March 2025 New Energy Vehicle Market Analysis: Penetration Tops 50%, Export and Domestic Sales Drive Growth

![]() 04/10 2025

04/10 2025

![]() 544

544

In March 2025, China's new energy vehicle (NEV) market sustained robust growth, with retail penetration surpassing 50%. Key metrics including production, wholesale sales, and exports all hit all-time highs. Bolstered by policy support and robust market demand, NEVs have emerged as the primary driver of growth in the domestic passenger vehicle market, while also showcasing strong competitiveness in international markets.

1. Production and Wholesale: Capacity Expansion and Market Supply Rise in Tandem

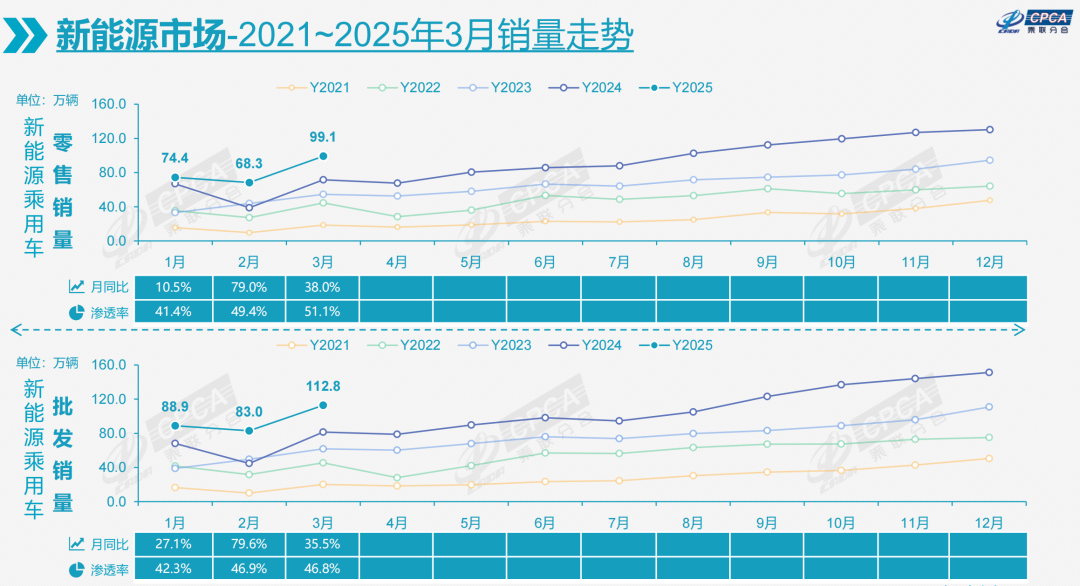

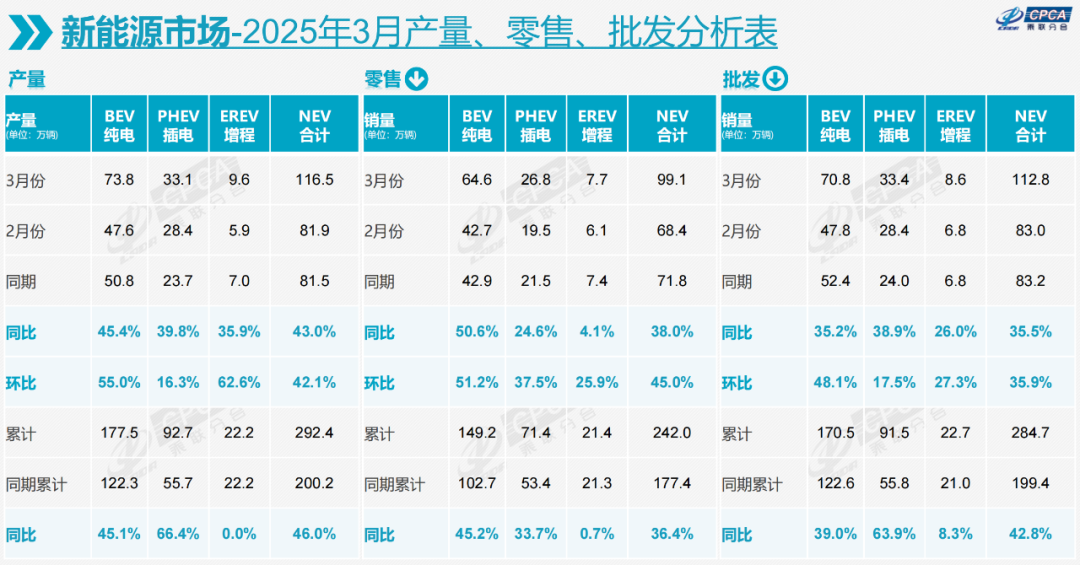

In March, NEV passenger vehicle production hit 1.165 million units, up 43% year-on-year and 42.1% month-on-month. Wholesale sales reached 1.128 million units, increasing 35.5% year-on-year and 35.9% month-on-month. Both production and wholesale figures set new records, reflecting rapid industry capacity expansion and efficient supply chain operations.

Notably, the wholesale penetration rate of NEV manufacturers reached 46.8%, up 9.2 percentage points from the same period last year. Among them, independent brands boasted a 63% penetration rate, while mainstream joint venture brands lagged at 5%, indicating that independent brands have further solidified their technological edge and market dominance in the NEV sector.

2. Retail: Penetration Surpasses 50%, Consumer Demand Continues to Surge

In March, NEV passenger vehicle retail sales reached 991,000 units, up 38.0% year-on-year and 45.0% month-on-month. The retail penetration rate climbed to 51.1%, an 8.7 percentage point increase from the same period last year, setting a new high.

From a market segment perspective, independent brands accounted for 71.5% of NEV retail sales, up 1.3 percentage points year-on-year. New force brands captured 17.1% of the market, up 3 percentage points, while Tesla's share stood at 7.5%, down 1.2 percentage points. Joint venture brands' NEV penetration rate remained at 6%, with their market share continuing to shrink.

3. Exports: NEVs Account for 36.6%, Plug-in Hybrids Shine

In March, NEV passenger vehicle exports totaled 143,000 units, up 6.4% year-on-year and 21.2% month-on-month, accounting for 36.6% of total passenger vehicle exports. Plug-in hybrid models saw a 202% year-on-year increase in exports from January to February, a trend that continued in March.

In terms of export destinations, developed countries like Belgium, Mexico, and the United Kingdom exhibited strong market performance, while Southeast Asian markets such as Thailand and the Philippines also emerged as key growth areas. Independent brands like BYD, Chery, and Geely continued to increase their overseas market share, driving China's NEV exports.

4. Automakers and Models: BYD Leads, New Force Brands Rise

In March, BYD maintained its leadership in the NEV market with wholesale sales of 371,000 units, marking a significant year-on-year increase. Traditional automakers such as Geely, Chery, and Changan also made significant strides in the NEV sector, with notable wholesale sales growth.

Among new force brands, Xiaomi Automobile ranked high with sales of 29,244 units, while NIO and XPeng continued to expand their market presence. In terms of models, BYD Song led with sales of 96,087 units, followed by Tesla Model Y and Wuling Hongguang MINI. NEV models dominated the top 9 spots in overall passenger vehicle sales, underscoring their market dominance.

5. Market: Policy and Demand Synergy, NEVs as the Growth Engine

March's robust NEV market performance was fueled by both policy support and consumer demand. China's 300 billion yuan special treasury bonds for consumer goods trade-ins, coupled with local consumption promotion policies and auto show activities, further unleashed market potential. Simultaneously, NEVs' high cost-effectiveness and technological advantages have made them increasingly competitive in both domestic and international markets.

With the deepening of the Belt and Road Initiative, the penetration of Chinese NEVs in developing country markets continues to rise, offering a "Chinese solution" for global green travel. Despite rapid market growth, the industry still faces challenges such as low profit margins and intensifying international competition. Moving forward, automakers must enhance profitability through technological innovation and cost reduction while accelerating their global footprint to solidify their international market leadership.