Shanghai Auto Show Highlights: Oil Cars Stage a Surprising Revival

![]() 04/27 2025

04/27 2025

![]() 577

577

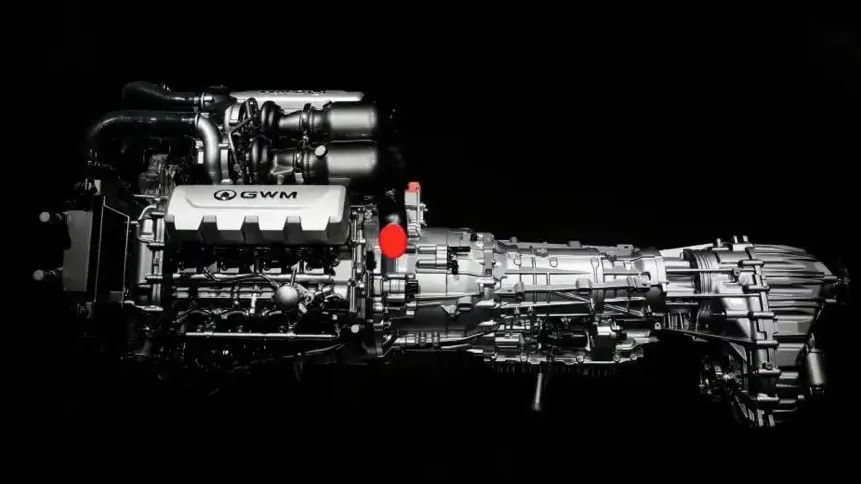

"Irreplaceable" was the ubiquitous slogan at Porsche's stand at the 2025 Shanghai Auto Show. Porsche showcased 18 vehicles, including 9 museum pieces, defying the trend of "fuel vehicles belonging in museums." Despite lacking flashy tech, Porsche's booth was more popular than Xiaomi and Wenjie, with visitors queuing for up to three hours. Great Wall Motors was equally "stubborn," vowing not to make range extenders and exhibiting a 4.0TV8 engine, a stark contrast to its all-in rivals on new energy.

Statistics reveal that out of the new cars at this year's Shanghai Auto Show, 67 were new energy models and 30 were traditional fuel vehicles. While new energy models dominated, 30 new fuel vehicles are significant. Earlier predictions anticipated fuel vehicles nearing extinction by 2025. McKinsey's "2025 Insights into Chinese Automotive Consumers" found that over 30% of EV owners regretted buying fuel vehicles last year and intended to switch back. This "regret rate" was higher than for plug-in hybrids and range extenders.

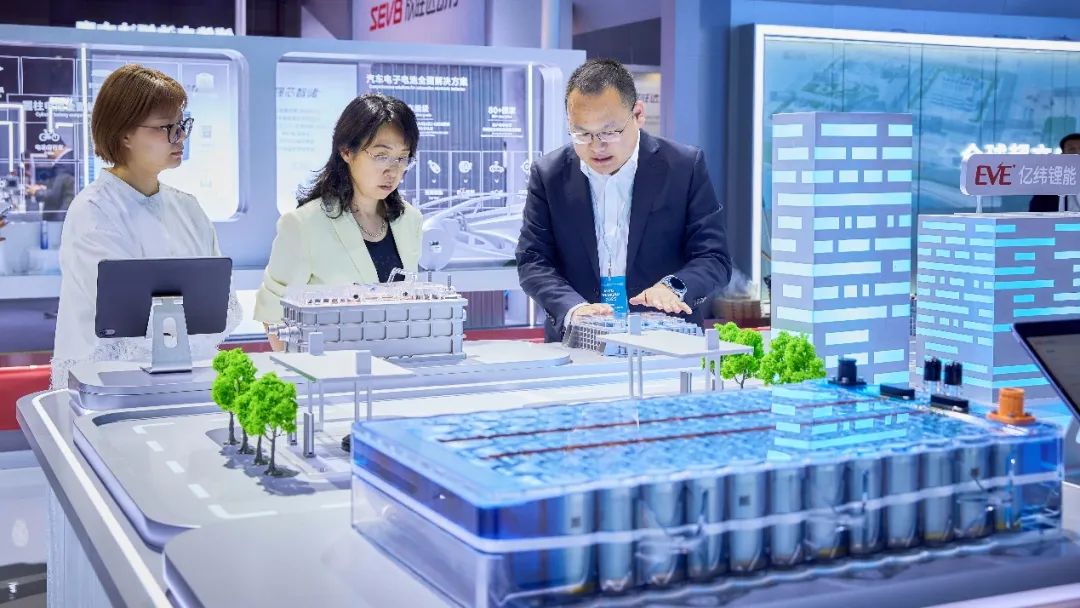

Is pure electric facing a bottleneck? Battery manufacturers made their presence felt at the show, as advancements in battery technology are crucial for EVs. On the eve of the show, CATL unveiled its second-generation Envision Ultra-Fast Charging Battery, charging from 5% to 80% in 15 minutes at -10°C. Additionally, CATL launched the Nexion sodium-ion battery, offering hybrid models over 200 km and pure EVs over 500 km of range. EVE Energy announced an upgrade to its large cylindrical battery technology, with Vice President Jiang Jibing stating that the battery's bottom impact energy absorption reached 1000 joules, 6.6 times the national standard.

Following BYD's 10C flash charging, CATL introduced 12C. The development of ultra-fast charging challenges battery swapping models. When asked about this, Li Bin of NIO responded, "Can ultra-fast charging offer a 10- or 15-year warranty? If so, I'll be impressed." Typically, ultra-fast charging compromises battery life, supported by data from Tsinghua University's Ouyang Minggao team showing that batteries frequently using ultra-fast charging above 120kW have a 40% shorter cycle life. Despite technological breakthroughs, achieving a closed-loop business model remains a challenge. Consumers demand a balance of range, economy, and safety.

Business model innovations cannot solely rely on technological progress. Resolving range anxiety introduces new challenges like battery life, charging infrastructure, and usage costs. A source in standard setting revealed that next-generation power battery standards will consider increasing energy consumption requirements under high and low temperatures, guiding enterprises to solve EVs' issues. This raises the bar for energy consumption management, especially for pure EVs.

Domestic cars are pricing up. Notable new fuel vehicles at the 2025 Shanghai Auto Show included the SAIC Audi A5L, Volvo XC90, sixth-generation Toyota RAV4, and new Volkswagen Lavida Pro, mainly from joint ventures. Domestic brands are focusing on the high-end new energy market.

Following Huawei and JAC's million-yuan Zunjie, Zeekr's flagship SUV 9X debuted with an expected starting price over 500,000 yuan, and the Zeekr 009 Guanghui Edition, over one million yuan. On media day, a Middle Eastern tycoon placed an order for the 9X on the spot. The full-size luxury SUV Nio U8L was also launched, priced in millions, alongside the Voyah Dreamer Shanhe MPV, priced at 709,900 yuan. At this year's show, most expensive cars were from domestic new energy brands. McKinsey's data shows increasing interest in plug-in hybrids and range extenders among potential EV buyers.

As plug-in hybrids and range extenders gain popularity, joint ventures are following suit. Buick released the GL8 Lushang, priced from 249,900 yuan, equipped with Buick's "True Dragon" plug-in hybrid system. While domestic cars price up, consumers' upgrade willingness is weak. China's auto market is a stock market, with additional purchases and replacements being the main consumer groups. McKinsey research shows that car owners with current cars priced between 150,000 and 300,000 yuan are more inclined towards "consumption downgrading." In the 200,000 to 400,000 yuan range, pricing is declining, making it increasingly difficult to sell cars above 300,000 yuan.

At the previous Shanghai Auto Show, an executive predicted the world would have no new fuel vehicles in three to four years. This year, nearly 70% of exhibited vehicles were new energy, but no similar predictions were made. Plans from Volkswagen, General Motors, Toyota, and Honda indicate that pure electric, hybrid, and fuel vehicles will coexist in the foreseeable future. The world changes too fast for accurate predictions. Rather than grandiose statements, auto industry leaders should prepare thoroughly for an uncertain future.