Nissan China Faces Another Factory Shutdown, Signaling Potential Market Shifts?

![]() 05/07 2025

05/07 2025

![]() 769

769

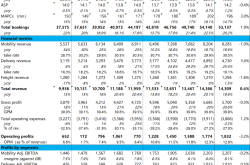

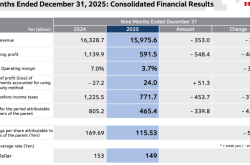

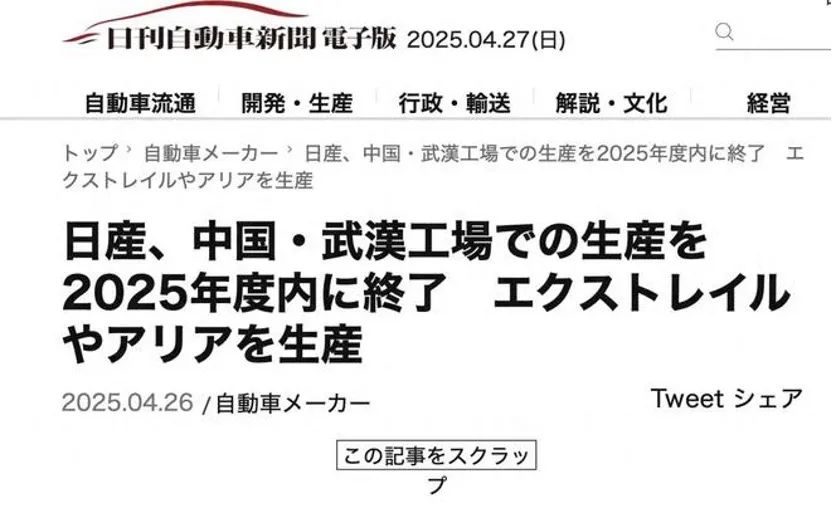

On April 26, 2025, local time, Japan's Yomiuri Shimbun reported that Nissan plans to cease production at Dongfeng Nissan's Wuhan factory by the end of fiscal year 2025 (March 2026). The decision is attributed to the factory's persistent decline in capacity utilization amidst fierce market competition.

Dongfeng Nissan's Wuhan factory, leased from Dongfeng Motor and operational since 2022, was designed with an annual production capacity of approximately 300,000 vehicles, primarily producing the ARIYA and X-Trail models. However, during fiscal years 2022-2023, the factory's actual annual production capacity utilization plummeted to around 10,000 vehicles. Since 2024, the factory has shifted to producing electric vehicles for Dongfeng. Notably, this is not the first time Nissan China has scaled back production. In June 2024, Nissan halted production at its factory in Changzhou, Jiangsu. Further, in February 2025, Nissan announced plans to reduce global production capacity by 20% by fiscal year 2026, with China's capacity being cut from 1.5 million to 1 million vehicles. The recent revelation about the Wuhan factory shutdown appears to be part of Nissan China's broader production capacity reduction strategy.

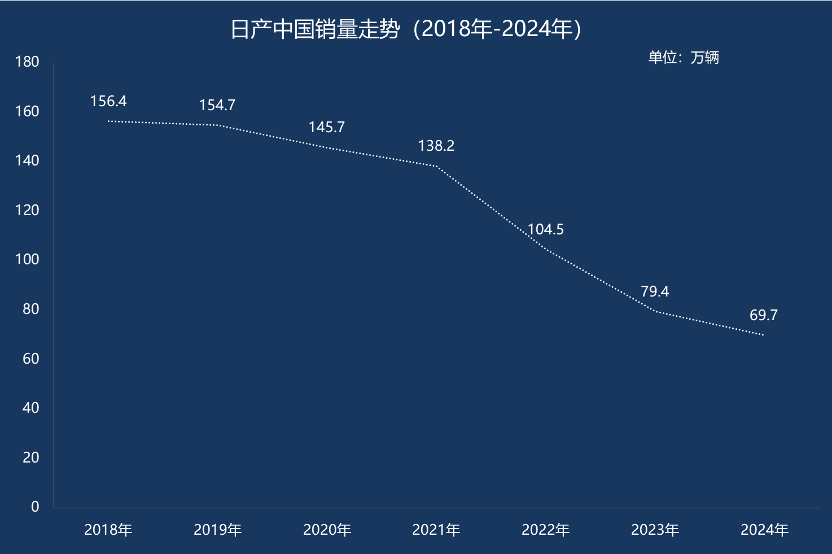

Public data indicates that in 2024, only 2,114 ARIYA vehicles were sold, averaging less than 200 per month, while 37,610 X-Trail vehicles were sold, averaging just over 3,000 per month. The low sales of the ARIYA were somewhat anticipated. However, the X-Trail, a long-time favorite in the domestic SUV market with peak sales of 30,000 to 40,000 vehicles, now sells only about a third of that peak. The decline in X-Trail sales serves as a microcosm of Nissan's faltering position in the Chinese market. Official data from Nissan shows that in 2024, Nissan China sold a total of 696,631 vehicles, marking a year-on-year decline of 12.23%.

The sales decline in 2024 marked Nissan China's sixth consecutive year of decline. This downward trend persisted into 2025, with Nissan China selling only 121,000 vehicles in the first quarter, a year-on-year drop of 27.47%. At this rate, Nissan China's sales are likely to be surpassed by numerous Chinese new energy vehicle brands. Data from third-party platforms reveals that in the first quarter of 2025, sales of the Teana fell to just over 3,000; sales of the Qashqai dropped to just over 6,000; and sales of the Sylphy hovered around 20,000. In previous years, monthly sales of the Teana and Qashqai easily exceeded 10,000, or even 20,000; the Sylphy, meanwhile, had been the annual sales champion of sedans for years, with an average monthly sales of nearly 40,000 vehicles. The decline of these star models has emerged as Nissan's biggest challenge in China.

Over the past few years, the Chinese automotive market has witnessed a surge in electrification and intelligentization, leading to significant shifts in consumer demand. Plug-in hybrid vehicles, vehicles equipped with refrigerators, TVs, and large sofas, and intelligent driving systems have become increasingly popular among consumers. Traditional fuel vehicles such as the Sylphy, X-Trail, and Teana, which were once highly favored by consumers, have gradually lost market appeal. In fact, Nissan is not alone; overseas brands like Hyundai, General Motors, and Honda have also begun to close factories in China. Among them, Beijing Hyundai operates five vehicle plants, one of which has been sold, two have ceased production, and the remaining two are not operating at full capacity. Even so, Beijing Hyundai's capacity utilization rate stands at only a quarter.

More importantly, amidst the rise of electrification and intelligentization, Chinese local automotive brands have gradually taken center stage and gained market discourse power. Overseas brands have lost their former allure. In the past two years, competition in the Chinese automotive market has intensified, with price wars and configuration races heating up. During this period, while Chinese local brands have gained higher popularity and market appeal, the cost-effectiveness of their products has also been continuously improved. The mechanical quality and product texture advantages of overseas brands have become increasingly blurred, and their market competitiveness has weakened. The decline of automakers such as Dongfeng Nissan, Beijing Hyundai, Dongfeng Peugeot Citroen Automobile, and Changan Mazda is a direct result of the competitive landscape adjustment amidst the tremendous changes in the Chinese automotive market. However, so far, there are still no signs of a halt to the decline of joint venture automakers.

Dongfeng Nissan, too, is actively seeking solutions. Stephen Ma, head of Nissan's China operations, announced that Nissan will increase investment in China by $1.4 billion. According to the plan, Nissan will launch approximately 10 new electric models in China by summer 2027, covering various power forms such as pure electric, plug-in hybrid, and extended range. Behind this strategy, Dongfeng's technology will serve as a catalyst for Nissan's new launches in China. Media reports from two years ago indicated that Nissan would utilize Dongfeng's latest S pure electric platform from its Quantum Intelligent Electric Architecture to develop and produce pure electric models under the Nissan brand. Recently, Dongfeng Nissan's new pure electric vehicle, the Nissan N7, was officially launched. It is believed that the vehicle is based on Dongfeng's Yipi platform, with potential for other Yipi variants in the future.

Another report states that Dongfeng's sub-brand Voyah has begun to "transfuse" technology to joint venture brands such as Dongfeng Nissan, sharing core technologies like electric drive systems and hybrid systems. Simultaneously, Dongfeng Nissan is actively engaging in in-depth collaboration with Voyah, planning to incorporate Voyah's upcoming ESSA2.0 architecture and SOA electronic and electrical architecture into its vehicles. Judging from the pricing of the Nissan N7, Nissan's strategy is indeed evolving. Notably, the Nissan N7, positioned as a mid-to-large-sized vehicle, has a starting price of only 119,900 yuan, the same as Dongfeng Yipi 007; the top-of-the-line model is priced at less than 150,000 yuan, more than 5,000 yuan cheaper than Dongfeng Yipi 007.

Admittedly, the current price war in the Chinese automotive market is intensifying. However, the pricing of the Nissan N7 still demonstrates a commendable level of sincerity. This is likely to become Nissan's competitive strategy in China in the coming years. The olive branch has been extended to consumers; now it remains to be seen whether they will embrace Nissan's plan. (Images sourced from the internet; infringement will be removed)