The Disenchantment Moment of the Shanghai Auto Show

![]() 04/21 2025

04/21 2025

![]() 469

469

Introduction

The current Shanghai Auto Show is painting a vivid picture of the automotive landscape and trends set to dominate post-2025 through a campaign of disenchantment.

Amidst a flurry of pre-announced press conferences, the Shanghai Auto Show is gradually reaching its peak activity.

This year's Shanghai Auto Show holds landmark significance. Not only did Shanghai win the bid against Beijing for hosting rights, but the theme "Embrace Innovation, Win-Win Future" stands out amidst the chaos of price wars, intelligent battles, and new energy transformations. It underscores a core idea: innovation is the fundamental driver of industry development, and win-win cooperation is the main theme of the automotive industry's future, not a deadly struggle.

As industry observers, Gongshe has always been insightful about the dynamics of the automotive market, delving into the fundamentals behind the phenomena. When discussing the theme that should encapsulate this year's auto show, the editorial team settled on one word: disenchantment.

Literally, "disenchant" means "to remove," and "enchantment" can be understood as "mysterious attractiveness." Disenchantment is the process of shedding mystique, revealing the truth by taking action and getting closer. It is through disenchantment that one sees the essence of things and begins the journey towards becoming stronger.

In a market with a capacity for 30 million vehicles, where the world's largest number of automotive brands converge, amidst the most diverse consumer demands, and with rapid advancements in electrification and intelligent transformation, the Shanghai Auto Show, representing the forefront of the Chinese automotive era, is painting a vivid picture of the automotive landscape and trends set to dominate post-2025 through a campaign of disenchantment.

Luxury is being disenchanted, entering an era of equality. When Hongqi Jinkuihua and Zunjie S800 allow autonomous brands to enter the Mercedes-Maybach market for the first time at a price of millions, when Zeekr 009 captures half of the market share of four-seat ultra-luxury products, and when Wenjie M9 and Lixiang L9 snatch market share from BMW X5 and Mercedes-Benz GLS with higher sales, the definition of luxury is being reshaped by the times.

What is luxury? Safety, quality, functionality, intelligence, brand, time, or price? Traditional luxury brands rely on safety, quality, time, user accumulation, and brand philosophy to interpret their brand connotations and set barriers for newcomers. The crux is that luxury is not promoted.

However, for those aiming to break into this luxury market, products and experiences reign supreme, always their magic weapon to break through labels and constraints. Even if extended-range technology is outdated, and pure electric products cause anxiety for most, where do the consumers of these products care? Refrigerators, TVs, large sofas, combined with the new experience of new energy smart cars, stacking configurations unheard of in the past, even if low-frequency, and raising prices, there will naturally be a group of luxury car users willing to pay. They call it the era of luxury equality.

So what is the essence of luxury? What kind of disenchantment moment is the luxury car market experiencing? When Mercedes-Benz and BMW sense market and consumption trends and start focusing on intelligence and experience, where lies the competitive edge for new luxury car brands? This is a question not only for BBA but also for newcomers to the luxury threshold, who need to reflect on the past 30 to 50 years.

Wenjie M8, which has secured over 100,000 small orders, Xiaomi YU7, absent from this year's auto show, and Zeekr 9X Brilliance, on the cusp of breaking through the benchmark of China's new energy value, each model will provide a definitive answer to the above questions.

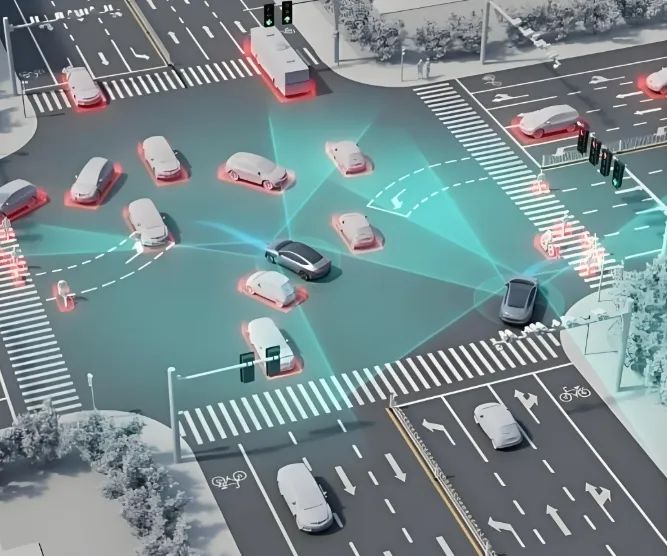

Intelligent driving is being disenchanted, wearing a tight hoop. Originally, many automakers planned to make a splash with intelligent driving at the Shanghai Auto Show. Unfortunately, due to the heat and public opinion surrounding a certain incident, the authorities had to intervene and impose strict regulations on intelligent driving development. "Do not use terms like automatic, autonomous, intelligent driving, or high-level intelligent driving. It is recommended to use combined assisted driving," "Disable valet parking, one-click summoning, and remote control," "Do not casually OTA. For emergency OTA, follow recall and production stoppage procedures..."

After this topic gained widespread attention, in recent days, automakers exhibiting at the Shanghai Auto Show have generally become less enthusiastic about promoting intelligent driving. Some automakers have started to downplay intelligent driving during press conferences, while others have begun using the new term "combined assisted driving" when communicating with the media.

Indeed, in the past, intelligent driving was heavily hyped, with various new terms used to package it, erasing the 0.01% risk and making consumers trust its 100% capability. However, as a mobile means of transportation, cars differ from electronic products like mobile phones. Even a 0.01% error can threaten people's lives and property.

Moreover, intelligent driving performance varies in perception from person to person. Different consumers have different evaluations of intelligent driving. Some find it highly capable, while others think the machine drives poorly. Whether it is top-tier or not is often subjective. Although we recognize that due to technological development and progress, L2-level driving assistance can already achieve a high level, before national policies are liberalized, the ambiguity of many rules and unclear rights and responsibilities will constrain intelligent driving. This is not a technical issue but more about the upgrading of the rule of law and ethics.

As the entire industry discusses intelligent driving, and all new forces, autonomous brands, and mainstream joint venture automakers comprehensively enter the intelligent driving race, is intelligent driving the entirety of a brand or just a single advanced feature? This answer will come from consumers, including netizens confused by public opinion.

Price wars are being disenchanted, and the pricing system is being reshaped. It is almost certain that price wars have never ceased since the vigorous development of the automotive industry. The essence of price wars is excess competition. There are over 600 new car models on sale in the Chinese market, of which only 60 to 70 sell over 10,000 units per month, and less than 120 sell over 5,000 units per month. Almost 80% of the cars are mere supporting players.

Supporting players need to rise and increase sales, inevitably leading to price adjustments, the most direct method. When price wars erupt nearby, affecting the entire market, should one follow suit? Facts have proven that we are all in the same boat. Sales volumes fluctuate, and to gain market share, one must endure the pain of cutting prices, because for future auto markets, scale is essential for reaching a peak.

Therefore, from BYD to Geely, from Chery to Changan, even though they are currently the top four domestic automakers, they can be said to be setting prices lower and more aggressively than each other. The goal is not only to compete for consumers but also to quickly capture half of the market share, ruthlessly driving some mid-to-low-tier automakers and brands out of the market.

Under this scenario, all automakers can be said to be open about it, especially joint venture automakers offering their most sincere one-price deals. From Honda's electric vehicles S7/P7, with a one-time price reduction of 60,000 yuan, to Buick Regal priced at 100,000 yuan, almost all mainstream joint venture brands are trying to gain a foothold in the fuel vehicle and new energy markets by unifying terminal prices and reducing internal sales consumption.

This new pricing logic essentially redefines market rules by joint venture automakers. Its core lies in eliminating the price negotiation space of traditional dealers, which not only guarantees dealers' profits but also frees consumers from bargaining anxiety, focusing more on product and service experiences, achieving a win-win situation for both "self-interest" and "altruism".

Technology is being disenchanted, with more diverse Sino-foreign cooperation. The question of whether Chinese technology is stronger or overseas technology is more capable has been widely discussed in recent years. In other words, when selecting technology and supply systems, should automakers prioritize domestic technology and supply chains emphasizing speed and efficiency, or should they prioritize overseas suppliers adhering to quality, safety, and stability? This is indeed a tough choice. One cannot have the best of both worlds.

If the sole goal is sales and market share, most automakers will resolutely invest in the local supply chain. However, each automaker upholds different philosophies, creating a more diversified market landscape. Including this year's Shanghai Auto Show, visible enterprises in the parts and components sector have been very active, competing to hold press conferences during the show to express their voices. Domestic and international enterprises are on par.

In the impression of many, the rise of autonomous brands and the strength of Chinese technology within them have naturally given rise to national confidence and pride. However, it also needs to be recognized that the foundation of Chinese technology was gradually cultivated and brought by a group of joint venture automakers in the past, from technology to talent and more. Chinese technology is still far from being able to independently support the development of the Chinese automotive industry.

As an industrial product with tens of thousands of parts, a car cannot do without any of them, which also means it is the result of diverse technological cooperation. This also involves competition in production volume, layout, and market sectors. Every parts and components company with strength and status in this industry, whether domestic or overseas, is an indispensable link.

Just as Volkswagen joins hands with XPeng, FAW cooperates with Leapmotor, and more joint venture automakers embrace China's intelligent cabins and intelligent driving, the process of Sino-foreign technological cooperation and collision, as well as the new opportunities and possibilities that have emerged, are the highlights of this industry that deserve more attention.

Products are being disenchanted, and autonomous brands can also make large cars. Once upon a time, China's product definitions were set by the German automotive industry, with standards and paradigms for length and wheelbase from Class A to Class C. However, when Chinese automakers began developing forward-looking capabilities, over-level competition became a killer move for many autonomous automakers to counterattack, using larger vehicles to compete against smaller ones, selling products of the same size or larger with higher configurations at a cheaper price; spending the same amount of money, one can buy products and experiences that are two levels higher.

In the last round of competition between autonomous automakers and joint ventures, this strategy was tried and true, laying the foundation for the current market share of nearly 70% held by autonomous automakers. However, within these 70%, the mutual slaughter among autonomous brands can be said to be even fiercer than that between autonomous and joint venture brands. After all, they are all smart Chinese companies with similar tactics, just like the increasing number of large SUVs.

At this year's Shanghai Auto Show, large SUVs can be said to be the core protagonists. The debut of Zeekr 9X, Letao L90, and Trumpchi Xiangwang S9, including the already unveiled Wenjie M8, Lynk & Co 900, Deep Blue S09, Hyperion HL, Chery Fengyun T11, etc., have nearly 10 products competing in the same segment market.

Why can autonomous brands make large cars? On the one hand, advancements in new energy technology and the improvement of the supply chain system have compensated for the weaknesses of autonomous brands in powertrains, fuel consumption, and chassis in the past. On the other hand, as autonomous competition has reached this point, the low-end and mid-end markets have long been saturated, and there is an urgent need to develop upwards against the backdrop of consumption upgrades. Of course, it is also related to the fact that companies like Lixiang and Wenjie have taken the lead in layout and achieved outstanding results. If others can succeed, why can't they?

As a result, the homogenization of large SUVs is becoming more severe, with 5-meter lengths, 3-meter wheelbases, large six-seater configurations, refrigerators, ceiling screens, large connected screens, rotating seats, etc. Technological configurations and experiences have already achieved equality. To stand out in the complex auto market, it ultimately depends on brand strength and marketing capabilities. For consumers, after all, these are cars costing 300,000 to 400,000 yuan, so they won't be that bad.

The market is losing its enchantment, making survival a paramount concern. Amid discussions on luxury, intelligent driving, pricing, technology, and products, competition inevitably boils down to market performance. All capabilities must be scrutinized and understood within the crucible of the market. The absence of numerous automakers from this year's Shanghai Auto Show underscores this trend.

For the first time since entering China in 2002, Hyundai, Kia, and Genesis are missing from a Class A auto show. This absence is tied to their product planning cadence, strategic shifts, and dwindling market share. Even SAIC-GM Chevrolet, a local player, rarely misses local auto shows, hinting that GM may be reallocating resources towards Buick and Cadillac. The absence of familiar names like NIO, Leapmotor, Hozon Auto, and Voyah also signals that these brands are at a critical juncture, facing potential silence, decline, or even bankruptcy.

The automotive market offers no shortcuts. Sales volume, profit, system efficiency, and the health of enterprise development are indispensable survival metrics for every automaker. Any lapse in these areas can be devastating. As we enter the fiercely competitive year of 2025, survival becomes the cornerstone of development.

While leading automakers may not grapple with the same troubles, many joint ventures must navigate how to offer Chinese solutions in the intelligent and new energy markets. A cohort of joint ventures at this year's Shanghai Auto Show will undoubtedly present their problem-solving strategies and answers.

For automakers and brands with monthly sales hovering around 10,000 or even less than 30,000 vehicles, navigating a turbulent market where concentration is increasingly shifting upwards becomes crucial. Retaining their footing and embracing opportunities for healthy development may be even more vital.

As NIO and Letao have encountered trust crises, and others like NIO Auto have stumbled, the reality is stark: once enterprises and brands decline, regaining momentum is exceedingly difficult.

For a Shanghai Auto Show marked by disenchantment, what state do you anticipate witnessing, and what answers do you seek to uncover?

Editor-in-Chief: Li Sijia

Editor: Chen Xin'nan