Car Manufacturers Launch Aggressive Campaigns, Yet New Energy Vehicle Share Stagnates

![]() 05/15 2025

05/15 2025

![]() 687

687

Introduction

After breaching the critical 50% mark for the first time, the penetration rate of new energy vehicles has struggled to maintain this milestone.

Spring arrived in 2025, but new energy vehicles faced an unexpected chill. After surpassing 50% penetration in the second half of last year, it abruptly dropped to 41.2% in the first quarter of this year.

Looking back to the first half of April last year, both retail and wholesale penetration rates of new energy vehicles surpassed 50%, and the phrase "buying fuel vehicles has officially become a minority" topped trending topics. In July of the same year, new energy vehicles breached the 50% penetration mark for the first time, a milestone that signaled a shift in the automotive era and boosted confidence in the boiling market.

To expedite their capture of the new energy market share, both slow-transforming joint ventures and proactive new forces have launched aggressive campaigns. Statistics indicate that in just the past four months, nearly 100 new car models have entered the market. At its peak, nearly 10 auto brands held new car launch events on the same day, with new energy vehicles comprising the vast majority.

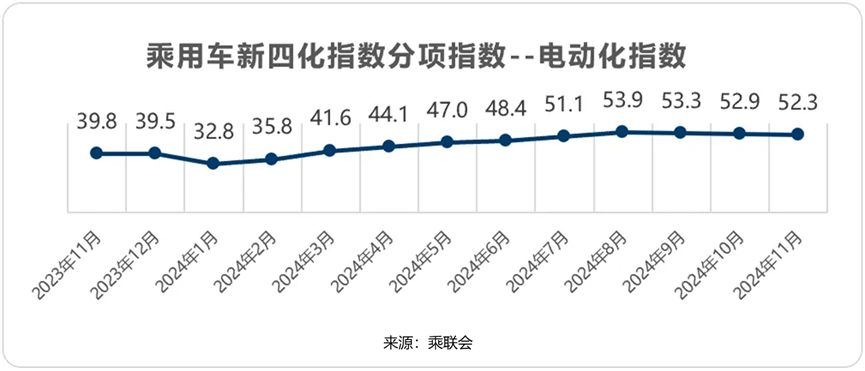

However, looking back from the current time node, ten months later, it is evident that despite manufacturers' fierce push into new energy vehicles, the penetration rate has continued to decline for five consecutive months after peaking at 53.9% in August last year, ending 2024 at 47.6%.

After years of rapid growth, the momentum of new energy vehicles has stagnated. Between repeated cycles of crossing and falling back, its penetration rate has been slow to truly cross the red line symbolizing the alternation of eras. It is undeniable that the confrontation between new energy vehicles and fuel vehicles is entering a protracted tug-of-war stage centered on technology and demand.

01 Rapid Growth Halts, and New Energy Faces a Bottleneck

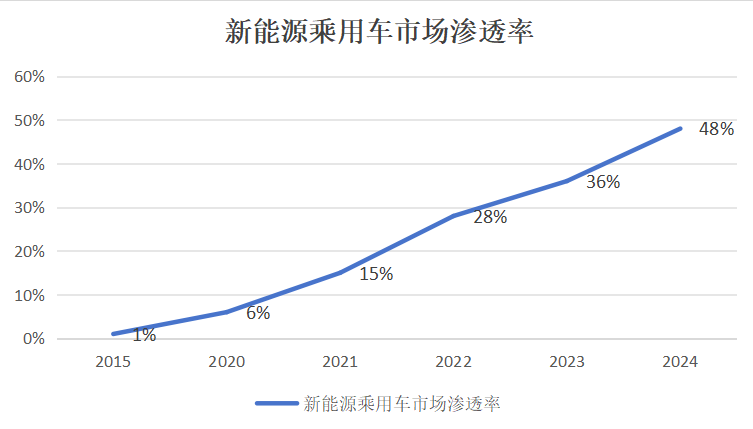

After more than a decade of investment and breaking through a 1% market share in 2015, the pace of new energy vehicles seizing the market accelerated.

Initially, new energy vehicles led by BAIC and Tesla sounded the attack horn on fuel vehicles. Later, the baton in BAIC's hands passed to BYD, and the entry of new forces such as NIO, Li Auto, and XPeng significantly bolstered the strength of the new energy lineup.

With sufficient resources, new energy vehicles divided into three routes: pure electric, plug-in hybrid, and extended range, launching fierce attacks on fuel vehicles that had yet to recover. Overnight, the solid defensive line built by fuel vehicles over a century was torn apart by new energy vehicles, laying the groundwork for an era change.

In 2020, the market penetration rate of new energy passenger vehicles in China reached 6.18%. With the rise of Tesla and NIO-XPeng-Li models, as well as the launch of mini cars such as the Ora R1 and Wuling Hongguang MINIEV, shifting from policy-driven to market-led, the market penetration rate of new energy passenger vehicles soared annually.

In 2021, the penetration rate of new energy vehicles sold in China was 15%, rising to 28% in 2022, then 36%, 48%... The growth rate of the penetration rate of new energy vehicles sold in China exceeded expectations.

Amid the rapid growth of new energy vehicles, various players from self-owned brands, joint ventures, and traditional luxury brands rushed in to support the conquest of new energy.

Zeekr, Galaxy, Deep Blue, Avita, Lantu, ARCFOX, IM Motors, AION... A multitude of major factories launched new force brands to seize the new energy market; Box Smart 3X, Dongfeng Nissan N7, Beijing Hyundai ELEXIO... Joint ventures adapted to Chinese user habits and launched new energy models comparable to self-owned brands; Audi launched the new luxury electric brand AUDI, Mercedes-Benz's all-new electric long-wheelbase CLA occupied the C-position of the Shanghai Auto Show stand, BMW globally deployed new factories and battery production measures... Traditional luxury brands embraced new energy with open arms.

However, industry-wide investment did not yield the anticipated results. After peaking at 53.9% in August last year, the penetration rate of new energy vehicles experienced a continuous five-month decline. In January this year, the share of fuel vehicles even rebounded to 58.5% against the trend. Since then, the tug-of-war between new energy vehicles and fuel vehicles has continued. In April, the wholesale and retail penetration rates of new energy vehicle manufacturers were 51.7% and 51.5%, respectively, still stuck at the 50% plateau.

02 New Energy Technical Challenges Persist, Protracted Battle Continues

From a technological cycle perspective, the new energy penetration rate curve over the past 20 years has exhibited "exponential explosion" characteristics: it took 10 years to go from 0 to 1% in 2005 and 3 years to reach 5%, while after 2020, it surged to 50% in just 4 years.

However, this explosion relied more on policy-driven incentives and early adopter dividends. Upon closer inspection, the contradictions hidden by immature technology also surfaced. The "2025 McKinsey China Automotive Consumer Insights" report reveals that more than 30% of pure electric car owners in 2024 expressed regret and planned to return to the fuel vehicle camp when replacing their cars. This "regret rate" exposes the reality that new energy technology has yet to fully cross the practical threshold.

Taking the battery, which users are most concerned about, as an example, although Contemporary Amperex Technology Co. Limited has introduced the second-generation CIB UltraCharge battery that can be fast-charged to 80% in 15 minutes under -10°C conditions, the latest research by the team of Academician Ouyang Minggao of Tsinghua University shows that the cycle life of batteries frequently using ultra-fast charging above 120kW is shortened by 40% compared to slow charging. This means the "seesaw effect" between endurance and lifespan remains unresolved, and consumers' needs for fast charging, long endurance, lifespan, and low cost cannot be met simultaneously.

As the market enters the mass consumption stage, consumers' sensitivity to issues such as range anxiety, energy replenishment efficiency, and resale value increases significantly. The remaining 50% of users considering new energy vehicles have more cautious purchasing habits, which also restricts further declines in the penetration rate of new energy vehicles.

"Now, when users choose a product, they go through three layers, akin to a funnel process," Liu Jie, President of Ideal Auto's product line, said in a previous interview. Currently, users need to navigate through multiple screening layers when selecting a product, testing the company's comprehensive capabilities.

The first layer is the user's consideration circle. In this circle, the specific product strength of the car is not the focus of users' attention. Users' potential cognition and impression are the ultimate criteria for deciding whether to include the product in their consideration set. "For example, if a brand is within the user's consideration circle, and the user has no cognition or impression of it, it is not in the circle at all. For pure electric cars priced above 200,000 yuan, energy replenishment is within the important consideration circle. If energy replenishment is not good, it may be directly eliminated."

The second layer is the comparison circle. Users use this to initially compare the selected multiple products and eliminate most of them. Taking family users as an example, comfort, space size, and intelligence become important measurement indicators.

In the final decision-making circle, in addition to repeatedly and carefully confirming the cost-effectiveness of the final product, users will also consider long-term influencing factors such as resale value and usage cost.

On the other hand, after achieving breakthroughs in intelligence, fuel vehicles will further enhance their overall strength. Previously, SAIC Volkswagen launched the Teramont Pro, equipped with an L2+ intelligent driving system and a multi-screen interactive cockpit, redefining the value benchmark of fuel vehicles with a "performance + intelligence" dual upgrade; FAW-Volkswagen Tayron L even proposed a "three-step" intelligent driving strategy, planning to achieve full-road autonomous driving by 2026. This intelligent transformation significantly narrows the gap between fuel vehicles and new energy vehicles in terms of user experience and even surpasses them in scenarios such as long-distance endurance and low-temperature performance.

In addition to Volkswagen, established automakers such as Great Wall, Geely, Changan, Chery, and Audi have been adhering to the fuel market. In 2024, fuel vehicles accounted for more than 50% of the total sales of these brands.

The most stubborn and radical is Great Wall. In the center of Great Wall's booth at the Shanghai Auto Show, the 4.0T V8 twin-turbocharged engine with the Great Wall logo is prominently displayed.

Under the general trend towards new energy, Geely's strategy of adhering to the dual approach of oil and electricity has also been very effective. As of April this year, the cumulative total sales of Xingyue L have exceeded 745,000 units. Last year, Xingyue L was in full swing, with total sales exceeding 267,000 units and an average monthly sales volume of over 20,000 units. In April, Geely Dihao welcomed the offline launch of its 4 millionth vehicle, becoming the first Chinese brand fuel sedan family to reach the 4 million offline milestone and the first Chinese brand fuel sedan to exceed one million sales.

In just a few decades, new energy vehicles have grown from infants in the policy cradle to giants shaking the century-old foundation of fuel vehicles, which is already a miracle in industrial history. But the other side of history tells us: When the revolution enters deep waters, the brand potential accumulated by history determines the thickness of market trust, and the speed of breakthroughs in core technologies delineates the boundary of penetration rates. The 4 million fuel vehicle user base of Geely Dihao and the precision manufacturing strength demonstrated by the Great Wall 4.0T V8 engine both prove the potential thickness of traditional giants during their transformation.

Just as the era of internal combustion engines required a hundred years of tempering to spawn the dominance of BBA, the new energy track also needs time to precipitate a true technological moat. Contemporary Amperex Technology Co. Limited's ultra-fast charging battery and Volkswagen Group's intelligent fuel vehicles seem opposed but are actually complementary - they jointly raise the ceiling of the automotive industry. When the market fades from frenzy, consumers will ultimately vote with reason: there is no eternal energy form, only continuously evolving travel experiences. There are no losers in this game. The coexistence of fuel and electric is precisely the path to industrial maturity.

Editor-in-Chief: Du Yuxin, Editor: He Zengrong