Plug-in hybrids and extended-range vehicles have hit rock bottom, and pure electric vehicles are about to see a major price drop

![]() 04/14 2025

04/14 2025

![]() 660

660

Thanks to BYD, intelligent driving is no longer expensive. Thanks to Geely and Chery, the prices of plug-in hybrids have hit rock bottom. Next up, it will be major price drops for pure electric vehicles.

A series of pure electric vehicle models to be unveiled at the Shanghai Auto Show are all formulating new pricing strategies as the prices of plug-in hybrids continue to decline. Among them, the most aggressive are undoubtedly NIO, which aims to achieve profitability in the fourth quarter of this year, as well as Tesla and Elon Musk, who have recently faced numerous setbacks.

"Chery is going all in for its IPO, so it has reduced the prices of its entire line of plug-in hybrids and extended-range vehicles by 20,000 to 30,000 yuan. Most companies can't keep up, especially joint ventures," said a senior industry insider when commenting on Chery's new moves as Li Xueyong unveiled all of Chery's price reduction strategies at the Chery Hybrid Night. Relying on exports, Chery sold over 1.14 million vehicles in 2024. Many models priced at just over 200,000 yuan domestically sold for more than Toyota's Prado in the Middle East. Relying on the growth in gasoline vehicle sales, Chery sold 2.02 million vehicles in 2024, a year-on-year increase of 18.4%. Chery has become the second Chinese automaker qualified to follow BYD's lead in significantly reducing the prices of its entire line of new energy vehicles. Unlike BYD's model, which has been brewing in the new energy sector for 10 years and has achieved a self-research and self-production model, Chery chooses to use gasoline vehicles and other revenue streams to support its new energy business.

In summary, ahead of the 2025 Shanghai Auto Show, leading automakers have already begun marketing efforts in advance to avoid their effectiveness being diluted amidst the high traffic of the auto show. Meanwhile, it's not just Chery making moves. BYD is also making moves with the Han L and Tang L, as well as Wuling and Geely. As of early April, it is an indisputable fact that the plug-in hybrid landscape has already changed.

Have plug-in hybrid prices already hit their theoretical low?

The main participants in this new round of price reductions are currently BYD, Chery, and Geely. Chery's most noticeable move has been to start with significant price reductions of at least 20,000 yuan on its current models. BYD and Geely, on the other hand, have offered unexpectedly low prices on their new models.

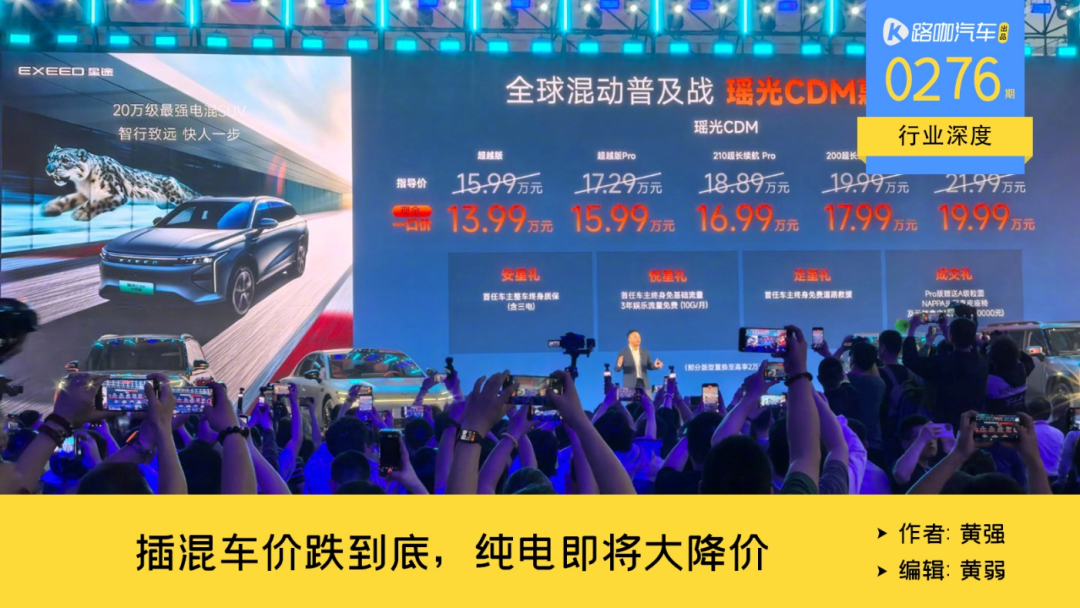

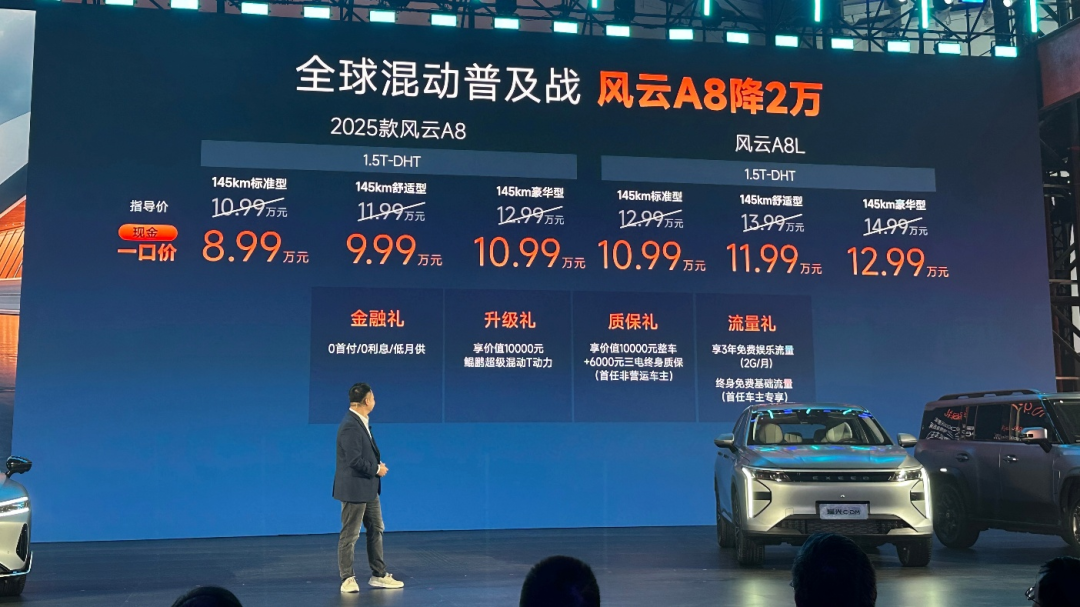

Chery has seen a general price reduction of 20,000 to 30,000 yuan, including a 20,000 yuan reduction across the entire Fengyun A8 lineup, bringing prices down from the previous range of 109,900 to 149,900 yuan to 89,900 to 129,900 yuan. The Xingtu Yaoguang C-DM lineup has also seen a 20,000 yuan price reduction, with the price range dropping from 159,900 to 219,900 yuan to 139,900 to 199,900 yuan. Pure electric models such as the iCar 03 have also seen direct cash discounts, with prices dropping from 119,800 yuan to 99,800 yuan.

Even Jietu, known for its affordable "cost-effective butcher" pricing, has reduced the prices of its four plug-in hybrid models - Shanhai T1, Shanhai T2, Shanhai L6, and Shanhai L7 - by 10,000 to 20,000 yuan. Combined with local subsidies for trade-ins, the lowest price offered is 117,900 yuan. Additionally, the Chery Fengyun T9 and Fengyun T10 also include local trade-in subsidies, with starting prices of 119,900 yuan.

However, it's not just about price reductions. With years of IPO dreams pent up, many Chery employees are eager to cash in their equity and achieve financial freedom after the company goes public. Therefore, Chery has also unveiled a series of combined strategies.

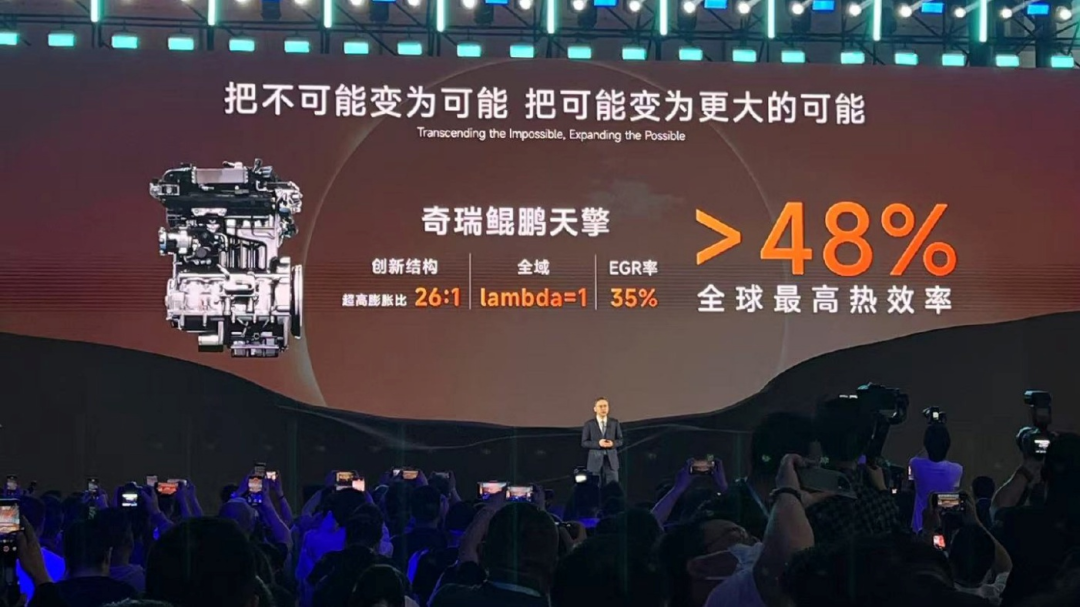

These include the launch of over 39 hybrid models in 2025, including 23 hybrid products for overseas markets, comprising 3 oil-electric hybrids, 16 plug-in hybrids, and 4 extended-range vehicles. More fuel-efficient Chery models will be introduced in large numbers. Additionally, Chery has secured a strong voice at the conference, claiming that "Chery sets the technical standard for plug-in hybrids in China," "Chery's next-generation plug-in hybrid engine has a thermal efficiency greater than 48%," and "Chery has the highest global thermal efficiency for mass-produced plug-in hybrids," given that it has already set a Guinness World Record for a full tank and full charge range of over 2,260 km on a sedan.

All of the above is aimed at making ordinary consumers aware of Chery's strong plug-in hybrid technology capabilities, thereby competing for user recognition with BYD, Geely, and Changan. Looking at Geely's actions, the Xingyao 8 has begun pre-sales with a pre-sale price range of 139,800 to 173,800 yuan. It features Deepseek, standard high-speed NOA, 3L-level fuel consumption, and most importantly, it is priced 30,000 yuan lower than the BYD Han and 70,000 yuan lower than the Han L.

From official data alone, the performance differences brought about by advancements in plug-in hybrid technology are not significant. The data is as follows:

The Chery Fengyun A8 has a combined range of over 1,400 km on a full tank and full charge; the Xingtu Yaoguang C-DM has a combined range of over 1,400 km on a full tank and full charge; the 2025 BYD Han has a combined range of 1,350 km on a full tank and full charge; and the Geely Xingyao 8 has a combined range of over 1,400 km on a full tank and full charge.

However, due to differences in operational capabilities among different companies, pricing strategies can vary. Compared to performance over the past three years, plug-in hybrid prices have now hit rock bottom. The BYD Qin PLUS defined the starting price for A-segment plug-in hybrid sedans at 79,800 yuan, and the Fengyun A8 has snatched the pricing definition rights from the previously entry-level mid-size plug-in hybrid sedan, the Qin L, with a starting price of 89,900 yuan instead of 99,800 yuan. The pricing power for the most mainstream mid-size sedans has shifted to the Geely Xingyao 8, which has seized the pricing rights from the BYD Han with a starting price of 139,800 yuan instead of 165,800 yuan.

However, there is still competition among plug-in hybrid SUVs. The Fengyun T9 has an entry-level price of 124,900 yuan, and the Fengyun T10 has an entry-level price of 177,900 yuan, both offering relatively differentiated pricing. Meanwhile, the BYD Song Pro, Song PLUS, and Geely Xingjian 7 still dominate the pricing for the most popular home-use segments with starting prices of 102,800 yuan, 135,800 yuan, and 115,800 yuan, respectively, for A-segment entry-level, mid-level, and fully equipped models.

Regardless, the current pricing for plug-in hybrids has reached an all-time low. Considering the continued narrowing of financing options and the rarity of automakers with Chery's and Geely's ability to support their new energy business with revenue from gasoline vehicles and other sources, mainstream plug-in hybrid models have basically hit rock bottom. As a result, the impact will be felt in the pure electric segment.

Don't be surprised if the LeDao L90 is priced under 200,000 yuan

There is an inverse relationship between gasoline vehicles and new energy vehicles. Therefore, when the prices of new energy vehicles drop significantly, gasoline vehicles must follow suit until there is no room for further reductions. Judging from the adjustments made by various joint ventures to their gasoline vehicle offerings since the Spring Festival, prices have now hit rock bottom.

For example, to avoid excessive sales losses for dealerships, Toyota has directly changed the pricing model of the Corolla to a fixed price of 89,800 yuan, similar to a purely direct sales model. From Dongfeng Nissan to SAIC-GM, most companies have introduced fixed pricing models. Even Cadillac has moved to a two-tier pricing system (an official fixed price, with additional discounts of over 5,000 yuan if the dealership cannot sell the car).

Volkswagen, the most capable gasoline vehicle automaker, is no longer planning direct price reductions but has instead switched to offering lifetime warranties on its vehicles to stimulate consumer confidence. For example, when the Teramont Pro was launched, its price was already lower than that of new energy vehicles, dropping from an entry-level price of over 300,000 yuan for the previous generation to a starting price of 269,900 yuan for the four-wheel drive version. In March, the Teramont family received 6,500 orders, which is over 50,000 yuan lower than the entry-level price of 321,800 yuan for the Li Auto L8. This represents the best performance among gasoline vehicles but also demonstrates market momentum.

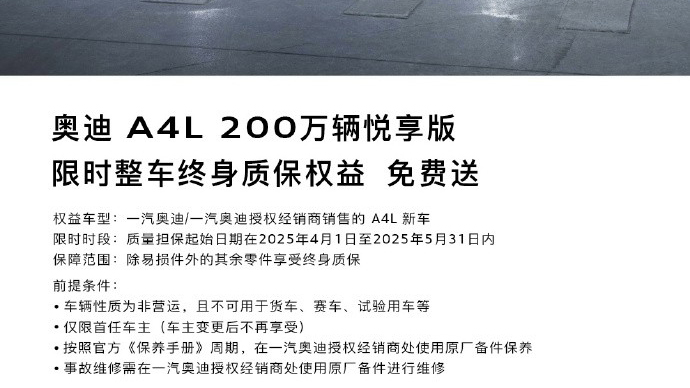

Currently, automakers focused on gasoline vehicles have offered various measures. Dongfeng Nissan has upgraded to lifetime warranties for all its gasoline vehicle models, while SAIC Volkswagen and FAW-Volkswagen have also upgraded to lifetime warranties. Audi has begun testing lifetime warranties in the luxury vehicle segment, offering lifetime warranties on the existing Audi A4L before the launch of the Audi A5L, valid until May 31, 2025.

In other words, gasoline vehicles have also hit rock bottom in terms of pricing.

Next up, there will be a trend of major price drops for pure electric vehicle models. With precedents set by XPeng and the latest pushes from BYD, Geely, and Chery, pure electric vehicle models will face significant pressure if they choose not to reduce prices but instead hold firm.

"LeDao L90 is currently discussing its internal pricing. The core debate is whether to reduce the price to below 250,000 yuan, or even 200,000 yuan after BAAS, or to aggressively enter the 200,000 yuan price range directly," said an insider. At the upcoming Shanghai Auto Show, the LeDao L90 will make its official debut and must make a big splash in the market all at once.

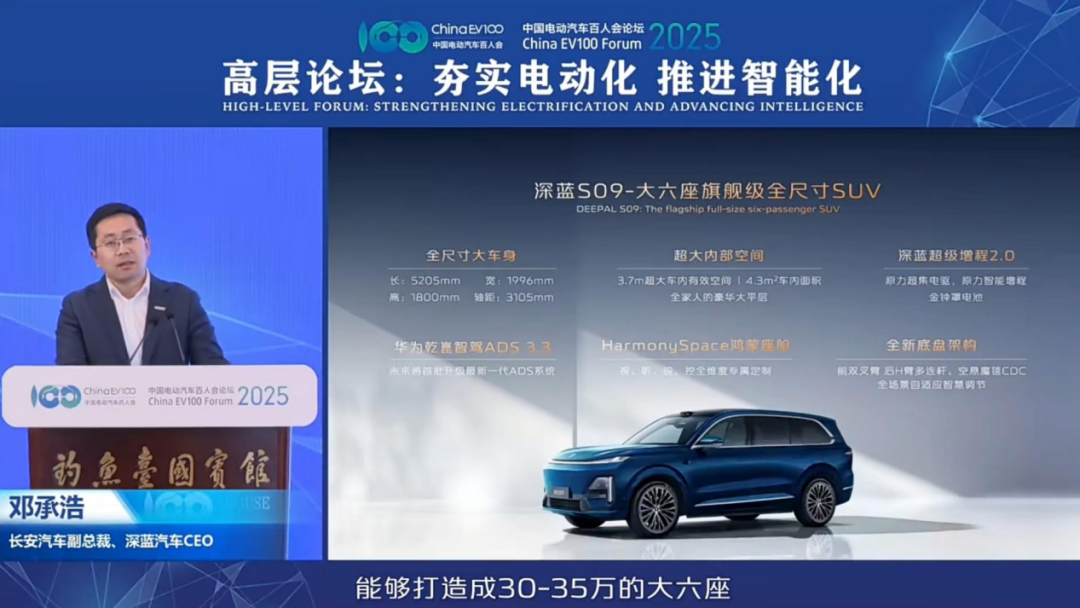

If LeDao continues to use its previous strategy of targeting the Li Auto L8, it will clearly be unable to keep up with the pace. Nearly 20 models have already set their sights on the market for large-size 6-7 seat new energy SUVs. The blue ocean previously occupied by the Li Auto L8 and AITO M9 is now a fiercely competitive red ocean. The Jietu Shanhai L9 has a pre-sale price starting at 169,900 yuan, and the Zero Run C16 already brought the price of medium and large SUVs down to 155,800 yuan in 2024. This year, it will also launch a model targeting the Li Auto L9, likely at half the price, starting at under 200,000 yuan. At the China EV100 Forum, Deng Chenghao hinted that the Deep Blue S09 would target the 300,000 to 350,000 yuan market segment, and based on Deep Blue's previous pricing model, it is expected that a starting price below 300,000 yuan will not be a problem.

",

",

Multiple sources have collectively confirmed that Tesla will develop and produce a new SUV in Shanghai with a cost 20% lower than the Model Y, internally codenamed E41. Currently, the Model Y's guidance price range is 263,500-313,500 yuan, so the starting price of E41 is likely to be between 210,000-220,000 yuan, or even within 200,000 yuan considering mass production and cost reduction through reusing existing technology.

In addition, more pure electric vehicle models aim to change the existing market rules. During Wuling's Technology Night in early April, it also announced a new motor capable of 30,000 RPM, and set a pre-sale starting price of 132,800 yuan for the Baojun Xiangjing. Seeing the popularity of the XPeng M03, more and more traditional manufacturers are beginning to try to beat XPeng using XPeng's model. Besides Wuling, there are also Aion RT and the recently launched Qin L EV.

Another example is the 150,000 yuan-level pure electric SUV. BYD has directly set the pre-sale price of the FANGCHENGBAOO Titanium 3 at 139,800 yuan, regaining the initiative.

Final Thoughts

The automotive market is always a chain reaction model, so every subtle move by leading automakers will have the effect of a butterfly flapping its wings.

Therefore, regarding the topic of pure electric vs. plug-in hybrid vs. extended-range electric vehicles, it is difficult to find an answer in the short term. At present, everyone is engaged in an arms race involving technological competition, price competition, and system competition. For example, although plug-in hybrids are currently gaining momentum, with more and more automakers quickly seizing market share from gasoline vehicles with plug-in hybrids, the combat effectiveness of extended-range electric vehicles within 300,000 yuan is gradually declining. However, in Ideal's new technology offensive, the next generation of extended-range systems is expected to be launched as early as this year, with a research and development target of 6L/100km fuel consumption after battery depletion, which will address current user complaints of 9L/100km fuel consumption after battery depletion. HarmonyOS Intelligent Driving also follows the same research and development logic for the next generation of extended-range systems, aiming for more solid pure electric range and more economical fuel consumption of the range extender.

In short, the price of pure electric vehicles is expected to continue to decline starting from the Shanghai Auto Show, and there may even be opportunities for them to be lower than plug-in hybrids and extended-range electric vehicles in segmented markets.