Behind the Industry Surge: The Painful Transformation of Traditional Automotive Hubs

![]() 04/10 2025

04/10 2025

![]() 677

677

Introduction

The ebbs and flows of the automotive industry are a direct reflection of economic growth rates.

In the global wave of the new energy vehicle revolution, China is leading the charge at an astonishing pace. This modernization transformation not only widens the gap between China and other countries but also reshapes the domestic economic landscape.

A notable shift is the gradual decline of traditional manufacturing bases reliant on joint ventures, while cities nurturing local automotive giants are surging ahead. This differentiation is particularly evident in southern cities, with the changing of the guard in the Pearl River Delta region serving as a vivid example.

As the capital of Guangdong Province, Guangzhou has been China's top automobile producer for five consecutive years. Over the past decade, the Guangzhou Automobile Group's joint ventures with Japanese manufacturers Toyota and Honda, along with Dongfeng Nissan's factories, have constituted the economic backbone of Guangzhou. The automotive industry has consistently held the top spot in the city's economy.

There was once an industry saying: "Out of every 10 cars produced domestically, one is made in Guangzhou." However, this narrative began to change in 2024.

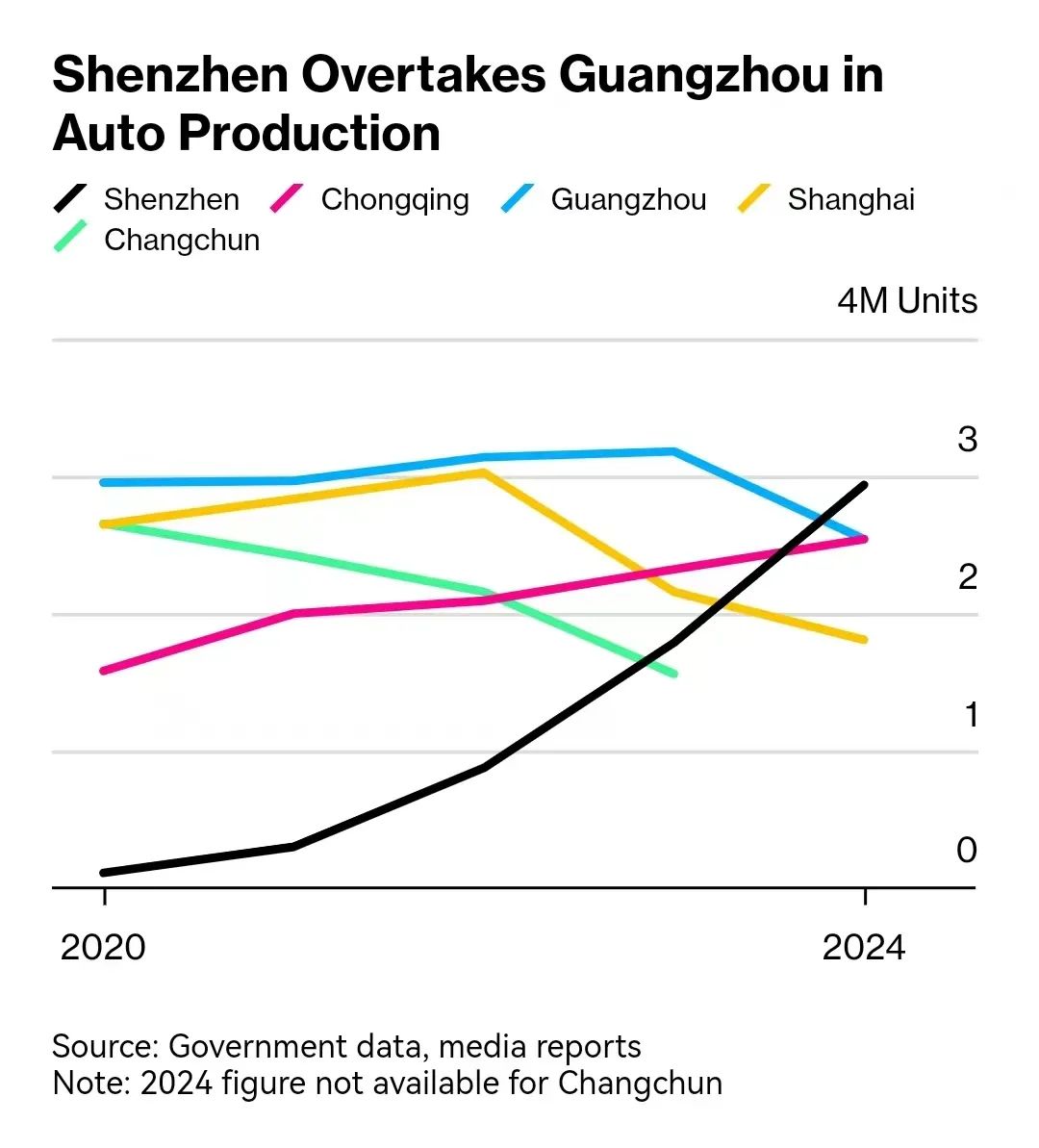

Guangzhou's automobile production totaled 2.5398 million vehicles in 2024, a year-on-year decline of 20%, with the city dropping from first to third place, ceding the championship to neighboring Shenzhen. Last year, Guangzhou's automobile manufacturing output value was 505.4 billion yuan, a year-on-year decrease of 18%, while Shenzhen, with BYD's 65% increase in production, was unstoppable, achieving a new vehicle scale of 2.9 million.

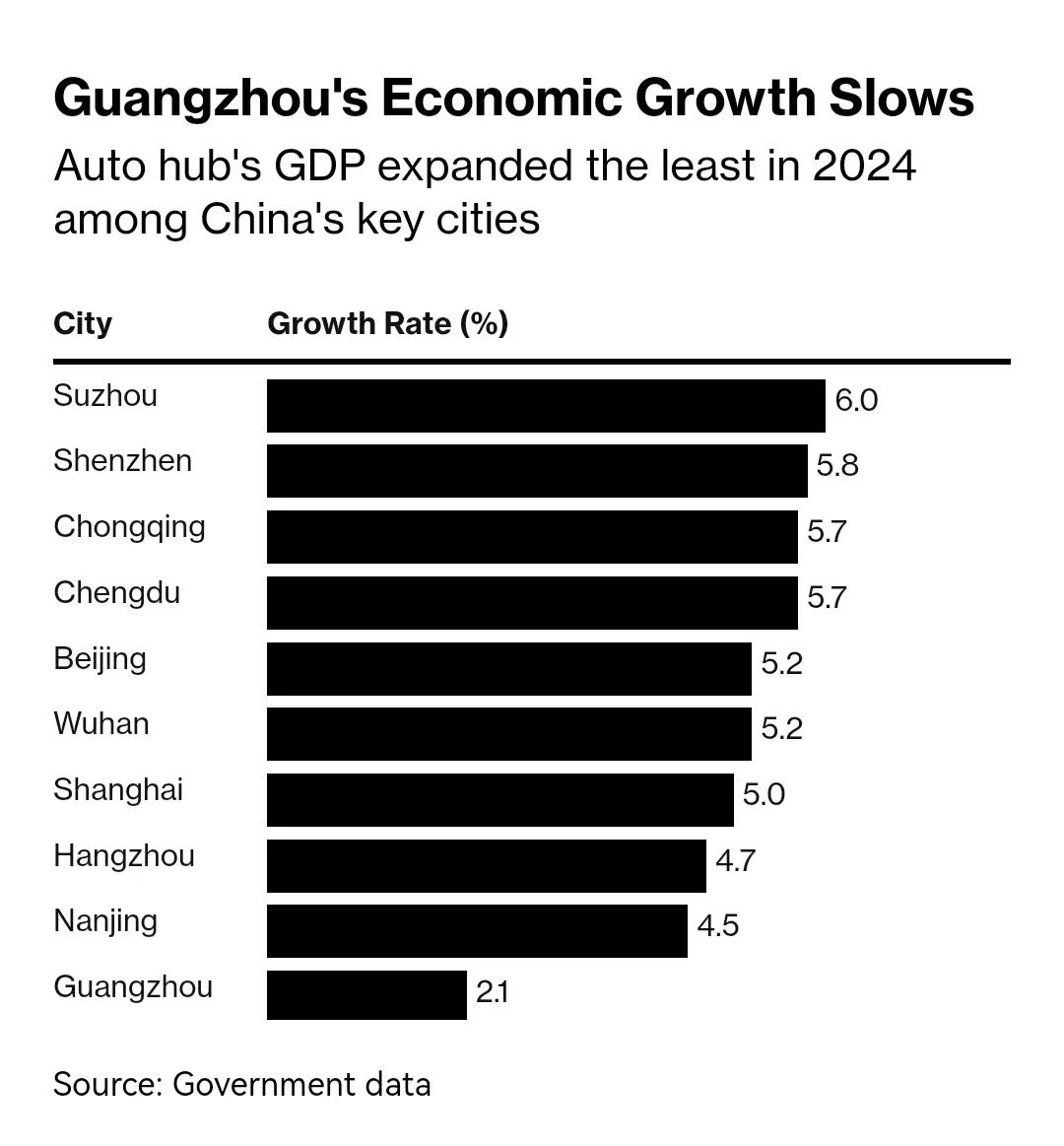

Shenzhen's overtaking and the industry's fluctuations are directly mirrored in economic growth rates. The contrasting fortunes of Shenzhen and Guangzhou have also sparked a chain reaction in their respective economies—

Dragged down by the automotive manufacturing industry (-18.2%), Guangzhou's GDP grew by only 2.1% in 2024, ranking second from the bottom among major cities, less than half of Shenzhen's growth rate (5.8%). That year, the GDP gap between Guangzhou and Shenzhen widened to nearly 600 billion yuan, with Guangzhou Toyota's production declining by 23%.

Established automotive cities like Changchun have also played out a similar script. This city, home to the headquarters of FAW Group, saw its production ranking slip from second in the country in 2020 to fifth in 2023.

In any industrial transformation, old players exit, and new ones emerge. More Chinese consumers prefer local brands, and the myth of former joint venture vehicles is gradually fading. The automotive industry boasts a huge and complex supply chain, where one move affects the whole body. However, transformation in this sector is often more thorough than others, bringing more drastic impacts on cities and economies.

Bloomberg recently noted that this is a unique moment with the newly inaugurated President Trump wielding the tariff stick, and Europe and the United States imposing tariffs on Chinese electric vehicles. Coupled with the fact that joint venture automakers are lagging behind in the field of intelligence, cities heavily reliant on these automakers will only feel an increasing sense of crisis.

On one hand, the old foundation urgently needs to be stabilized, and on the other, new increments need to keep pace. Years ago, Guangzhou supported emerging car manufacturing forces like XPeng and Evergrande, but the latter has faced a troubled fate, with Evergrande's 80-hectare factory in Guangzhou's Nanshan District now abandoned.

However, Guangzhou also boasts notable achievements.

The city has successfully nurtured the star enterprise XPeng Motors and attracted autonomous driving enterprises such as WeRide and Pony.ai to settle there. The Guangzhou government fund once invested 4 billion yuan to support XPeng Motors in establishing its second production base in Guangzhou, forming a "Guangzhou + Zhaoqing" dual-site manufacturing layout.

Chongqing also experienced a long-awaited high-profile moment in the past year. In the first half of 2024, Chongqing's cumulative automobile production exceeded 1.21 million vehicles, ranking first among cities nationwide, and after years of dormancy, it reclaimed the title of "China's First Automobile City." This was a competition between Chongqing and Guangzhou, with Changan and Thalys making invaluable contributions.

In Chongqing's automotive industry, Changan Automobile has provided the local area with a stable production and sales stock through the rapid implementation of its third round of innovation and entrepreneurship, while Thalys has emerged as a dark horse with the empowerment of Huawei's intelligent system, giving Chongqing considerable potential for new growth.

In the early stages of its cooperation with Huawei, Thalys lacked funds and was unable to support the expensive cost of advanced factories. At a critical moment in its transformation, the Chongqing government coordinated billions of industrial funds to build a super factory for Thalys, which was rented to the company at a low price for production. This decision was a testament to Chongqing's long-term vision and strategic wisdom.

Thanks to the success of Huawei's empowerment, Thalys has risen again, reflecting the ups and downs of Chongqing's industry over the years. In 2024, Thalys sold a total of 497,000 vehicles throughout the year, with a cumulative sales volume of 426,900 new energy vehicles, a year-on-year increase of 182%.

In 2025, Anhui began to reap the rewards of its transformation.

In the first two months of this year, Anhui's total automobile production reached 445,000 vehicles, and its total new energy vehicle production was 234,000 vehicles, both ranking first in the country, achieving a historic breakthrough.

BYD's strong position has made Hefei a new highland for the new energy vehicle industry in Anhui and even the entire country, while Chery, which has mastered the pace of going overseas, has rejuvenated Wuhu, becoming a highlight in the global automotive landscape. It's worth mentioning that Anhui also boasts multiple vehicle enterprises such as JAC, NIO, and Volkswagen Anhui, with great potential in the coming years.

The head of UBS China's automotive industry said that it is expected that by 2030, joint venture automakers will reduce production capacity by another 10 million vehicles, jeopardizing the profit pool of up to 20 billion US dollars (about 147 billion yuan) once enjoyed by joint ventures.

Editor-in-Chief: Cui Liwen, Editor: He Zengrong