Involution, Smart Driving Equity, and New Energy Mayhem: Decoding Morgan Stanley's China Autos Outlook

![]() 05/26 2025

05/26 2025

![]() 598

598

Recently, Morgan Stanley, a prestigious investment firm, unveiled its 'China Autos Overview' report, offering a comprehensive view and forecast of China's automotive industry through 2025. The report delves into numerical predictions across various facets of China's auto market, spanning production, sales, exports, electrification, and intelligence.

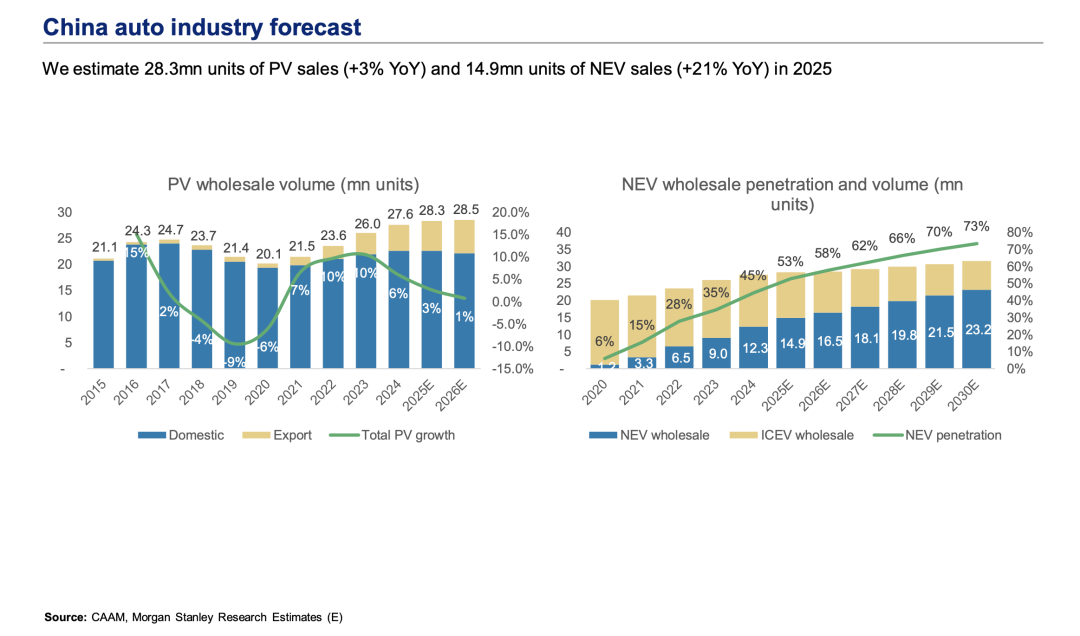

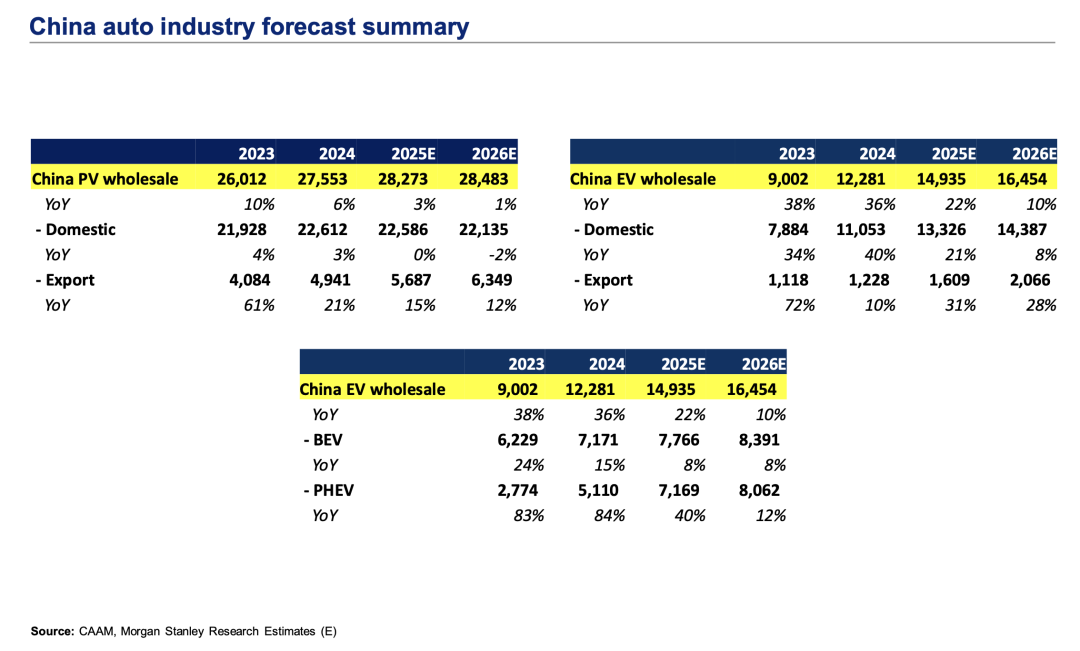

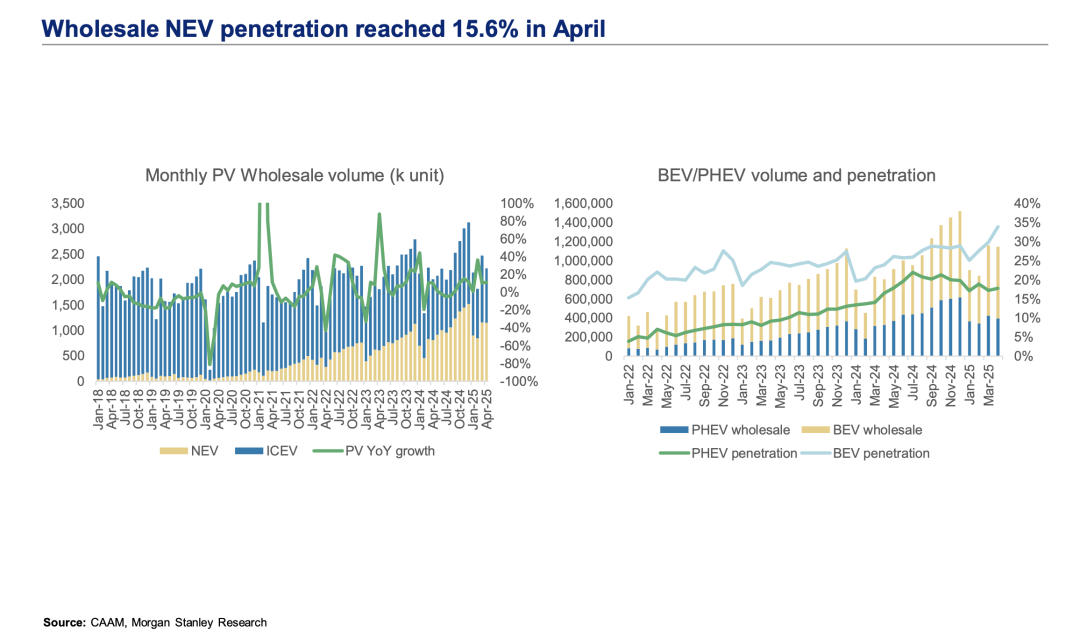

Drawing upon the numerical predictions in Morgan Stanley's 'China Autos Overview' report, this article integrates relevant experience and information to summarize the following viewpoints: Market Volume and Structure: Stock Competition and Export Differentiation Morgan Stanley projects that by 2025, China's total domestic and export sales of passenger vehicles will reach 28.3 million units (a 3% increase), with 14.9 million units being new energy vehicles (a 22% increase), achieving a penetration rate of 53%. Within the new energy vehicle segment, pure electric vehicle sales are expected to hit 7.766 million units (an 8% increase), while hybrid vehicle sales will reach 7.169 million units (a 40% increase).

Domestically, passenger vehicle sales are estimated at 22.586 million units in 2025, roughly equal to 2024 figures, with 13.326 million units being new energy vehicles (a 21% increase). Exports are projected to reach 5.687 million units in 2025 (a 15% increase), of which 1.609 million units will be new energy vehicles (a 31% increase).

Interpretation: Domestically, China's total auto sales have plateaued after years of growth and will start to decline slightly from 2026, with the penetration rate of new energy vehicles slowing down. This suggests intensified industry competition, continuing price wars, excess auto talent leading to increased layoffs, and heightened industry pressure. In terms of exports, while the overall volume continues to rise, the growth rate is slowing down. However, the export growth rate of new energy vehicles is accelerating, indicating that enterprises reliant on traditional fuel vehicles for exports will face pressure, while new energy exports emerge as a bright spot.

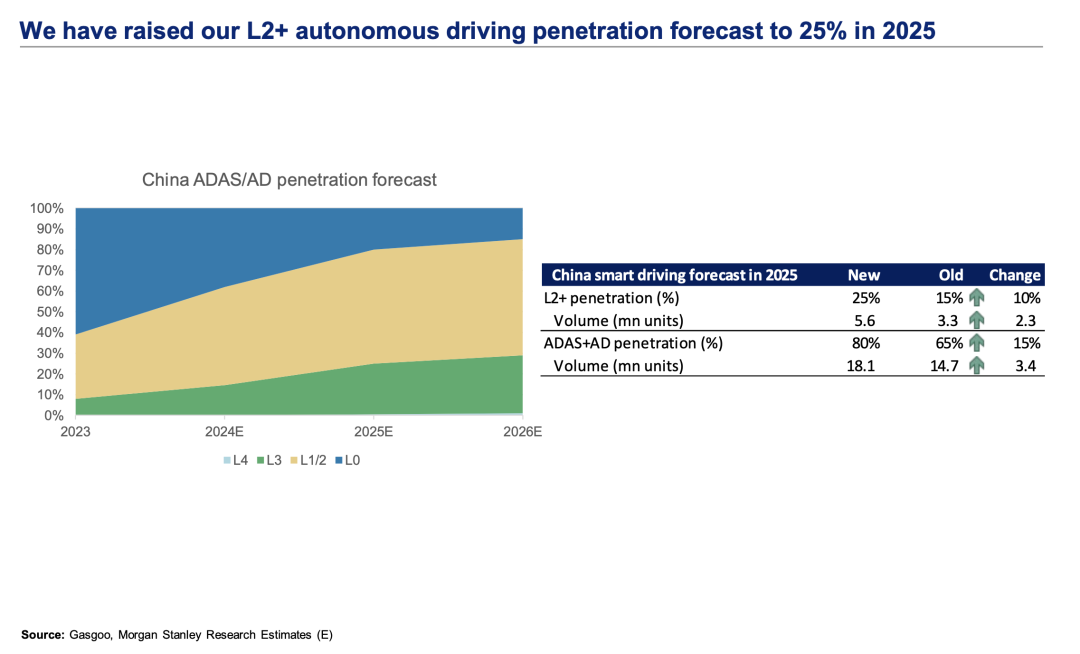

Intelligence: Penetration Rate Peaks and Industry Chain Reshuffling By 2025, the penetration rate of L1/L2 ADAS (Advanced Driver Assistance Systems) and L2+ smart assisted driving with navigation assistance in Chinese vehicles will reach 80%, equating to 18 million vehicles equipped. The penetration rate of L2+ smart assisted driving with navigation assistance will reach 25%, with 5.6 million new vehicles equipped.

Interpretation: Smart assisted driving will peak in 2025. As discussed in our previous article, "BYD's Smart Driving Dream: Can 'Smart Cars' Really Be Popularized by 2025?", BYD's foray into smart driving equity ignited the entire industry. With an 80% penetration rate, industries such as smart driving chips, domain control electronics, camera sensors, radars, and LiDARs will experience a sudden surge. Talent in smart assisted driving will also increase significantly, and the aftermarket and insurance sectors will quickly follow suit. However, rapid growth often heralds a swift decline, leaving behind a reshuffled supply chain and talent landscape.

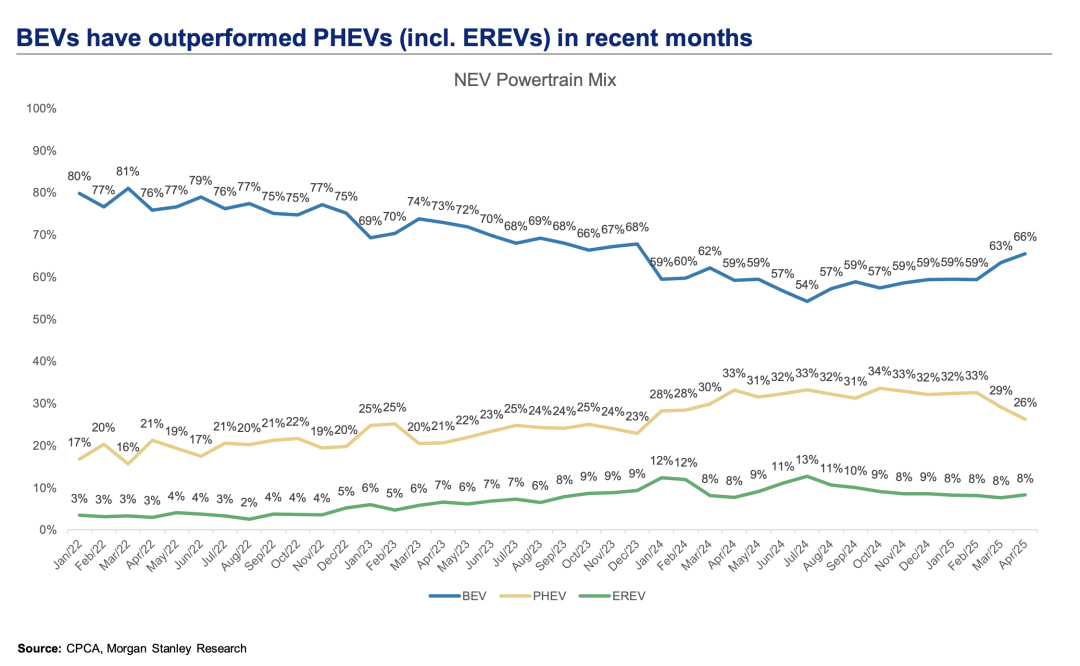

Electrification: New Energy Technology Path, Pure Electric Return, and Extended-Range Comeback According to Morgan Stanley, the two main forces in new energy vehicles have been pure electric vehicles (BEV) and plug-in hybrid vehicles (PHEV). Since 2022, with the emergence of BYD's DMi, its sales share in 2024 approached a 50:50 split with pure electric vehicles. However, from 2025, a rapid differentiation is evident, with plug-in hybrid vehicle penetration stabilizing or slightly declining, while pure electric vehicle penetration is rapidly increasing.

Among the three major categories of new energy vehicles, internal proportion trends have shifted: Plug-in hybrids like BYD's DMi have started to weaken this year. Pure electric vehicles have started to recover after experiencing a decline due to the rise of plug-in hybrids. Extended-range vehicles (EREV) accounted for about 10% of new vehicle sales in the total sales of new energy vehicles in the past year, and the sales share of extended-range vehicles has started to increase since April.

Interpretation: Pure electric vehicles undeniably represent the future of new energy vehicles. The intermediate form of plug-in hybrids is likely to be encroached upon by extended-range vehicles. Within the framework of policy allowances, the technical form of extended-range vehicles is relatively simple, and their technical path is not vastly different from that of electric vehicles, suggesting they will rise in the coming years.

Final Thoughts 2025 marks a critical juncture for China's auto market as it transitions from 'scale expansion' to 'value reconstruction'. The resurgence of pure electric vehicles, the substitution of extended-range vehicles, smart driving equity, and export strategies will reshape the competitive landscape. In the next 2-3 years, the concentration ratio of the auto industry (CR10) may rise from 65% in 2023 to 75%, with the true 'survivors' being a select few players possessing both scale effects and technological barriers. Enterprises must make decisive choices regarding technology routes, cost control, and globalization strategies. Auto industry talent faces not only intense competition but also the risk of excess, with increased pressure on layoffs in R&D and manufacturing, necessitating preparations. However, intelligent and international talent remains scarce.Reference Articles and Images

China Autos Overview pdf - Investor Presentation | Asia Pacific Morgan Stanley

*Reproduction and excerpts are strictly prohibited without permission. To obtain reference materials for this article, join our knowledge platform to download a vast amount of resources from our public account, including the above references.