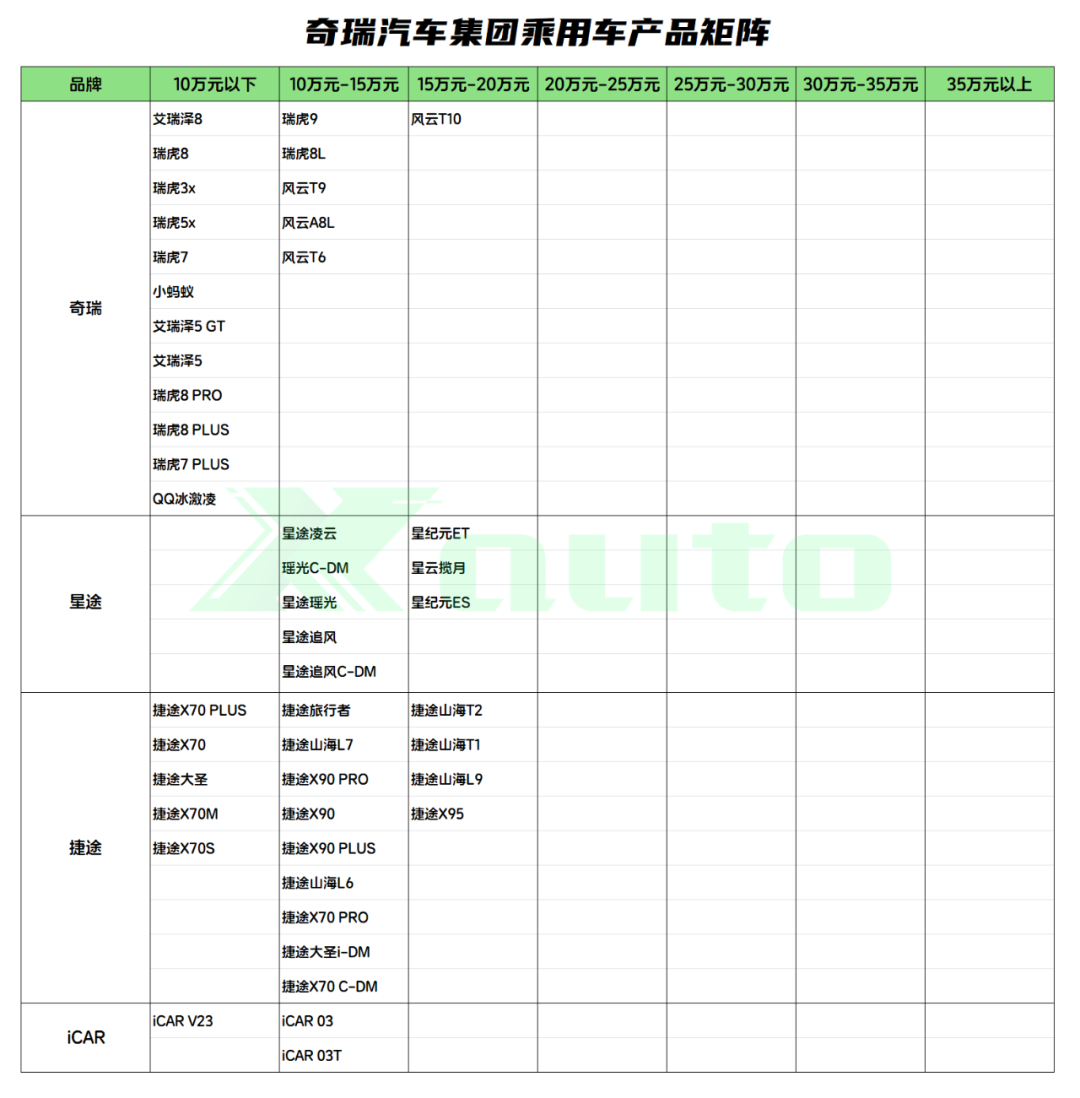

Out of the 16 auto groups and 54 domestic auto brands covered by the "Xauto Report" database, as of publication, four auto groups have disclosed their comprehensive sales figures, and 20 brands have released their new energy sales figures.

BYD, Geely, Chery, and Great Wall have comprehensively released their respective brand sales figures, along with their total sales. BYD leads the pack with approximately 300,000 units sold in January, while Geely and Chery both surpassed 200,000 units in monthly sales.

Notably, BYD has fully transitioned to new energy, while Geely, Chery, and Great Wall are also stepping up their pace in new energy, with their respective brands deploying new energy products at varying speeds.

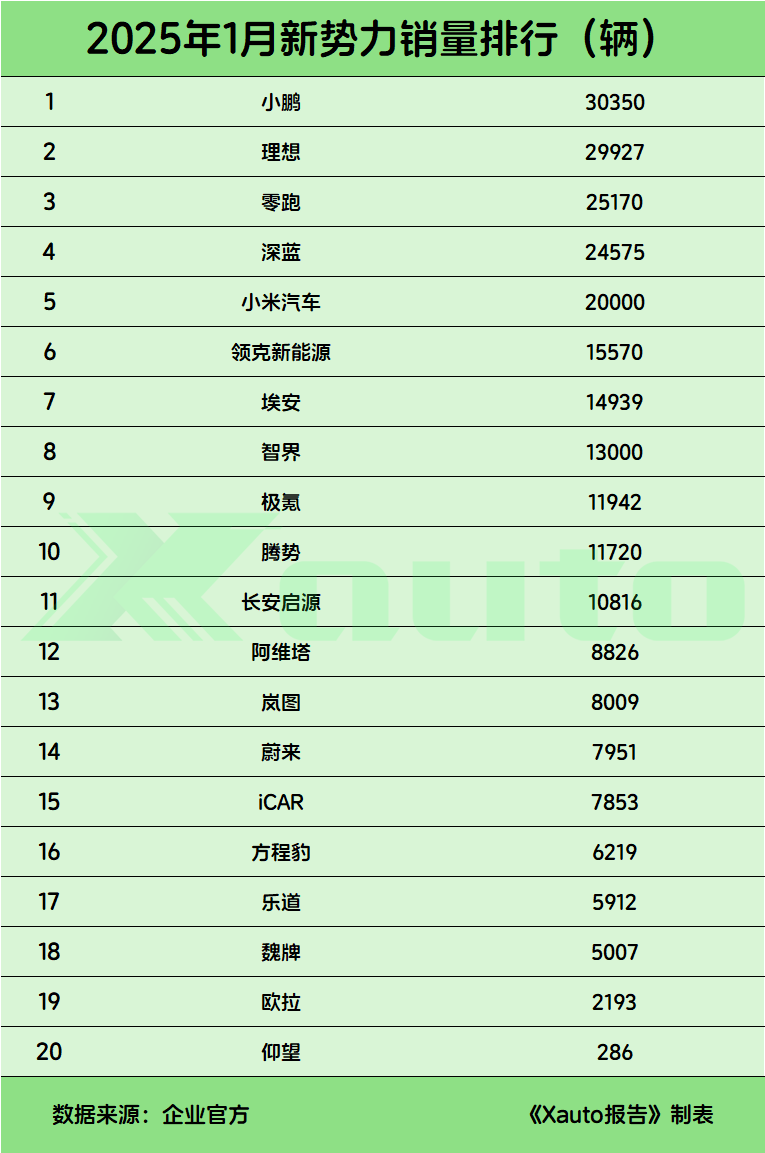

Let's delve deeper into the sales performance of the new automotive forces:

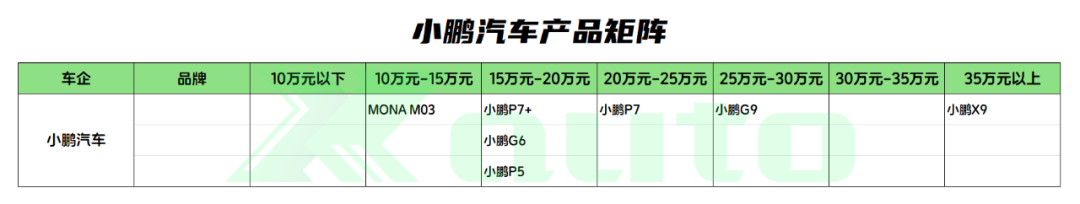

According to the January 2025 new energy sales rankings, Xpeng Motors' sales exceeded 30,000 units, topping the chart.

Xpeng Motors has delivered over 30,000 units for three consecutive months. The Xpeng MONA M03 accounted for half of these deliveries, with over 15,000 units sold for a single model. Additionally, the Xpeng P7+ also performed outstandingly, with cumulative deliveries swiftly surpassing 20,000 units in just two months since its launch.

Xpeng Motors' sales surge began in September 2024, when its sales first exceeded 20,000 units, and continued to climb throughout the last quarter.

However, due to the low-price competition strategy of the Xpeng P7+ and Xpeng MONA M03, Xpeng Motors' gross profit margin in 2024 remains a focal point.

Li Auto sold nearly 29,927 units in January 2025, a decline compared to 58,513 units in December 2024 and 31,165 units in January 2024.

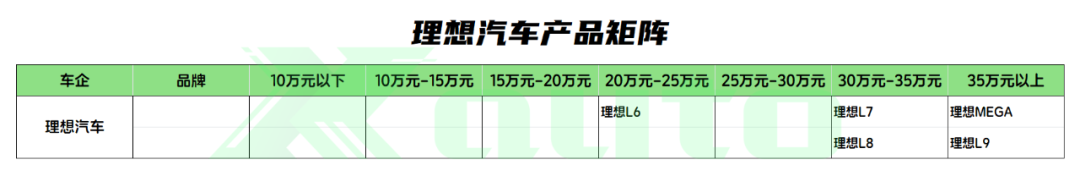

Currently, Li Auto offers five models, including the extended-range models Li L6, L7, L8, L9, and the pure electric model MEGA. Li Auto's latest pure electric model is anticipated to launch in the first half of this year.

In 2024, Li Auto excelled in sales and operations among the new forces, but it is also facing mounting competitive pressure.

On one hand, AITO is in fierce competition with Li Auto in the high-end mid-size and large extended-range SUV segments. On the other hand, the emergence of more "Li Auto alternatives" in the extended-range segment is also encroaching on Li Auto's comfort zone to a certain extent.

Therefore, 2025 will continue to be a challenging year for Li Auto.

NIO and AITO were two dark horses in sales in 2024, and although their January sales declined month-on-month, they still maintained good rankings.

NIO currently has five main sales models, primarily the C series, priced between 100,000 and 200,000 yuan. In the first half of 2025, NIO's B series models will be launched, further enriching NIO's product portfolio.

After releasing its sales figures, NIO promptly announced multiple purchase incentives for February. In addition to the national subsidy, different models will receive cash subsidies ranging from 5,000 to 13,000 yuan, as well as charging incentives, optional accessories incentives, and financial incentives.

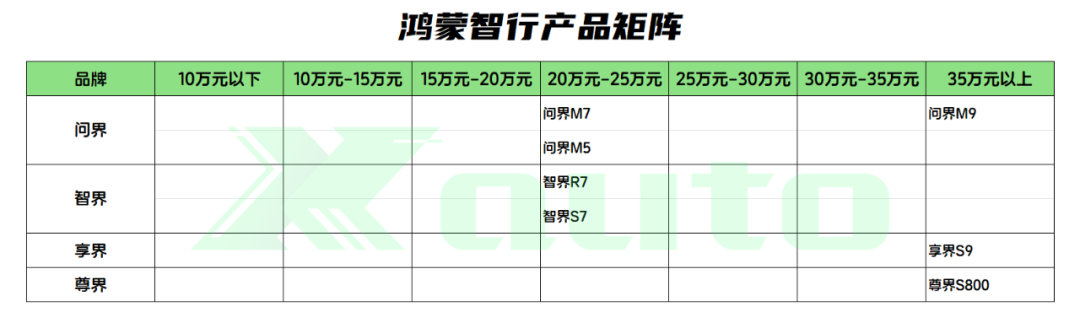

AITO's sales performance was relatively impressive in 2024, with sales exceeding 30,000 units in November and December. The AITO S05 and S07 are popular models in their respective segments, and the higher-end AITO S09, a large six-seat luxury SUV, will be launched this year.

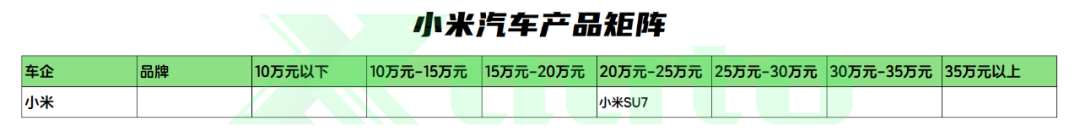

Xiaomi Motors maintained a delivery level of 20,000 units in January this year. The Xiaomi SU7 has been delivered since 2024, with deliveries stabilizing at 10,000 units from June to September, 20,000 units in October and November, and reaching 25,000 units in December.

This year, Xiaomi will launch its second product, the Xiaomi YU7, a pure electric mid-to-large SUV. This model will continue Xiaomi's sporty design aesthetic and will form a combined strategy with the SU7 upon its launch.

Xiaomi has also announced limited-time purchase incentives for February, including Nappa leather seats and lifetime free access to intelligent driving functions.

Lynk & Co is accelerating its transition towards new energy products, with a total sales volume of 30,077 units in January, of which 15,570 units were new energy vehicles, accounting for over 50% of total sales.

In terms of product layout, Lynk & Co already has two pure electric models, the Lynk & Co Z10 and Z20, as well as core plug-in hybrid models such as the Lynk & Co 07 EM-P, 08 EM-P, and 09 EM-P.

At the beginning of January, Lynk & Co also unveiled its new flagship model, the Lynk & Co 900 EM-P, which is expected to be launched within the year.

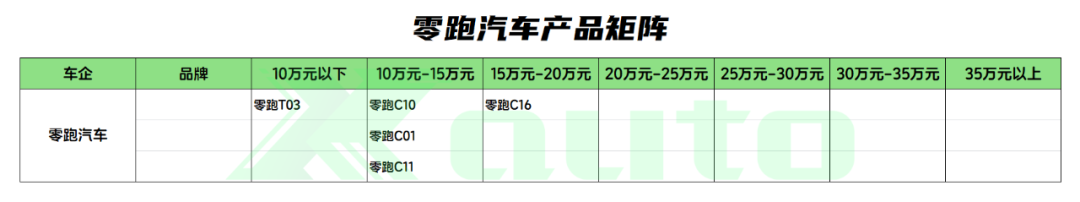

AITO, ranked seventh, sold nearly 15,000 units in January, a significant decline year-on-year and month-on-month. Currently, AITO has six main sales models, primarily priced in the 100,000 to 150,000 yuan range.

On January 6, GAC AITO's third strategic model, the UT Parrot Dragon pure electric sedan, officially started pre-sales in Guangzhou, with a pre-sale price range of 89,800 to 109,800 yuan. Its affordable price has garnered significant attention.

With the support of the S7 and R7 models, AITO sold 13,000 units in January, which can be considered a respectable sales performance. Meanwhile, Huawei Intelligent Automotive released its overall sales figures, including AITO, WENJIE, and ENJOY, with a total sales volume of 34,987 units.

ZEEKR sold 11,942 units in January, backed by its seven products.

2025 will continue to be a pivotal year for ZEEKR in terms of product offerings. In terms of product planning, ZEEKR will launch a shooting brake, a full-size flagship SUV, and a mid-to-large luxury SUV based on the 007 architecture in the second, third, and fourth quarters of 2025, respectively.

It is noteworthy that both SUVs will be available with both pure electric and super hybrid powertrain options.

Tengshi's sales performance has remained stable at between 10,000 and 15,000 units from March to December 2024. In January 2025, Tengshi continued to maintain a relatively stable sales performance, reaching 11,720 units.

Currently, Tengshi has five models on sale: Tengshi N7, N8, D9, as well as Tengshi Z9 and Z9GT. The mid-to-large SUV Tengshi N9 will be launched at the end of February or early March.

The above are the sales performances of the top 10 players in the new automotive forces rankings. Affected by the short market window during the Spring Festival holiday, sales of various brands in January 2025 generally declined month-on-month.

According to the annual sales trend, January and February are typically low sales periods, but the rankings provide insights into the comprehensive competitiveness of each brand's products.