American Car Market | Car Sales in Argentina Surge 63.2% Year-on-Year in April 2025

![]() 05/26 2025

05/26 2025

![]() 552

552

In April 2025, Argentina's new car market exhibited a robust rebound, soaring 63.2% year-on-year, marking a seven-year high for the month. Amidst the swift recovery of the overall automotive market, Chinese brands have gradually gained traction, albeit from a small base, with their sales burgeoning.

01

Robust Market Recovery:

Traditional Giants Lead, Multipolar Competition Emerges

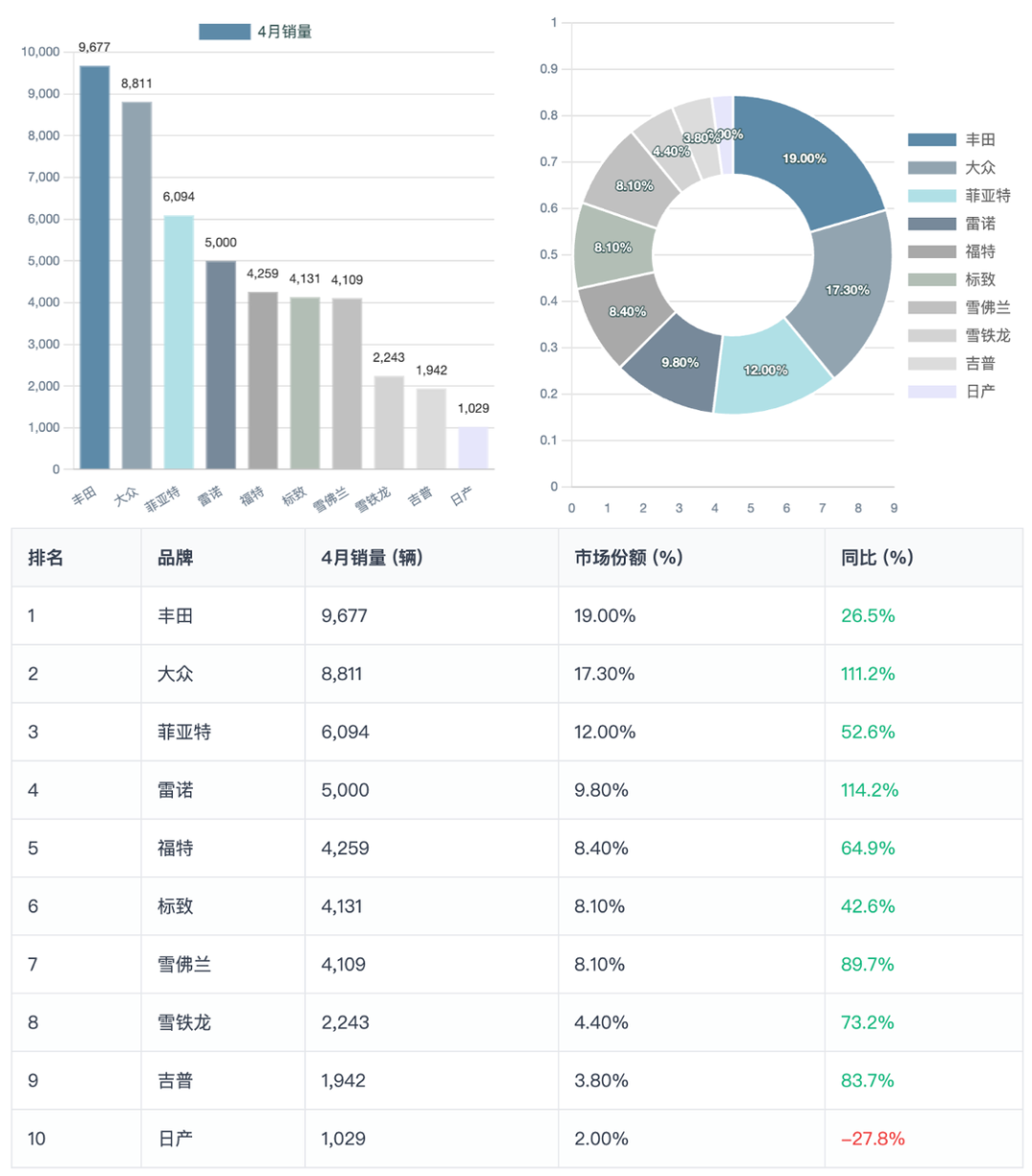

After years of stagnation, Argentina's auto market saw a significant upturn in April 2025, with sales of light vehicles reaching 50,963 units, a substantial 63.2% increase from the previous year. This not only extended the upward trajectory since 2025 but also constituted the best April performance since 2018.

Cumulative sales for the first four months of 2025 amounted to 205,201 units, an astonishing 83.5% year-on-year growth, signifying a swift recovery from the economic downturn.

● Brand Rankings

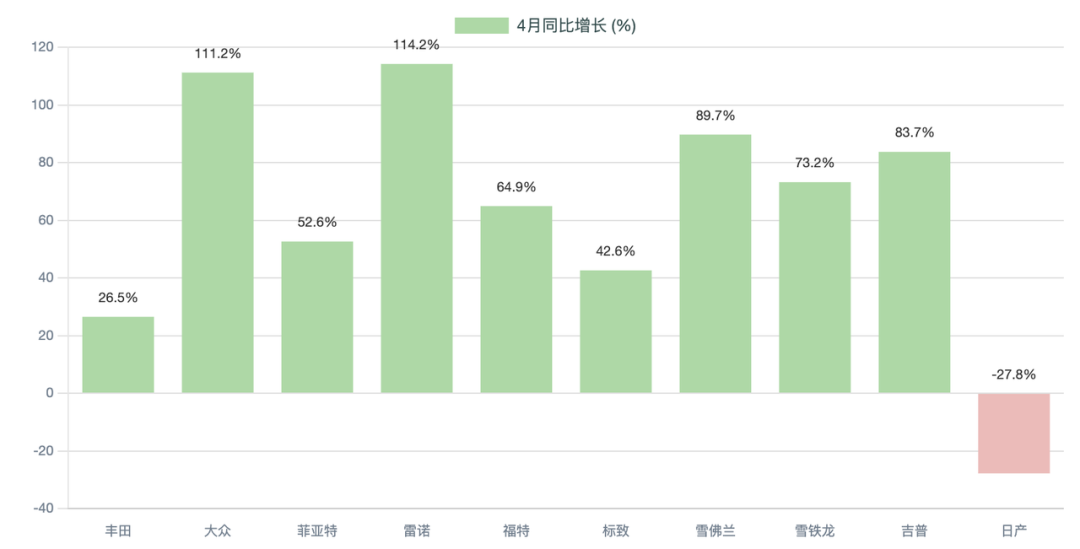

◎ Toyota reclaimed the top spot with 9,677 units sold, capturing a 19% market share. Despite a moderate 26.5% year-on-year growth, its performance stood out compared to others.

◎ Volkswagen closely followed with 8,811 units, surging 111.2% year-on-year, making it one of the fastest-growing mainstream brands and maintaining its sales leadership since the beginning of the year.

◎ Renault delivered an impressive performance, driven by its new model Kardian, achieving a monthly growth rate of 114.2% and ranking fourth with a 9.8% market share.

◎ Additionally, Fiat, Ford, Peugeot, Chevrolet, and Citroen also recorded strong growth, indicating a balanced development among multiple brands in the Argentine market.

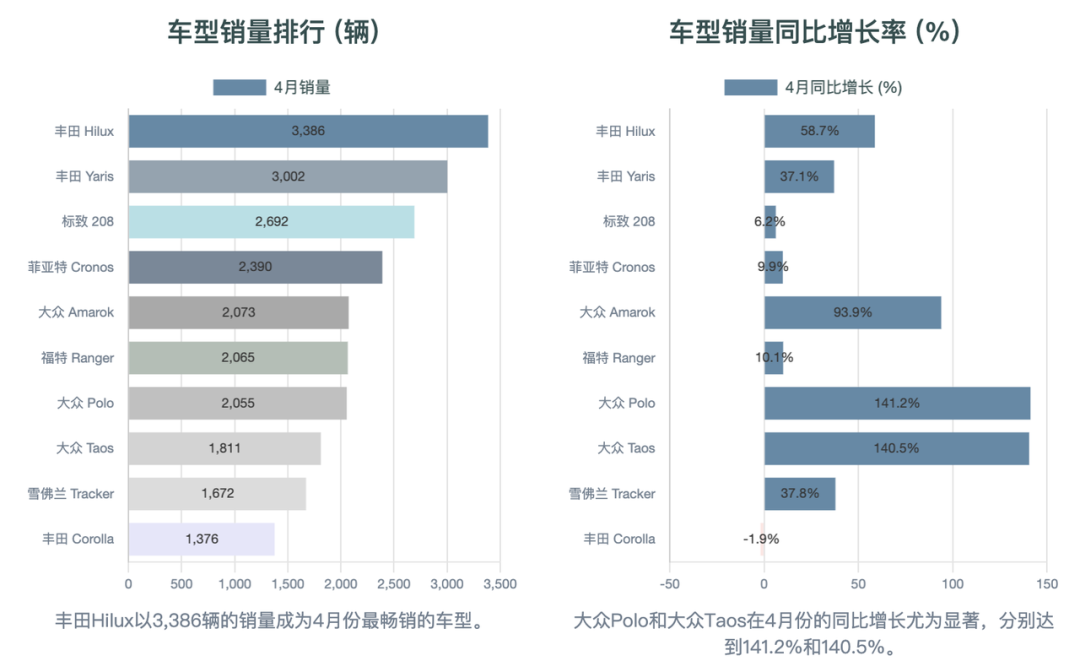

● Model Level

◎ Toyota Hilux continued to dominate sales with 3,386 units.

◎ Toyota Yaris and Peugeot 208 followed in second and third place with 3,002 and 2,692 units, respectively.

◎ While traditional popular models like Fiat Cronos and Volkswagen Amarok remained strong, the notable sales surge of Volkswagen Polo and Taos, by 141.2% and 140.5% respectively, indicated a rapid recovery in demand for small and medium passenger vehicles.

◎ Furthermore, the newly launched Renault Kardian performed exceptionally well, topping new car sales in its first month, outpacing models like Citroen Basalt, Kia K3, and Hyundai HB20, demonstrating high market acceptance for new products.

Overall, the Argentine market currently presents a landscape of "dual leadership + multipolar rise," with Toyota and Volkswagen still dominating but brands like Renault, Chevrolet, and Citroen aggressively catching up.

02

Strong Growth of Chinese Brands:

Blooming in Multiple Areas but Challenges Remain

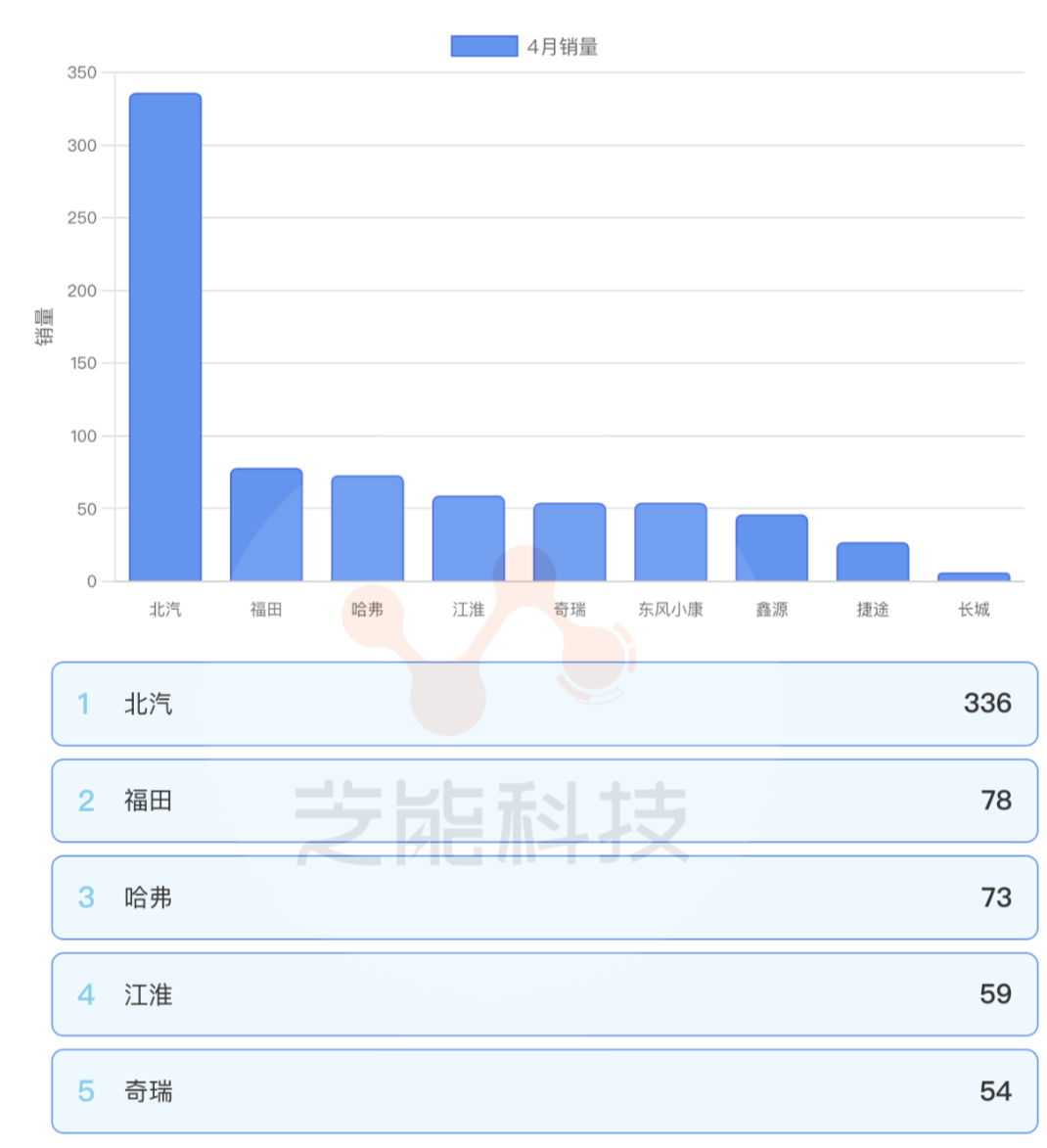

In April 2025, the performance of Chinese auto brands in the Argentine market warrants close attention.

Multiple Chinese brands achieved triple-digit or even four-digit year-on-year growth, reflecting their strong market expansion aspirations and preliminary successes.

◎ BAIC led the pack among Chinese brands with 336 units sold, a whopping 500% year-on-year increase, and has sold 853 units since the beginning of the year.

◎ Dongfeng Xiaokang and Chery tied with 54 units each, though DFSK saw a 500% year-on-year increase while Chery grew by 22.7%, highlighting strategic differences among brands.

◎ JAC stood out with a monthly growth rate of 1866.7%, accumulating 179 sales for the year, increasing its penetration among light commercial vehicles and price-sensitive consumers.

◎ Haval achieved a 942.9% year-on-year increase, while Jettour recorded 800% growth. These Chinese brands, primarily focused on SUVs, are gradually tapping into Argentine consumers' traditional preference for space and off-road capability.

While the total monthly sales of Chinese brands still account for less than 2% of the overall market, their acceptance among price-sensitive consumers is gradually increasing.

Argentina's openness to new products provides Chinese brands with a testing ground. With continuous advancements in global product capabilities and brand building, Chinese automakers are gradually shifting away from the "low-cost alternative" positioning towards "optimal cost-performance."

Chinese brands are still in the market cultivation stage in Argentina, with channels and service networks not yet fully established. Traditional brands' dominant position, especially in core segments like pickups and hatchbacks, is difficult to shake in the short term. Exchange rate fluctuations and import policies remain non-negligible risk factors.

Summary

Argentina's auto market showed robust recovery momentum in April 2025, with market competition becoming increasingly diversified. During this period, Chinese brands achieved explosive growth from a low base, but their current sales share remains limited.