Geely and Zeekr Merger Poised to Boost Annual Revenue by 20 Billion Yuan

![]() 05/16 2025

05/16 2025

![]() 679

679

Several Zeekr employees have already been integrated into Geely, primarily focusing on R&D. "I didn't expect Geely's actions to be so swift and comprehensive," remarked industry insiders. These changes stem from Geely's (0175.HK) announcements at the third-quarter earnings meeting on May 15, which included accelerating integration, restructuring the management team, and adjusting the pace of new car launches. These announcements will pave the way for further changes in sales teams, sales models, R&D systems, vehicle definitions, cost control, and more.

Key managerial appointments include: Gan Jiayue will become the CEO of the merged Geely Auto Group, which encompasses the Geely Galaxy Business Group and the Zeekr Technology Business Group, while maintaining his position as an executive director of Geely Automobile Holdings Limited. An Conghui will take on the role of CEO of Geely Holding Group, responsible for the overall operation and management of the group. Prior to the completion of the merger, An Conghui will continue as CEO of Zeekr Technology Group.

Regarding new cars, the Zeekr 9X will launch in the third quarter, the Zeekr 8X will debut or launch in the fourth quarter, the Lynk & Co 10 EM-P will debut in the second quarter, the Geely Galaxy L9 will launch in the fourth quarter, and a new A+ sedan will be unveiled at the end of the second quarter. These launches will bring about three major market shifts, particularly in the realm of new cars, where Geely aims to seize pricing power from new-energy vehicle startups and BYD.

R&D Integration Initiated, Saving 10 Billion Yuan Annually

Do not underestimate Geely's competitive prowess when it rolls up its sleeves. The changes are significant and swift, as evidenced by the progress made in 2025. In January, Ezhen and Radar were officially integrated into Geely Auto; in February, Zeekr and Lynk & Co merged, leading to the establishment of Zeekr Technology Group; in March, Geely's Intelligent Driving Assistance System completed structural integration, unveiling five solutions: Qianli Haohan H1, H3, H5, H7, and H9.

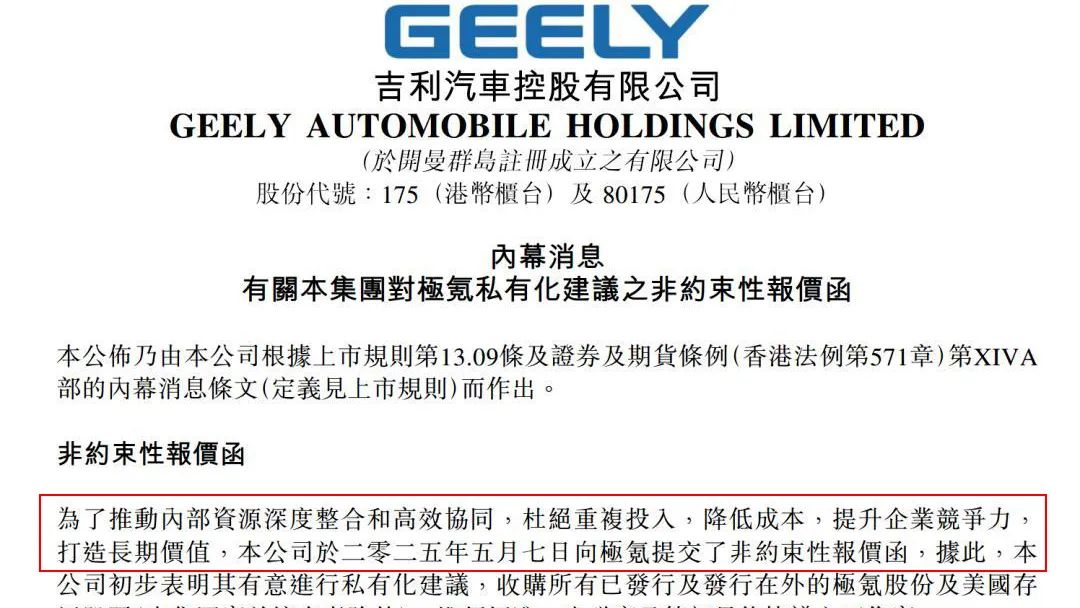

In April, the group integrated its battery business, establishing JiYao Mobility, which unified Shendun Battery and Jinzhuan Battery. In May, major actions accelerated significantly. On May 7, Geely announced plans to privatize Zeekr, aiming for full integration into the Hong Kong-listed company. Subsequently, Lin Jie was appointed as the head of domestic marketing services for the Zeekr brand. On May 15, a series of announcements were made.

Undoubtedly, this integration efficiency is remarkable in the current era and within the history of the automotive industry. As a founder-led company, further R&D announcements are expected in the near future.

In this new round of technological integration, resources are concentrating within the Geely Research Institute. The integration of Zeekr and Lynk & Co was proposed in the Taizhou Declaration, with the number of products reduced by 20% post-integration. The R&D architecture has been streamlined into four major product lines and five major centers (cockpit, intelligent driving, architecture, software, and three electrics), achieving a high degree of platformization.

Currently, the intelligent cockpit has been integrated into the Geely Research Institute. Regarding intelligent driving, although full integration into the research institute is not yet definitive, the core architecture of Qianli Technology, Jieyue Xingchen, and Xingji Meizu has been established. Qianli Technology is responsible for AI and vehicle integration, Jieyue Xingchen handles algorithms and large models, and Xingji Meizu provides technical support and solutions encompassing software, hardware, and software-hardware integration foundations.

Previously, Geely faced excessive complexity in intelligent driving, with various self-developed solutions from LOTUS, the Haohan architecture of Zeekr, the Mobileye solution of Zeekr, self-developed solutions from the research institute, and external cooperation solutions. The goal is to improve efficiency, reduce costs, and enhance technological competitiveness. Simply put, resources will be optimized, and R&D results will be shared among Geely's advantageous brands, spanning from the China Star series of fuel vehicles to Galaxy, Lynk & Co, and Zeekr.

Currently, there are two key sets of data regarding cost control. The first is that the R&D cost per vehicle has been reduced by 30% or more. The Haohan architecture of Zeekr and the SPA Evo architecture of Lynk & Co are interoperable, with a reuse rate of core modules such as three-electric technology and electronic and electrical architecture exceeding 70%. Consequently, Lynk & Co 900 and Zeekr 9X share chassis and battery packs through differentiated positioning, reducing R&D costs by 30%.

The second set indicates that post-merger, R&D investment is expected to decrease by 10%-20%, supply chain costs are anticipated to drop by 5%-8% due to economies of scale, and capacity utilization is forecast to rise by 3%-5%. Based on Zeekr's 2024 revenue of 75.9 billion yuan, supply chain cost savings could translate into a profit margin of 6 billion yuan. Now, with the integration with Geely (0175.HK), savings exceeding 10 billion yuan are within reach.

Change 2: Overseas Strategy Shifts, Creating a Profit Margin of 10 Billion Yuan

Another focal point at this earnings meeting was Geely's overseas expansion efforts. The plan is to add over 300 new sales and service points globally by the end of 2025, bringing the total overseas sales and service network to over 1,100 locations. This represents about 30% of Geely's scale in China. With 1,911 dealers in China, including other brands and service networks such as Lynk & Co and Zeekr, this accounts for approximately 30% of Geely's overall network.

At the earnings meeting, key changes in the overseas strategy were highlighted, encompassing three points. Besides expanding overseas networks and delivering models such as Xingjian 7, Lynk & Co 08, and Zeekr 7X globally and in Europe, a new six-seater model will be launched. The second point involves increasing production capacity in overseas markets, with the Indonesia factory commencing production in 2025 and the Vietnam factory in 2026. The third point pertains to altering the sales and profit structure.

At the earnings meeting, adjustments to the overseas strategy were elaborated upon. Previously, Geely's overseas models followed a globally unified logic, with configurations consistent with those in the Chinese market. However, amidst growing competition among automakers expanding overseas, the mainstream approach now involves conducting in-depth research on local consumer needs and eliminating configurations that suit Chinese consumers but do not match overseas demands. This will lead to more precise pricing and higher sales and profit figures.

Regarding overseas profits, Geely (0175.HK) did not provide relevant data in its 2024 financial report. However, we can estimate its scale based on available information. In 2024, Geely's cumulative overseas exports reached 414,500 vehicles, with a gross margin 3.2% higher than the domestic market. The total gross margin in 2024 was 38.2 billion yuan, with the overseas market accounting for about 19% of gross margin, or approximately 7.26 billion yuan. Based on the latest increase in the number of dealers and adjustments to the profit structure, this space is projected to reach over 10 billion yuan in 2025, an increase of about 5 billion yuan compared to the 2024 estimate.

Aiming at BYD, Seizing Pricing Power for New Cars in the Chinese Market

The third change is closely tied to the latest personnel shifts. Geely's subsequent focus has been clarified, with a deep concentration on its advantageous automotive segments. From the new round of appointments, it is evident that Gan Jiayue will become the CEO of the merged Geely Auto Group, which includes the Geely Galaxy Business Group and the Zeekr Technology Business Group, while maintaining his position as an executive director of Geely Automobile Holdings Limited (0175.HK).

In the first quarter, sales reached 704,000 vehicles, a year-on-year increase of 48%, with 339,000 new energy vehicles, representing a penetration rate of 52.2%, surpassing the industry average. Among them, Galaxy sold 260,000 vehicles, a year-on-year increase of 214%, Zeekr sold 41,000 vehicles, a year-on-year increase of 25%, and Lynk & Co sold 73,000 vehicles, a year-on-year increase of 19%. Notably, the Galaxy model, spearheaded by Gan Jiayue, stood out. The reason behind this is clear: Geely is initiating a new round of competition for pricing power in the Chinese automotive market. As the market evolves, Geely is redefining the rules. Currently, under Geely's strategies, new energy vehicles have completed pricing reconstructions in four major sub-market segments.

The Geely Galaxy E5 was the first to move, lowering the pricing of entry-level compact SUVs by 14% compared to previous models. Before BYD launched its intelligent driving version, the Galaxy E5's direct competitor was the BYD Yuan PLUS, which also had a strong grasp on pricing power and even the right to define the market. With the launch of the Galaxy E5, its configuration and guide price are on par with the BYD Yuan PLUS Glory Edition 430km Beyond model, priced at 126,800 yuan, but the Galaxy E5's guide price is 107,800 yuan.

Subsequently, Geely Galaxy's strategy proved successful in sales, with models like Xingyuan, Xingjian 7, and the newly launched Xingyao 8 all completing market reconstructions. Xingyuan, in particular, delivered a decrease of 18%. This car is a strategic move, offering the size and configuration of the BYD Dolphin at the pricing of the BYD Seagull. Xingyuan's entry-level guide price is 68,800 yuan, which is even 10,000 yuan lower than the BYD Seagull. When directly compared to the Dolphin, Xingyuan's guide price is 18,000 yuan lower. For a model priced under 100,000 yuan, a difference of 18,000 yuan is significant. Hence, it is not surprising that from January to April this year, Xingyuan became the sales champion in the entire passenger vehicle market. On the other hand, Geely Xingjian 7 is encroaching on the territory of the Song Pro DM-i. When compared with the same configuration, as entry-level models, there is a price difference of 15,000 yuan between the two. Similarly, for a model priced just over 100,000 yuan, Xingjian 7 has lowered the pricing of the mainstream model by 13%.

A 23% price reduction is akin to offering a direct 25% discount on current pricing. The most groundbreaking news undoubtedly involves the Geely Yinhe Xingyao 8, which recently completed its listing and secured over 10,000 firm orders within six days. Geely's strategy is clear: in larger markets, the price drop is more gradual, whereas in smaller or more competitive markets, it strikes hard. Initially, this market was dominated by the BYD Han DM-i, priced at 168,800 yuan, which leveraged technological advancements like five-link suspension, new batteries, and intelligent driving assistance systems to deliver significant product enhancements. However, the Geely Yinhe Xingyao 8, with an entry-level price of just 125,800 yuan for comparable specifications, has slashed the pricing of medium and large sedans by 23%. Including the limited-time 10,000 yuan subsidy redeemable for any model, this figure jumps to an astonishing 31%. According to financial data, in the first quarter of 2025, 0175.HK's operating revenue surged 25% to 72.5 billion yuan, with gross profit rising 26% in tandem with revenue. Notably, profits soared by 264%, with net profit attributable to shareholders reaching 5.67 billion yuan. This suggests that following deep vertical integration, Geely Yinhe's breakthrough with the current model has not only been benign for the company but has had a positive impact. Whether Zeekr and Lynk & Co will adopt this model remains uncertain. However, it is evident that with more capital, technology, and lower costs post-integration, Geely can offer higher configurations and more advanced technology at the same price, even without resorting to a low-price strategy to boost Zeekr and Lynk & Co sales.

Postscript

This innovative approach to soaring profits and sales can clearly pave the way for further profit enhancement. Judging by the first quarter of 2025 alone, the projected growth potential for the entire year could reach 5 billion yuan. Consequently, considering all factors, Geely is poised to earn an additional 20 billion yuan. Of course, this discussion can be expanded. For instance, Zeekr and Lynk & Co are currently accelerating their pace. A recurring phrase at the press conference was "time waits for no one." All three new models entered the market a month ahead of schedule, with Zeekr 8X and Zeekr 9X positioned as luxury car profit leaders, akin to Wenjie M8 and Wenjie M9.