European Auto Market | The Netherlands April 2024: The Undercurrent and Breakthrough of Chinese Brands

![]() 05/26 2025

05/26 2025

![]() 803

803

The Dutch auto market continued to face pressure in April 2024, with overall sales declining by 4% year-on-year and cumulative sales for the year decreasing by 8.7%.

Amidst the rapid rise of hybrids and the robust market share of electric vehicles, Chinese auto brands, although not topping the sales charts, have quietly launched an offensive, with some brands achieving breakthroughs through new models.

In this report, Cheenergy Technology delves into the macro dynamics, brand competition, and market performance of Chinese brands in the Netherlands, offering insights into underlying trends and potential.

01

Market Overview:

Hybrid Dominance, Electric Resilience

Traditional Fuel Vehicles Continue to Decline

The Netherlands auto market sold 27,159 new vehicles in April, a year-on-year decrease of 4%, indicating a weak trend in overall auto consumer demand in Europe. Cumulatively, new vehicle sales in the first four months of the year stood at 118,683, down 8.7% year-on-year, and the market has yet to recover.

● From the perspective of powertrain structure:

◎ Hybrid Electric Vehicles (HEVs) have emerged as the dominant force, accounting for 49.1% of the market share with monthly sales of 13,329 units. This trend underscores consumers' quest for a balance between electric and traditional vehicles.

◎ The Battery Electric Vehicle (BEV) market has shown remarkable resilience, accounting for 33.9% of sales with 9,206 units sold, maintaining one of the highest electric vehicle penetration rates globally.

◎ Traditional gasoline and diesel vehicles continue to shrink, accounting for only 14.4% and 2.3%, respectively.

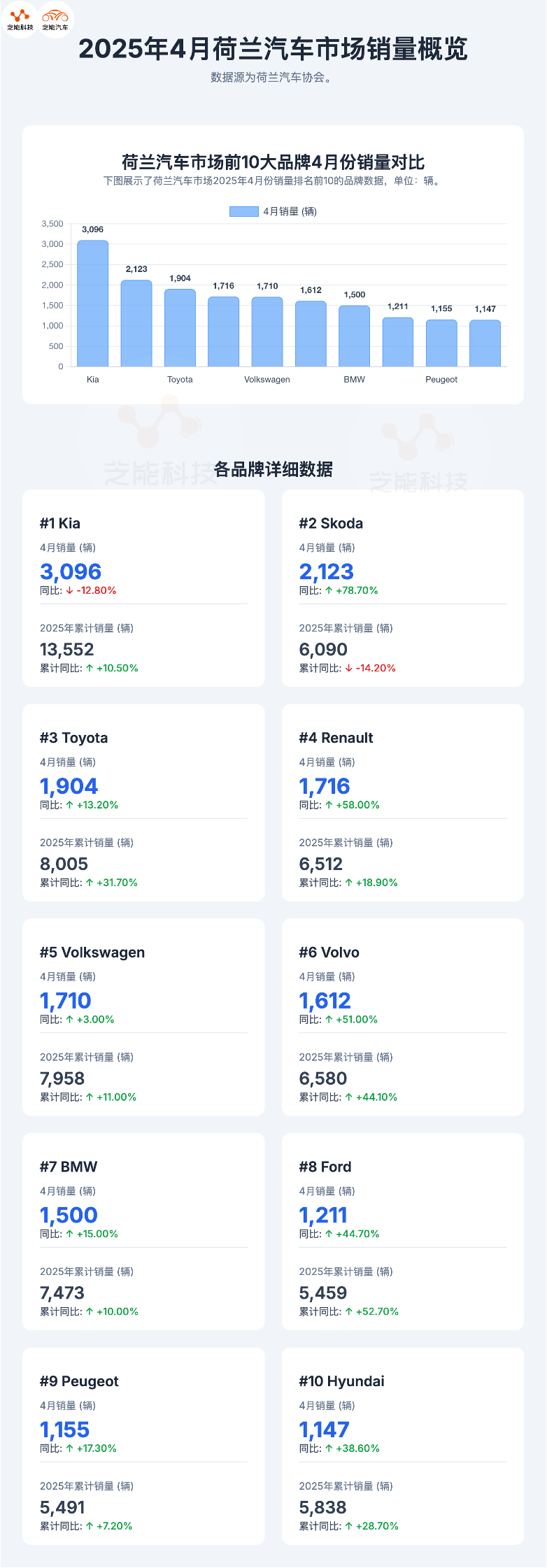

● In terms of brands:

◎ Kia, despite a year-on-year decline of 12.8%, retains its top spot due to the popularity of the EV3, with a market share of 11.4%.

◎ Škoda surged to second place with a staggering year-on-year increase of 78.7%, reflecting the market success of its new Elroq model.

◎ Toyota ranks third, experiencing a year-on-year decline of 13.2%.

◎ Brands such as Renault, Ford, Peugeot, and BMW have performed actively, especially Ford and Peugeot, which recorded year-on-year growth of 44.7% and 17.3%, respectively, demonstrating the resilience of European traditional brands.

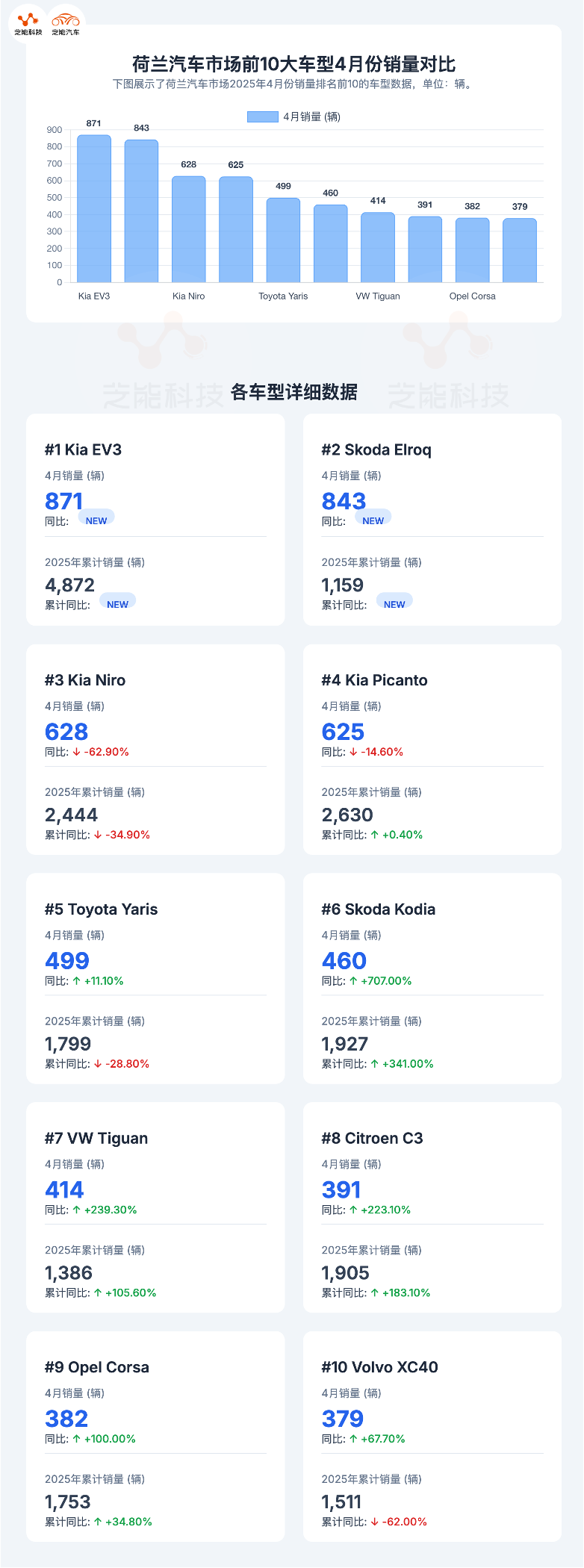

● In the model sales ranking:

◎ The Kia EV3 has secured the sales crown for four consecutive months, selling 871 units in April.

◎ Close behind is Škoda's Elroq with 843 units sold, only 28 units behind, posing a direct threat.

◎ Notably, Kia also has two models in the top four: Niro (628 units) and Picanto (625 units), although the former saw a significant year-on-year drop of 62.9%.

◎ Toyota Yaris Cross, a representative of small SUVs, surged to fifth place with an 11.1% year-on-year increase.

● From the perspective of market structure, pure electric SUVs for urban commuting from A0 to A segments and economical cars continue to dominate.

It is noteworthy that the high growth of multiple models is accompanied by the "new model effect," with models like Elroq, Tiguan, and Kodiaq exhibiting a typical "post-launch sales surge" pattern.

02

Chinese Brands Compete in the Netherlands:

From the Margins to Breakthroughs, Displaying Diverse Strengths in Segmented Markets

In the highly competitive Netherlands market, Chinese auto brands are gradually transitioning from "marginal existence" to "strategic breakthroughs."

While overall sales still belong to the second tier, the performance of segmented brands and models reveals a scenario of multi-point breakthroughs and concentrated efforts.

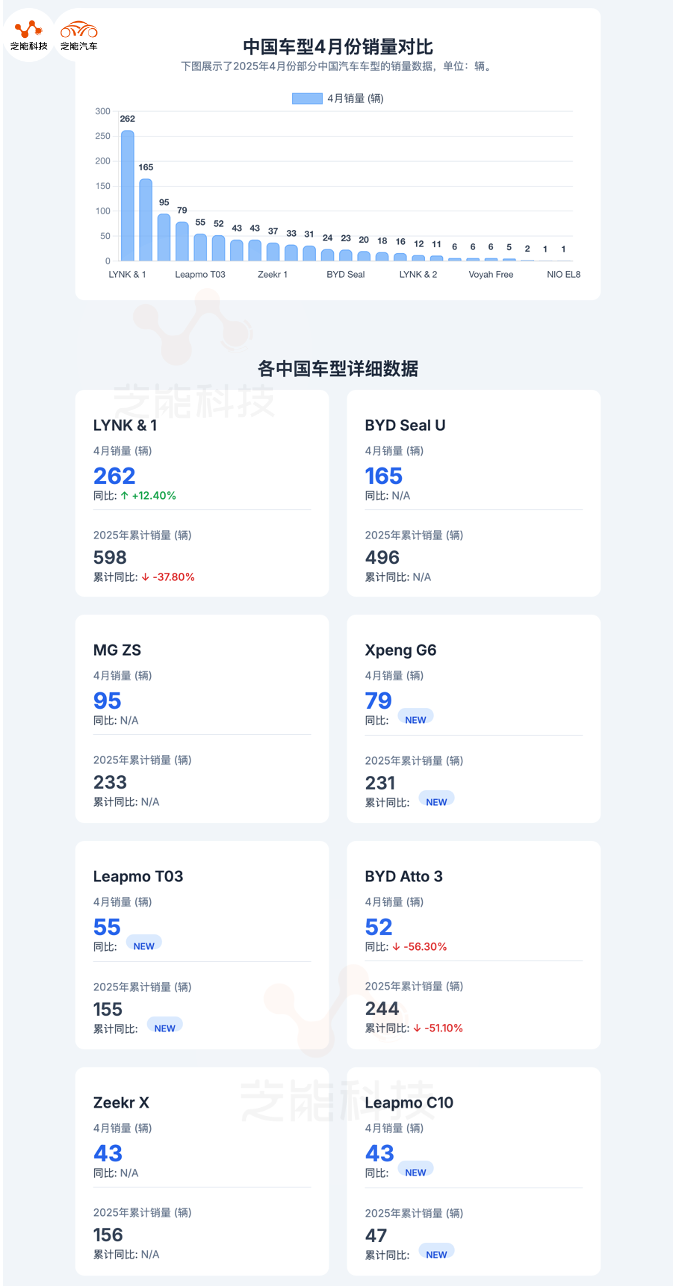

◎ Lynk & Co has demonstrated stable performance with monthly sales of 274 units, a year-on-year increase of 17.6%. Its model, LYNK & Co 01, remains the sales pillar.

◎ BYD sold 268 units, a year-on-year increase of 34%. Cumulatively, sales for the year reached 1,028 units, a year-on-year increase of 37.1%.

Among them, the main model Seal U achieved monthly sales of 165 units, a year-on-year surge of 931.3%, with cumulative sales for the year reaching 496 units, indicating its gradual establishment in the family SUV market. However, early mainstay models such as Atto 3 and Dolphin saw declines, suggesting increased market competition and the pressure of product cycle replacement.

◎ MG also remained active, selling 213 units in April, including 95 units of the MG ZS, a year-on-year surge of 313%. More notably, the MG 3 small car achieved a year-on-year growth of 450%, with a cumulative increase of 2433.3%, proving its cost-effectiveness advantage in the A0-segment car market.

◎ Xpeng Motors sold 105 units, a year-on-year increase of 69.4%, with the newly launched G6 SUV dominating sales at 79 units.

◎ NIO is currently in a "trough period," selling only 2 units in April, a year-on-year decline of over 90%, indicating that high-end electric vehicles face both product and brand challenges in the Netherlands market.

◎ Zeekr sold 80 units, a year-on-year increase of 29%, with the compact pure electric SUV Zeekr X as the main model, demonstrating its initial penetration into the high-end compact electric vehicle market.

◎ Leapmotor achieved sales of 98 units, primarily driven by the T03 and C10 models. Although a newcomer, it has shown strong growth momentum in the short term. Emerging high-end brands such as Dongfeng Voyah are still in the trial phase, with limited sales.

From the perspective of the competitive landscape, Chinese brands in the Netherlands market have formed three types of differentiation:

◎ Steady Progress: Brands like BYD, MG, and Lynk & Co have established relatively stable sales channels and brand recognition, maintaining their presence in the market through a multi-model layout.

◎ Emerging Breakthroughs: Brands such as Zeekr, Leapmotor, and Xpeng, leveraging new products, have begun to form differentiated competition in segmented markets.

◎ High-end Exploration: Brands like NIO and Voyah face challenges in brand recognition and local user acceptance and still need time to cultivate the market.

Summary

As a frontier for the new energy transition in Europe, the Netherlands market serves as a testbed for Chinese auto brands to showcase their product strength and globalization capabilities.