Nissan's Drastic Measures for Self-Rescue: Laying Off 20,000 Employees and Closing 7 Factories

![]() 05/14 2025

05/14 2025

![]() 496

496

Compiled by | Yang Yuke | Edited by | Li Guozheng | Produced by | Bangning Studio (gbngzs)

Nissan's crisis is well-documented, but the severity of the situation may surpass initial expectations.

On May 13, 2025, Nissan Motor unveiled its fiscal year 2024 financial results, revealing plans to shutter seven factories worldwide and lay off 20,000 employees.

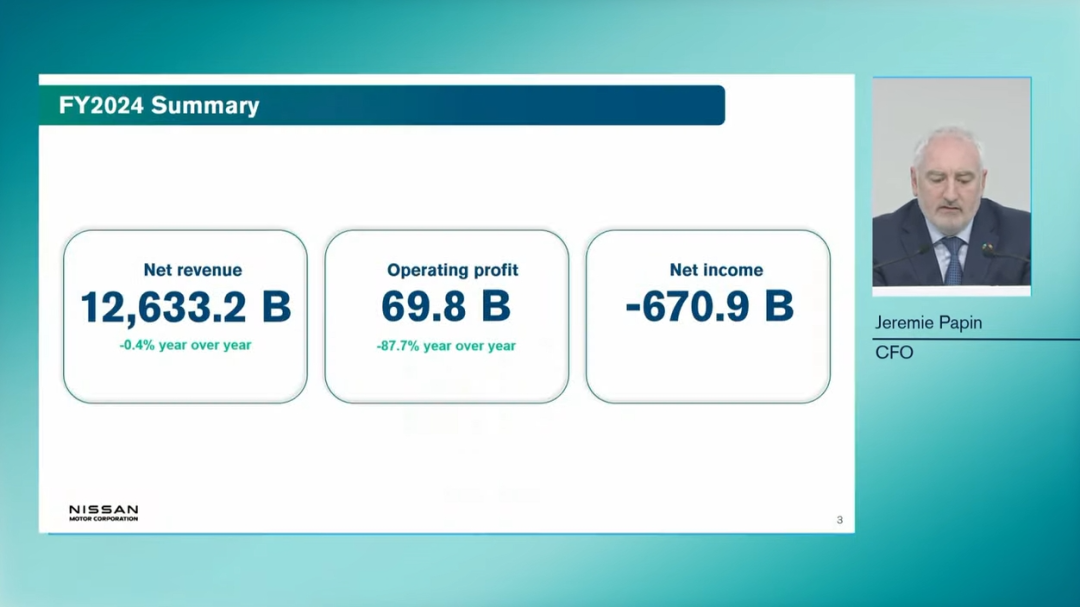

For fiscal year 2024 (April 1, 2024, to March 31, 2025), Nissan reported a net loss of 670.9 billion yen (approximately $4.5 billion), a stark contrast to the previous fiscal year's net profit of 426.6 billion yen ($2.88 billion). Operating revenue dipped from 12.69 trillion yen ($85.7 billion) to 12.63 trillion yen ($85.3 billion), while operating profit plummeted from 568.7 billion yen ($3.843 billion) to 69.8 billion yen ($470 million).

This marks Nissan's third-largest annual loss in history, following losses incurred during the 2000 financial crisis and the 2020 pandemic and chip crisis. In 2000, Nissan was on the brink of bankruptcy and sought assistance from the Renault Group.

In fiscal year 2024, Nissan's sales declined by 2.8% to 3.35 million vehicles, with projections for fiscal year 2025 (April 1, 2025, to March 31, 2026) indicating a further decrease of 2.9% to 3.25 million vehicles.

Citing uncertainty stemming from US tariff policies, Nissan did not provide profit forecasts for fiscal year 2025.

At the communication meeting, Nissan's CEO Ivan Espinosa emphasized, 'We have a big mountain to climb.' This endeavor demands discipline and teamwork. 'From today onward, we will build the future for Nissan.'

Wake-Up Call

Espinosa described the company's performance as a 'wake-up call,' and he is intensifying efforts for Nissan's recovery with a new revival plan named Re:Nissan.

This is his first comprehensive plan since taking office, involving the layoff of an additional 11,000 employees on top of the previously announced 9,000 job cuts. Simultaneously, it entails the closure of seven global assembly plants aimed at turning around the troubled company.

This year in March, Makoto Uchida, the former CEO of Nissan Motor, resigned following stalled negotiations with Honda Motor. Espinosa took over on April 1.

Carlos Ghosn, the former chairman of Renault-Nissan, shared his views on Nissan's latest predicament in an interview with French media BFM Business. Ghosn fled Japan in 2019 and currently resides in Lebanon.

Ghosn described Nissan's situation as 'terrible.' 'I told you so. I predicted Nissan's decline and the demise of the alliance,' he said, referring to the Renault-Nissan-Mitsubishi alliance, though the latter has yet to occur. Ghosn believes that the split between the Renault Group and Nissan Motor is inevitable.

He attributed the blame to his successors, arguing that 'Nissan's management' and their 'slow decision-making' are the root of the problem. He claimed that Nissan was 'forced to seek help from one of its main competitors in Japan,' again criticizing the failed merger negotiations with Honda.

Ghosn reiterated his opposition to this idea, comparing it to 'the alliance between Renault and Peugeot in France,' and added, 'It doesn't make sense.'

Interestingly, during the earnings conference on the same day, a reporter asked Espinosa if Nissan's current predicament was similar to the situation when Ghosn was appointed to save Nissan in 2001. Espinosa replied that the current challenges are far more severe.

Regarding partners, Espinosa expressed an open attitude. While he did not rule out deepening cooperation with Honda Motor, he is also considering other partners, particularly advanced technology companies, as long as it benefits synergistic effects.

New Revival Plan

After a tumultuous year, Nissan Motor is initiating a large-scale recovery plan to restore profitability by 2026.

This plan, named 'Revive Nissan' (Re:Nissan), aims to save 500 billion yen (approximately $3.38 billion) through cost savings, divided into fixed and variable costs, with the goal of restoring positive cash flow to Nissan's operations.

Regarding variable costs, Nissan is suspending several projects after 2026. Structurally, by fiscal year 2027, Nissan will abandon the Kyushu battery plant project, reducing its industrial footprint from 17 to 10 sites.

By fiscal year 2027, 20,000 jobs will be cut from the global workforce of 133,000, representing about 15% of all employees, including the previously announced 9,000 job cuts. All departments will be affected, involving direct, indirect, and contractual roles in production, sales, management, and R&D.

In terms of R&D, Nissan aims to reduce average hourly costs by 20% while decreasing parts complexity. Vehicle development will be accelerated, with the cycle shortened to 30-37 months. The goal is to reduce parts complexity by 70% and the number of platforms from 13 to 7 by 2035.

The revival plan also includes geographical adjustments.

Nissan will focus on six key regions—the United States, Japan, China, Europe, the Middle East, and Mexico—and strengthen localized products, particularly for electrification and compact SUVs. The alliance with Renault, Mitsubishi, and Honda will play a pivotal role.

Nissan's strategy in China will focus on improving the localization of new energy vehicles. Additionally, exports of localized products from China will support meeting diversified and global demands.

Espinosa stated that these new plans were formulated after a thorough assessment of Nissan's operations, aiming to align production with demand, including formulating market and product strategies.

Nissan hopes to consolidate its global automotive production bases from 17 to 10 by fiscal year 2027, four more than the previous target. Nissan has not disclosed which factories will be closed, but Japan is not excluded.

Espinosa noted that factory closures are a global initiative, including those in Japan. 'This is a very, very painful and sad decision... We wouldn't do it if it weren't for Nissan's survival,' he emphasized.

These measures aim to adjust the company's scale to achieve a global production capacity of approximately 2.5 to 3 million vehicles by fiscal year 2027.

'Big Mountain'

At 46, Espinosa is the youngest CEO in Nissan's history, and undoubtedly, he faces numerous 'big mountains':

He must reduce global production capacity, revive sluggish sales, update aging product lines, cut billions of dollars in fixed and variable costs, repay substantial debt, restore the company's credit rating above junk status, and eliminate record deficits.

Nissan must also somehow revive its technical cooperation with Honda Motor. In February this year, its merger plan with long-time competitor Honda Motor failed.

In fact, Espinosa was already considering these challenges before the Trump administration imposed a 25% tariff on US auto imports and a 25% tariff on auto parts, triggering global trade turmoil.

In the quarterly earnings announcement in February this year, Nissan proposed some revival measures—6,500 of the previously announced 9,000 layoffs occurred in the manufacturing sector, with some layoffs resulting from the closure of three factories.

The first factory to close was in Thailand, starting from the first quarter of fiscal year 2025. The second will close between October and December, and the third will close in fiscal year 2026. Nissan has not disclosed the names of these factories.

However, according to the Q&A session at the earnings conference on May 13, among the seven factories to be closed, those currently known are in Mexico, Argentina, Thailand, and India.

In 2024, Nissan imported approximately 115,000 vehicles from Japan to the United States, of which 92,752 were Rogues produced at the assembly center in Kyushu, southwestern Japan.

Nissan is seeking to avoid tariff risks by shifting more Rogue production to the United States.

(Parts of this article are based on reports from Automotive News, Reuters, The Hill, Daily Sabah, and WSJ, with some images sourced from the internet)