2024 Financial Report Review of 9 Private Auto Makers: Unveiling China's Auto Industry's Strongest Contender

![]() 04/11 2025

04/11 2025

![]() 600

600

China's Auto Industry: Who Reigns Supreme?

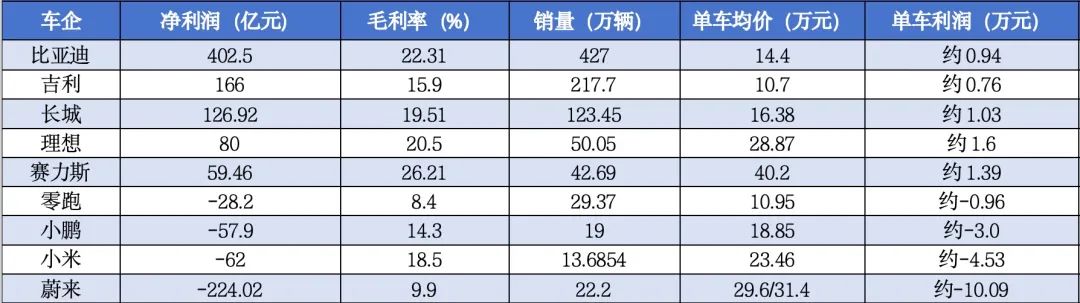

On the surface, BYD stands tall with sales exceeding 4 million vehicles and net profits topping 40 billion yuan, leading one to ask, "Who else?" However, delving deeper, the landscape reveals multiple formidable players.

With Thalys' financial report now released, all major private automakers in China have unveiled their 2024 financials. The traditional heavyweights include BYD, Geely, and Great Wall, while the up-and-coming "new forces" comprise NIO, Xpeng, and Li Auto. Additionally, there's the latest trio of Thalys, Li Auto, and Xiaomi, alongside the rising star Leapro, which once challenged the top spots with its robust sales, ranking second in 2024.

Among these automakers, BYD reigns supreme in both sales and operations. In 2024, BYD sold 4.27 million vehicles, leading the industry by a wide margin. Geely follows with 2.177 million sales, and Great Wall with 1.2345 million. Brands with sales between 500,000 and 1 million include Li Auto (500,500), Thalys (426,900), Leapro (293,700), NIO (222,000), Xpeng (190,000), and Xiaomi (136,800).

BYD's annual profit of 40 billion yuan is unmatched, with neither Geely nor Great Wall coming close to half that figure.

Geely and Great Wall reported net profits of 16.6 billion and 12.692 billion yuan, respectively, in 2024. Geely's higher net profit was bolstered by non-recurring gains from asset disposals, including a one-time gain of 9.264 billion yuan from AH. Adjusting for these gains, Geely's actual net profit falls below Great Wall's profitability this year.

In terms of profitability, BYD, Geely, and Great Wall currently top the list. However, newcomers Li Auto and Thalys are swiftly catching up. Li Auto earned 8 billion yuan in 2024, which would have surpassed Geely's adjusted net profit. Thalys, with a net profit of 5.946 billion yuan in 2024, is poised to increase its profits further with more AITO products on the horizon, posing a challenge to the top three.

Meanwhile, other automakers are still incurring losses. Leapro lost 2.82 billion yuan but achieved profitability in the fourth quarter of 2024, indicating a likely profitable year in 2025. Xpeng reported a net loss of 5.79 billion yuan in 2024 but is expected to turn a profit in the fourth quarter of this year as sales grow rapidly. Xiaomi Auto currently loses 6.2 billion yuan but anticipates profitability as its product line expands.

NIO faces the steepest challenge, losing 22.402 billion yuan in 2024—more than the combined losses of other companies. NIO is undergoing significant reforms to cut costs, including CEO changes at Ledao and CFO oversight of the energy sector. Rumors suggest CATL may take a controlling stake in NIO's battery swap business, highlighting the urgency for profitability. NIO aims to become profitable in the fourth quarter of this year.

Regarding average vehicle price, Thalys leads the pack. Using automotive business revenue divided by vehicle sales, Thalys' 2024 average price was 402,000 yuan, followed by NIO at 314,000 yuan. Five automakers have an average price above 200,000 yuan, with Li Auto (282,000 yuan), Xiaomi (234,600 yuan), and Xpeng (188,600 yuan) rounding out the top five.

The remaining companies have average prices below 200,000 yuan, with Great Wall at 163,800 yuan, BYD at 144,000 yuan, and Leapro at 109,500 yuan—even surpassing Geely's 107,000 yuan. This suggests that while BYD and Geely are large-scale, many of their products target the sub-100,000 yuan market. For example, BYD sold 1.639 million vehicles in this segment in 2024, accounting for 38.2% of its total sales, while models above 200,000 yuan accounted for only 11.1%.

Profit per vehicle generally aligns with average price, with slight variations. Li Auto leads with 16,000 yuan per vehicle, followed by Thalys at 13,900 yuan. AITO's profit per vehicle is likely higher, but Thalys' Blue Power brand lowers the overall average. Great Wall ranks third with 10,300 yuan per vehicle, explaining its high net profit despite a sales volume of only 1.26 million vehicles.

Geely's book profit per vehicle is 7,600 yuan (based on a profit of 16.6 billion yuan). Adjusting for non-recurring gains, Geely's net profit is 8.524 billion yuan, reducing its actual profit per vehicle to approximately 3,900 yuan. The remaining companies are currently incurring losses, with Leapro losing 9,600 yuan per vehicle in 2024, Xpeng losing about 30,000 yuan per vehicle (excluding software business revenue from Volkswagen), Xiaomi Auto losing 45,300 yuan per vehicle, and NIO losing 100,000 yuan per vehicle.

Gross margin, another crucial operational indicator, places Thalys atop with 26.21%, even higher if considering only the AITO brand. BYD's automotive segment follows with 22.31%, and Li Auto ranks third at 20.5%. Great Wall, despite ranking third in profit per vehicle, has a gross margin of 19.51%, reflecting its efficient management and cost control. Geely's gross margin of 15.9% indicates solid performance.

Among non-profitable automakers, Xiaomi's gross margin stands at 18.5%, while Xpeng's is 14.3%. NIO's overall gross margin is 9.9%, and Leapro's is 8.4%. However, NIO, Leapro, and Xpeng all saw significant gross margin improvements in the fourth quarter of 2024, with NIO at 13% and Leapro at 13.3%. Based on these metrics, Thalys emerges as the strongest player.

While BYD sets the benchmark in the auto industry, there's still room for growth. Geely, post-restructuring, and Thalys with AITO, are solidifying their EV strategies. Li Auto focuses on operations and quality, Great Wall on management excellence, and Xiaomi Auto, Xpeng, NIO, and Leapro all exhibit significant growth potential. Each has the potential to become the next king.

(This article contains substantial data. Please contact us for corrections if any errors are found.)