African Auto Market | April 2025 in South Africa: Chery and Great Wall Motors Rapid Ascent

![]() 05/15 2025

05/15 2025

![]() 562

562

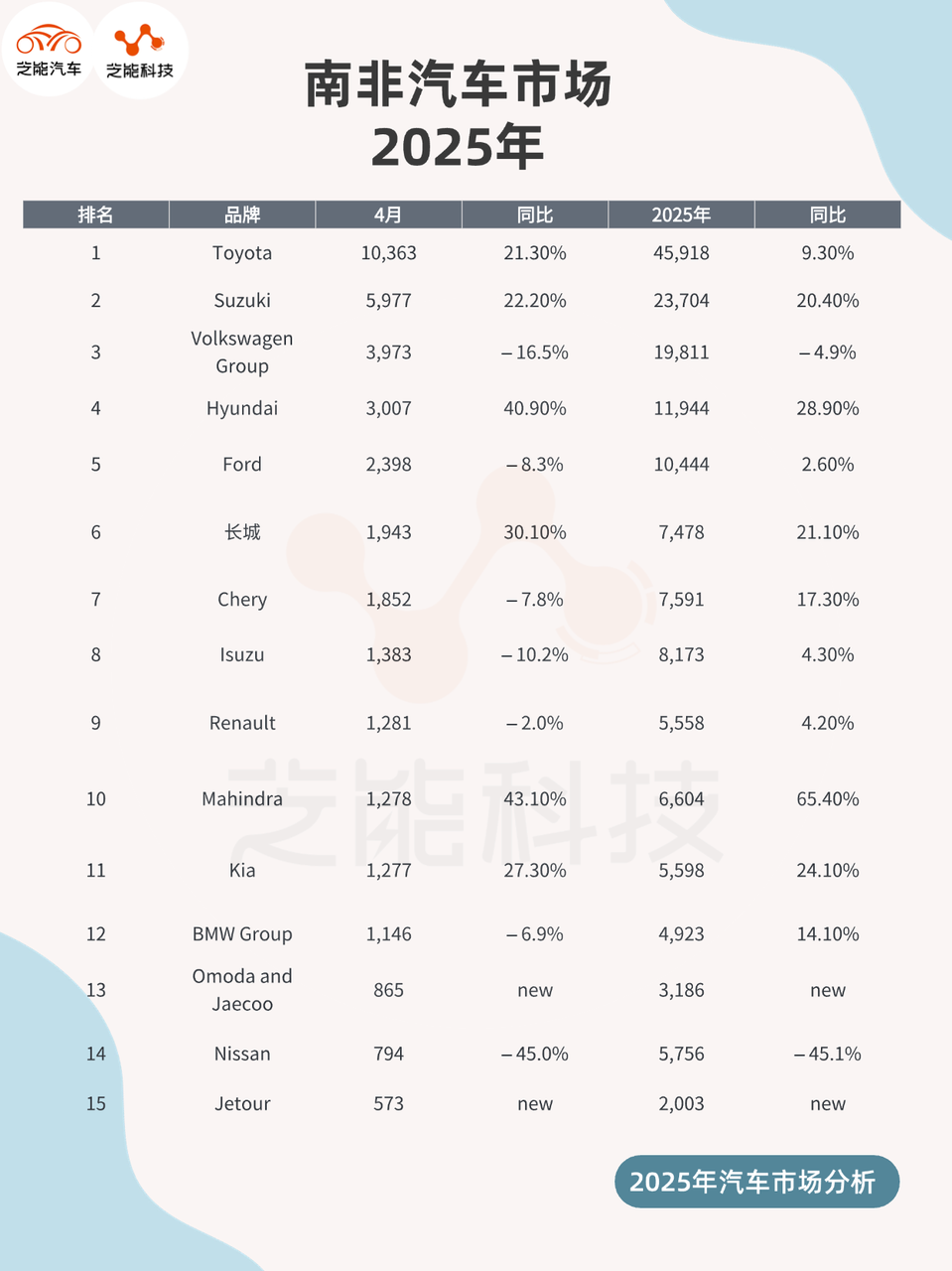

In April 2025, the South African automotive market maintained its momentum from the year's onset, recording an 11.9% year-on-year increase, with cumulative sales exceeding 180,000 units.

Among the mainstream brands, Toyota and Suzuki retained their top two positions, while Volkswagen Group experienced a notable decline. Concurrently, Mahindra, Hyundai, and Great Wall Motors demonstrated robust growth, particularly the Chinese brands swiftly gaining market share.

Chinese automakers, represented by Haval, Chery, Omoda, and Jetto, exhibited strong competitiveness and a multi-tiered brand strategy in the South African market.

01

Overview of the South African Auto Market

Performance of Major Brands

In April 2025, new vehicle sales in South Africa totaled 42,401 units, up 11.9% year-on-year, with cumulative sales of 186,433 units in the first four months, a 10.6% increase over the same period last year.

From a sales channel perspective, 87.9% of new vehicle sales originated from traditional dealer networks, with leasing companies and corporate fleets accounting for 7% and 2.7%, respectively, and government procurement comprising 2.5%.

Private consumption continues to dominate the market, yet steady demand from businesses and governments offers solid support.

From the perspective of automakers:

◎ Toyota retained its lead in the South African market with 10,363 units sold in April, a 21.3% year-on-year increase, and a market share of 24.4%.

◎ Suzuki came in second with 5,977 units and a 14.1% share, up 22.2% year-on-year. Notably, Volkswagen Group sold 3,973 units in the month, down 16.5% year-on-year, marking another decline since the second half of 2024.

◎ Hyundai (+40.9%), Mahindra (+43.1%), and Great Wall Motors (+30.1%) surged into the top ten, showcasing robust growth.

◎ Hyundai ranked fourth with 3,007 units sold, continuing to expand its influence in the small car and SUV segments in South Africa.

◎ Mahindra's sales surged 43.1% year-on-year to 1,278 units.

◎ Great Wall Motors leapt to sixth place with 1,943 units, continually enhancing its presence in the South African market.

In terms of specific models:

◎ Toyota Hilux retained its top position with a 6.6% market share, up 32.8% year-on-year.

◎ Suzuki Swift climbed to second place with consistent product strength, up 19%.

◎ Ford Ranger declined 16.6% year-on-year due to supply and pricing challenges.

Other notable models include:

◎ Hyundai Grand i10 (+62.7%), Suzuki Fronx (+429.5%), Great Wall Haval Jolion (+56.9%), and Chery Tiggo 4 Pro (+16.1%).

◎ Omoda C5 surged 128.8% year-on-year to 22nd place, reflecting user recognition of Chinese brands' design and intelligent features.

Zhineng Commentary: The South African auto market's brand landscape is undergoing transformation. From traditionally dominant German and Japanese brands, it is gradually diversifying with the inclusion of Korean and Chinese brands, especially in the price-sensitive and entry-level SUV market, where Chinese brands' penetration continues to rise.

02

Chinese Brands Make Strong Inroads:

Sales Growth and Competitive Strategy

In April 2025, Chinese brands in the South African market sustained their growth trajectory, collectively achieving significant sales jumps.

◎ Great Wall Motors (including Haval) sold 1,943 units, up 30.1% year-on-year, vaulting to sixth place.

◎ Chery sold 1,852 units, down 7.8% year-on-year but still ranking seventh.

◎ Omoda and Jaecoo combined sold 865 units, entering the mainstream.

◎ Jetto also made initial strides with sales of 573 units.

◎ Additionally, Chinese brands such as JAC (+105.0%), BAIC (+27.2%), Foton, and FAW are steadily expanding in the commercial vehicle segment.

Regarding specific product layouts, the popularity of Haval Jolion (+56.9%) and Chery Tiggo 4 Pro (+16.1%) underscores the success of Chinese brands' "small models, big market" strategy in South Africa.

◎ Jolion won over many family users in the compact SUV segment due to its reasonable pricing, spacious feel, and rich features. ◎ Chery leverages the Tiggo family's multiple layouts to penetrate lower market segments, catering to different consumption levels.

As Chery's new high-end brand portfolio targeting the global market, Omoda and Jaecoo, despite being nascent, have seen Omoda C5 repeatedly feature in monthly best-seller lists in October 2024 and April 2025, indicating that its design, intelligent features, and cost-effectiveness resonate with young South African consumers. Jetto's entry further complements Chery's mid-to-large SUV product line. The rise of Chinese brands in the South African market is not coincidental but a strategic breakthrough fueled by "technology parity + price efficiency".

◎ On one hand, domestic brands leverage their long-standing expertise in new energy and smart cabins to build products that better align with local consumer expectations.

◎ On the other hand, Chinese automakers enhance their sustainable competitiveness in African markets through collaboration with local dealers, parts localization, and service system development.

Judging by the pace of Chinese brands' development, they are no longer content with low-price competition but are constructing a deep market structure through a multi-brand and multi-product line strategy.

◎ For instance, Great Wall Motors leads with Haval, with potential follow-ups from high-end brands like WEY and Tank; ◎ Chery stabilizes the market with Tiggo, shapes its image with Omoda and Jaecoo, and expands user base with Jetto; ◎ JAC and Foton continue to deepen their roots in the commercial vehicle sector, capturing government procurement and small-to-medium enterprise users.

Summary

The growth of the South African auto market in April 2025 signals Mahindra and Hyundai's resurgence, while the collective rise of Chinese brands heralds a more polarized and complex competitive landscape. As an emerging battleground for global automakers, South Africa has become a pivotal node in Chinese brands' globalization strategy. Zhineng Technology will continue to monitor Chinese brands' in-depth expansion and strategic evolution in overseas markets like South Africa, gaining insights into their multi-dimensional advancements in technology, channels, and branding.