Emerging Carmakers Battle for Sales, While Industry Leaders Focus on Profits and Winter Preparation

![]() 05/11 2025

05/11 2025

![]() 659

659

Automakers have largely released their April sales figures. Many newcomers have reported robust sales and substantial year-over-year growth. However, compared to the 2024 peak, the electric vehicle (EV) industry has cooled off, and industry leaders are clearly feeling the chill of the winter season, proactively boosting profits and setting aside funds for future contingencies.

First-quarter earnings reveal a surge in profits for both the leading EV company and the top domestic traditional automaker, indicating their commitment to cost reduction and profit maximization amidst intensifying market competition. These two entities have also spearheaded the most intense price wars in the automotive market, aggressively vying for market share.

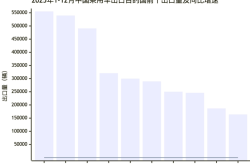

The leading EV company has been initiating price wars for the past two years. In 2024, this strategy propelled its monthly sales to a peak of 500,000 vehicles. Recently, it reignited the price war by lowering the starting price of its cheapest EV to RMB 56,800. This price is not significantly different from the RMB 49,900 price tag of the leading domestic traditional automaker's fuel vehicle, despite the battery pack cost being notably higher than that of a fuel engine. It is estimated that this price is close to the cost price, underscoring the ferocity of the price war.

The leading domestic traditional automaker is equally resolute in its price war. Its fuel vehicle price has been slashed to RMB 49,900, a figure unseen for many years. This sub-RMB 50,000 price point further underscores its determination to safeguard the market through price reductions. Additionally, it is aggressively entering the EV market and has achieved significant success.

April data shows that the leading traditional automaker sold 234,000 vehicles, of which 125,000 were new energy vehicles, marking a year-over-year surge of 144% in new energy vehicle sales. It is now the second-largest player in the new energy vehicle market, a remarkable achievement considering it wasn't even in the top ten a few years ago.

These two leading automakers have achieved rapid profit growth while actively engaging in price wars, largely due to their internal cost control measures, which have bolstered profits and allowed for the setting aside of funds. The automotive industry's winter chill has indeed arrived.

Taking the leading EV company as an example, its monthly sales reached 500,000 vehicles in 2024, but in April, even with further EV price reductions, it only managed 380,000 vehicles, a decline of over 120,000 from its 2024 peak. Furthermore, the month-over-month increase in April was less than 1%, indicating that even more intense price wars are struggling to boost sales.

New carmakers face a similar situation. In April, the top new carmaker sold only around 41,000 vehicles, 9,000 fewer than the 50,000 monthly sales achieved by the top new carmaker in 2024. Both the top and second-ranked new carmakers achieved these sales by developing models priced just above RMB 100,000, highlighting the challenges faced by new carmakers in the high-end market.

Previous analysis has pointed out that sales of models priced above RMB 300,000 are declining for both EVs and fuel vehicles. Currently, the fastest-growing fuel vehicle models are priced between RMB 100,000 and RMB 150,000, while the fastest-growing EVs are priced between RMB 150,000 and RMB 200,000. Last year's top EV company mainly sold models priced above RMB 300,000, but it has now introduced models priced just above RMB 200,000, with April sales of only 33,900 vehicles.

The sharp decline in EV sales from last year's peak is not only due to consumer doubts about EVs but also because of the aggressive push by traditional automakers, particularly the significant price reductions by foreign automakers to protect their market share.

Sales of the two major foreign automakers, Volkswagen and Toyota, have rebounded, with weekly sales surging by more than 20%, indicating that consumers are re-embracing foreign cars. The reputation built by foreign automakers over the years has led some consumers to return to foreign cars amidst ongoing concerns about EVs.

In summary, fuel vehicle companies have been cornered and have launched fierce counterattacks. While EV sales are still growing year-over-year, they have significantly fallen from their peak. Furthermore, this year's price wars in the EV market have not yielded substantial results. Both sides are now in a bitter stage of attrition, competing for consumption. Leading automakers are enjoying healthy profits, and foreign automakers are supported by robust profits from the European and American markets. However, many new carmakers are still mired in losses, making them the most vulnerable group in this stage of attrition.