Guangzhou Automobile Group's 100-Day Transformation: Feng Xingya's Reform Maneuvers Amid Sales Challenges

![]() 05/26 2025

05/26 2025

![]() 554

554

Change, often accompanied by pain, is inevitable.

By Wu Wei, Investor Network

On February 3, 2025, Feng Xingya officially succeeded Zeng Qinghong as the chairman of Guangzhou Automobile Group (601238.SH), taking the helm of the enterprise. Over 100 days have elapsed since then. Amidst a new market landscape, Feng Xingya has spearheaded a profound reform within Guangzhou Automobile Group, encompassing organizational restructuring, technology roadmap adjustments, and market strategy shifts. The headquarters' relocation southward, the establishment of four key departments, renewed collaboration with Huawei on high-end projects, and the countdown to mass production of L3 autonomous vehicles—these actions underscore the established state-owned enterprise's resolve to transform.

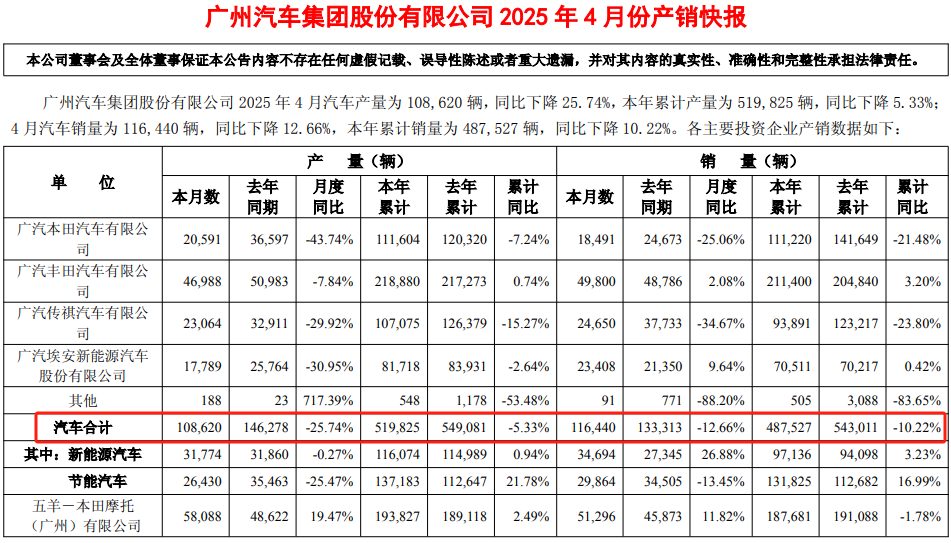

However, sales figures from January to April 2025 cast a pall over the company's transformation efforts. During this period, Guangzhou Automobile Group sold a total of 487,500 vehicles, marking a year-on-year decline of 10.22%, with April's sales alone dropping by 12.66%. Furthermore, despite producing 519,800 vehicles from January to April, the company only managed to sell 487,500, leaving a backlog of over 30,000 vehicles.

In the first quarter of 2025, the company's inventory turnover days increased to 79.56 days. Among the nine passenger vehicle enterprises listed on the A-share market, only Haima Automobile (000572.SZ) and two others recorded higher inventory turnover days than Guangzhou Automobile Group. Amidst declining sales and a protracted share price downturn, the new leader must also navigate the complexities of state-owned enterprise market value management.

As the blueprint for reform collides with the harsh realities of the market, Feng Xingya finds himself at a pivotal juncture, tasked with steering the enterprise through a critical phase of transformation and performance breakthrough.

The Path of Reform for a Visionary Leader

Feng Xingya's bond with the automotive industry is inseparable. After graduating in 1988, he embarked on a career in the industry and joined Guangzhou Automobile Group in 2004. With a Master's degree in Engineering, he began his tenure in a technical role and held pivotal positions in core divisions such as Guangqi Honda and GAC Motor. He led the transformation of Trumpchi from a joint venture independent brand to a standalone brand and propelled AION's emergence as a high-end new energy brand, earning him the moniker of "the reformist who understands Guangzhou Automobile Group best."

Amidst the rapid rise of new automakers and the evolution of domestic automotive recognition and intelligence, Guangzhou Automobile Group's operational performance deteriorated in 2024. The company's revenue declined by 16.9%, and its non-deductible net profit incurred its first loss in nearly two decades. Consequently, upon taking office in 2025, Feng Xingya initiated an internal reform centered around "managing and controlling the headquarters."

The first step of this reform involved restructuring the organization. In October 2024, Guangzhou Automobile Group's headquarters relocated from Zhujiang New Town, Guangzhou, to the Panyu Hualong Automotive Industry Base, marking the launch of the "Panyu Action." This move aimed to dismantle the barriers posed by a "headquarters far from the production frontline." Concurrently, four core departments focusing on products, finance, procurement, and marketing were established to address the chronic issue of resource fragmentation across independent brands. The Product Department integrated the R&D systems of Trumpchi, AION, and Hyper, implementing the IPD integrated development process. The Marketing Department assumed responsibility for the market strategies of these three brands in January 2025, putting an end to overlapping channels and fragmented marketing efforts. This "concentration of resources to achieve greatness" is emblematic of state-owned enterprises' efforts to enhance operational efficiency.

Source: Company Annual Report

In terms of development strategy, Guangzhou Automobile Group under Feng Xingya's leadership has placed significant bets on new energy and intelligence. The company adopts a dual-track strategy of "independent + joint venture" in the new energy realm. As the pioneer among independent brands, AION achieved overseas sales of over 100,000 vehicles in 2024, and the commissioning of its smart factory in Thailand signaled its entry into a new stage of "vehicle exports + local production." For the joint venture segments of Guangqi Honda and Guangqi Toyota, the company continues to rely on the traditional fuel vehicle market while also introducing new energy models such as the Vezel and e:NP1.

In the realm of intelligent technology, Guangzhou Automobile Group is even more proactive. The company's first L3 autonomous driving model is scheduled for mass production in the fourth quarter of 2025, equipped with the ADiGO PILOT intelligent driving system, supporting highway congestion pilot functions, and introducing 12 automotive-grade chips and the "Starling Safety Protection System."

After experiencing twists and turns, the collaboration between Guangzhou Automobile Group and Huawei has deepened once more. In January 2025, they jointly established the "GH Project Company," a new brand named "HuaWang" with a registered capital of 1.5 billion yuan, targeting the high-end market segment of 300,000 yuan. This venture aims to carve out a unique path beyond competitors like AITO and Intelligent World. Additionally, the unveiling of the flying car GOVY AirJet and the embodied intelligent robot GoMate further underscore Guangzhou Automobile Group's ambitions for future travel scenarios.

Globalization and supply chain autonomy serve as the other two pillars of this reform. In 2024, Guangzhou Automobile Group sold 127,000 vehicles overseas, marking a year-on-year increase of 67.6%, with operations spanning 74 countries. Factories in Malaysia and Thailand form the fulcrum of the company's ASEAN presence. The company's self-developed InPower batteries and InPower electric drives have entered mass production and installation, aiming to alleviate the "choking" issue of core component supply. In the Feng Xingya era, Guangzhou Automobile Group aims to transform from a traditional automaker into a "global technology travel group" through technological self-reliance and market expansion.

The Challenges Underlying Reform Pain

Despite the ambitious strategic layout, Guangzhou Automobile Group's terminal market has been cooling off in the short term. April 2025 sales data revealed that the company sold a total of 116,400 vehicles, a year-on-year decline of 12.66%. Among these, Trumpchi sold 24,700 vehicles, a year-on-year drop of 34.67%, and Honda sold 18,500 vehicles, down 25.06% from the previous year. Notably, from January to April, Guangqi Toyota produced 218,900 vehicles but only sold 211,400 during the same period, resulting in a backlog of 7,480 vehicles. Coupled with Trumpchi's backlog of 13,200 vehicles and AION's over 10,000 vehicles, Guangzhou Automobile Group had a total backlog of 32,300 unsold vehicles from January to April.

Data Source: Company Announcement

Following the slowdown in corporate turnover, Guangzhou Automobile Group's multiple financial indicators continued to underperform. As of the end of March, the company's inventory scale reached 18.92 billion yuan, an 8.1% increase compared to the same period last year. In the first quarter of 2025, Guangzhou Automobile Group's inventory turnover days increased to 79.56 days, up 2.42 days from the same period in 2024. In contrast, in the first quarter of 2023, the company's inventory turnover days were only 47.08 days. Wind data indicates that among the nine passenger vehicle enterprises listed on the A-share market, only Haima Automobile and two others have higher inventory turnover days than Guangzhou Automobile Group.

Beyond inventory backlogs, Guangzhou Automobile Group's gross margin also experienced an abnormal decline, with the first quarter of 2025 recording a gross margin of only 0.21%. Among the nine passenger vehicle enterprises listed on the A-share market, only one company has a lower gross margin. It is noteworthy that even NIO (09866.HK), which has been consistently unprofitable, has maintained a minimum gross margin of over 1% in recent years. Due to this low gross margin, Guangzhou Automobile Group incurred a loss of 732 million yuan in the first quarter of 2025, with net profit and non-deductible net profit declining by 159.95% and 229.89% year-on-year, respectively.

As a state-owned enterprise controlled by Guangdong state-owned assets, Guangzhou Automobile Group under Feng Xingya's leadership must also confront the pressure of market value management. To bolster market confidence, regulatory authorities issued policies such as "Several Opinions on Improving and Strengthening the Management of Market Value of Central Enterprise Holding Listed Companies" and "Guidance for the Supervision of Listed Companies No. 10 - Market Value Management" at the end of 2024. These policies aim to enhance the quality of central enterprises and incorporate market value management into the performance appraisal system for responsible persons, thereby strengthening positive incentives. Guided by central policies, Guangdong also issued "Several Measures on High-Quality Development of the Capital Market to Support the Modernization of Guangdong," implementing relevant regulations.

Since 2025, Guangzhou Automobile Group's A-share price has declined by over 10%, significantly reducing the market value held by the controlling shareholder. Currently, the company's A-share price hovers around 8 yuan per share, representing only a 13% increase from the company's recent low in September 2024. The company's total market value has also dipped below 85 billion yuan. Although Guangzhou Automobile Group has initiated a repurchase program to boost market confidence, investor sentiment remains subdued.

Finding a balance between reform investments (such as L3 research and development, overseas factory construction) and shareholder returns will be a thorny issue for Feng Xingya's leadership team.

Under Feng Xingya's stewardship, Guangzhou Automobile Group's reform logic is clear and discernible. The company aims to enhance efficiency through organizational integration, build barriers through technological innovation, and open up growth avenues through globalization. However, the automotive industry's transformation has never been a linear process. In a market where BYD (002594.SZ) and Tesla have established scale advantages, and Huawei and XPeng (09868.HK) are accelerating intelligent penetration, the margin for error for latecomers is narrowing.

Nevertheless, AION's overseas breakthrough, the impending mass production of L3 models, and deepening cooperation with Huawei could serve as catalysts for Guangzhou Automobile Group's performance turnaround. In the short term, however, addressing the nearly 19 billion yuan inventory backlog, accelerating the electrification of joint venture brands, and enhancing the market competitiveness of new models present uphill battles for the company.

The success or failure of this reform may hinge on whether Guangzhou Automobile Group can achieve a positive cycle of "technology investment - product landing - sales rebound" within the next 1-2 years. For state-owned enterprise reforms, this is not merely a test of performance but also an ultimate test of reform determination and marketization capability. As the strategic blueprint encounters practical hurdles, can Guangzhou Automobile Group's transformation train adjust its course in time and embark on a new growth cycle? Time will tell all. (Produced by Sifinance) ■

Source: Investor Network