European Auto Market | Italy April 2025: Mainstream Brands Intensify Competition, Chinese Carmakers Emerge Prominently

![]() 05/07 2025

05/07 2025

![]() 906

906

Passenger car sales in Italy totaled approximately 139,000 units in April 2025, marking a slight year-on-year decline.

Traditional brands such as Fiat and Volkswagen continue to dominate, yet the surge in hybrid and electric models is transforming the market amidst the new energy transition.

Simultaneously, Chinese brands, notably MG and BYD, are rapidly expanding their market share, demonstrating robust growth and signaling the rapid ascent of Chinese cars in the Southern European market.

We delve into the changes in the Italian market from two perspectives: the overall sales landscape and the performance of Chinese brands.

01

Overview and Competitive Dynamics of the Italian Auto Market

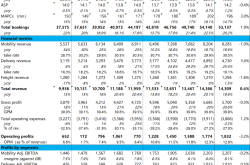

In April 2025, Italy registered 138,950 passenger cars, witnessing a modest year-on-year decrease.

● Heightened Brand Competition

◎ Fiat led the market with 12,220 units, accounting for 8.8% of the share, yet its sales dipped by 19.6% year-on-year, indicating the erosion of its traditional advantages.

◎ Volkswagen and Toyota followed closely with sales of 11,143 and 10,598 units, respectively, up 8.4% and 6.3% year-on-year. This underscores the enduring appeal of German and Japanese brands in Italy. Volkswagen, in particular, is expanding its market share with a stable lineup of gasoline and mild hybrid vehicles.

◎ Peugeot surged ahead with a 48.3% year-on-year growth, standing out with popular models like the 208 and 2008, favored in the small car and SUV segments.

◎ Jeep and BMW also registered significant growth, especially Jeep with a 30.1% year-on-year increase, reflecting strong demand for compact SUVs among Italian consumers.

In terms of brand sales, most of the top ten are traditional European and American brands. Tesla, an electric vehicle manufacturer, sold only 446 units, accounting for 0.3% of the market. Despite a 29.3% year-on-year increase, its overall sales share remains low, indicating that pure electric vehicles have yet to dominate the Italian market.

● Powertrain Trends

◎ Hybrid and plug-in hybrid vehicles remain the market's backbone, driven by brands like Toyota and Ford, where gasoline-electric hybrids hold a significant share.

◎ The growth of the pure electric vehicle market is structural, focusing mainly on models with lower prices or higher brand recognition, such as the MG 4 and Dacia Spring.

● Model-wise, the Fiat Panda remains a top seller, along with the Dacia Duster, Peugeot 208, and Volkswagen Golf, which maintain high sales. Small cars and B-segment SUVs continue to form the core of the Italian market.

02

Impressive Performance of Chinese Brands

MG and BYD Lead the Charge

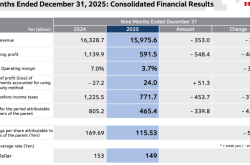

In April 2025, Chinese brands MG, BYD, and Chery emerged as significant players in the Italian market.

◎ MG ranked 12th in the market with sales of 5,488 units, a 50.5% year-on-year increase. Its cumulative sales for the year reached 20,844 units, surging 53.6% year-on-year, significantly ahead of other Chinese brands. MG's key models, the MG 4 (electric) and ZS (hybrid/gasoline), form a robust product lineup. Notably, the MG 4 stands out in the electric vehicle segment priced around 100,000 yuan due to its excellent range and competitive pricing.

◎ BYD emerged as the month's biggest "dark horse." Its sales in April reached 1,683 units, a staggering 2852.6% year-on-year increase. With annual cumulative sales of 5,654 units (+2529.8%), it swiftly rose to 21st place in the brand ranking. BYD's main models in Italy include the Dolphin and Seal, leveraging blade battery and platform-based vehicle design advantages to offer superior range, safety, and manufacturing costs, enhancing its technological image among local consumers.

◎ Chery achieved rapid breakthroughs through its Omoda and Jaecoo sub-brands. Its April sales were 939 units, a 2034.1% year-on-year increase; cumulative sales for the first four months were 2,995 units, surging 2699.1% year-on-year. Models like the Omoda 5 and Jaecoo 7 are designed and priced to appeal to European consumers' aesthetic preferences.

The success of Chinese brands in the Italian market is not coincidental. It reflects the maturity of electric vehicle products, supply chain efficiency, and precise pricing strategies.

◎ MG, with its British heritage, excels in blending new energy technology with European traditional brand labels.

◎ BYD and Chery represent significant advancements in brand independence and global design language for Chinese automakers.

The Italian market is becoming a "springboard" for Chinese automakers entering Europe. With Italian consumers' dual demands for cost-effectiveness and design, and the launch of new models like the BYD Seal 06 EV, the penetration of Chinese brands in the mid-to-high-end market is expected to further intensify.

Summary

In April 2025, the Italian auto market exhibited intensified brand competition and a transforming powertrain structure. Traditional automakers face the pressure of electrification, while Chinese brands are rapidly rising with a "new" approach, reshaping the competitive landscape. The success of MG and BYD validates the viability of Chinese automakers' "product strength + localization strategy" in the European market. Moving forward, the keys to their long-term success will be continuously building brand recognition, expanding sales networks, and addressing compliance challenges.