European Auto Market | Sweden April 2025: Volvo Reclaims Throne, Tesla Faces Sharp Decline

![]() 05/12 2025

05/12 2025

![]() 541

541

Driven by robust electric vehicle sales, Sweden's auto market surged 10.5% year-on-year in April 2025, with both pure electric and plug-in hybrid market shares hitting new peaks.

Volvo dominated the top six spots, reclaiming its local throne, while Volkswagen saw significant gains with models like the ID.7 and Passat. Conversely, Tesla sales plummeted 80.7%, sliding from third to nineteenth in the annual rankings.

Although Chinese brands remain marginal players in Sweden, newcomers such as XPeng and Zeekr exhibited promising growth, signaling an impending wave of competition.

01 Swedish Auto Market Overview: New Energy Dominance, German-Swedish Rivalry, Tesla's Sharp Decline

In April 2025, Sweden's passenger vehicle market sold 24,292 new cars, marking a 10.5% increase year-on-year.

New energy vehicles continued to spearhead growth, with plug-in hybrids and pure electrics accounting for 63.3% of the market, significantly higher than the 57% recorded in the same period last year.

◎ Pure electric vehicle sales reached 8,555 units, up 25.8% year-on-year, accounting for 35.2% of the market.

◎ Plug-in hybrid sales totaled 6,829 units, up 19.3% year-on-year, representing 28.1% of the market.

This underscores Sweden's firm commitment to electrification, offering brands ample opportunities to penetrate the market.

Brand Performance

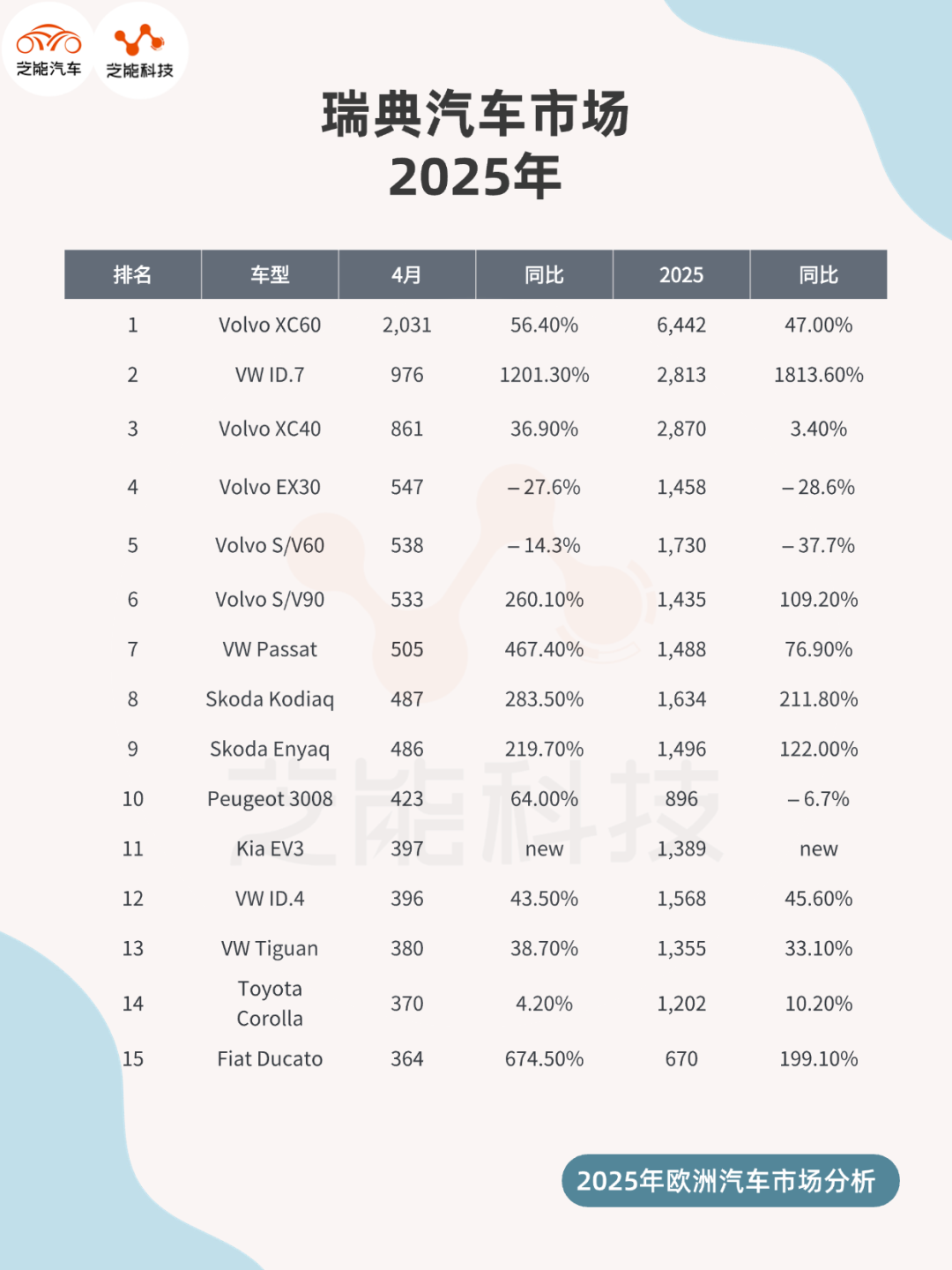

◎ Local brand Volvo firmly established its lead in the new energy transition, with April sales surging 29.2% year-on-year to 5,119 units, capturing 21.1% of the overall market share. This not only surpasses the annual average of 18.4% but also sees Volvo occupying five of the top six best-selling models, solidifying its dominance in the Swedish market.

The Volvo XC60 witnessed a significant 56.4% increase, securing the top sales position, with other models like the XC40, EX30, S/V60, and S/V90 also ranking highly, demonstrating Volvo's multi-line transition from traditional fuel to pure electric vehicles.

◎ Volkswagen emerged as a formidable 'dark horse,' with April sales skyrocketing 86.3% year-on-year to 3,856 units, second only to Volvo. The ID.7 soared to second place in monthly sales, experiencing a year-on-year increase of over 1200%, while the Passat, Skoda's Enyaq, and Kodiaq also saw significant growth.

◎ German brands collectively flourished, with Skoda, BMW, Audi, and Mercedes-Benz all recording year-on-year growth exceeding 20%, reflecting their persistent advantages in product strength, electrification transformation, and brand recognition.

◎ Conversely, Tesla experienced a 'cliff-like' decline, selling only 203 units in April, down 80.7% year-on-year, and slipping to nineteenth place, compared to third place in the same period last year. Its star model, the Model Y, ranked fortieth, with a year-on-year drop of 79.7%.

This may be attributed to price wars in the European market, the absence of local production, and changes in policy subsidies, marking the end of Tesla's golden era in Europe.

02 Chinese Brands in Sweden: Emerging from the Margins, Zeekr and XPeng Begin to Break Through

Chinese brands have yet to establish a dominant presence in the Swedish auto market, but several newcomers are gradually breaking through, showing considerable growth momentum in April 2025 data.

Data indicates that XPeng sold 98 units in that month, up 71.9% year-on-year, ranking twenty-seventh in the brand rankings. Zeekr, with sales of 82 units, achieved a year-on-year growth of 115.8%, becoming the brightest star among Chinese brands, ranking twenty-ninth.

Although this growth stems from a low base, the increase reflects a gradual rise in Swedish consumers' acceptance of Chinese new energy vehicles.

Brand Structure

◎ MG sold 167 units, down 30.7% year-on-year, ranking twenty-second, revealing that its early advantages are gradually being eroded by new brands.

◎ Brands like Li Auto and NIO have yet to appear in the mainstream rankings, but considering XPeng and Zeekr's layouts in technology, intelligence, and the mid-to-high-end market, coupled with their increasingly systematic localization strategies for the European market, such as establishing service networks, OTA adaptations, and local operating teams, they hold strong potential for the future.

Sweden's technological preferences also align well with Chinese brands.

◎ On one hand, the high demand for plug-in hybrids and pure electrics gives Chinese automakers' native electric platforms (like the SEA and EEA architectures) a technological edge.

◎ On the other hand, Swedish consumers' emphasis on vehicle intelligence experience complements Chinese brands' leadership in smart cabins and autonomous driving.

The Swedish auto market remains dominated by Volvo and Volkswagen, with German cars enjoying significant advantages in brand history and user loyalty. Consumer awareness of Chinese brands still needs further cultivation, after-sales networks are not yet mature, and policies and regulations are in constant flux, posing challenges for new entrants.

Chinese brands, represented by XPeng and Zeekr, have already made a breakthrough. If they can continue to enhance their local operational capabilities, strengthen brand trust mechanisms, and consistently deliver technological advantages in the field of smart electric vehicles, their performance in Northern Europe in the coming years is highly anticipated.

Conclusion

Sweden's market in April 2025 once again validated the 'electric first' development path. Amidst the strong resurgence of local brand Volvo and the collective advance of German cars, Tesla's decline was particularly stark. While Chinese brands are still marginal players, their growth momentum is undeniable, steadily progressing with technological advantages and product strength.

For Chinese automakers, this multi-faceted game revolving around smart electric vehicles, brand recognition, and market localization will be a crucial test of their ability to deeply penetrate the European market.